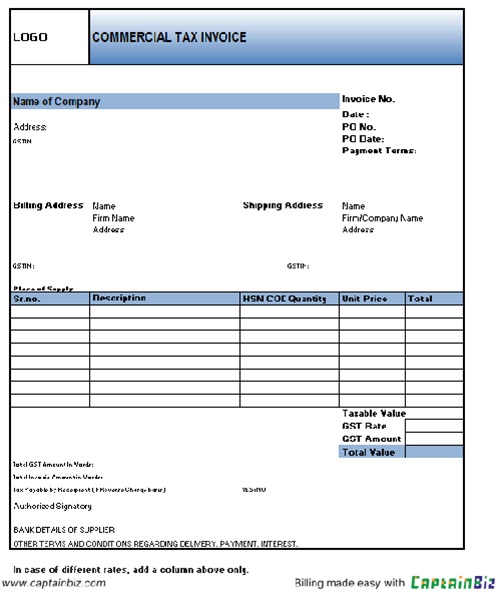

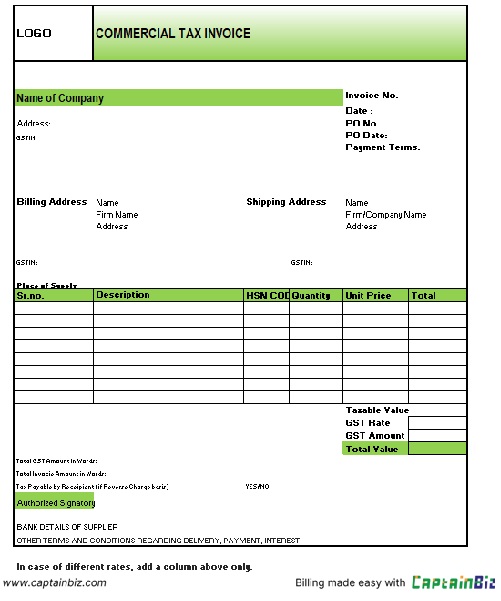

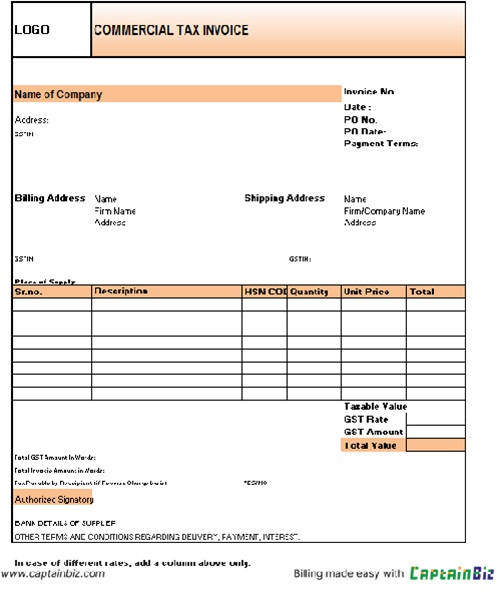

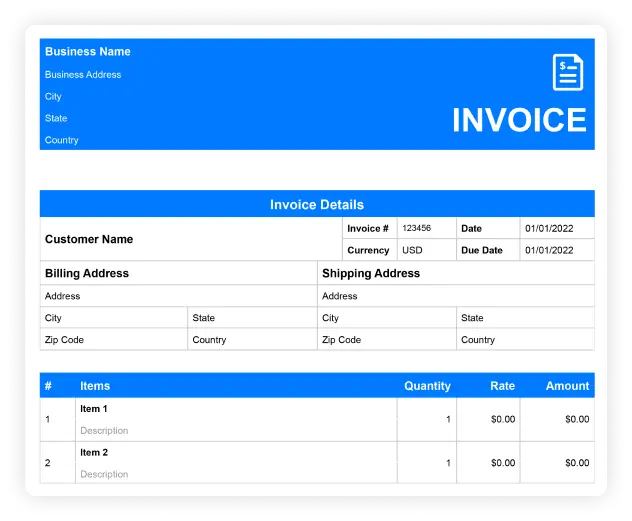

Commercial Invoice Format

A commercial invoice template facilitates international trade billing.

- Includes product descriptions and harmonized codes.

- Provides necessary customs details and duties.

- Specifies payment methods and due dates.

Download Customizable Commercial Invoice Format

Create Your First Customize Commercial Invoice Template With CaptainBiz

What Should Be Included in Commercial Bill Format

- Exporter and Importer Information:

Include the exporter’s and importer’s contact details, such as business names, addresses, and tax identification numbers. This ensures clear communication and compliance with international trade regulations.

- Description of Goods:

Provide a detailed description of the goods being shipped, including quantity, unit price, and total value. This information is essential for customs clearance and helps in calculating duties and taxes accurately.

- Harmonized System (HS) Codes:

Include the HS codes for each product to classify the goods according to international trade standards. Accurate HS codes facilitate smooth customs processing and reduce the risk of delays or fines.

- Invoice Number and Date:

Include a unique invoice number and the date of issue for tracking purposes. This helps both parties maintain organized records and simplifies the process of referencing past shipments.

- Customs and Tax Information:

Specify any applicable customs duties, taxes, and fees related to the shipment. This provides transparency and helps the importer understand the total cost of bringing the goods into their country.

- Payment Terms and Incoterms:

Clearly state the payment terms, such as prepayment or credit terms, and include the relevant Incoterms (e.g., FOB, CIF). This sets clear expectations for both parties and ensures that the financial and logistical responsibilities are understood.

So what are you waiting for?

Frequently Asked Questions (FAQs)

A commercial bill format is used in international trade to bill for exported goods. It includes details such as product descriptions, HS codes, and customs information to ensure compliance with trade regulations.

It should include exporter and importer information, description of goods, HS codes, invoice number, customs details, and payment terms. These elements ensure accurate billing and smooth customs processing.

Yes, commercial bills can be customized to include specific product details, Incoterms, and unique customs requirements. This flexibility helps in providing precise documentation for various international shipments.

HS codes classify products according to international standards, facilitating customs clearance and accurate duty calculation. Including them helps avoid delays and ensures compliance with trade regulations.

It supports accurate documentation, compliance with international trade laws, and efficient customs processing. A clear invoice template also helps in maintaining professional relationships with international clients.