Since its inception in 2017, the E-way bill system has enhanced the movement of goods in India. The electronic document, which is mandatory while shipping goods worth more than Rs. 50,000, helps businesses and transporters comply with tax laws while streamlining the entire supply chain. The system assigns a unique code as the e-way bill number when it creates the e-way bill. It helps the person who sends, receives, or transports the goods to check where the goods are.

Updates and regulations have improved how carriers and other registered workers obtain the permit through the e-way bill system. Before delving into some of the updates that have come into play. First, you should understand how an e-way bill works and how it generates.

The e-way bill includes the receiver’s GSTIN, delivery location, and date. The bill also details the quantity and unit measurement of the goods, their value and the reasons for transportation.

Understanding E-way Bill Generation

E-way bill registration is mandatory whenever there is a need to transport a consignment of goods worth more than Rs. 50,000. The transportation could relate to inward supply within the State or interstate. On the other hand, if a dealer exempt from GST handles the transportation of goods. Then the dealer must generate the e-way bill, even if the value of the food does not exceed the Rs. 50,000 level.

Only the parties involved in a consignment transaction that exceeds Rs. 50,000 have the duty to generate the e-way bill. However, in most cases, the sole or primary responsibility lies on the person supplying the goods and not the recipient.

On the other hand, if the supplier is not registered under GST rules, the responsibility of generating the e-way bill will always be held by the receiver, commonly referred to as the consignee. If both parties cannot create the permit, the transporter will have to do so to comply with the regulations.

Once the authorities generate the e-way bill, they find it much easier to implement GST laws in the country. The e-way bill helps to track the goods better in the supply chain. It shows how the goods are moving, where they are going, and what kind of transport they are using.

Multiple e-way bills are needed when a consignment is conveyed by multiple vehicles or modes owing to unanticipated circumstances. The transporter has to change the details of the transport on the e-way bill portal before the goods are moved to another vehicle or way of transport. The update must reflect the new vehicle number and the new transporter ID. You fill out GST EWB-01 GST EWB-01 to do this.

When do you not require an E-way Bill?

There is an exceptional circumstance when the supplier, transporter or recipient will not have to produce the e-way bill permit. Circumstances under which a person can engage in a transaction without an e-way bill under provisions of rule 138 (14) include:

- Whenever the transportation of the goods is not via a motor vehicle

- When they transport goods to an inland container depot for customs clearance

- When a company transports a consignment under a Customs Bond

- Also, when moving goods governed by defense formation

- When transporting empty containers of cargo.

- Whenever the government is pushing a consignment via rail

- When transporting goods whose value is less than Rs. 50,000?

However, when we transport a consignment for a short distance of less than 20 Km for weighing purposes, we require a delivery Challan.

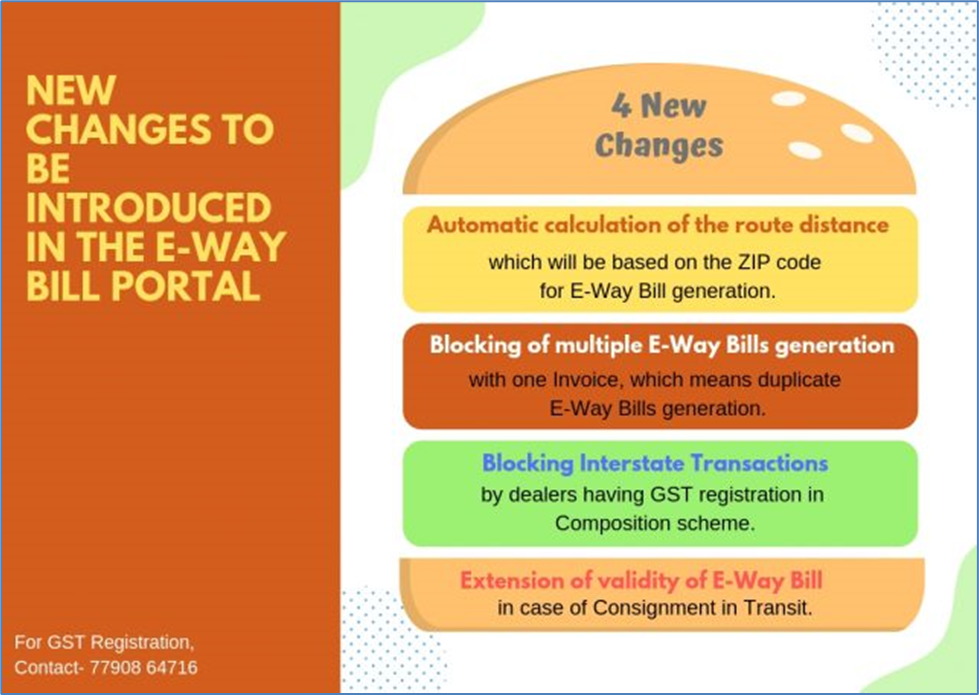

E-way Bill Amendments and Updates

Since the e-way bill system came into use in 2017 under the CGST ACT, more than 353 crore e-way bills have been generated. In addition, it has undergone several updates and amendments, all aimed at enhancing how the systems operate and how consignments are transported from one point to another. The e-way bill has seen many changes in the last three years, with 14 revisions so far. This can pose a challenge and a cost for businesses to stay updated and compliant with the government rules. While some taxpayers have learned the E-Way Bill rules, processes, and procedures, others are still unaware of them.

Some of the major amendments that have come into use include:

- The validity period of the e-way bill has since been revised from the previous 100 km requirement to 200 km per day. The increase is a significant relief as it averts the need to generate several e-way bills while transporting goods over long distances.

- It’s no longer necessary to generate e-way bills through the portal for GSTINs when dealing with consignments for business-to-business or export transactions eligible for electronic invoicing and invoices.

- The e-way bill permit can be generated for canceled other party GSTIN as long as the GSTIN was active as detailed in the date specified in the document date. Consequently, the permits can only be generated if the status of the Supplier GSTNs is ‘Active’. If you find that the status of the Supplier GSTINs is suspended, provisionally inactive, or canceled, you cannot complete the process.

- It’s no longer possible to generate an e-way bill for a supplier, recipient or transporter if GSTR 3B has not been filed concerning such GSTIN for the last two consecutive months. On the other hand, the e-way bill can be generated if the Recipient GSTIN is active and suspended but not provisionally inactive or canceled.

- On the other hand, if the GSTIN is blocked for non-filing of GST R3B, it becomes a challenge for suppliers to generate e-way bills. The e-way bill will only be generated when the respective GSTIN is of the recipient or the transporter.

While generating an e-way Bill:

- There should be at least one item with an HSN code for the goods in transit, as generating an e-way bill with SAC codes is impossible.

- If the transportation mode is Ship, then the vehicle Type’ can be ‘O’ (ODC) and the Vehicle Number has to be provided.

- A detailed e-way bill print has a unique Invoice Reference Number (IRN), essentially an acknowledgement number. If you do not include the item details, you will get the IRN copy.

- In addition, the (IRN) can be generated even if the PIN code does not exist in the master database of the e-invoicing system if the first three digits of the PIN code match the respective State as per the pattern of PIN code-to-state mapping pattern defined by the postal department.

- While generating an e-way Bill, you can set the distance as zero, signaling the system to put the appropriate distance between the provided PIN codes. Similarly, if passed, it should be between the distance available in the E-Way Bill system plus or minus 10%. If the distance between two PIN codes is less than 100, you can provide the distance up to the actual distance plus 10%.

- The system will automatically calculate the distance between two locations, considering the pin codes and adding a grace of 10% extra distance for transporting goods. If someone provides a wrong distance in the database, the system generates the e-way bill without any alert message.

On the other hand:

- If the distance between the two pin codes provided is not available in the system, the permit is to be generated with an alert message as “The distance between the given pin codes is not available in the system.” In such cases, the taxpayer must provide the correct distance.

- A transit Type mode (R- Road, W – Warehouse, Other) has been introduced to distinguish between goods on or in transit. For Tran’s mode 1 to 4, the consignment status should be M; for Tran’s mode 5, the consignment status value should be T, and the transit Type value can be R, W, or O.

- The e-way bill system constantly checks duplicate e-way bills on the same supplier document number. If an e-way bill exists with the same document number, the system will block creating one more e-way bill on the same number. The curb applies to taxpayers who generate multiple permits based on one document number. On the other hand, if the recipient and transporter try to develop numerous e-way bills on the same document number of the consignor, the system will generate an alert through API to the consignee that an e-way bill with exact details exists.

Conclusion

The e-way bill system has become integral in the race to achieve an efficient and transparent logistics ecosystem in India. It has improved shipping and supply chain tracking.

While the system enhances custom operations, it has undergone several amendments and updates to make it seamless and user-friendly for both parties. Over the past three years, there have been more than 14 amendments, which can be extremely difficult and expensive for companies to keep track of.

Nevertheless, staying up to date updated with all the latest regulations and changes is the only way businesses can be compliant and carry out their operations without crossing borders with customs officials. In addition, factoring in the updates and mandates reduces duplicity and repeated invoice entries while reducing documentation redundancies, therefore ensuring a seamless process of moving goods from one point to another.

FAQs

1. Is an e-way Bill mandatory while transporting goods?

Yes, under Rule 138 of CGST Rules, 2017, taxpayers or any person must obtain an e-way bill when they are transporting goods valued at more than Rs. 50,000 within or outside the State. The permit enhances the real-time tracking of consignments and checks for instances of tax evasion.

2. What’s the minimum distance mandate for an e-way bill?

When sending products over Rs. 50,000 within the same state straight to the recipient, an e-way bill is required. The e-way bill is a document that shows the details of the goods and the transport. The goods must travel at least 1 Km to get an e-way bill.

3. Whose responsibility is it to generate the e-way bill?

Every registered person engaged in the transportation of goods can generate the e-way bill of consignment goods whose value is more than fifty thousand rupees. While the supplier usually holds responsibility before goods hit the road, the recipient and transporter can assume this role in exceptional circumstances, especially when the supplier is not a registered taxpayer.

4. What is the requirement for extending the validity of an e-way bill?

An essential requirement to extend the validity of an e-way bill, filling Part B of Form GST EWB- 01 and updating the transportation details is if there is a change of motor vehicle or transporter. The changes can only be made 8 hours before the E-Way Bill (EWB) expires.

5. How is the e-way bill beneficial?

The e-way bill simplifies and enhances the transportation of goods within states and across states. The permit also reduces duplication and repetitive invoice entries and documentation redundancies and streamlines goods transport.

6. Is it legal to add two invoices to one e-way bill?

It is illegal to add multiple invoices to generate a single EWB. Creating a single EWB is possible by individually uploading each invoice and utilizing the same vehicle for transporting the consignment.

7. What are the requirements for generating an e-way bill?

A person must be a registered taxpayer to generate an e-way bill. Enrollment on the common e-waybill portal is compulsory for non-registered transporters before generating the permit. We also require the following documents: the tax invoices, bills of sale, or delivery Challan; the Transporter’s ID and the transporter document number; and the vehicle number that is carrying the goods.

8. Is it possible or legal to edit or modify an e-way bill?

You can only edit the vehicle details once you generate the e-way bill. You cannot make any other modifications to the e-way bill.

9. What is the validity of an e-way bill?

An e-way bill is valid for a certain period, depending on the distance that has to be covered. For normal cargo, the permit remains valid when the distance to be covered is 200 km. For every additional 200, we provide a day to complete the transportation.

10. Is e-invoicing mandatory?

Yes, e-invoicing became mandatory to all taxpayers as of 1st October 2020, targeting those with an aggregate turnover that exceeds Rs.500 crore in a year. Starting from April 1, 2022, the government has expanded the applicability of e-invoicing to businesses with a turnover exceeding Rs. 20 crore.