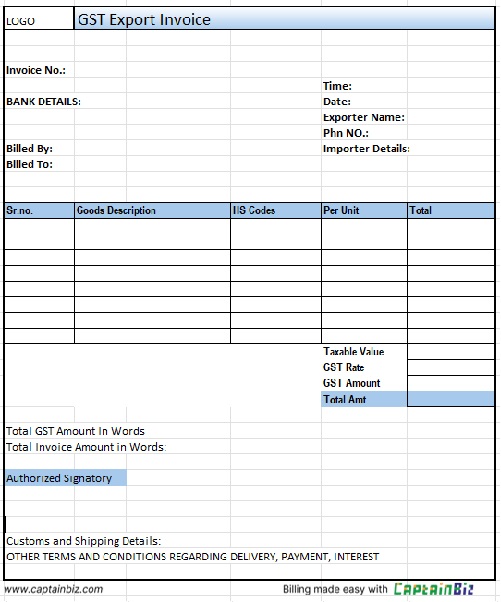

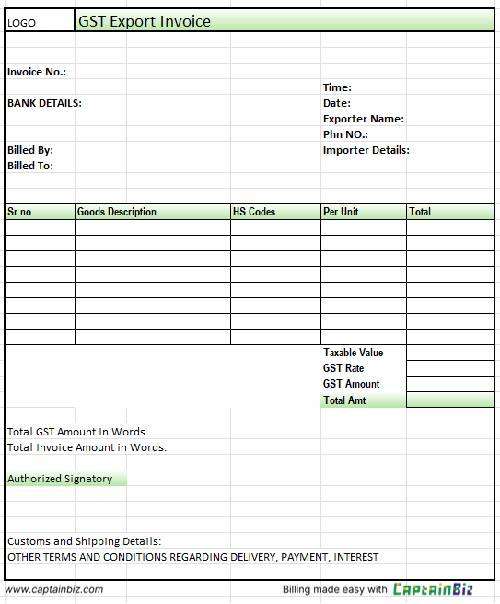

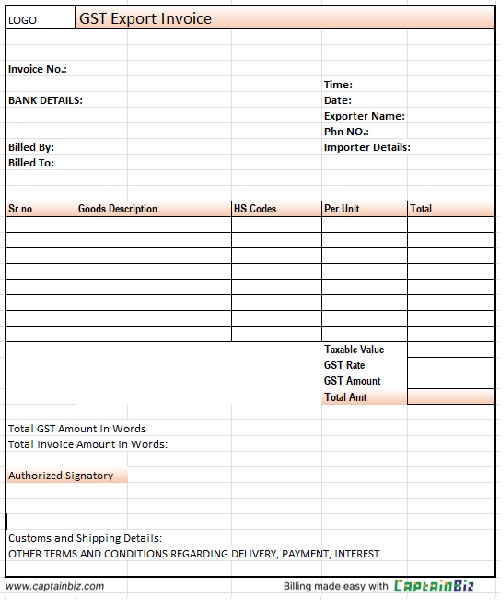

GST Export Invoice Format

A GST export invoice template is used for billing goods and services sold internationally, ensuring compliance with GST regulations.

- Includes GST details for international transactions.

- Provides fields for customs and export documentation.

- Simplifies tax filing for export businesses.

Download Customizable GST Export Invoice Format

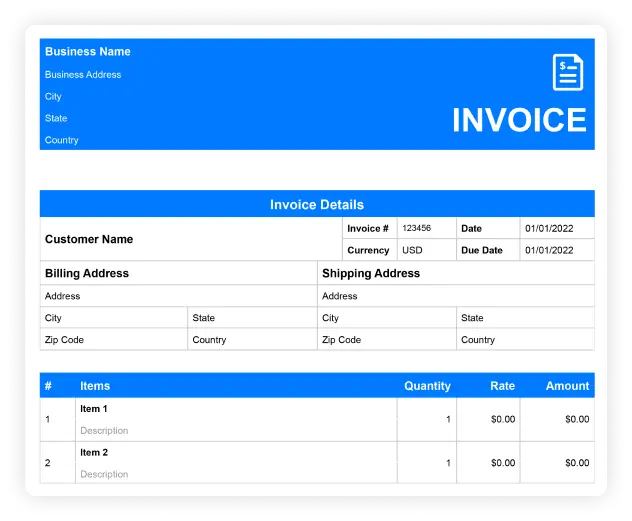

Create Your First Customize GST Export Invoice Template With CaptainBiz

What Should Be Included in GST Export Bill Format

Exporter and Importer Information:

Include both the exporter’s and importer’s contact details for record-keeping and compliance with GST export regulations.

Invoice Number and Date:

Assign a unique invoice number and date to facilitate tracking and record-keeping for tax and export filings.

Description of Goods or Services:

Provide a detailed description of the goods or services being exported, including quantities and unit prices.

GST Details:

Include GST rates and total amounts, ensuring compliance with GST regulations for exported goods or services.

Customs Information:

For international shipments, include relevant customs details and export documentation to ensure smooth cross-border transactions.

Payment Terms:

Clearly state the payment terms, deadlines, and preferred payment methods for international clients.

So what are you waiting for?

Frequently Asked Questions (FAQs)

A GST export invoice template is used to bill international clients for goods and services, ensuring compliance with GST and export regulations.

It should include exporter and importer details, a description of goods/services, GST rates, customs information, and payment terms.

Customs details ensure compliance with international trade regulations and facilitate smooth cross-border shipments.

Yes, GST export invoices can include both goods and services, provided they are being sold internationally and subject to GST regulations.

It simplifies billing for international transactions, ensures compliance with GST and customs regulations, and helps businesses maintain organized financial records.