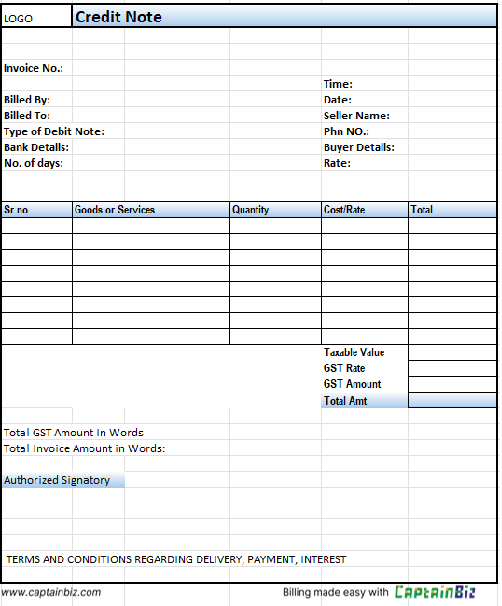

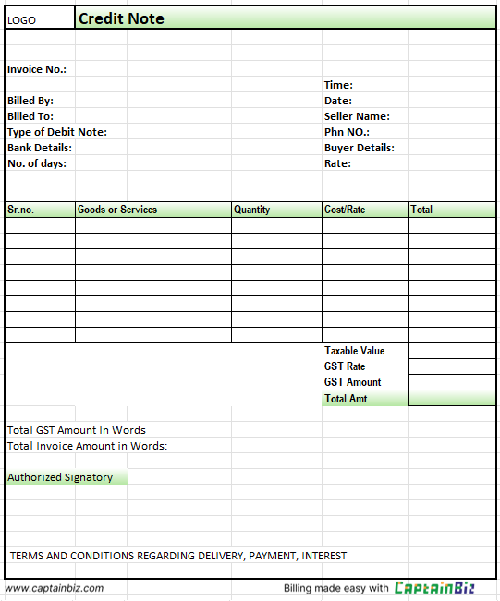

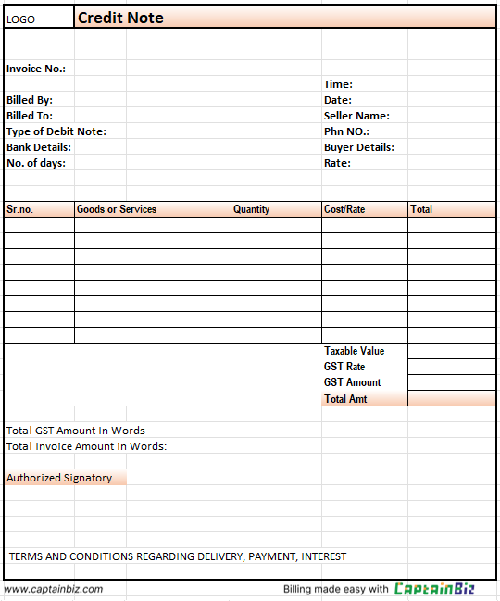

Credit Note Format

A credit note template helps businesses issue refunds or adjust overbilled invoices, ensuring accuracy in financial records.

- Lists the original invoice reference, refund amount, and adjustment reason.

- Allows record adjustments for overcharges or returns.

- Provides transparency for both business and client.

Download Customizable Credit Note Format

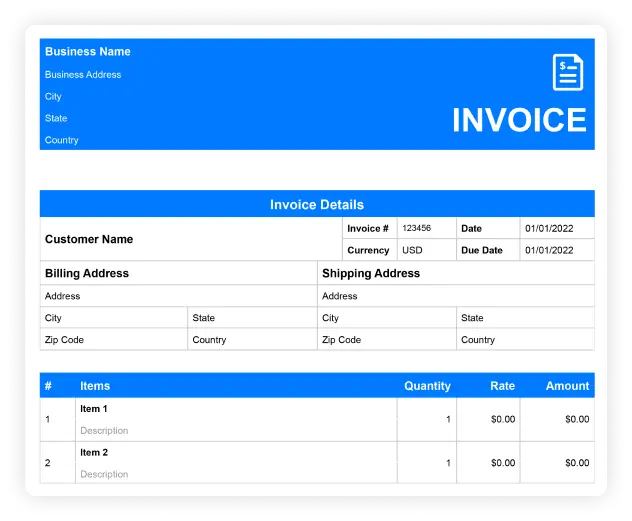

Create Your First Customize Credit Note Template With CaptainBiz

What Should Be Included in Credit Note Format

Business and Client Information:

Include business and client names, addresses, and contact information for clear identification.

Reference to Original Invoice:

Mention the original invoice number and date, helping both parties track adjustments accurately.

Refund or Adjustment Amount:

Clearly state the amount to be refunded or adjusted, detailing the reason for client clarity.

Unique Credit Note Number and Date:

Assign a unique credit note number and date for tracking and documentation.

Terms for Application or Refund:

Specify whether the amount will be refunded or applied as credit for future invoices.

Additional Notes on Policies or Conditions:

Add any relevant notes, such as return policies, for transparent transactions.

So what are you waiting for?

Frequently Asked Questions (FAQs)

A credit note format is used for issuing refunds or adjustments, detailing amounts owed back to clients.

It should include client details, original invoice reference, refund amount, and terms.

Yes, credit notes can be applied to upcoming invoices or refunded directly.

This helps in tracking adjustments and ensuring accurate records.

It ensures financial records reflect accurate adjustments, promoting transparency.