Online GST Calculator

Total Amount (Tax Inclusive)

0.00

GST Amount

*CGST & SGST are applicable on intrastate Transport (same production & Supply state)

Online GST Calculator: What is a GST Calculator?

A GST calculator is a tool used to compute the Goods and Services Tax (GST) on a given amount. It helps users determine the GST component (either Central GST or State GST) and the total amount including GST.

This tool is particularly useful for businesses and individuals in regions where GST is applicable, allowing for quick and accurate calculations of tax amounts on goods and services.

How to calculate GST?

GST can be calculated simply by multiplying the Taxable amount by GST rate.

If CGST & SGST/UTGST is to be applied then CGST and SGST both amounts are half of the total GST amount.

GST = Taxable Amount x GST Rate

If you have the amount which is already including the GST then you can calculate the GST excluding amount by below formula.

GST excluding amount = GST including amount/(1 + GST rate/100)

For example:

GST including amount is Rs. 525 & GST rate is 5%

GST excluding amount = 525/(1+5/100) = 525/1.05 = 500

What are different tax components under GST in India?

GST Rates

Central Goods and Services Tax (CGST) - This is applicable to the transactions done within state boundaries or at the intrastate level.

SGST

State Goods and Services Tax (SGST) - Very much like CGST, this tax is also applicable to the transactions done within state boundaries or at the intrastate level

IGST

Integrated Goods and Services Tax , is a tax imposed on India’s inter-state supply of goods and services.

What is GST?

GST ( goods and services tax) is an Indirect Tax which replaced many Indirect Taxes in India. The good and services tax act was passed in 2017 and has been implemented since then.

GST is an indirect tax for the whole nation, which makes India one unified common market. It is a single tax on the supply of goods and services. It is the biggest indirect tax reform in India.

Before GST, taxes such as service taxes, state vats, entry taxes, luxury taxes were applied on goods. These taxes have been absorbed under GST.

Similarly, Service tax, entertainment tax were levied on services. Now there is only a single tax, that is, GST. Under GST, tax is levied directly at every point of sale.

GST Rates

The GST Council determines the GST rate slabs. The GST Council reviews the rate slabs for goods and services on a regular basis. GST rates are typically high for luxury items and low for necessities.

GST rates in India for various goods and services are divided into four slabs:

5% GST, 12% GST, 18% GST, & 28% GST.

Advantages of our Online GST Calculator

Accuracy

Ensures precise GST calculations, minimizing errors that could lead to penalties. Automated processes reduce the risk of manual mistakes, offering reliable results.

Time Saving

Speeds up tax calculations, reducing the time spent on paperwork and manual computation. This efficiency allows businesses to focus more on their core operations.

Compliance

Keeps businesses compliant with GST regulations by accurately calculating the correct tax amounts. It simplifies the filing process, ensuring adherence to all legal requirements.

Cost Saving

Eliminates the need for hiring external tax consultants by providing accurate calculations. Saves money by reducing potential errors and associated penalties.

Transparency

Offers a clear and detailed breakdown of tax components, enhancing trust in the billing process. Businesses can maintain transparent records for audits and future references.

Better Pricing Decision

Helps businesses make informed pricing decisions by factoring in the correct GST rates. Enables competitive pricing while maintaining profitability.

Manage cash flow

Assists in managing cash flow by accurately calculating the tax liabilities. Businesses can plan their finances better, ensuring smooth operations.

Tax Planning opportunity

Offers insights into GST liabilities, helping businesses optimize tax planning. Enables strategic decisions that can minimize tax burdens and enhance savings.

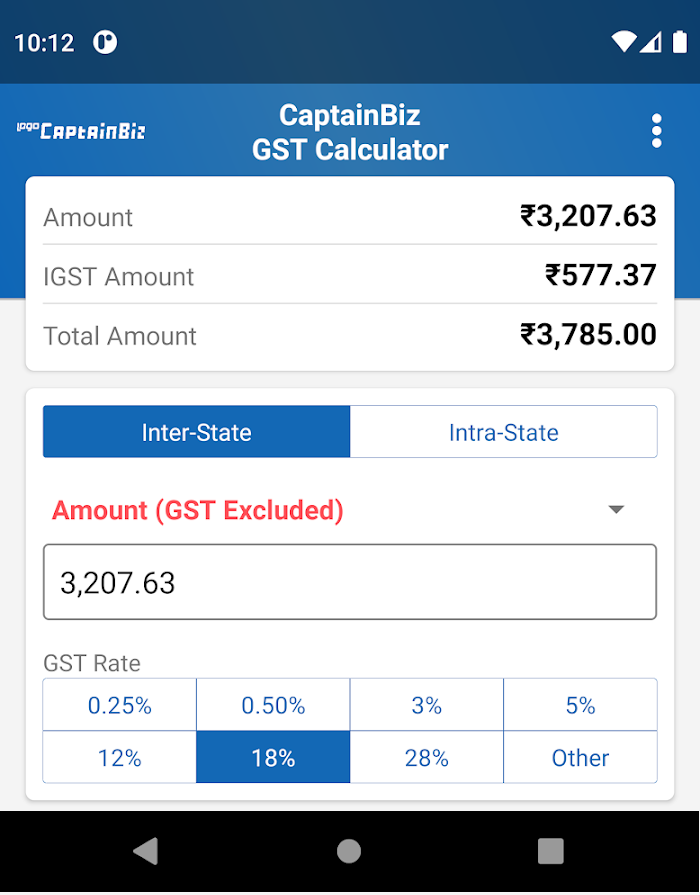

CaptainBiz GST Calculator

CaptainBiz GST Calculator app will help you to estimate total cost of your products/services including their IGST (Integrated GST tax), CGST (Central GST tax), SGST (State GST tax) amounts without adding any formula. You can use both the predefined tax slabs (0.25%, 0.5%, 3%, 5%, 12%, 18%, 28%, Other) or set different rate. IGST, CGST, SGST tax amounts will be calculated according to the transaction type (inter-state or intra-state). Tax amounts can be estimated based on GST inclusive and GST exclusive amounts

Get the app from preferred play store

Frequently Asked Questions

GST calculators can be used by businesses, individuals, tax professionals, accountants, and bookkeepers alike.Whether you’re registered for GST and need to calculate it for your transactions, or you simply want to know how much GST is included in the price of a product or service you’re purchasing,a GST calculator can help. Don’t waste time trying to manually calculate GST – use a GST calculator and get accurate results quickly and easily.

If you’re a buyer looking to calculate the Goods and Services Tax (GST) you’ll need to pay on a purchase, using a GST calculator is a quick and easy way to do so. To use a GST calculator effectively, follow these simple steps:

1. Determine the correct GST rate: Since the GST rate varies depending on the type of goods or services being purchased, it’s important to identify the correct rate for your purchase. This is especially true in countries with multiple GST rates.

2. Calculate the GST amount: Once you know the applicable GST rate, you can use a GST calculator to calculate the amount of GST you need to pay or collect. To do this, simply multiply the taxable value of your supplies by the GST rate (10%).

3. Add or subtract the GST amount: Depending on whether you’re paying or collecting GST, you’ll need to add or subtract the GST amount to or from the taxable value of your supplies.

4.Determine the total amount to be paid: The calculator will also display the total amount to be paid, which includes the purchase amount and the GST amount.

Using a GST calculator can be beneficial in multiple ways. It can help you budget for your purchases, compare prices between products or services, and ensure that you’re aware of the total amount you’ll have to pay, including GST. So, next time you’re making a purchase, try using a GST calculator to make the process simpler and easier.

If you’re a manufacturer or wholesaler looking to calculate the Goods and Services Tax (GST) on your taxable supplies, you can use a GST calculator. Here are the steps you can follow to use a GST calculator:

1. Determine the applicable GST rate: You need to know the GST rate that applies to your products or services. In Australia, the current GST rate is 10%.

2. Calculate the GST amount: Once you know the applicable GST rate, you can use a GST calculator to calculate the amount of GST you need to pay or collect. To do this, simply multiply the taxable value of your supplies by the GST rate (10%).

3. Add or subtract the GST amount: Depending on whether you’re paying or collecting GST, you’ll need to add or subtract the GST amount to or from the taxable value of your supplies.

4.Keep accurate records: It’s important to keep accurate records of your GST transactions. Make sure to keep copies of your tax invoices, receipts, and other documents to support your GST claims.

By using a GST calculator, you can ensure that you’re calculating the correct amount of GST to pay or collect, which can help you avoid penalties and other compliance issues. Make sure to use a reliable and accurate calculator for your business needs.

Looking for a convenient and accurate way to calculate your Goods and Services Tax (GST)? Look no further, CaptainBiz’s GST calculator! Our tool offers a range of benefits for businesses, including:

1. Accurate calculation: Don’t waste time struggling with complex GST calculations. Our GST calculator ensures accuracy, saving you time and reducing the risk of errors.

2. Quick and convenient: With easy-to-use features and lightning-fast results, our GST calculator is perfect for businesses that need to calculate GST on multiple transactions.

3.Compliance with regulations: Stay up-to-date with the latest GST rates and regulations by using our GST calculator. Our tool ensures compliance and accurate calculations.

4. Planning and budgeting: Plan and budget for GST payments or refunds with ease using our GST calculator. This can improve cash flow management and help you stay on track financially.

5. Transparency: Our GST calculator promotes transparency in GST calculations, making it easy for businesses to demonstrate compliance to stakeholders, including customers and regulatory authorities.

Try CaptainBiz’s GST calculator today and experience the benefits for yourself!

Looking for information on the GST, or Goods and Services Tax? CaptainBiz’s GST Calculator FAQ page can help!

GST is a value-added tax that is applied to the supply of goods and services at each stage of production and distribution. This means that the tax is ultimately paid by the end consumer but is collected and remitted by businesses at each step of the supply chain.

The introduction of the GST was motivated by several factors, including the need to simplify the tax system, increase revenue for the government, and address the problem of tax cascading or tax pyramiding. The GST is designed to eliminate this problem by allowing businesses to claim credit for the GST they pay on their purchases, reducing the overall tax burden.

By taxing a wide range of goods and services at a relatively low rate, the GST can generate significant revenue while minimizing the impact on consumers. Overall, the GST is intended to create a more efficient and equitable tax system that benefits both businesses and consumers while providing a stable source of revenue for the government.Visit CaptainBiz’s GST Calculator FAQ page to learn more about the GST and how it impacts your business.

Looking for information on the Goods and Services Tax (GST) system in India?

As of September 2021, the GST system includes four tax slabs based on the type of goods or services being supplied. The tax rates range from 5% for essential goods such as food items, books, and medical equipment, to 28% for luxury goods such as cars, aerated drinks, and tobacco products.

Additionally, there is a zero GST rate on certain goods and services like fruits, vegetables, and healthcare services, while some goods and services are exempt from GST altogether, like education and healthcare services provided by the government.

Please note that the GST rates are subject to change by the government, so be sure to regularly check for any updates or changes in the GST tax slabs. CaptainBiz GST Calculator can help you calculate the GST rates for your goods or services quickly and easily.

Welcome to the CaptainBiz GST Calculator FAQ page, here we provide you with useful information about Goods and Services Tax (GST) in India. GST is a consumption tax that is levied on the supply of goods and services and has subsumed various indirect taxes such as service tax, value-added tax (VAT), central excise duty, and other state taxes.

Under the GST regime, goods and services are classified into different tax slabs, including 0%, 5%, 12%, 18%, and 28%, based on their nature, usage, and other factors. The tax is levied at the point of consumption, which means it is collected at the final sale of goods or services to the end consumer.

GST subsumes several taxes, such as Central Excise Duty, Service Tax, Value Added Tax (VAT), Additional Customs Duty (Countervailing Duty), Special Additional Duty of Customs, Central Sales Tax (CST), Octroi and Entry Tax, Luxury Tax, Entertainment Tax (not levied by local bodies), and Taxes on lotteries, betting, and gambling (not levied by local bodies).

The primary objective of GST is to simplify the indirect tax structure and create a unified market for goods and services across India. We hope this information has been helpful. For more details and assistance with calculating GST, please try our GST Calculator tool.

Yes, the GSTIN (Goods and Services Tax Identification Number) is mandatory for businesses in India that are registered under GST (Goods and Services Tax) regime. It is a unique 15-digit identification number that is issued by the Government of India to all businesses that are registered under GST.The GSTIN is used for various purposes such as filing GST returns, claiming input tax credit, and complying with various GST regulations. Without a GSTIN, a business cannot collect or pay GST.It is important for businesses to ensure that they have a valid GSTIN and that they comply with all the rules and regulations related to GST. Failure to do so can result in penalties and other legal consequences.