Introduction

When the place of supply and the supplier belong to the same state, the state government or union territory government levies SGST or UTGST, and the central government levies CGST. If a supply is interstate, the government imposes IGST on the transaction. The central government levies CGST on goods and services.

The state government applies SGST within its jurisdiction. The union territory governments impose UTGST in their respective territories. CGST refers to Central Goods and Services Tax. SGST means State Goods and Services Tax.

UTGST stands for Union Territory Goods and Services Tax. Depending on what kinds of products or services are provided, the tax rate of intra-state supplies changes. In the case of intra-state transactions, the supplier needs to collect a combination of CGST and SGST from the buyer.

Definition Of Intra-State Supply

According to the GST Act, intra-state supply occurs when the buyer and the supplier of goods and services are in the same state.

In simple terms, when the supplier provides goods or services to a buyer within the same state, the supply qualifies as an intra-state supply. In this type of supply, the government levies CGST and SGST. CGST gets to the central government, while the SGST is the property of the state government.

Transactions Within The Same State As Intra-State Supplies

To help you understand the concept of intra-state supply better, here are some examples —

Suppose a supply occurs between Kolkata, West Bengal, and Durgapur, West Bengal. In that case, the authorities consider the supply as an intra-state supply because it happens within one state, which is West Bengal in this example.

Now, when it comes to the math of the tax rate of intrastate supplies, it goes like this —

If the supply is worth ₹10,000 and the GST levied on it is 10%, then 5% is CGST, and the remaining 5% is SGST. The total GST payable in this case is ₹10,000 × 10% = ₹100. If we divide it by 2, we will determine the CGST and the SGST separately, which is 50 rs.

The dealer collects the total GST amount of ₹100 and distributes ₹50 to the central government as CGST and ₹50 to the state government (West Bengal, in this example) as SGST.

However, the amount both SGST and CGST add up to is the same amount that IGST is charged with. This is why no matter the nature of the supply – intra-state or interstate, the tax amount remains the same; the only difference is who levies the tax and how they levy it.

Characteristics Of Intra-State Supplies

Under the GST Act India, the main characteristics of intra-state supplies are —

- The primary characteristic that sets the core nature of the supply is the location of the supplier and the supply. If the product or service distribution is done from one place of a state to another palace of the same state, then the supply is tagged as intra-state supply. This supply can happen within the same territory of the country as well.

- When participating in the intra-state transaction of goods and services as a supplier or seller, one needs to get the SGST and CGST tax from the purchaser.

- The central government collects the SGST, and the state government collects the SGST.

Identifying Intra-State Supply Scenarios

Suppose a supply occurs between Jalalabad, Uttar Pradesh, and Faridpur, Uttar Pradesh. In that case, the supply is considered intra-state supply because the supply is happening within one state, Uttar Pradesh, in this example.

Also Read: GST Interstate Vs Intrastate Supply: What Is The Difference

Legal Aspects Of Intra-State Supply

Intra-state supply is the supply within a singular state, so some of the legal aspects of intra-state are —

- The supply is between two places in the same state or the same Union Territory.

- Some exceptions include supply between SEZ developer or SEZ unit.

- When the goods are imported to India or goods supplied to the tourist (referred to in section 15 of the IGST Act)

- The intra-state supply doesn’t include any kind of supply from or to special economic zone units and special economic zone developers.

- However, these legal aspects do not apply if the supply is export or import of goods when the supply comes under the provisions of IGST Act section 11.

Aside from this, if either the buyer or the supplier is located outside India, the place of supply matches the supplier’s location when the following services are provided —

- Any kind of services provided by the financial institute, banking institute, non-financial institute, or even account holders.

- When an intermediary provides the services.

- When the hiring means of transport are in question, those services also come under intra-state supplies.

- Some means of transport don’t come under this section, including aircraft and vessels. The time, in this case, is up to 1 month.

Intra-State Supply In GST Regulations

If a taxpayer mistakenly pays intra-state supply tax as an interstate supply tax, it leads to an incorrect tax payment. Section 19(1) of the IGST Act addresses this issue.

If a taxpayer pays IGST instead of SGST and CGST, they can claim a full refund. However, this applies only if they initially believed the supply was interstate when it was actually intra-state. Certain prescribed conditions must also be met.

The taxpayer does not need to pay any interest on the incorrect tax payment. However, they must still pay the actual tax amount under the correct nature of supply.

Conclusion

The Indian government levies GST as a tax on goods and services. The type of GST depends on the nature of the supply. If the supply is intra-state, it takes place within the same state. In this case, the government applies both CGST and SGST and charges them together.

Intra-state supplies do not include imports or exports in India, the SEZ developer, or unit zones. The SGST and CGST are divided equally and amount to the whole GST, the same amount as the IGST in that particular case. This means that only the nature of the supply changes and not the amount of the tax.

Also Read: How Is The Place Of Supply Determined For Intra-State Supplies?

FAQs

-

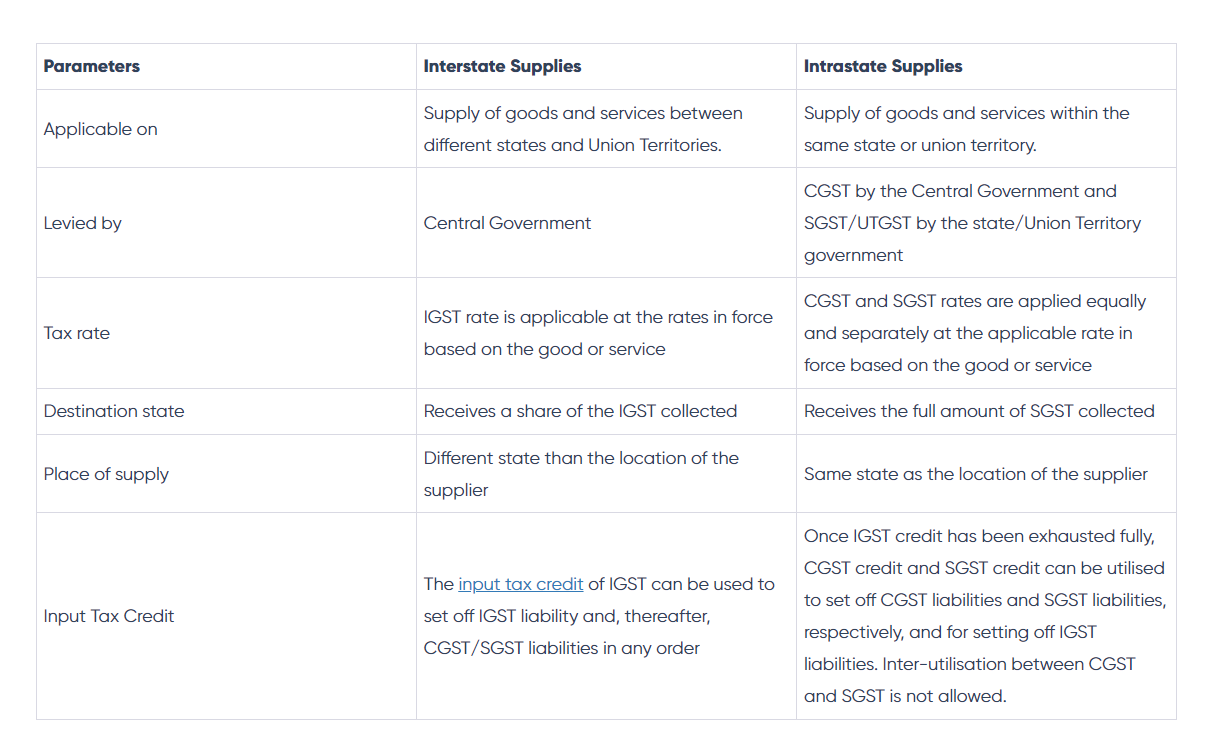

What is the difference between intrastate and interstate supply?

Intrastate supplies happen when the supplier and the purchaser are in the same state. Interstate supply happens from one state to another state, one state to another union territory, and vice versa, and one union territory to another.

-

What is the place of supply in intra-state supply?

Suppose a supplier is located in Bhuj, Gujarat, and the recipient of the supply is in Jamnagar, Gujarat. In that case, the supplier determines the place of supply based on their location or the point from which they initially ship the product or service. In this case, the place of supply is Bhuj, Gujarat.

-

How are CGST and SGST distributed?

CGST and SGST apply to intra-state supplies.

The dealer collects a combination of taxes from the buyer. The dealer then submits these taxes to the central and state governments separately. However, the CGST and SGST amounts are always equal. For example, if the total GST rate is 16%, the SGST is 8%, and the CGST is also 8%.

-

What’s an example of intra-state supply?

For example, if one company in Park Street, Kolkata, supplies products worth ₹50,000 to another company in Dum Dum, Kolkata, the transaction qualifies as an intra-state supply. In that case, the supplier is the company in Park Street. The place of the supply is Dum Dum. If the total GST rate is 10%, the buyer pays ₹5,000 as GST. The supplier then takes the GST and submits it to the government, where it will be distributed among the central and state governments at a rate of 250 rs each.

-

Who collects the CGST, SGST, or UTGST?

The central government receives the CGST, while the state government collects the SGST. If the supply occurs in a Union Territory, the UT government receives the UTGST.

-

What does intra-state outward supply mean?

Intra-state outward supply means the place of supply and the location of the supplier are within the same state. However, exceptions exist when the supply occurs between SEZ Unit B and an SEZ Developer, which also qualifies as an intra-state supply.

-

What is RCM in GST in Intra-Supply?

RCM in GST stands for Reverse Charge Mechanism. It refers to the situation where the purchaser of goods and services pays the RCM to the government. In this case, the supplier doesn’t pay taxes, which is the typical mechanism of GST, which states that the supplier collects the GST from the purchaser and gives it to the government.

-

What is the Cess Tax in intra-state supply?

When businesses promote education or health-related services, the government levies a cess tax. This tax specifically funds the development of those social sectors. The word “cess” originates from “assess,” but a past mistake in a census-related issue led to the spelling difference.

-

What happens if IGST is paid instead of CGST and SGST?

Section 19(1) of the IGST Act ensures a full refund for anyone who mistakenly pays IGST instead of CGST and SGST due to misjudging the tax type. However, there will be other conditions that will be prescribed for such incidents.

-

Can you use SGST credit for CGST in intra-state supply?

No, you can not use the SGST input tax credit to fulfill the criteria of CGST liability. However, the liabilities regarding SGST can be paid by the SGST input tax credit. You can also pay your IGST liability from your SGST available credit balance.