Introduction

Every small and medium-sized company is attempting to shape its financial ecology in today’s highly competitive business environment. In fact, the majority of firms are shifting to cloud-based accounting and billing software for generating invoices, e-way bills, accounting, and other tasks. Moreover, under GST laws in India, a delivery challan is a vital document for continual communication between sellers and purchasers.

According to Section 31 of the CGST Act 2017, registered users who transport taxable goods must submit a bill of sale with the amount and necessary information. Furthermore, it ensures compliance with GST regulations and helps maintain proper documentation for all transactions.

In addition, businesses must ensure compliance with all GST regulations while maintaining accurate records and documentation. Therefore, using reliable and efficient software becomes crucial to streamline this process and avoid potential complications. are essential for carrying and distributing goods.

Additionally, under the Goods and Services Tax (GST), businesses must issue a tax invoice for every supply of goods or services. However, specific transactions, such as relocating machinery or transporting commodities to a separate branch within the state, do not qualify as supplies. Regardless of the lack of a supply in these cases, it is important to issue a delivery challan rather than a tax invoice to simplify the transfer of the commodities while following regulatory standards.

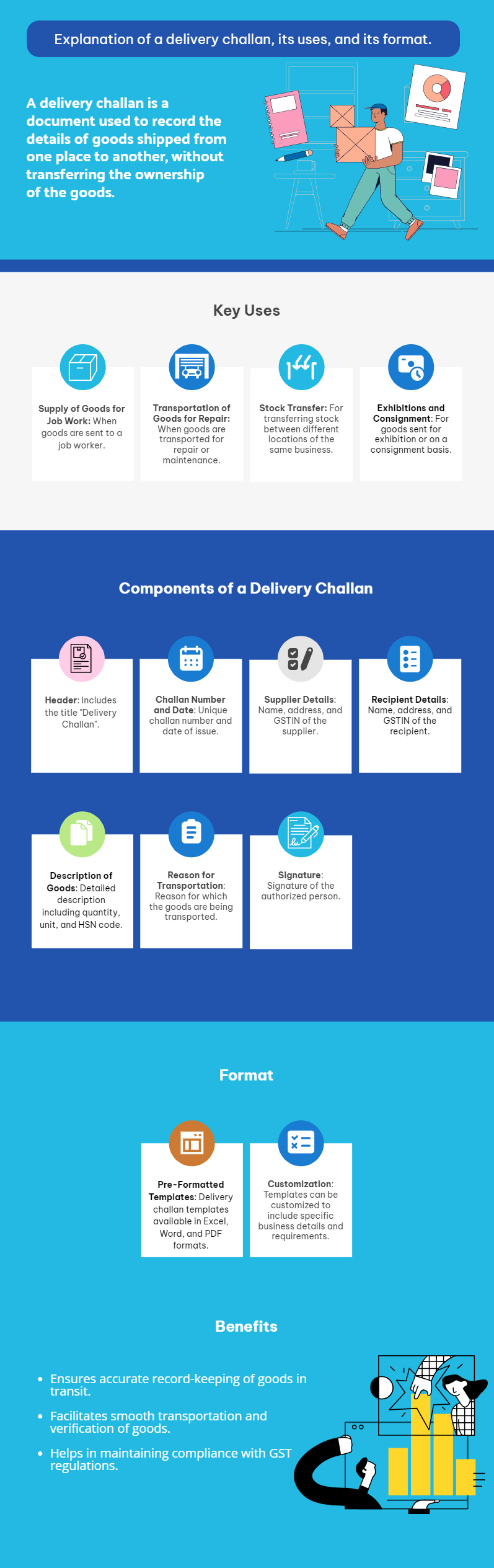

Meaning of Delivery Challan

A business that sells products issues a delivery challan. From the perspective of the Goods and Services Tax (GST), it serves as a record of goods transported from one place to another. The primary purpose of the delivery challan is to track the goods during transportation. It provides information about the products, including their quantity and number, as well as additional relevant characteristics.

A delivery challan under GST is crucial for transactions involving the transfer of goods without a sale. For example, businesses may use it to send items for job work or to transfer commodities between branches of the same company. As a result, it helps businesses streamline their operations while adhering to the legal framework set by GST.

Used Cases of Delivery Challan

When the transfer of goods is necessary without generating a tax invoice, a delivery challan is issued. Here are some instances when a delivery challan can be created by using CaptainBiz Billing software

- Goods for a job work: When businesses send goods to a job worker for processing, repair, or other reasons, they issue a delivery challan instead of a tax invoice. The sender returns the goods after completing the job.

- Exhibition or trade fairs: Similarly, if businesses provide products or items for display in exhibits, trade fairs, or as free samples, they issue a delivery challan to facilitate their movement without requiring a tax invoice.

- Goods transfer between branches: The company issues a delivery challan when it transports goods from one branch to another, documenting the movement without generating a tax invoice.

- Goods on approval supply: A delivery challan for small businesses is use to send products without a tax invoice until they are approves the items in cases where the products are supplied on an approval or sale-or-return basis.

- Export supply: Delivery challan for exporters are used in the export of products to move items from one place to another without the need of a tax invoice.

Who Can Use Delivery Challans?

Goods Transportation

- Business to Customers (B2C): The delivery challan can verify the delivery of acquired items sold online or offline to the customer’s address.

- Business to Business (B2B): Manufacturers or wholesalers can use delivery challans to document the delivery of goods, thereby streamlining the invoicing and payment process.

Transfer of Goods

- Inter-Branches Transfer: Businesses with multiple branches record the movement of goods from one branch to another using delivery challans.

- Warehouse Management: A delivery challan can record the transfer of goods from warehouses to retail stores or vice versa.

Return or Replacement of Goods

- Product Returns: If a customer returns goods due to damage, defect, or other reasons, you can use a delivery challan.

- Replacement of goods: When exchanging goods, businesses can use a delivery challan to document the exchange of goods.

Manufacturing and Production

- Raw Material Supply: During manufacturing, you can record the transfer of raw materials using delivery challans when you send them for production.

- Finished Goods Distribution: Additionally, you can create a delivery challan to track the transportation of finished goods when you transport them from the manufacturing unit to retailers or wholesalers.

Benefits of a delivery challan

A GST delivery challan is a document that accompanies goods during transportation. You can also refer to it as a delivery note or delivery receipt.

Here are some benefits of a delivery challan:

1. Delivery proof

- A delivery challan acts as a proof of delivery.

- Additionally, the sender delivers the products to the designated recipient, ensuring timely delivery.

- It includes all the vital details of the goods, such as number of items, description, and so on.

2. Delivery tracking

- Through delivery challan for small businesses, they can keep track of all the goods they have delivered to their customers.

- By doing so, the business ensures that it delivers all the products as per the order.

3. Facilitates invoicing

- A business can use delivery challans to easily create invoices from a sales order.

- A GST delivery challan provides the necessary information for generating accurate invoices, such as the quantity and description of the delivered goods.

Read More: E invoicing FAQs

4. Minimizes errors

- The use of digital delivery challans can significantly help reduce errors and avoid losses.

- Moreover, digital GST delivery challans provide faster and easier access to information, thereby minimizing the chances of manual errors in recording and processing deliveries.

5. Saves valuable time

- Using a delivery challan template not only saves time in creating consistent delivery notes, but also ensures accuracy

- In addition, withthe help of predefined templates, businesses can quickly fill out the necessary fields and generate professional-looking delivery challans.

6. Convenience and centralized tracking

- Cloud-based software suites can store delivery challans in a centralized database.

- As a result, this makes it easier to track and check them.

- It enables businesses to monitor their shipments, keep customer records separate, and easily access delivery information whenever required.

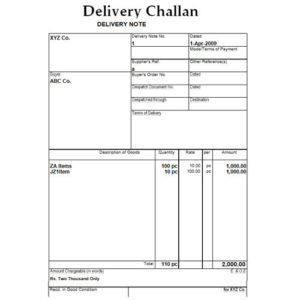

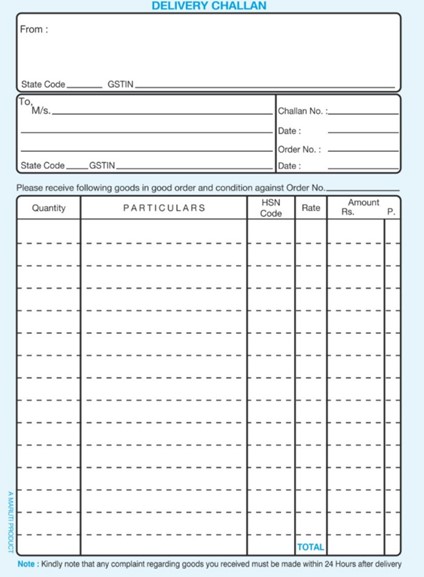

Delivery Challan Format

The GST delivery challan format may vary based on the specific needs of a business or the regulatory requirements of a specific country or region. In general, the following is a basic outline of the delivery challan format:

Delivery Challan Format in Excel

Delivery Challan Format in Word

- Serial number: The delivery challan under GST regulations includes a pre-assigned serial number.

- Issuance date: The format incorporates the date on which the delivery challan is issued.

- Header details: The header section includes vital details such as the consignor’s logo, name, address, GSTIN (Goods and Services Tax Identification Number), and Challan Identification Number.

- Consignee details: The delivery challan format includes information about the consignee – name, address, GSTIN.

- Product information: Detailed information about the products is provided. Furthermore, it includes product descriptions and Harmonized System of Nomenclature (HSN) codes.

- Quantity: The quantity of the goods being transported is specified in the delivery challan format.

- Financial details: Financial aspects are outlined. This includes the total taxable value, price per unit of the item, overall amount, and any discounts provided.

- GST amount: The GST amount applicable is clearly mentioned in the delivery challan.

- Interstate movement details: In cases of interstate movement, the location of supply is indicated in the delivery challan format.

- Authorized Signature: The format concludes with the signature of an authorized person, thereby confirming the legitimacy of the goods being transported.

Key components of a GST delivery challan

The GST delivery challan, assigned a serial number not exceeding 16 characters, whether in a singular or multiple series, must include the following particulars:

- Date and number of the delivery challan

- Name, address and GSTIN of the consigner

- Name, address and GSTIN of the consignee

- HSN code and description of goods;

- Quantity (provisional, where the exact quantity being

- supplied is not known)

- Taxable value

- Tax rate and tax amount – Central tax (CGST), State tax (SGST), Integrated tax (IGST)

- Place of supply

- Signature

A sample delivery challan (specimen)

Generation of delivery challans in Triplicate

The delivery challan, in the event of goods supply, is to be generated in triplicate and should follow this format:

-

-

- Firstly, the first copy is designated as the “ORIGINAL FOR CONSIGNEE.”

- The second copy is designated as the “DUPLICATE FOR TRANSPORTER.”

- Lastly, the third copy is designated as the “TRIPLICATE FOR CONSIGNER.”

-

Step-by-step process to generate a delivery challan for small businesses

- Understand the purpose behind generating the delivery challan: Identify the purpose behind issuing the proof of purchase, whether it is for job work, exhibition, inter-branch transfer, or any other valid reason.

- Create the delivery challan: Create the delivery challan with all the essential details such as the sender’s name, address, GSTIN, receiver’s name, address, GSTIN, challan number, issuance date, and a precise description of the transported goods, including quantity and HSN/SAC codes.

- Verify e-way bill requirement: Initially, assess whether the value of the transported goods surpasses the GST threshold limit. In that case, confirm the necessity of an e-way bill. If necessary, generate the e-way bill with relevant information and affix it to the proof of purchase.

- Declaration: Additionally, add a declaration to the delivery challan, highlighting the purpose of the goods’ movement and certifying the accuracy and truthfulness of all provided information.

- Signatures: Ensure both the sender and receiver sign the delivery challan, signifying acknowledgment of the goods’ movement.

- Record maintenance: Preserve a duplicate of the issued delivery challan and associated documents for record purpose. Additionally, it is crucial to retain these records for a minimum of three years (72 months) from the issuance date as per the GST rules and regulations.

- Issuance and handover: Provide the delivery challan to the individual responsible for transporting the goods, ensuring it accompanies the goods throughout transit.

- Follow-up: After the movement of the goods, follow up with the receiver to ensure they received the goods as intended. Additionally, in cases of job work, ensure the return of goods upon completion of the job.

Also Read: How Digital Billing Solutions Simplify Challenges for MSMEs

Conclusion

In addition, the careful preparation and issue of a delivery challan for small businesses is essential in guaranteeing the seamless movement of products. By doing so, organizations may improve effectiveness and compliance in their supply chain management by understanding and methodically creating the delivery challan with accurate data. The GST delivery challan must comply with regulatory standards such as E-way bills where appropriate. An effectively managed delivery challan procedure, in essence, is critical to ensuring transparency, compliance, and successful logistics management.

Frequently Asked Questions (FAQs) about delivery challans

Here, we present some of the most frequently asked questions about delivery challans.

1. What is the meaning of delivery challan?

A delivery challan is a document to monitor product shipments. Furthermore, it ensures timely delivery without hassles like missing or damaged items.

2. Why is a delivery challan necessary for businesses?

A delivery challan is crucial for businesses to:

- Track shipments

- Ensure on-time delivery

- Confirm receipt by the party/customer

- Resolve issues pertaining to damaged or missing product

3. Which are the main components of a delivery challan?

The key components of a delivery challan are:

- Supplier’s name and address

- Recipient’s name and address

- Shipment date

- Delivery challan number

4. How can businesses ensure that their delivery challans are efficient?

Businesses can ensure efficiency of their delivery challans by:

- By using a template having all the essential information, you can streamline the process.

- Additionally, assign a unique number for a particular shipment

- Finally, ensure you preserve a copy of the delivery challan for record purposes to comply with regulations.

5. Who is supposed to issue delivery challans?

Businesses delivering products are required to issue delivery challans. These include:

- Retailers

- Wholesalers

- Manufacturers

- Distributors

- E-commerce businesses

6. What is the main difference between a delivery challan and E-challan?

Delivery challan is in physical form, while e-challan is electronic.

7. How many copies of a delivery challan need to be generated?

Three copies of the delivery challan need to be generated. They should be labeled as:

- Original for consignee

- Duplicate for transporter

- Triplicate for consignor

8. What information (details) are required in a delivery challan?

The delivery challan should have the following information:

- Consignor’s business details

- Shipment date

- Challan number

- Supplier’s state

- Transportation details

- Consignee’s state and GSTIN

- Product description andHSN code, quantity

- Rate per unit, total amount, discounts, taxable value

- GST details (IGST, CGST, SGST)

- Calculated total.

9. What is the difference between a delivery challan and a tax invoice?

Distinguishing between a delivery challan and a tax invoice involves considering various aspects:

| Parameter | Tax invoice | Delivery challan |

| Ownership and legal responsibilities | Establishes ownership and legal responsibilities. | Lacks proof of ownership or legal responsibilities. |

| Value representation | Actual value of goods is presented. | Signifies that the customer/client has acknowledged receipt of the goods but does not reflect the actual value. |

| Transaction confirmation | Serves as evidence that a sale transaction has occurred. | Delivery challan may or may not result in a sale. |

| Financial information | Provides comprehensive details, including the actual value and applicable taxes. | Displays the rate of a specific product but not the complete value of the sale. |

10. What exactly is a returnable challan?

A returnable challan serves as a document to temporarily transport goods. Afterward, the recipient must return the identical goods. Typically, businesses use this challan for contract labor, repairs, or exhibits. Moreover, it clearly indicates the returnable character of items. Moreover, it monitors their temporary travel, ensuring the distribution does not conclude until the products are returned. It monitors the temporary travel of the goods and ensures the distribution does not conclude until the products return.