Under the ambit of the Goods and Services Tax (GST) in India, the Unique Identity Number (UIN) serves as a distinctive identifier. Allocated to specific entities, such as foreign diplomatic missions, embassies, and entities exempt from GST, the 15-digit alphanumeric UIN plays a crucial role. This article delves into the comprehensive compliance obligations, reporting requirements, and also various facets associated with the UIN under the GST regime.

UIN Registration Compliance Obligations for Organizations

The process of obtaining a Unique Identity Number (UIN) under the Goods and Services Tax (GST) framework in India demands adherence to a set of compliance obligations. This section will also provide a comprehensive understanding of the various steps and requirements in the UIN registration process for eligible organizations.

Eligibility Criteria

Organizations eligible for a UIN are typically entities that do not engage in taxable outward supplies. The categories eligible for UIN also include:

- Specialized agencies of the United Nations Organization.

- Multilateral Financial Institutions and Organizations notified under the United Nations (Privileges and Immunities) Act, 1947.

- Consulates or Embassies of foreign countries.

- Any other person or class of persons as notified by the Commissioner.

Below, we detail the process of registration.

– Application Submission – Form GST REG-13

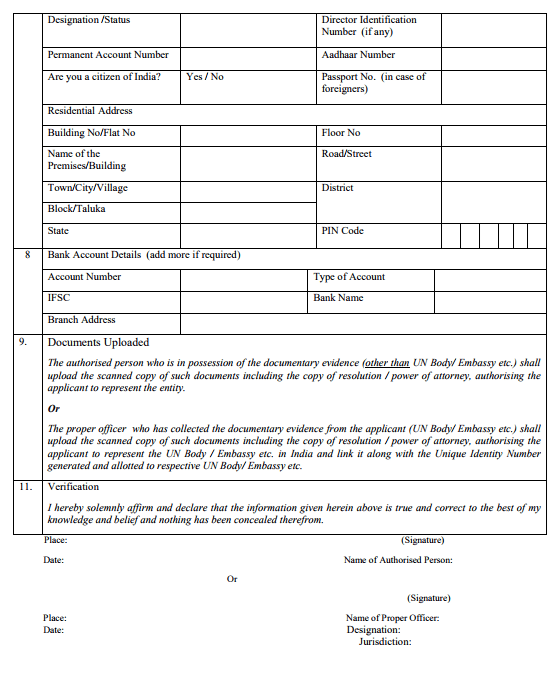

The initiation of the UIN registration process involves the submission of Form GST REG-13. This form serves as the official application through which entities declare their eligibility for a UIN. Moreover, The applicant must furnish comprehensive details about its legal entity, principal place of business, and other relevant particulars.

– Verification and Processing

Upon the submission of Form GST REG-13, the GST authorities undertake a thorough verification process. This verification ensures the accuracy and legitimacy of the information provided by the applicant. Moreover, the verification process aims to confirm that the applicant falls within the specified categories eligible for UIN.

– Granting or Rejection of UIN

Post verification, the authorities make a determination regarding the grant or rejection of the UIN. The authorities communicate the decision to the applicant within a stipulated time frame. Therefore, once they approve the application, they issue the UIN in the form of a certificate of registration (GST REG-06).

– Deemed Approval and Timelines

If the authorities do not communicate any deficiencies to the applicant within the prescribed period, they grant the registration or Unique Identity Number. Moreover, authorities typically issue the certificate of registration within 3 working days from the date of the submission of the application.

– Prescribed Form and Period for Registration

The GST authorities grant or reject the registration or UIN based on the prescribed form and within the period specified. They process the application in a manner that ensures timely communication of the outcome to the applicant.

– Communication of Deficiencies

If the verification process identifies deficiencies, the authorities promptly inform the applicant. They allow the applicant to rectify the deficiencies within a specified period. This also ensures a fair and transparent process, preventing undue rejections without providing an opportunity for correction.

– Suo-Moto Registration

In addition to applying for UIN using FORM REG-13 on the GST Common Portal, consulates and embassies have the provision for suo-moto registration by a proper officer. This also allows authorities to take a proactive approach in ensuring that eligible entities are registered appropriately.

– Issuance of Certificate of Registration – GST REG-06

Upon successful verification and approval, the authorities issue a certificate of registration in the form GST REG-06 to the applicant. Therefore, this certificate officially confirms the grant of UIN and provides details about the registered entity.

– Deemed Registration under State/Union Territory Acts

Under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act, authorities deem a UIN to be a grant of registration or a Unique Identity Number under the Central Goods and Services Tax Act. Moreover, this is subject to the condition that the application for registration or the UIN has not been rejected under the CGST Act.

Once an entity or organization registers with a UIN, it must file for returns using Form GSTR 11. You will find more information on this as you read further.

Mandatory Reporting Requirements for UIN Holders

As entities with a Unique Identity Number (UIN) under the Goods and Services Tax (GST) regime, UIN holders are subject to specific reporting requirements. Unlike regular taxpayers, UIN holders are not classified as “registered persons” under the Central Goods and Services Tax (CGST) Act. Moreover, this distinct classification implies a certain level of flexibility in their reporting obligations, tailored to the unique nature of their exempted status.

Although exempted from certain reporting norms applicable to registered persons, UIN holders are obligated to maintain specific records. These could also include a true and correct account of:

- Inward supply of goods or services

- Stock of goods

- Input/Output tax credit availed

- Other particulars as prescribed

If there are any changes in the information furnished at the time of registration or subsequently, UIN holders must inform the proper officer. The officer may approve or reject amendments in the registration particulars. The approval process also involves considerations based on the information furnished and ascertained by the officer. However, the proper officer may amend certain prescribed particulars without explicit approval.

GST Return Filing and Tax Payment Obligations

UIN holders have distinct obligations regarding GST return filing and tax payment. Form GSTR-11 must be filed by the 28th day of the following month to claim a refund of taxes paid on inward supplies. This form comprises auto-populated information updated by the supplier, and also the UIN holder cannot add or modify any details. GSTR-11 is divided into four sections:

- UIN: This section requires the input of the unique identification number assigned to notified bodies.

- Name of the person having UIN: This information is auto-populated at the time of filing the return.

- Details of inward supplies received: This section necessitates the provision of GSTIN numbers of suppliers, with details auto-populated from the GSTR-1 return form. UIN holders cannot add or modify details in this section.

- Refund amount: The system auto-calculates the refund amount, with the UIN holder required to provide bank details for refund crediting.

The taxpayer must digitally sign the return through a digital signature certificate or Aadhaar-based signature verification.

It’s imperative to note that UIN holders must file returns within six months from the last day of the quarter in which the supply was received. Failure to claim a refund within this timeframe results in refund forfeiture. In certain cases, an obligation to furnish an information return arises. Any person to whom a Unique Identity Number has been granted, responsible for maintaining records or statements of accounts, must furnish such information within the prescribed time, form, and manner.

E-Waybill Generation and Filing Procedures

UIN holders engaged in the movement of goods must also diligently comply with e-waybill generation and filing procedures. The common portal for e-waybill generation is https://ewaybillgst.gov.in. Proper registration and authentication enable UIN holders to generate e-waybills. The process also involves entering the UIN, receiving an OTP on the registered mobile number, and authenticating the same to generate a username and password for the e-waybill system.

How to Register for e-Way Bill

Recordkeeping and Documentation Requirements

For entities bestowed with a Unique Identity Number (UIN) under India’s Goods and Services Tax (GST) framework, meticulous recordkeeping and documentation are indispensable components of compliance.

Preservation of Invoices: UIN holders are mandated to maintain a systematic record of invoices related to their transactions. These invoices are critical evidence of the goods or services received, helping substantiate the nature and authenticity of transactions. Properly preserved invoices are crucial during audits and inquiries.

- Receipts and Transaction Documents: In addition to invoices, UIN holders must diligently preserve receipts and other relevant transaction documents. This also includes documentation related to the receipt of goods or services, payment receipts, and any other records that validate the transactions conducted under the purview of the UIN.

- Facilitating Audits and Assessments: The meticulous recordkeeping by UIN holders is not merely a compliance formality; it serves as a foundation for facilitating audits and assessments. Therefore, well-documented records enable auditors to review transactions efficiently, verify compliance, and ascertain the accuracy of financial declarations.

- Ensuring Accountability and Transparency: Beyond the immediate regulatory requirements, robust recordkeeping by UIN holders fosters accountability and transparency in their operations. Moreover, it demonstrates a commitment to ethical practices and enhances the entity’s credibility.

Navigating UIN Compliance Complexities

Given the intricacies of UIN compliance, a proactive approach is indispensable. Businesses dealing with UIN holders should stay abreast of regulatory changes, seek professional advice when needed, and implement robust internal controls. A strategic and informed approach is vital for ensuring continuous compliance in the dynamic GST landscape. Moreover, navigating UIN compliance complexities requires a commitment to monitoring, evaluating, and adapting to changing regulatory requirements.

Understanding Unique Identification Number (UIN) Registration Requirements

Endnotes

UIN compliance is a nuanced and multifaceted aspect of GST in India, requiring a thorough understanding of registration processes, filing obligations, and reporting procedures. Therefore, organizations involved with UIN holders must stay informed, adopt proactive measures, and continually assess and adapt to evolving regulatory landscapes. Moreover, a strategic and informed approach is indispensable for ensuring seamless and compliant operations within the dynamic GST framework.

FAQs

Here are some frequently asked questions.

1. What is the difference between GSTIN and UIN?

Authorities assign Goods and Services Tax Identification Number (GSTIN) to regular taxpayers who engage in the collection of GST and the filing of corresponding GST returns. It serves as a unique identifier for businesses involved in taxable transactions within the GST framework. On the other hand, authorities exclusively designate the Unique Identity Number (UIN) for specific entities, such as diplomatic missions, consulates, and other organizations meeting specified criteria. Unlike GSTIN, authorities issue a UIN not for regular business entities but for those exempt from certain tax obligations.

2. What is an e-way bill?

An e-way bill is a crucial document mandated by the Government for the movement of goods valued at more than fifty thousand rupees. Governed by Section 68 of the Goods and Services Tax Act and Rule 138 of the associated rules, the e-way bill is generated through the GST Common Portal. It is the responsibility of registered persons or transporters overseeing the transportation of goods to generate the e-way bill before the commencement of the movement of the consignment. This document ensures regulatory compliance and facilitates the seamless flow of goods across different jurisdictions.

3. What is the seller’s protocol for handling UIN clients?

Sellers registered under GST who supply goods or services to entities holding a UIN must observe specific protocols:

- Firms must explicitly mention the UIN on the invoices issued for transactions involving UIN holders.

- Businesses treat such sales as supplies to another registered person (B2B), acknowledging the unique nature of the UIN holders’ tax-exempt status.

- Businesses should upload invoices for transactions with UIN holders using the same process as regular B2B sales, adhering to GST filing standards.

4. Can UIN holders modify information under GSTR-11?

Notably, UIN holders cannot manually add or modify any information in GSTR-11, as the system automatically populates the data from their GSTR-1 submissions. This streamlines the return filing process, ensuring accuracy and consistency. Moreover, UIN holders who seek to claim refunds on taxes paid for their inward supplies must file a GSTR-11 by the 28th of the subsequent month. This return also includes details of taxable products or services received.

5. Can consulates and embassies be granted suo-moto registration?

Yes, after the registration is complete, consulates and embassies can be granted suo-moto registration by a proper officer.

6. What happens if a UIN holder fails to claim a refund within the specified timeline?

If a UIN holder fails to claim a refund within six months from the last day of the quarter in which the supply was received, the refund shall lapse and cannot be claimed.

7. Is UIN applicable only to foreign diplomatic missions and consulates?

While the Commissioner may assign a UIN to foreign diplomatic missions and consulates, they can also assign it to other entities meeting specific criteria.

8. Can UIN holders make amendments to their registration particulars without proper officer approval?

A UIN holder should promptly inform the proper officer of any registration detail changes as and when they occur. The frequency may depend on the nature and extent of changes. The proper officer may amend certain prescribed particulars without explicit approval. However, approval is required for other amendments, and the proper officer typically does not reject the application without providing an opportunity for a hearing.

9. Can a regular taxpayer claim input tax credit for supplies made to UIN holders?

A regular taxpayer can claim the input tax credit for supplies made to UIN holders. However, the documentation and reporting process may differ from regular B2B transactions.

10. Is there a specific format for maintaining records by UIN holders?

While authorities require UIN holders to maintain specific records, they may not explicitly prescribe the exact format. However, compliance is crucial for adherence to the prescribed particulars and maintaining accurate records.