Introduction

GST Applicability means when and how a tax called Goods and Services Tax (GST) is used. It started on July 1, 2017, in India to make taxes simpler. Before GST, there were many different taxes, which made things confusing.

The main goal of GST is to help both businesses and the government. For businesses, GST makes things easier by combining many taxes into one. This makes it simpler to do business and helps them save money. It also stops taxes from piling up, so businesses only pay tax on what they sell.

For the government, GST makes it easier to collect taxes. It helps them track transactions better and reduces cheating. The money from GST is shared between the central and state governments, which helps everyone work together.

Understanding GST Applicability is important for businesses. Following GST rules correctly can bring them benefits. This introduction explains why GST was made, how it helps, and why businesses need to know about it. In this blog we will understand the basics of GST, key components, entities covered and many more.

Understanding the Basics of GST

GST, or Goods and Services Tax, is a kind of tax that’s applied when you buy things. It’s a bit different from the old tax system we had before. Instead of having lots of different taxes like sales tax and service tax, GST combines them into one.

Now, there are three types of GST. The first one is CGST, which is like a tax collected by the central government. The CGST part of GST goes to the central government. Then there’s SGST, which is a tax collected by the state government. The SGST part of GST goes to your state government. And finally, there’s IGST, which is a tax for goods and services that move between different states.

Example: Let’s say you buy a shirt in your own state for $100. If the GST rate is 10%, you pay $5 as CGST and $5 as SGST. So, the total GST is $10. Now, if you buy the same shirt from a different state, you pay IGST, let’s say $10. The total $10 goes to the central government, and then it’s divided between the central and state governments.

So, if you buy something within your own state, you pay CGST and SGST. But if you buy something from another state, you pay IGST.

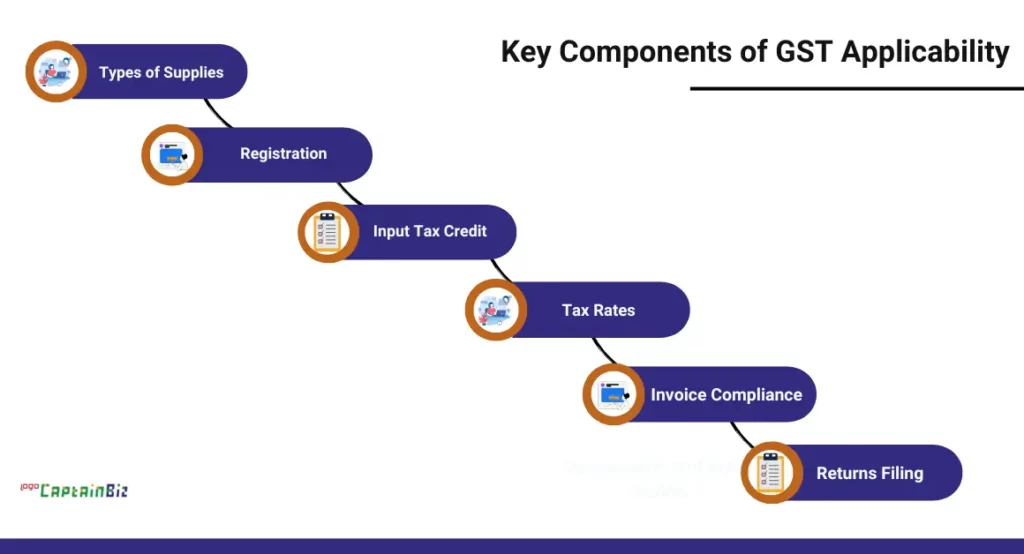

Key Components of GST Applicability

The key components are:

Threshold Limits: GST applies to businesses based on their turnover. If a business’s turnover crosses a certain limit, they must register for GST. This limit is different for different states and types of businesses.

- Types of Supplies: GST is applied to both goods and services. It covers almost all types of supplies except for a few specific items listed as exempt.

- Registration: Businesses need to register for GST if they meet the turnover threshold. Once registered, they get a unique GST identification number.

- Input Tax Credit (ITC): This is an important part of GST. Businesses can claim credit for the GST they pay on purchases. This reduces the tax they need to pay on their sales.

- Tax Rates: GST has different rates for different goods and services. These rates can be 5%, 12%, 18%, or 28%, depending on the category.

- Invoice Compliance: Businesses must issue proper GST invoices with specific details. This helps in claiming ITC and ensures transparency.

- Returns Filing: Regular GST returns must be filed by registered businesses. This includes details of sales, purchases, and taxes paid.

Also Read: Understanding GST Applicability For Businesses In India

Entities Covered under GST

There are various entities are covered under GST such as:

Manufacturers: Any business involved in the production or manufacturing of goods, whether large factories or small-scale units, falls under GST.

- Service Providers: This includes businesses that offer services such as consulting, IT services, healthcare, hospitality, transportation, and more.

- Traders and Wholesalers: Businesses engaged in buying and selling goods, whether within a state (Intra-state) or across states (Inter-state), are covered by GST.

- E-commerce Operators: Online platforms that facilitate buying and selling of goods or services are also included. They have specific compliance requirements under GST.

- Importers and Exporters: Those involved in importing goods into India or exporting goods out of India are covered by GST regulations.

- Startups and Small Businesses: Even small businesses and startups are covered, with some exceptions based on turnover thresholds.

- Aggregators: Businesses that bring together customers and service providers, such as ride-hailing apps and food delivery platforms, are also covered.

- Casual Taxable Persons: Individuals or businesses who occasionally supply goods/services but don’t have a fixed place of business fall under this category.

- Non-Resident Taxable Persons: Foreign entities supplying goods/services in India are considered Non-Resident Taxable Persons and are covered by GST.

- Other Special Cases: There are specific provisions for special entities like Input Service Distributors (ISD), Composition Dealers, and more, each with their own set of rules under GST.

Understanding which entities are covered under GST is crucial for businesses to know if they need to register and comply with GST regulations. It helps ensure proper tax collection and smooth functioning of the GST system.

GST Applicability Across Industries

- Manufacturing Sector:

- Manufacturers of goods are subject to GST on their production processes.

- GST has simplified the earlier tax structure, reducing the tax burden on manufacturers and making it easier to claim input tax credits.

- It promotes efficiency in the manufacturing sector by streamlining taxation and removing barriers to interstate trade.

- Service Industry:

- Service providers like IT companies, consultants, restaurants, and healthcare services are also under the GST regime.

- GST has brought uniformity in tax rates across different services, reducing the complexity that existed under the previous tax system.

- Input tax credit benefits encourage service providers to source inputs from registered taxpayers, promoting formalization of the sector.

- Retail and Wholesale Trade:

- Retailers and wholesalers now follow GST rules, affecting pricing and invoicing.

- GST has simplified tax compliance for these businesses, especially for those operating across multiple states.

- The introduction of input tax credits has helped in reducing the tax burden at each stage of the supply chain.

- Real Estate:

- Under GST, real estate transactions also fall within its ambit, although there are specific rules.

- Developers and builders need to understand GST implications on sales of under-construction properties.

- The GST on real estate aims to bring transparency and reduce tax evasion in the sector.

- E-commerce:

- E-commerce platforms have specific compliance requirements under GST.

- They act as intermediaries between buyers and sellers, collecting and remitting GST.

- GST has made it easier for small sellers on these platforms to comply with tax regulations.

- Textiles and Apparel:

- This sector was previously subject to a complex tax structure, which GST has simplified.

- GST rates on textiles vary depending on the product, with some essentials taxed at lower rates.

- Input tax credit benefits have helped textile manufacturers reduce costs and improve competitiveness.

- Transportation and Logistics:

- GST has had a significant impact on the transportation and logistics industry.

- Interstate movement of goods has become smoother due to the elimination of state entry taxes.

- GST rates for transport services are categorized based on the mode of transport.

- FMCG (Fast Moving Consumer Goods):

- FMCG companies have benefited from GST as it has streamlined their supply chains.

- With reduced cascading taxes, prices of many FMCG products have become more competitive.

- Input tax credits have helped FMCG companies manage costs more effectively.

- Construction and Infrastructure:

- GST impacts construction projects, especially those involving services like architects, contractors, and subcontractors.

- Input tax credit benefits apply to construction materials, reducing the tax burden on builders.

- Developers need to understand GST implications on both residential and commercial projects.

Also Read: When GST Is Applicable For Business

Impact of GST on Business Operations

- Simplified Tax Structure:

- GST has replaced multiple indirect taxes with a single tax, making compliance easier for businesses.

- Businesses no longer need to deal with various state and central taxes separately, reducing paperwork and complexity.

- Input Tax Credit (ITC):

- One of the most significant benefits of GST is the ability to claim Input Tax Credit.

- Businesses can set off the tax they have paid on inputs against the tax they need to pay on output, reducing the overall tax burden.

- Streamlined Supply Chain:

- GST has streamlined the supply chain by eliminating the need for multiple warehouses across states.

- Businesses can now consolidate their warehouses, leading to cost savings in logistics and inventory management.

- Improved Cash Flow:

- With the availability of Input Tax Credit, businesses have more working capital at their disposal.

- This improves cash flow, as they don’t have to pay tax on the entire value of goods/services sold.

- Uniform Tax Rates:

- GST has brought uniformity in tax rates across the country for goods and services.

- This reduces price variations between states, making it easier for businesses to price their products/services competitively.

- Easier Interstate Trade:

- Interstate trade has become smoother as GST eliminates the entry tax barriers.

- Businesses can now sell to customers in different states without worrying about different tax rates and procedures.

- Technology Adoption:

- GST compliance requires businesses to use technology for invoicing, filing returns, and maintaining records.

- This has led to increased adoption of digital technologies, making operations more efficient and transparent.

- Impact on Small Businesses:

- Small businesses benefit from GST as it exempts those with turnover below a certain threshold.

- However, for those who fall under the GST ambit, compliance can be a challenge initially, requiring them to adapt to new processes.

- Increased Formalization:

- GST encourages businesses to operate within the formal economy to avail benefits such as Input Tax Credit.

- This leads to increased transparency and accountability in business transactions.

- Sector-Specific Impacts:

- Different sectors have experienced varying impacts. For example, the FMCG sector has seen reduced prices and increased competitiveness.

- Real estate has witnessed changes in property prices and compliance procedures.

Also Read: GST And The Ease Of Doing Business

Conclusion

In essence, GST Applicability is a transformative shift in India’s tax structure, aiming to simplify and unify taxes across the country. Understanding its basics, key components, entities covered, industry impacts, and effects on operations is crucial for businesses. GST replaces multiple taxes with a single tax, benefiting entities like manufacturers, service providers, and e-commerce operators. It streamlines supply chains, improves cash flow through Input Tax Credit, and encourages technology adoption. The impact spans industries, making interstate trade smoother and promoting a more formalized economy. By adhering to GST rules, businesses navigate this new landscape, save costs, and contribute to a fairer, efficient tax system.

Also Listen: GST applicability on advance payment: Explained

FAQ’s

-

What is GST and why was it introduced?

GST stands for Goods and Services Tax, introduced in India to simplify the tax structure by unifying multiple indirect taxes into one comprehensive tax.

-

How does GST differ from the previous tax system?

Unlike the previous tax system, GST is a single tax that applies to the supply of goods and services across India, eliminating the cascading effect of taxes on taxes.

-

What are the key components of GST Applicability?

Key components include threshold limits for registration, types of supplies covered, input tax credit (ITC), tax rates, invoice compliance, returns filing, e-way bills, and more.

-

Who needs to register under GST?

Businesses whose turnover crosses the prescribed threshold limits need to register for GST. This includes manufacturers, service providers, traders, e-commerce operators, and others.

-

How does GST impact different industries?

GST affects industries differently, simplifying processes for manufacturing, streamlining supply chains for retailers, and introducing new compliance measures for e-commerce.

-

What entities are covered under GST?

Entities covered include manufacturers, service providers, traders, e-commerce platforms, importers, exporters, startups, small businesses, and more.

-

How does GST benefit businesses?

Businesses benefit from GST through input tax credit, reduced tax cascading, streamlined processes, improved cash flow, and a more competitive market.

-

What is Input Tax Credit (ITC) under GST?

ITC allows businesses to claim credit for the GST paid on inputs used in their business, reducing the tax liability on the final product or service.

-

How does GST impact cross-state transactions?

GST has made interstate transactions easier by removing entry barriers and standardizing tax rates, enabling seamless movement of goods and services across state borders.

-

What changes should businesses make to adapt to GST?

Businesses should ensure proper registration, understand and comply with GST rules, maintain accurate records, issue GST-compliant invoices, and adopt digital technologies for easier compliance.