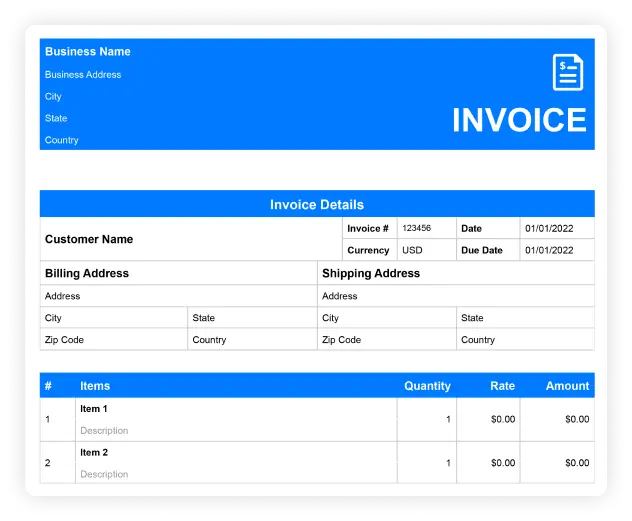

GST Invoice Format

A GST Invoice Template helps businesses comply with Goods and Services Tax (GST) regulations while billing for services or products.

- Automatically calculates GST for services and products.

- Includes space for GSTIN and other regulatory information.

- Ensures compliance with government tax regulations.

Download Customizable GST Invoice Invoice Format

Create Your First Customize GST Invoice Invoice Template With CaptainBiz

What Should Be Included in GST Invoice Template

Business and Customer Information:

Include the business’s contact details, GSTIN, and the customer’s information to ensure compliance with tax regulations.

GST Rates and Calculations:

Clearly mention the GST rates applied to the services or products. Accurate calculations prevent legal issues and ensure proper tax filing.

Invoice Number and Date:

Add a unique invoice number and the issue date to help keep track of GST filings and payments.

Breakdown of Services or Products:

List the services or products provided, along with their corresponding GST amounts. This ensures transparency and proper tax documentation.

Total Amount Payable:

Include the total payable amount, inclusive of GST, to make the final payment clear to the customer.

So what are you waiting for?

Frequently Asked Questions (FAQs)

- A GST invoice template is used to bill for goods or services while complying with GST regulations and ensuring proper tax documentation.

It should include GSTIN, business details, tax breakdown, invoice number, and the total payable amount inclusive of GST.

Clearly mentioning GST rates ensures that businesses remain compliant with tax laws and helps customers understand the tax portion of their payments.

Yes, the GST invoice template is versatile and can be customized to suit various industries while ensuring compliance with tax regulations.

It ensures proper documentation of GST amounts, making it easier for businesses to file accurate tax returns and maintain compliance.