INTRODUCTION

In the logistics sector, electronic waybills, or E-waybills, are essential records that guarantee the prompt delivery of goods. But occasionally, it can be necessary to extend the validity of an E-waybill.

Understanding these situations can help you efficiently handle the constraints, whether you are a business owner or a logistics staff member. This article examines the reasons for extending the validity of E-waybill so you are aware of when they’re essential.

So, let us explore the root cause of E-waybill extensions together…..

Scenarios necessitating E-waybill extension

Sudden scenarios can arise while transporting cargo with E-waybills in some cases. These circumstances may indicate that you require an extension of the period allotted in the original E-waybill. Some of these situations are given below:

| Unexpected Delays | If there are unforeseen delays in the delivery of your goods, an extended E-waybill guarantees that you can still transfer them without any issues. |

| Trans-shipment Needs | You may need additional time if goods need to switch between vehicles or modes of transportation in the middle of their journey. In these cases, extending the E-waybill is beneficial. |

| Natural Calamities | Natural disasters or bad weather might cause schedules for travel to be disrupted. Such occurrences necessitate an extension if goods become stuck. |

| Vehicle Breakdowns | There may be delays if the vehicle transporting your goods breaks down. You can handle these unforeseen circumstances with more flexibility if you extend the E-waybill. |

Legal recognition of valid reasons for E-waybill extension

The Goods and Services Tax (GST) laws generally permit e-waybill extensions. These laws set up the guidelines for creating and maintaining E-waybills and regulate the taxation of goods and services in India.

Businesses may prolong the validity of an E-waybill for valid reasons, such as transshipment or extraordinary circumstances. When applying for an E-waybill extension, it’s crucial to adhere to the rules and specifications established by the GST laws to guarantee compliance.

Compliance obligations for citing valid reasons

Citing valid reasons for functions necessitates compliance with specific rules and guidelines. They include:

|

|

|

|

|

|

|

Documentation supporting valid reasons for E-waybill extension

The following documents are typically required to provide sufficient reasons for an E-waybill extension:

- Extension Request Form: A formal request form outlining the necessity of an extension. It is available in E-Waybill Portal.

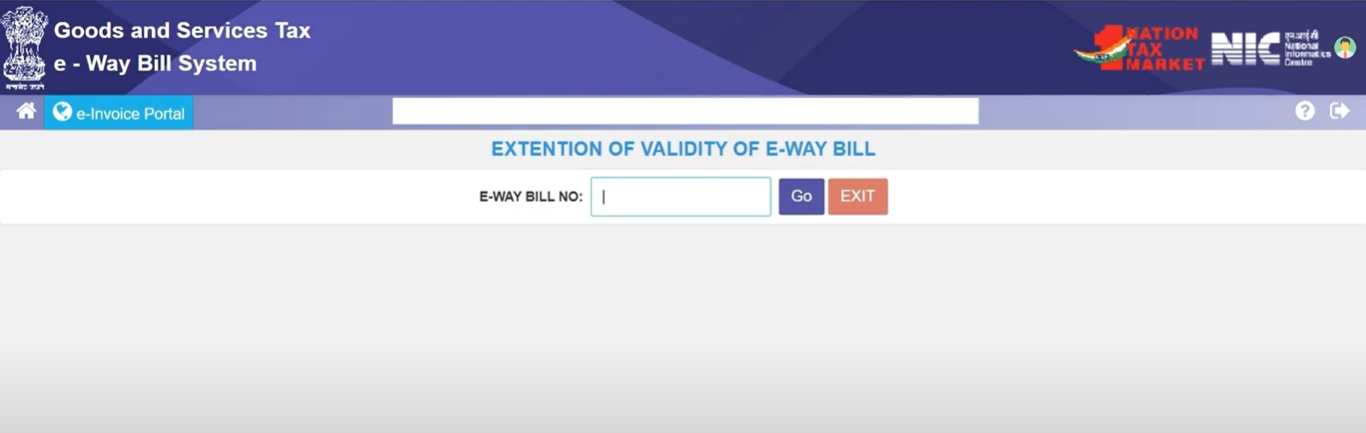

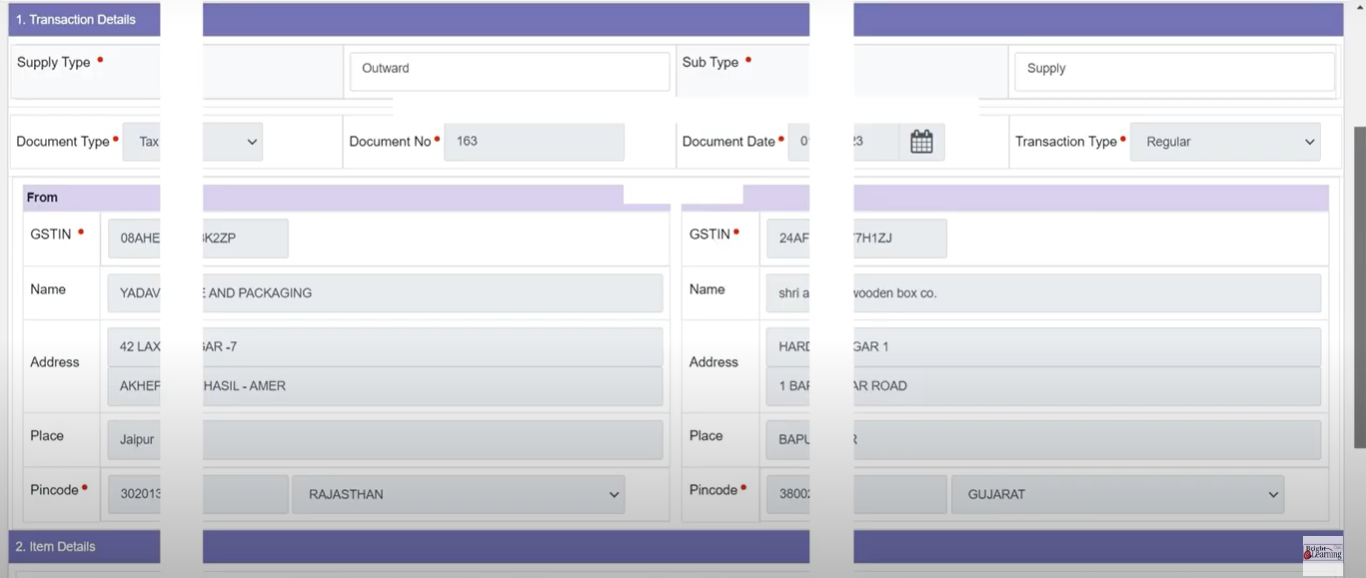

1) FORM 1 of E-waybill Extension

2) FORM 2 of E-waybill Extension

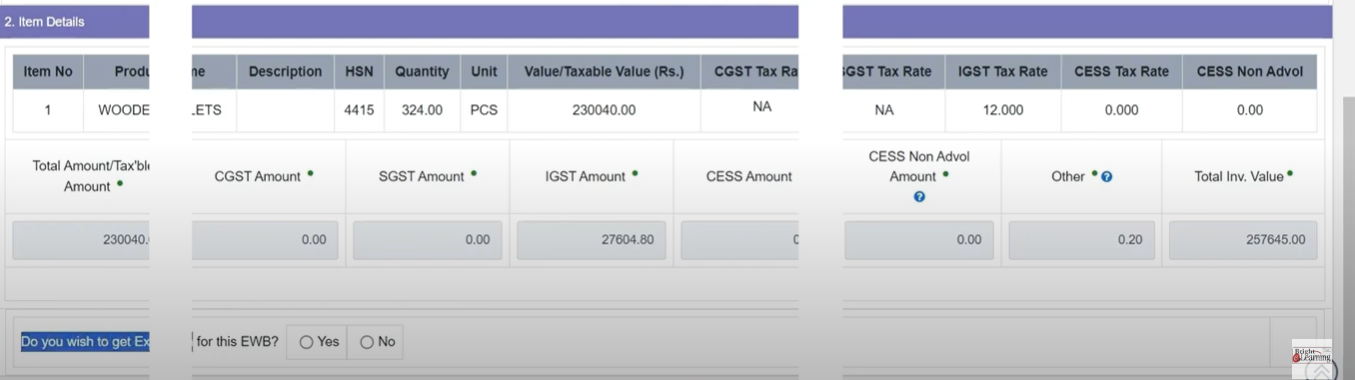

3) FORM 3 of E-waybill Extension

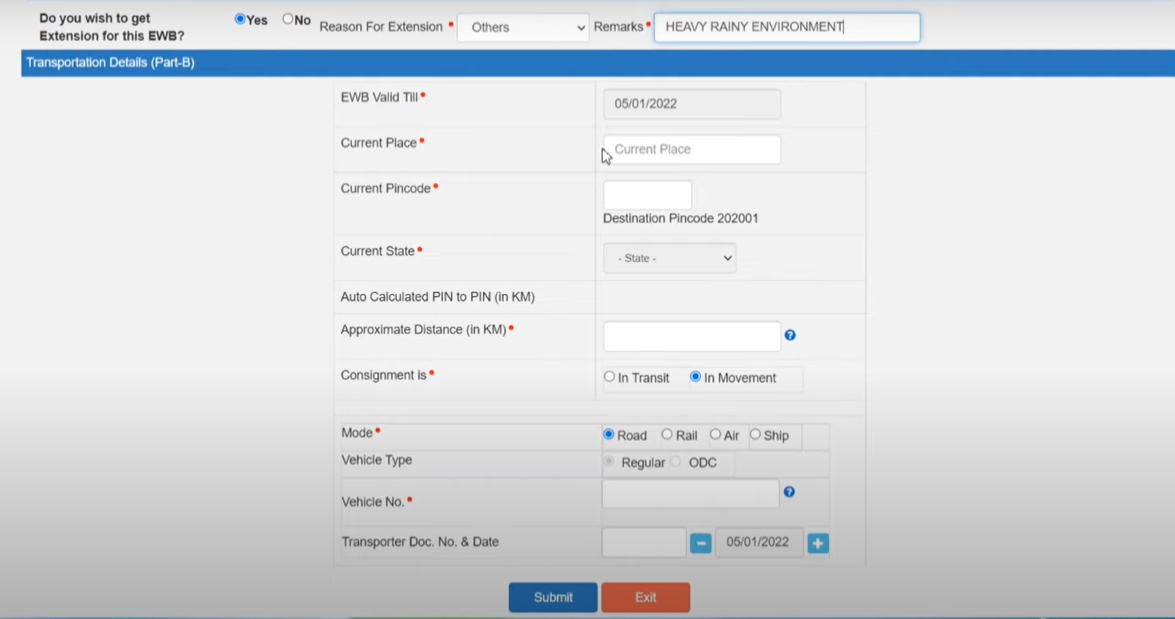

FORM 4 of E-waybill Extension

- Original E-waybill: A duplicate of the original E-waybill for validation and reference.

- Reason Statement: A clear and comprehensive explanation for the extension. It may be any of the following situations:

|

|

|

|

|

- Supporting Evidence: Any supporting documentation or proof (such as official correspondence, contracts, etc.) that supports the claimed purpose.

- Timeline Documentation: Documents illustrating the timeline or list of circumstances that lead to the requirement for an extension, if necessary.

- Approval Records: Maintain documentation of the approval procedure if the extension needs permission.

- Internal Procedures Documentation: Records detailing the internal procedures required to identify and handle E-waybills extensions.

- Any Other Relevant Records: Supplementary documents relevant to the industry or the reason for the extension.

Reporting requirements for extended E-waybill scenarios

Reporting extended E-waybill scenarios is crucial for ensuring the seamless movement of goods throughout the transportation process. This practice supports compliance with legal requirements and upholds transparency among all involved stakeholders.

By submitting E-waybill extensions, businesses help ensure that the status of their goods is clearly and accurately represented. This practice not only aids in complying with legal requirements but also fosters efficient communication between consignors, consignees, transporters, and other involved parties.

In the supply chain, timely and accurate information promotes better scheduling and coordination, which lowers the chance of delays. Additionally, it offers a record of compliance, which is crucial for regulatory inspections and audits.

In general, disclosing extended E-waybill possibilities is a proactive step that improves legal compliance, operational effectiveness, and ecosystem trust in logistics.

Challenges in determining and proving valid reasons

There are many challenges in identifying and substantiating valid reasons for an e-waybill’s validity extension. To begin with, the lack of uniform standards for extensions can create uncertainty about what qualifies as an acceptable justification. Furthermore, the justifications given must be verified and recorded, necessitating an open and effective mechanism for validation.

The procedure is made challenging by the need to verify the legitimacy of the extension requests and safeguard against abuse. In addition, the diverse character of business activities and unforeseen incidents complicate the process of developing widely applicable standards.

The successful implementation of e-waybill validity extensions is a constant challenge, as it requires striking a delicate balance between safeguarding the system against abuse and ensuring sufficient flexibility for legitimate circumstances.

Exemption considerations for specific situations

Authorities could grant an extension in some circumstances without requesting an in-depth explanation while they might need one in others. In general, authorities may permit the extension of an e-waybill validity in the following situations without requesting specific reasoning:

| Technical Glitches or System Issues | Authorities may grant extensions without requiring a specific explanation if system malfunctions or other problems interfere with the timely creation or updating of e-waybills. |

| Natural Calamities or Unforeseen Events | Situations such as natural disasters, catastrophes, or unforeseen circumstances that have a major effect on transportation may be accepted as legitimate excuses for an extension without the need for a thorough explanation. |

| Government-Declared Events | Businesses might not necessarily give explicit justifications in situations where the government has stated that particular events or circumstances demand an extension of the validity of e-waybills. |

| System-Generated Extensions | Certain authorities could possess automated mechanisms that automatically accept extensions under specific predetermined circumstances, eliminating the need for human explanation. |

| Predefined Grace Periods | The regulations may provide grace periods or concessions that allow the validity extension of an e-waybill without specific explanation. |

Best practices for communicating valid reasons for extension

It is critical to be genuine, precise, and clear when explaining justifications for an e-waybill validity extension. The following are some basic approaches for expressing reasons:

- Provide Specific Details: Give a comprehensive description of the particular circumstances that led to the request for the extension. Add information about the location, the kind of delay, and any additional relevant details.

- Use Clear and Formal Language: When communicating, use formal, professional language. Give concise, clear explanations for the extension’s reasons.

- Reference Applicable Regulations: If there are any particular rules or laws that permit e-waybill validity extensions in certain situations, make sure to include them in your correspondence. This provides a more solid basis for your request.

- Attach Supporting Documentation: Provide supporting documentation wherever you can prove your requests for the extension. Weather warnings, accident reports, and other relevant information may be part of this.

- Timely Communication: Let them know that the e-waybill might not be valid within the allotted period and that an extension is required as soon as possible. Fast communication might show proactive management and compliance.

- Use Electronic Communication Channels: When requesting an extension, if applicable, use the electronic channels of contact that the appropriate authorities have authorized. This guarantees that appropriate individuals receive your communication properly.

- Follow Official Procedures: Follow the formal procedures outlined by the tax or transportation authorities to submit a request for an extension. This might include certain documents, web portals, or contact information where individuals may request extensions.

- Explain Preventive Measures Taken: If there was an avoidable reason for the delay, describe the preventive steps you took to make sure that similar circumstances never happen again. This might show that you are upholding regulations and pursuing ongoing development.

- Maintain Transparency: Be open and honest in every interaction. Refrain from giving inaccurate or deceptive information as performing so may result in legal consequences and ruin your reputation.

Audit and verification of reasons for E-waybill extension

As part of the audit and verification process, it is, therefore, usually necessary to confirm that the explanations given for the e-waybill extension are true, accurate, and in compliance with all applicable laws.

Depending on the particular regulations of the relevant authority, the procedure could, therefore, change. However, the general procedures for evaluating and verifying the justifications for e-waybill extensions are as follows:

- Documentary Review: Collecting and thoroughly checking every necessary document for the extended e-waybill is essential. This process, therefore, might include the initial e-waybill, the extension request, and any relevant supporting paperwork to ensure accuracy and compliance.

- Reasonable Cause Assessment:Examine the reasons given for the extension to see if they meet the appropriate standards established by the transportation or tax authorities. For instance, natural catastrophes, technological problems, and acts of exceptional circumstances are examples of common, acceptable explanations.

- Timeline Verification: Verify the sequence of events carefully to ensure that the extension request was submitted within the allotted time. Additionally, confirm that the provided explanations align with the transit procedure’s time frame, maintaining accuracy and compliance.

- Supporting Evidence: Examine the supporting documents or evidence submitted to justify the extension request. This may include weather reports, vehicle breakdown documentation, or any other relevant proof to ensure the validity and authenticity of the extension.

- Communication Records: Examine any correspondence that may have taken place between the consignee, consignor, and transporter regarding the reasons for the postponement in order to verify the accuracy and consistency of the details provided.

- Cross-Verification with Authorities: Confirm the reasons with the appropriate authorities or government organizations if necessary. Certain countries could have a system setup that allows the authorities to verify the explanations.

- Audit Trail Analysis: Examine the audit trail to see if the e-waybill generation and extension process occurs electronically in order to ensure that the extension was obtained and authorized through the proper channels.

- Compliance with Regulations: Confirm the reasons with the appropriate authorities or government organizations if necessary. Additionally, certain countries could have a system set up that allows the authorities to verify the explanations.

- Internal Controls: Examine the organization’s internal controls to guarantee that procedures exist in place to confirm and validate the reasons for e-waybill extensions before submission.

- Penalty Assessment: Determine if penalties or fines are appropriate following the regulations if the extension grounds prove to be invalid or non-compliant.

Also Read: How Long Does An E-Way Bill Remain Valid And What Needs To Extend Its Validity

Legal consequences of providing false reasons for E-waybill extension

Giving a false reason for an e-waybill extension appears as a regulatory violation, which carries significant legal consequences. Depending on the authority, the precise consequences could change, however typical legal implications might include the:

| Penalties and Fines | Companies or individuals face financial penalties or fines if they give fraudulent reasons for an e-waybill extension. The severity of the violation and the laws of the particular area will determine how much of a punishment is imposed. |

| Prosecution and Legal Action | Giving false information with knowledge might result in criminal charges in more extreme situations. Individuals or organizations discovered to have intentionally provided false information may face legal action. |

| Revocation of E-Waybill Privileges | If companies or individuals consistently give misleading information, the authorities have the right to cancel their e-waybill rights. Normal company operations and logistics may be disrupted as a result. |

| Civil Liability | In a civil court, the person who gives misleading information might be held accountable for any losses or damages suffered by third parties as a result of the false information. This can entail paying those affected a cash settlement. |

| Business Disruption | A company’s daily operations, client relationships, and financial security may all be affected by legal issues. |

Also Read: Legal Provisions and Penalties for Non-compliance with E-waybill Expiry

Conclusion

In summary, addressing issues is necessary to identify reasons for extending the validity of an e-waybill. Setting up transparent and well-defined criteria is essential to make sure the validation process is honest and transparent. Moreover, complicated aspects include the requirement for credible paperwork and a strong mechanism to prevent misuse.

One of the fundamental challenges, however, is maintaining a balance between avoiding misuse and allowing for flexibility in real circumstances.

A careful strategy, therefore, is necessary to improve the efficacy of e-waybill extensions, particularly by taking into account the variety of business conditions and unanticipated events.

Also Read: E-waybill Extension: When and How to Extend an E-waybill Validity

Also Listen: How to create E-way Bill With CaptainBiz

FAQs

Q1. What is an e-waybill extension?

An e-waybill extension, therefore, allows for the prolongation of the validity period of the electronic waybill beyond its initial expiration date.

Q2. What are some common valid reasons for e-waybill extension?

Valid reasons may include, for instance, unforeseen delays in transit, natural disasters, vehicle breakdowns, or other exceptional circumstances that affect the timely completion of the journey.

Q3. How do I apply for an e-waybill extension?

The process typically involves, first, submitting a request through the designated electronic platform and, subsequently, providing detailed information about the reason for the extension.

Q4. Is there a standard duration for e-waybill extensions?

The duration can vary, as it often depends on the nature of the valid reason provided. Typically, however, extensions are granted for a reasonable period to effectively accommodate the specific circumstances.

Q5. Can I request an extension after the e-waybill has expired?

Requests should be made as soon as possible, but if the delay has a legitimate and well-documented explanation, certain systems could permit retroactive extensions.

Q6. Are there penalties for requesting an extension without a valid reason?

Yes, misuse of the extension mechanism may lead to penalties. Therefore, it is essential to provide accurate and verifiable reasons in order to avoid such consequences.

Q7. Are all kinds of goods eligible for e-waybill extensions?

The majority of the time. All items being transported, regardless of their type or categorization are eligible for the validity extension.

Q8. What is the processing time of the e-waybill extension?

Though actual requests are normally processed quickly, processing times can vary. The e-waybill system’s automation, therefore, facilitates a more efficient extension procedure.

Q9. If my request for an extension of my e-waybill is rejected, may I appeal?

A procedure for appeals, in some cases, may exist; however, it depends on the system in use. Therefore, it is important to comprehend the particular procedures delineated by the appropriate authorities.

Q10. How do you stop e-waybill extensions from being misused?

Several measures, therefore, exist to prevent fraudulent extension requests and maintain the integrity of the e-waybill system. These include, therefore, stringent verification procedures, audit trails, and fines for misuse.