Introduction to GST Return Filing

GST return filing is an essential part of taxation for businesses. It’s like a report card that companies submit to the government, showing details of their sales and purchases. This helps the government keep track of taxes owed and paid. In simple terms, GST return filing ensures that businesses follow the rules and contribute their fair share to the country’s tax system. Without it, there could be confusion and even unfairness in tax collection. So, understanding GST return filing is crucial for businesses to operate smoothly within the legal framework. In this blog, we will understand the basic of GST return filling, process, benefits, impact on businesses and many more.

Basics of GST Return Filing

GST return filing is like sharing a business’s sales and purchases with the government. It’s needed to keep track of taxes. It’s important because it ensures businesses pay the right amount of tax and follow the rules. As we all know The introduction of GST was aimed at simplifying the taxation structure in India by replacing multiple indirect taxes with a single, unified tax.

GST return filing is a key component of this reform, streamlining the tax administration process and reducing the compliance burden on businesses and the businesses can benefit from GST return filing in various ways. It enables them to claim input tax credit on taxes paid on their purchases, thereby reducing their overall tax liability. Additionally, timely and accurate filing can help businesses avoid penalties and legal consequences associated with non-compliance.

Some essential terms associated with GST return filing include:

- GSTIN (Goods and Services Tax Identification Number): A unique identification number assigned to registered taxpayers under GST.

- Output Tax: The tax charged by a business on the sale of goods or services.

- Input Tax: The tax paid by a business on its purchases of goods or services.

- Taxable Turnover: The total value of sales on which GST is applicable.

- Tax Liability: The amount of tax that a business is required to pay to the government.

Also Read: GST Return Filing-Types Of Returns And Process Of Filing

Step-by-Step Guide for GST Return Filing

Here’s a simple step-by-step guide to help you file your GST return:

- Ensure Registration: Ensure that your business is registered under GST and you have a valid GSTIN (Goods and Services Tax Identification Number).

- Determine Filing Frequency: Determine the frequency of filing based on your turnover and business type (monthly, quarterly, or annually).

- Access GST Portal: Log in to the GST portal (https://www.gst.gov.in/) using your username and password.

- Select Return Form: Select the appropriate return form based on your business type and turnover:

- GSTR-1: Details of outward supplies (sales) to be filed by the 10th of the following month.

- GSTR-3B: Summary of outward and inward supplies, and tax payment to be filed by the 20th of the following month.

- Fill in Details: Fill in the details accurately for each section of the chosen return form:

- GSTR-1: Enter details of outward supplies including invoice-wise details.

- GSTR-3B: Provide summary details of outward supplies, inward supplies, and tax liability.

- Upload Invoices: Upload invoices and supporting documents for outward supplies (GSTR-1) if applicable.

- Verify Information: Double-check all entered information for accuracy and completeness.

- Calculate Tax Liability: Calculate the total tax liability based on the details provided in the return form.

- Claim Input Tax Credit: Deduct the input tax credit available on your purchases from the total tax liability.

- Preview and Submit: Preview the filled-in form to ensure accuracy and completeness. Once verified, submit the return form on the GST portal.

- Generate Challan: Generate the GST challan for payment of tax liabilities (if applicable).

- Make Payment: Make the payment of tax liabilities through online banking, credit/debit card, or offline modes such as over-the-counter payment at authorized banks.

- File Return: After successful payment, file the return on the GST portal by confirming the submission.

- Download Acknowledgement: Download and keep a copy of the acknowledgment receipt for future reference.

Also Read: Learn About Types Of GST Returns In India

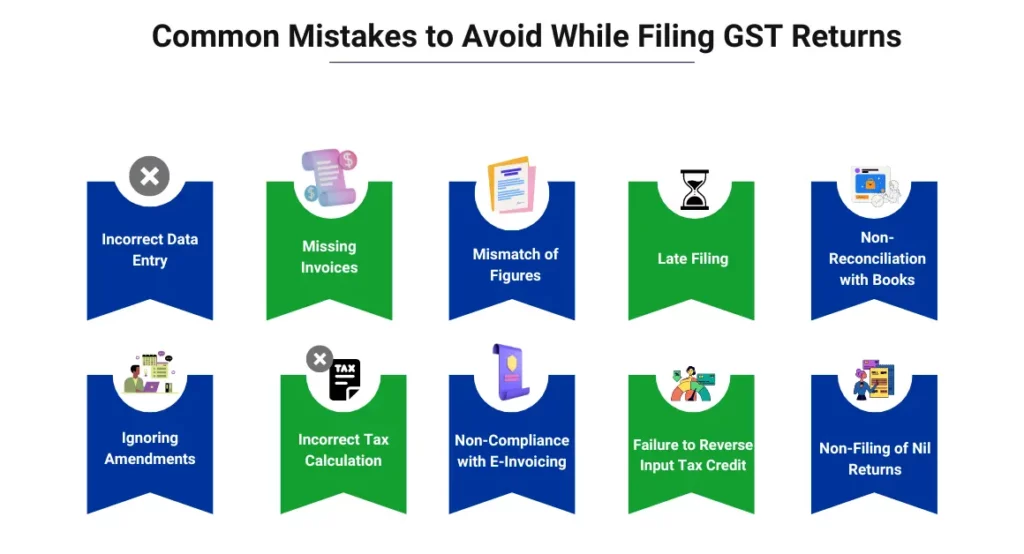

Common Mistakes to Avoid While Filing GST Returns

When filing GST returns, it’s important to avoid common mistakes that could lead to errors or penalties. Here are some common mistakes to steer clear of:

- Incorrect Data Entry: Ensure accuracy when entering details such as invoice numbers, GSTIN, and transaction amounts to prevent discrepancies.

- Missing Invoices: Failure to include all invoices for outward and inward supplies can lead to incorrect reporting and loss of input tax credit.

- Mismatch of Figures: Reconcile data between GSTR-1 (outward supplies) and GSTR-3B (summary return) to avoid discrepancies in reported figures.

- Late Filing: Missing filing deadlines can result in penalties and interest charges, so it’s crucial to file returns on time.

- Non-Reconciliation with Books: Regularly reconcile GST data with accounting records to ensure accuracy and identify discrepancies promptly.

- Ignoring Amendments: Update filed returns promptly in case of any errors or omissions to avoid compliance issues.

- Incorrect Tax Calculation: Ensure proper application of GST rates and tax calculations to prevent under or overpayment of taxes.

- Non-Compliance with E-Invoicing: Ensure compliance with e-invoicing requirements for specified businesses to avoid penalties.

- Failure to Reverse Input Tax Credit: Reverse input tax credit for ineligible or reversed transactions to avoid incorrect claiming of credits.

- Non-Filing of Nil Returns: Even if there are no transactions during a tax period, file nil returns to comply with GST regulations.

Also Read: Top 10 GST Filing Mistakes To Avoid In 2024

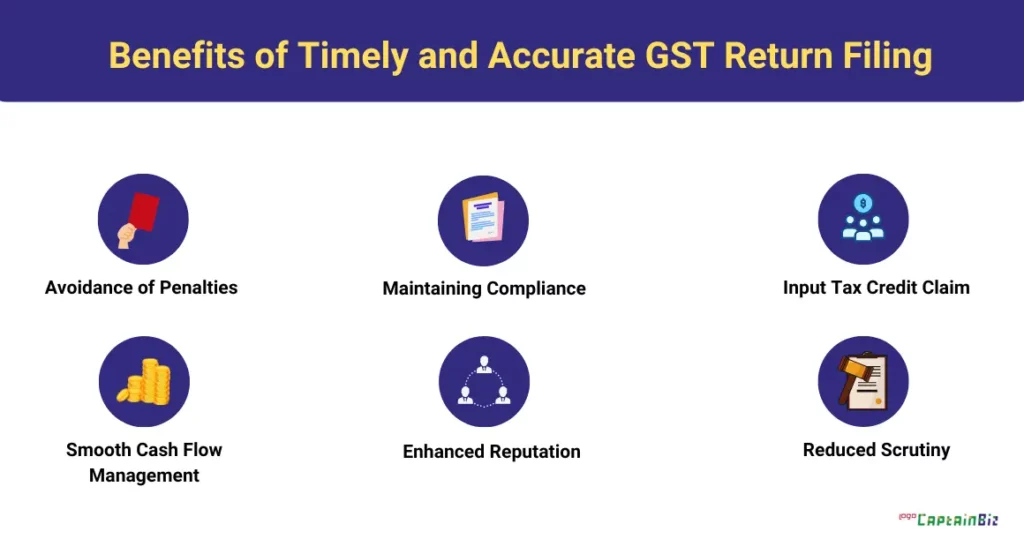

Benefits of Timely and Accurate GST Return Filing

Timely and accurate GST return filing offers several benefits for businesses:

- Avoidance of Penalties: Filing GST returns on time helps businesses avoid penalties and interest charges imposed for late filing or non-compliance.

- Maintaining Compliance: Timely filing ensures compliance with GST regulations, fostering trust with tax authorities and preventing legal consequences.

- Input Tax Credit Claim: Businesses can claim input tax credit (ITC) on eligible purchases only if they file their returns accurately and on time. This reduces the overall tax liability.

- Smooth Cash Flow Management: Accurate and timely filing provides clarity on tax liabilities, aiding businesses in managing their cash flow effectively and avoiding financial strain.

- Enhanced Reputation: Maintaining a consistent record of timely and accurate GST return filing enhances a business’s reputation and credibility among suppliers, customers, and financial institutions.

- Reduced Scrutiny: Businesses that consistently file their GST returns accurately and on time are less likely to attract scrutiny or audits from tax authorities, reducing the risk of compliance-related issues.

Advanced Aspects of GST Return Filing

Advanced aspects of GST return filing involve more complex considerations and practices beyond the basics. Here are some advanced aspects to consider:

- Reverse Charge Mechanism (RCM): Understand and correctly apply RCM provisions, where the recipient of goods or services is liable to pay GST instead of the supplier. This often applies to specific services or transactions.

- Composition Scheme: Explore eligibility and implications of opting for the composition scheme, which offers simpler compliance requirements but restricts certain benefits such as input tax credit.

- Exports and Imports: Navigate the GST implications of international trade, including exports, imports, and related documentation such as shipping bills and customs declarations.

- Input Service Distributor (ISD): Understand the role of ISD and its mechanism for distributing input tax credit (ITC) among various branches or units of a business.

- Place of Supply Rules: Determine the correct place of supply for transactions involving interstate or international supply of goods or services, as this affects the applicability of IGST (Integrated Goods and Services Tax).

- E-commerce Transactions: Comprehend the specific GST provisions applicable to e-commerce operators, including tax collection at source (TCS) and obligations related to GST returns.

- Input Tax Credit Reconciliation: Implement robust processes for reconciling input tax credit claimed in GST returns with supplier invoices and accounting records to ensure accuracy and compliance.

- Annual Return (GSTR-9): Familiarize with the requirements and procedures for filing the annual return, which provides a comprehensive summary of all GST transactions for a financial year.

- GST Audit: Prepare for and undergo GST audits conducted by tax authorities to ensure compliance with GST laws and regulations.

- Advanced Reporting and Analysis: Utilize advanced reporting tools and techniques to analyze GST data, identify trends, optimize tax planning strategies, and mitigate risks.

GST Return Filing Tools and Software

In India, several tools and software are available to assist businesses with GST return filing, ensuring compliance with Indian laws and regulations. Here are some popular GST return filing tools and software:

- GSTN Portal: The Goods and Services Tax Network (GSTN) portal (https://www.gst.gov.in/) is the official platform for GST registration, return filing, payment, and other GST-related activities. It provides various online services for taxpayers and tax authorities.

- GST Suvidha Providers (GSPs): GSPs are authorized entities that provide GST compliance solutions and services to taxpayers. They offer software applications, APIs, and other tools to facilitate GST return filing, invoicing, and reconciliation. Some prominent GSPs in India include ClearTax, Tally Solutions, and GSTN-approved ASPs (Application Service Providers).

- Accounting Software: Many accounting software solutions, such as Captainbiz offer built-in GST compliance features. The software applications automate GST invoicing, return filing, and reconciliation processes, streamlining compliance for businesses.

- Mobile Apps: Several mobile applications are available for GST return filing and related activities. These apps allow taxpayers to file returns, track payments, and access GST-related information on the go.

- Offline Utilities: The GSTN portal provides offline utilities for preparing GST returns offline and uploading them to the portal for filing. These utilities are helpful for taxpayers who prefer offline preparation of returns or face connectivity issues.

- Government Initiatives: Various government initiatives and schemes, such as the GST Saheli program, aim to empower women entrepreneurs and small businesses with GST compliance support. These initiatives may offer tools, training, and assistance for GST return filing.

- Vendor-Specific Solutions: Some vendors offer specialized GST compliance solutions tailored to specific industries or business needs. These solutions may integrate with existing ERP systems or accounting software to provide comprehensive GST compliance support.

Impact of GST Return Filing on Different Business Entities

The impact of GST return filing varies for different types of business entities. Here’s a breakdown of how GST return filing affects various business entities:

Large Corporations:

Big companies have lots of things going on, so following GST rules is a big deal for them. They need to file their GST returns on time and correctly to stay in line with the rules, get the most out of tax credits, and handle taxes well. These companies often deal with problems like handling lots of data, making sure everything matches up, and coordinating between different parts of the company. To handle all this, they need to invest in good systems and processes for GST compliance.

Small and Medium Enterprises (SMEs):

Small and Medium Enterprises (SMEs) face challenges due to limited resources and no dedicated tax departments. Timely and accurate GST return filing is crucial to avoid penalties. It helps SMEs claim tax credits, reduce tax liabilities, maintain compliance, and enhance credibility with suppliers and customers.

Microenterprises and Startups:

Microenterprises and startups struggle with GST compliance due to limited experience and resources, diverting focus from core activities. Government initiatives and tailored solutions offer support, simplifying compliance and aiding effective navigation of GST requirements.

Conclusion

Understanding the basics, following a step-by-step guide, avoiding common mistakes, and embracing advanced aspects are key to successful GST return filing. Utilizing available tools and recognizing its impact on various business entities ensures compliance, fosters growth, and strengthens the tax ecosystem.

FAQ’s

-

What is GST return filing?

It’s reporting sales and purchases to the government for tax purposes.

-

How often do I need to file GST returns?

It depends on your turnover: monthly, quarterly, or annually.

-

What are the common mistakes to avoid?

Errors in data entry, missing invoices, and late filing.

-

Why is timely filing important?

It avoids penalties, helps claim tax credits, and maintains compliance.

-

What are some advanced aspects of GST return filing?

Reverse charge mechanism, composition scheme, and e-commerce transactions.

-

What tools can I use for GST return filing?

GSTN portal, GST Suvidha Providers, accounting software, and mobile apps.

-

How does GST return filing impact different business entities?

It varies based on size, industry, and complexity, affecting compliance and operations differently.

-

What is the process for filing GST returns?

Gather information, access the GST portal, select the return form, fill in details, verify, and submit.

-

What benefits do I get from accurate filing?

Input tax credit, reduced tax liabilities, credibility, and smoother operations.

-

How can I ensure accuracy in my GST returns?

Double-check data, reconcile with books, and stay updated on regulations.