Navigate Better: CaptainBiz's New E-Way Bill Feature

CaptainBiz now enables the e-Way bill features to make your operations awesome. We’ve put so much effort towards having businesses of your caliber to manage all transportation documents and trackings yourself.The CaptainBiz could bulk orders, and shipment management, and also will help in keeping all the info about regulations available which therefore could save time as repetitive tasks.Whether you are a large enterprise or a small business enterprise, our E-Way Bill is designed for effortless operation in your business. Sailing can become one less thing to worry about as you will foresee headaches with paperwork and just greet a smooth sail with CaptainBiz. Get into the car trouble-free together with CaptainBiz E-Way Bill’s innovative options. Therefore, make your try today.

Start 14 day free trial. No payment required.

What is an E-Way Bill?

An e-way bill is an electronic document that is required for the movement of goods valued more than the pre-fixed values. e-Way bill generation constitutes compliance provisions. An E-Way Bill (or electronic way bill), which is the document that one can enter on the GST bill portal while removing goods worth more than Rs 50,000 is one such in kind of document. The E-Way Bill system helps verify that the goods in transit do not violate any of the GST regulations. Through this, the movement of goods is traced back to promote tax evasion. The supplier of the movement of goods is required to feed in the necessary data into the GST portal and to create e-way bills before the transportation of the goods is done. The movement of goods could be for supply or for any other reason; it is mandatory according to Rule 138 of CGST Rules. Therefore, a Goods and Services Tax (GST) number is required to be used.

When was eWay Billing Introduced?

On April 01st, 2018, there was an implementation of an e-way bill system for multi-state transportation of goods all over India. On the other hand, intra-state vehicles movements had different faculties to obtain e-way bills were independently regulated by various state authorities and e-way bills were introduced by various states at different times in 2018. Consequently, an e-way bill is mandatory for the transportation of goods irrespective of the source and the destination that have crossed threshold amounts. Moving goods across state borders still requires the same limit to be met everywhere, but different restrictions apply when it comes to transporting goods within specific states.

Introducing E-Way Bill Live on Android

The E-Way Bill system aimed at electronic documentation of goods being transported from one place to another will become available for Android on May 1st. This will enable users to create and process E-Way Bills straight from their Android phones. This step is intended to increase ease and availability for users to create an E-Way Bill as they travel.

The Objective of Generating E-Way Bill

The E-Way Bill is a document required to be generated by the person responsible for the movement of goods in India, and it is used for the following purposes

Movement of Goods

The real-time movement of goods is validated by the application of E-Way Bill used as the validation document of the entire process. It allows the Tax Authorities to follow the goods on their way by controlling documents and their requirements.

Compliance With Tax Laws

The E-Way Bill is compulsory like other clearance documents which are under the Indian GST registry for goods worth over Rs. 50,000 – it also validates enough that tax authorities have no problems and tax evasion is minimally possible.

Hassle-Free Transportation

The E-Way Bill feature however guarantees the unbroken transportation of commodities between a state or a union territory and all the other consequential movements because it acts as the only document needed for the entire journey.

Efficient Logistics Management

An E-Way Bill looks to be very helpful as it provides current information about the goods in transit thus maintaining orderliness in logistic operations. It is the case that it can permit us to optimize the supply chain and also to make the transportation time and cost smaller.

Duration of E-way Bill

E-Way Bill’s validity is dependent upon the distance goods travel from one place to another. The validity period of E-Way Bill will be one day from the relevant date of the journey for distances less than 100 km.

The E-way Bill is valid for one day from the billing date for up to 100 km. For distances up to 100 km, the e-Way bill will be valid for one day from the relevant day.

The validity time is calculated from the time the E-Way Bill was filled out, with one day being equal to 24 hours.

The extension of the E-Way Bill validity can not be justified. On the other hand, in certain categories of goods, the commissioner can only make an extension to the rights validity period by issuing a notification.

Benefits of E-Way Bill

The E-Way Bill is a document required to be generated by the person responsible for the movement of goods in India, and it is used for the following purposes

Send Professional E-Way Bill Format

Get your own specific E-Way Bill Format for your business features .It provides you with E-Way Bill Formats for you free. They do not put in any extra effort to be used. There are a variety of templates offered that you can simply pick the one that is suitable for your business and then you will provide the vital information input.

Create an E-Way Bill in Any Format

We have created them in all available formats like Word doc, PDF and Excel. The generator can instantly prepare an E-PDF tailored to the goods that are being moved.

Use the E-Way Bill Format For Free

The seller can personalize the E-Way Bill Right-of-Way by formats and download it for future use. The entire process of remittance, from sending to receiving money, is completely free. The particularity of them represents you in a professional way and eventually, your image and brand value will be improved.

Reduce Human Error Significantly

Wasting time on each details' manual typing in Way Bills might provide a chance of making mistakes. It is recommended that a user pick up the E-Way Bill Template, where the data of the product gets replicated automatically, which thereby necessarily cuts down unnecessary data entry and chances of mistakes

Enhances Your Brand’s Goodwill

The ability to provide a professional E-Way Bill Format as part of their services through the use of E-Way Bill Format in transactions comes in as a reputation booster for the brand. The generation of the E-Way Bill, which contains all the necessary data needed, encourages even more trust. Sharing of the deal can be in part or in full since all the data is in the E-Way Bill format.

Maintain Consistency While Saving Time

Wasting time on each details' manual typing in Way Bills might provide a chance of making mistakes. It is recommended that a user pick up the E-Way Bill Template, where the data of the product gets replicated automatically, which thereby necessarily cuts down unnecessary data entry and chances of mistakes

Who Should Generate an E-Way Bill?

1.If the value of the goods is above Rs 50,000:

- Every individual using their own vehicle to transport their goods is responsible for the creation of an E-Way Bill. A registered person includes a consignor, a consignee, a recipient or a transporter.

- To illustrate, if an unregistered person makes a sale/supply to a registered person, the recipient must follow the aforementioned compliances, as the supplier has not registered.

- In the case of road transportation, the transporter must generate the E-way bills, if the consignor as well as the consignee offering the transporter their goods for delivery, fails in creating the E-way bill.

An E-Way Bill must be generated irrespective of the value of the consignment, even if the value is less than 50000 in the following cases:

- When a foreign trade deals with a principal, the employee provides input goods or services to the latter.

- Now, if a seller who has been relieved of the burden of registering under GST caters the hand made products across the state.

What Documents are Necessary to Create an E-Way Bill?

- Bill of sale, Electric or physical invoice, Deliver challan or waybill will depend on whether it is electronic or not.

- Transportation should provide the passport of the passenger in the vehicle for the security issues.

- Identification information must be included in the shipment along with Transport ID, transport boat number and the date of shipping for transportation by land, air or sea.

- If two E-way Bills are required to be attached in one consignment by two transporters separately, the job of transporters and the godown holders will be doubled.

- In both cases the data in question might be available like on papers or on a Radio frequency identification device (RFID) friendly device.

Stay Up-to-Date: Latest e-Way Bill Notification

E-Invoice Details Mandatory for e-Way Bill Generation

From 1 March 2024, E-Way generation will not be possible without E-Invoice details for all users who would be required to furnish the said details wherever applicable. It is enforced from the last selling stage of the B2B and export transactions. The new E-waybill system which is applicable to B2c and non-supply related transactions does not involve B2B.

6 digit HSN Code Must be for all the B2B and Export Transactions

From 1st February 2024, taxpayers whose income is above Rs.5 Crores need to supply a 6 digit HSN code when filing e-way bills for all Export and B2B transactions. Organizations whose turnover is less than Rs. 5 crore should have 4 digit HSN Code.

Frequently Asked Questions about E- Way Bill

The feature "E-Way Bill" by CaptainBiz is brand-new and it is aimed to simplify the procedure of creating, delivering, handling and monitoring electronic waybills of the companies that are responsible for the transportation of merchandise.

The E-Way Bill feature streamlines logistics operations by abrogating the mandate of manual paperwork, offering a user-friendly environment for making and monitoring the waybills by digital means, which in effect saves time and prevents mistakes.

As such, yes the E-Way-Bill feature developed by CaptainBiz serves as a versatile platform for businesses both small and large.

Absolutely, CaptainBiz E Way Bill software can comfortably enable you to handle multiple waybills at a time which makes it ideal for businesses with mixed types of transport.

With this E-way Bill feature, it makes sure that it follows the recommended guidelines set out by the lawful entities whose duty is to ensure compliance. In the end, this is done to prevent any possible violation of the law.

Through creating and issuing waybills electronically with CaptainBiz, eWaybill, businesses save the time having to do manual paperwork and administrative jobs.

Yes, E-Way Bill service can be accessed from any device which is connected to the internet and will provide you with the flexibility of managing your waybills whenever you like and wherever you are.

CaptainBiz E-Way Bill may be available for free or you can pay subscription charges for advanced features according to the plan you choose. On the contrary, the benefits which are associated with improved efficiency and compliance far outweigh any inconvenience of paying small fees which are charged as results.

Feature E-Way Bill works along with CaptainBiz tools and forms a single logistics management system that connects the different strata of your business overall.

Apart from E-Way Bill features, CaptainBiz offers users online guides and tutorials along with dedicated customer support channels to ensure that all users will have a smooth ride.

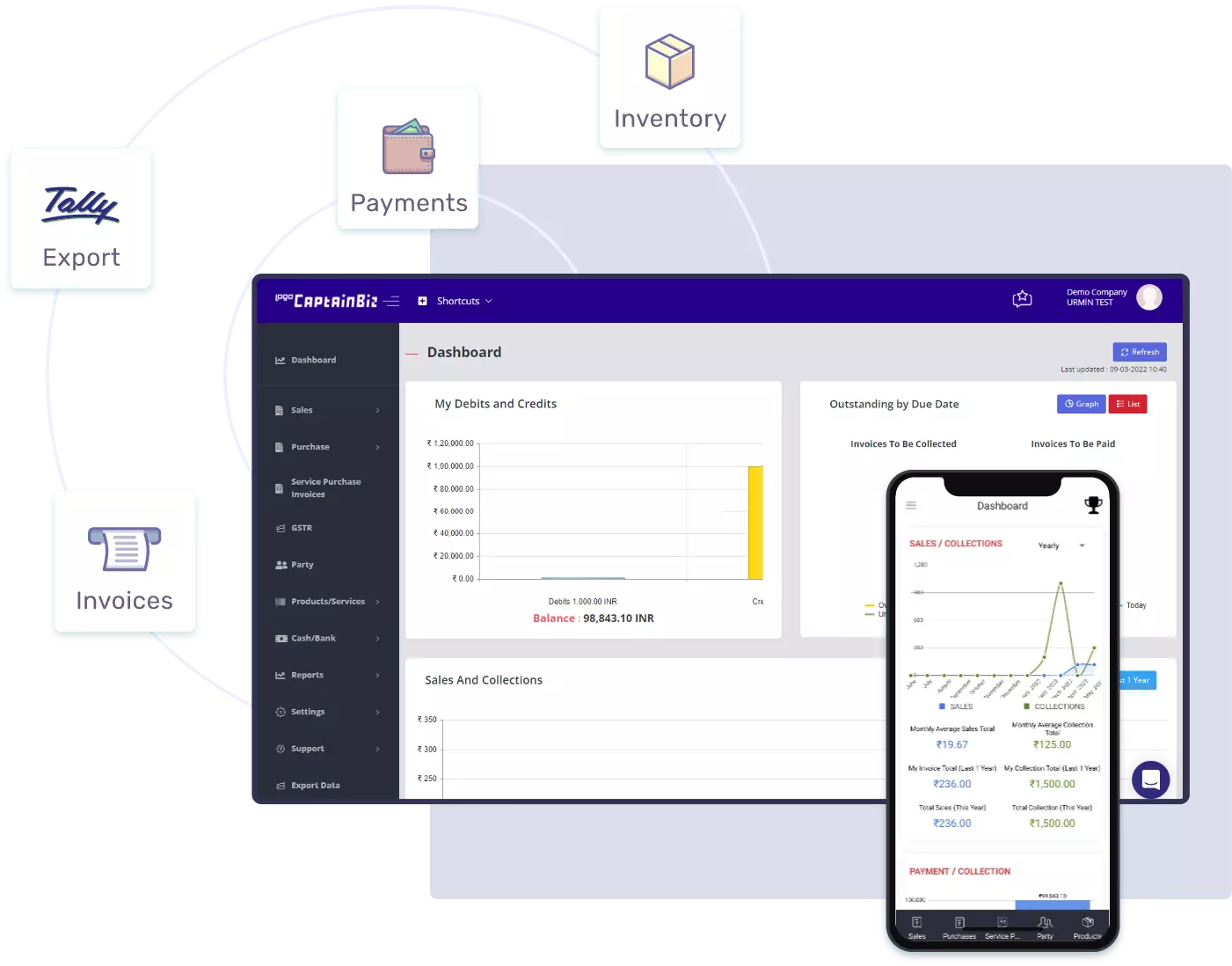

Explore the New E-Way Bill Feature from CaptainBiz

Now, it is time to simplify your logistics with the new E-Way Bill feature of CaptainBiz. Now you can forget about the piles of papers and joyfully say welcome to an electronic waybill that works for you just like that. The user-friendly web-app helps you to generate, organize, and trace E-way Bills seamlessly, thus speeding up the work process and increasing productivity.So why wait? Become a freighter with ease today with CaptainBiz’s E-Way Bill tool and make your voyage to success seamless.