Introduction

Goods and Services Tax (GST) is a significant element in Indian business, simplifying taxation by consolidating smaller taxes into a comprehensive system. For businesses, adherence to the GST registration criteria is essential, triggered when income or turnover crosses a defined limit. This ensures businesses contribute to government revenue, streamlining the taxation process.

Understanding the diverse types of GST and the applicable GST threshold is crucial for businesses entering the GST framework. Manufacturers, a vital segment, should comprehend the impact of GST on their operations as it influences pricing, supply chains, and compliance.

The concept of Place of Supply under GST determines where a transaction is considered to occur for tax purposes, affecting applicable GST rates and revenue distribution between central and state governments. A holistic understanding of these aspects empowers businesses to navigate the GST landscape effectively.

GST Registration

-

Who Needs to Register:

- Understanding the Threshold: First, figure out if your business has crossed the turnover threshold that requires GST registration. This threshold varies for different types of businesses.

- Check Eligibility: Check, if your business is eligible for GST registration based on the rules in place.

-

Eligibility Criteria:

- Determine Eligibility: Before registration process, confirm that your business meets the eligibility criteria. This usually revolves around the annual turnover exceeding the prescribed limit.

- Verify Business Type: Different types of businesses may have specific eligibility conditions. Verify that your business type aligns with the criteria outlined for GST registration.

-

Documents Needed:

-

- Proof of Identity: Collect documents that serve as proof of your business’s identity. This might include PAN card, Aadhar card, or registration certificate.

- Address Proof: Gather documents verifying the business address. This could be utility bills, rent agreement, or property documents.

- Details of Authorized Person: Have details of the person authorized to handle GST matters in the business. This includes their identification and address proof.

- Financial Documents: Keep financial documents, such as bank statements and audited accounts, ready for submission.

- Business Entity Proof: Depending on your business structure, provide proof of the entity, like partnership deed or registration certificate.

- Photographs: Keep recent passport-sized photographs of the business owner or authorized signatory.

-

Registration Process:

- Visit the official GST portal.

- Fill out the GST registration form with accurate details about your business, including its name, address, type, and turnover.

-

Submission and Verification:

Once the form is submitted, the GST authorities will review the information provided. They may ask for additional details or clarification during this stage.

-

Verification of Documents:

The submitted documents are verified by the GST authorities. Ensure that the documents are accurate and up-to-date.

-

Getting a GST Number:

Upon successful verification, your business will be assigned a unique GST identification number (GSTIN). This number serves as your business’s identification in the GST system.

-

Acknowledgment Certificate:

You’ll receive an acknowledgment certificate confirming your GST registration. Keep this certificate safely, as it validates your legal status as a registered taxpayer.

-

Compliance:

After registration, ensure compliance with GST regulations, including timely filing of returns and adhering to other obligations.

-

Ongoing Responsibilities:

Update your business details on the GST portal if there are any changes. Additionally, stay informed about any updates or changes in GST rules that might affect your business.

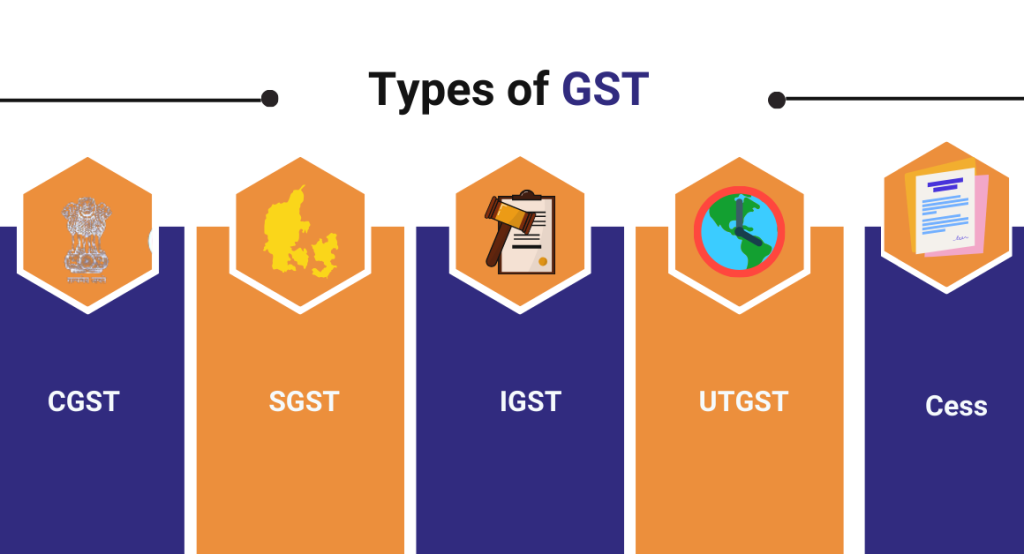

Types of GST

GST is not a single tax but is divided into multiple types. The most common types are Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), and Integrated Goods and Services Tax (IGST). This section may elaborate on the different types of GST and their respective applications.

-

Central Goods and Services Tax (CGST):

CGST is what the Central Government collects on transactions within a state, supporting national programs. When you buy or sell within your state, part of the GST paid is CGST.

-

State Goods and Services Tax (SGST):

SGST, collected by the state government, supports local initiatives within state boundaries. It ensures funds stay within the state for regional development, emphasizing community needs.

-

Integrated Goods and Services Tax (IGST):

IGST applies to transactions between states, combining CGST and SGST. It facilitates smooth inter-state trade, with revenue divided between the central and state governments based on the transaction.

-

Union Territory Goods and Services Tax (UTGST):

UTGST, similar to SGST, is collected in Union Territories. The revenue stays within the territory, addressing specific financial needs and contributing to local development.

-

Cess:

Cess is an extra tax for purposes like education or healthcare. Not part of regular GST, it’s an added charge on certain goods or services, with revenue directed to designated projects or sectors.

Understanding these types helps businesses know where their tax money goes and how it contributes to both central and state governments, depending on the nature and location of transactions.

Also Read: Types of GST in India: CGST, SGST, and IGST

Threshold for GST Registration

The threshold in GST is like a financial milestone for businesses. It’s a set limit on how much money a business can make before it has to officially register for GST. Different types of businesses have different threshold amounts.

Knowing the threshold is crucial because it tells businesses when they’ve reached a point where they must start dealing with GST. It’s a signal that the business has grown to a size where it needs to be part of the tax system.

To figure out the threshold for your business, you need to check the rules based on your business type. Different businesses have different thresholds, and these can change. Keep an eye on your business turnover – the total money it makes – and compare it with the specified threshold for your business type. Here’s the details:

| Aggregate Turnover | Registration Required | Applicability |

| Earlier Limits – For the sale of Goods/Providing Services | ||

| Exceeds Rs.20 lakh | Yes – For Normal Category States | Up to 31st March 2019 |

| Exceeds Rs.10 lakh | Yes – For Special Category States | Up to 31st March 2019 |

| New Limits – For Sale of Goods | ||

| Exceeds Rs.40 lakh | Yes – For Normal Category States | From 1st April 2019 |

| Exceeds Rs.20 lakh | Yes – For Special Category States | From 1st April 2019 |

| New Limits – For Providing Services | ||

| There has been no change in the threshold limits for service providers. Persons providing services need to register if their aggregate turnover exceeds Rs.20 lakh (for normal category states) and Rs.10 lakh (for special category states). | ||

Also read: Understanding GST Threshold Limits And Exemptions: Essential Guide

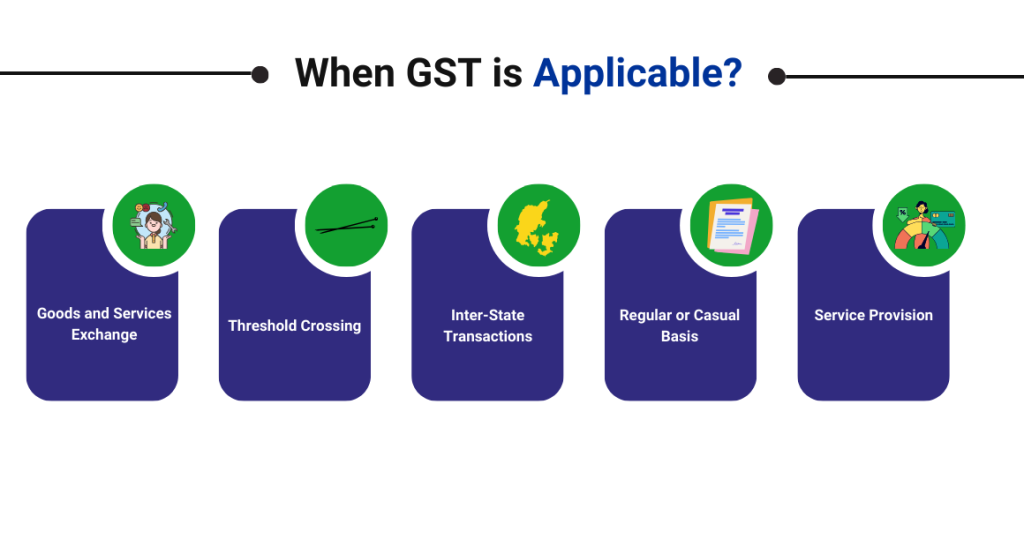

When GST is Applicable

GST is applicable in various ways; however, below are a few key scenarios where businesses need to consider its implications.

-

Goods and Services Exchange:

GST comes into play when goods or services are bought or sold. So, if your business involves transactions where you’re giving or receiving something, GST applies.

-

Threshold Crossing:

Once your business earnings cross a specific limit, known as the threshold, GST becomes necessary. It’s like a signal that your business has grown to a point where it needs to be part of the tax system.

-

Inter-State Transactions:

If your business deals with transactions between different states, GST is applicable. It ensures that taxes are distributed between the central and state governments for smooth inter-state trade.

-

Regular or Casual Basis:

Whether your business operates regularly or on a casual basis, GST applies. It doesn’t matter if it’s a one-time sale or a continuous operation – if it involves goods or services, GST is in the picture.

-

Service Provision:

If your business provides services, not just goods, GST is still applicable. From a plumber fixing pipes to a consultant offering advice, any service exchange falls under the GST framework.

Impact of GST on Different Business Types

Different businesses may be affected differently by the implementation of GST. This section might discuss how GST impacts various types of businesses, such as manufacturing, trading, and service-oriented and others.

-

Manufacturing Businesses:

-

- GST simplifies tax for manufacturing, reducing taxes on raw materials and making final products more competitively priced.

-

-

Trading Businesses:

-

- Trading businesses enjoy smoother interstate trade as GST integrates taxes, eliminating the complexities of multiple state taxes.

-

-

Service-Oriented Businesses:

-

- GST brings uniformity to service taxation, replacing the earlier service tax and simplifying the taxation of various services.

-

-

Small Businesses:

-

- Small businesses benefit from the composition scheme, simplifying tax payments and reducing compliance burdens, fostering ease of doing business.

-

-

Consumer Impact:

-

- Consumers often see reduced prices due to GST, ensuring transparency and competitiveness in the market by eliminating multiple taxes.

-

-

Digital Businesses:

-

- Digital businesses, especially in e-commerce, benefit from a standardized tax system, ensuring equality with traditional transactions.

-

-

Logistics and Transportation:

-

- The logistics and transportation sector benefits from the removal of state entry taxes, leading to smoother movement of goods across state borders and reducing transit time and costs.

-

Time of Supply under GST

Time of Supply under GST is about pinpointing when a business needs to pay taxes on its transactions. It’s crucial for businesses to understand this as it helps them comply with GST regulations accurately and on time. The time is determined by factors like the date of the invoice, date of payment, and date of receipt, with the earliest triggering the tax liability. This concept acts like a timeline, guiding businesses on when to fulfill their tax responsibilities, making the GST system operate smoothly.

Also read: Understanding GST Time Of Supply For Goods And Services

Place of Supply under GST

Place of Supply under GST is like figuring out where a sale happened for tax purposes. It’s important because it decides the right tax rates and which government—central or state—gets the tax money. Understanding this helps avoid confusion and ensures fair taxes.

Specific rules in GST laws determine the Place of Supply. Knowing this helps apply the correct GST rate—whether CGST and SGST or IGST—based on where the sale took place. This makes sure tax money is shared fairly between central and state governments, making the GST system work better.

Conclusion

In conclusion, we talked about how GST affects businesses. We looked at registering, different types, and when it applies. It’s important because it impacts various businesses and makes taxes simpler. Knowing when and where transactions happen for taxes is also crucial. Overall, businesses need to follow GST rules to fit into the tax system smoothly.

FAQ’s

-

What is GST?

GST is a tax on things you buy or sell. It’s like a small amount of money the government collects when goods or services are involved.

-

How do I register for GST?

To register, fill out a form on the GST website with details about your business. Once approved, you get a unique GST number.

-

What are the different types of GST?

There’s CGST for the central government, SGST for the state, IGST for inter-state transactions, and also UTGST for Union Territories.

-

When do I need to register for GST?

You register when your business earns more than a set limit. This threshold varies for different types of businesses.

-

When exactly is GST applicable for my business?

GST applies when you buy or sell something, cross the earnings threshold, or deal with transactions between different states.

-

How does GST impact different businesses?

It makes things simpler for manufacturing, trading, and service businesses, ensuring fair taxation. Small businesses benefit from an easier tax payment process.

-

What is Time of Supply under GST?

Time of Supply is when a transaction is considered to have happened for tax reasons. It’s crucial for figuring out when to pay taxes.

-

What is Place of Supply under GST?

Place of Supply is where a transaction is considered to have occurred. It helps determine the correct tax rates and which government gets the tax money.

-

How does GST affect consumers?

GST often leads to reduced prices for consumers. It makes the cost of products and services more transparent and competitive in the market.

-

Can small businesses benefit from GST?

Yes, small businesses can benefit. There’s a composition scheme that simplifies tax payments for smaller enterprises, reducing the compliance burden.