An e-way bill is a designation for an electronic waybill. The E-way bill will apply to goods movement in both inter and intra-state transportation.

Simply put, it is an electronic document generated from the e-way bill portal ewaybillgst.gov.in evidencing the transportation of commodities. It is essentially a GST compliance system in which the person causing the movement of goods (consignor/seller) uploads the appropriate information before the start of the movement of goods and creates an e-way bill on the GST portal via a digital interface.

It includes the following information:

- Name of consignor

- Consignee

- The point of origin of the consignment

- Destination details and

- Route

According to the GST laws, any person registered under GST who causes the movement of goods with a consignment value greater than Rs.50000 must provide the details of the said goods in a specific form (e-way bill) before the movement of goods begins.

Who is Responsible for Creating GST e-way bills?

The following entities should proceed with the e-way bill generation process:

1) A registered person who is a consignee/consignor, a transporter, or a recipient if the transit is done by their vehicle/hired rail/road/air transport.

2) An unregistered individual who plans to make a supply to a registered individual.

3) If the consignee or consignor has not generated the e-Way bill while handing the items to the relevant transporter, the transporter must generate the e-way bill GST document.

E-way Bill and E-way Bill Login Requirements

The following are the prerequisites for establishing an E-way bill:

- Register an invoice/bill of supply/challan on the E-Way Bill platform in connection with the transportation of goods.

- If traveling by route, use the Transporter ID or Vehicle number.

- Transporter ID, Transport document number, and document date – by train, plane, or ship.

E-way Bill Format

The GST EWB-01, or E-Way Bill, is divided into Part A and Part B. Part A contains product information, whereas Part B includes the vehicle’s identification number.

| Part A | Part B |

| GSTIN Number of Recipient | Vehicle Number which the goods are transported |

| PIN Code of Delivery – this is the PIN Code of Delivery. | |

| Invoice or the Challan Number | |

| Invoice or the Challan Date | |

| Value of the Goods | |

| HSN Code – A minimum of two digits of HSN Code | |

| The reason for transportation could be Supply / Exp / Imp / Job Work. | |

| Transportation Document Number (TDN) which is the Document Number provided by the transporter. |

E-way Bill Generation: [Part A]

Step 1: Go to ewaybillgst.gov.in/login to access the e-way Bill Popular Portal.

Step 2: You will then be directed to the dashboard of your E-way bill site login. This screen will show details about your most recent portal phase and other alternatives.

Step 3: The various possibilities for generating an e-way bill are detailed below.

Step 4: Select e-Waybill > “Generate Fresh” to generate a fresh e-way bill.

Step 5: The information entering the screen will display. Fill up the blanks with the necessary information.

The Transaction Details

Transaction Type: If you are a seller, look outward, and if you are a buyer, look inward.

Sub Type: The document kind, number, and date of the document being shipped with the items.

Document Details: The sort, number, and date of the document being mailed with the products.

Bill From and Bill to Details: The contact information for the supplier and the recipient. Depending on the nature of the transaction, your data in the From / To segment will be auto-filled.

Item Details: Detailed information on the items being shipped.

Transporter Details: This section covers details on the transporter, transportation manner, and vehicle transportation.

Step 6: Once you’ve input all the information, click Preview to review it again. If the Preview goes well, click Submit to generate an e-way Bill Number (EBN).

e-way Bill Reprint

If you want to reprint the e-way bill, take these steps:

Step 1: On the left side of the screen, choose the e-way bill option. Choose “Print EWB” from the drop-down option.

Step 2: Enter the required EWB number. The EWB will be displayed, and it can be printed and reused.

e-way Bill Generation: [Part B]

Follow the steps below to update the EWB’s PART-B records:

Step 1: Select e-waybill from the menu on the left side of the screen. Choose “Update Part B / Vehicle” from the drop-down menu.

Step 2: Enter the EWB number or the date the EWB was generated. The EWB that was developed will be mentioned.

Step 3: Next, select the proper EWB, make any necessary revisions, and click Submit.

The modifications can then be updated.

Also Read: Eligibility Criteria for e-Way Bill Generation

Penalty for Non-Generation

If the e-way bill is not created, a Rs. 10,000 penalty will be applied. In addition to the fine, the vehicle used to convey the commodities and the products themselves will be seized or detained.

What is the minimum distance for an e-way bill?

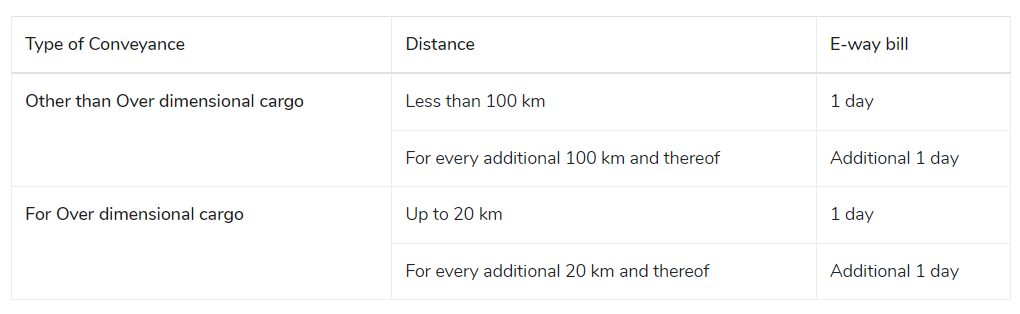

The substantial revision made effective by video notification no. 12/2018- The central tax on March 7, 2018, modifies the validity period of the E-way bill. The E-way bill’s new validity period provisions are listed below:

The relevant date of generation of the E-way bill and the period of validity would be counted from the time the E-way bill was generated, and each day would be considered as the period ending at midnight on the day after the date the E-way bill was generated.

Over-dimensional cargo is transported as a single indivisible unit that exceeds the dimensions restrictions specified in rule 93 of the Central Motor Vehicle Rules, 1989, promulgated under the Motor Vehicles Act, 1988 (59 of 1988).

Also Read: How Can I Extend The E-Way Bill Validity With Ease?

SMS E-Way Bill Generation on Mobile

SMS e-way bill creation is excellent for entities with few transactions, as alternative methods should be used for more enormous volumes.

Taxpayers can also utilize the SMS e-way bill production service in an emergency, such as late at night or while traveling in a vehicle.

Enabling SMS E-Way Bill Generate Facility

The taxpayer must register his or her cellphone number on the GST e-way bill portal before beginning to transact. The system only allows and replies to mobile numbers written on the portal for a specific GSTIN.

The following screen appears when the user selects the option ‘for SMS’ under the main option ‘Registration.’

To register the mobile number, the user must input the mobile number and submit the OTP.

The cellphone number associated with the GSTIN is displayed on the next screen. The user can use this screen to delink or change the cellphone number if necessary.

Step 1: Gaining Access to the Portal

The taxpayer or transporter must first access the e-way bill portal and log in using his or her credentials.

Step 2: Register Your Mobile Phone Number

Enable the SMS e-way bill feature by completing the steps outlined above. Once the mobile number has been validated and registered, you can generate an e-way bill via SMS.

Cases in which an E-Way Bill is not required or is exempt

When transporting the following items, an E-way bill is not required:

- Liquefied petroleum gas for residential and non-domestic exempted category (NDEC) users;

- Kerosene oil is available through PDS.

- The Postal Department transports postal baggage.

- Natural or cultured pearls and valuable or semi-precious stones; precious metals and precious metal clad metals (Chapter 71); jewelry, goldsmiths’ and silversmiths’ wares, and kindred products (Chapter 71);

- Currency;

- Personal and home effects were used;

- Unworked coral (0508) and worked coral (9601)

When transferring goods from an immigration port, airport, air cargo complex, or land customs station to an inland container depot or a container freight station for Customs clearance, e-way invoices are not required.

E-way bill generation is not necessary when a non-motorized conveyance transports products.

The e-way bill is not required to be generated when the following commodities are transported:

- Alcoholic liquor for human consumption

- Petroleum crude

- High-speed diesel

- Motor spirit (commonly known as petrol)

- Natural gas,

- Aviation turbine fuel

- An E-way bill is unnecessary when there is no supply as defined in Schedule III of the Act.

When the products are being carried, an E-way bill is not required:

- Under immigration bond, through a container freight station or inland container depot to an immigration port, airport, air cargo complex, and land immigration station, or from one immigration station or immigration port to another.

- Where the commodities being transported are transit cargo from or to Nepal or Bhutan; Where the items being transported are exempt from tax under various notifications;

- No E-way bill is necessary when the Central Government, State Government, or a local government acting as a consignor transports goods by rail.

- No E-way bill is necessary when goods movement is triggered by a defense formation under the Ministry of Defense as consignor or consignee.

- In the case of transporting empty freight containers, no E-way bill is necessary.

- If items are being transported for weighing purposes and the distance between the consignor’s place of business and the weighbridge is less than 20 kilometers, no E-way bill is necessary. The transportation of commodities, however, must be accompanied by a delivery challan.

- When items other than de-oiled cake are indicated in the schedule annexed to notification no, 2/2017-Central Tax (Rate) dated 28.06.2017 are transported, no e-way Bill is necessary.

How can you cancel an e-way bill?

When an e-way bill is generated under this Rule, but the products are either not transported or are not transported, it complies with the details provided in the e-way bill. Within 24 hours of being generated, the e-way charge can be canceled.

However, if the e-way has been confirmed in transit in line with Rule 138B, even before the 24-hour period has expired, an e-way bill cannot thereafter be canceled.

Also Read: How Do a Person Cancel an E-way Bill and What are the Consequences of Non-cancellation

Wrapping It Up

The council stated that in the case of goods movement by railways, airplanes, and waterways, the e-way bill might be generated even after the commodities are in motion. On a similar note, Finance Minister Arun Jaitley, who presided over the meeting, stated that the e-way bill system for inter-state transportation of products would be implemented on April 1, after which the states would be divided into four lots for the provision’s implementation.

Also Listen: How to create E-way Bill With CaptainBiz

FAQs

-

Who is the person responsible for creating the e-way bill?

As a registered person or a carrier of goods, the consignor or consignee can generate the e-way bill.

-

Who is required to pay the e-way bill?

A taxable person registered under GST who transports goods worth more than Rs. 50,000 must have an E-way bill prepared on the GST Portal.

-

Is an e-way bill required for trips of less than 50 kilometers?

It is not even needed if the distance between the transporter’s location and the consignee’s location is less than 50 kilometers, which is less than the minimum distance required by the e-way bill.

-

Is it possible to generate an e-way charge without a vehicle number?

When generating part A of the e-Way bill, the Vehicle Number entry is optional. However, an e-Way Bill without a vehicle number is ineffective for the movement of goods.

-

Is it possible to refuse an e-way charge after 24 hours?

If the time restriction has been exceeded, the recipient may cancel the e-way bill within 722 hours. As a result, an e-way bill cannot be withdrawn beyond 72 hours from the time it was generated.

-

How long is the validity of an e-way bill?

In the case of average vehicles or modes of transportation, one-day validity has been supplied for every 100 km or portion of its travel.

-

Is an e-way bill required for exempted goods?

All firms should be aware that e-way bills are not required for exempted goods.

-

Who has the authority, and why, to reject the E-way bill?

A taxpayer has the option to reject e-way bills created by third parties using the former’s GSTIN.

-

Who has the authority to extend the validity of an e-way bill?

Only the present transporter can prolong the validity of EWB.

-

Is it possible to sell my gold ring without a bill?

A genuine gold buyer will always request the original purchase bill when purchasing gold from you.