Introduction:

In the intricate realm of Indian taxation, the Goods and Services Tax (GST) holds dominion, revolutionizing the landscape for businesses of all sizes. As a result, ensuring GST compliance remains crucial, and within this framework, registering an additional place of business emerges as a critical yet often disregarded step.

To help you navigate this process, allow this blog to serve as your guiding compass in comprehending the implications, requirements, and intricacies surrounding GST additional place of business registration.

By exploring its significance further and understanding the practical steps, you’ll ultimately gain a comprehensive grasp of how it significantly impacts your tax obligations.

Importance of GST Additional Place of Business Registration:

Exploring the significance of registering an additional place of business for GST moves beyond a mere formality; it evolves into a strategic decision with far-reaching implications. Let us delve into why this registration is undeniably crucial.

Enhanced Geographical Reach: Expanded geographical reach offers numerous benefits for your business. By extending your footprint, you can tap into new markets, establish trust with customers, and enhance overall accessibility.

Legal Compliance: Legal compliance with GST regulations is not optional; rather, it is a requirement upheld by the law. Therefore, by registering additional places of business, you can ensure that your operations consistently adhere to legal boundaries.

Streamlined Operations: By registering multiple places of business, you can effectively streamline operations. Moreover, this approach offers the advantage of managing different locations under a single GST registration, thereby making it easier to handle and oversee your operations effectively.

Input Tax Credit (ITC) Benefits: Multiple registrations increase the benefits of Input Tax Credit (ITC). Consequently, this allows businesses to claim ITC benefits across various locations, thereby reducing their tax liability and ultimately enhancing their financial advantage.

Competitive Edge: Having additional places of business positions a company for growth and gives it a competitive edge in the highly competitive business environment.

Business Expansion and Growth: Business expansion and growth often involve registering additional places of business, which signifies progress and provides opportunities to access new markets and revenue streams.

Understanding the significance of this registration is crucial before delving into the requirements.

GST Additional Place of Business Registration Requirements:

To proceed, you must ensure that your business fulfills all the requirements for registering an additional place of business.

Eligibility Criteria: To qualify, the business must be registered under GST. Additionally, any additional places of business should possess distinct Permanent Account Numbers (PAN).

Information Gathering: Gathering essential documents is important for any endeavor. To begin with, these include the PAN card and GSTIN of the primary place of business. Additionally, you must provide proof of ownership or occupancy, bank account details, and an authorization letter.

Registration Process Overview: This overview will guide you through the steps involved in registering for GST. To begin, access the GST portal and log in. Then, navigate to the “Amendment of Registration” section. Finally, add the additional place of business to complete your registration.

Validations and approvals: The application undergoes validation after submission. Once it gains approval, the additional place of business will be added to your existing GST registration.

Separate Business Verticals:

If the additional place of business engages in different business activities, then it might be deemed a distinct business segment. As a result, this would necessitate maintaining separate accounts and records.

Meeting these requirements is crucial, as it forms the cornerstone of a successful registration. Now, let’s move forward and delve into the step-by-step process.

Steps to Register an Additional Place of Business for GST:

To register an additional place of business for GST, follow these steps:

- Access the GST Portal: Star the process by visiting the official GST portal.

- Log In: Use your GSTIN and password to log in.

- Select ‘Services’: On the portal, select the ‘Services’ tab.

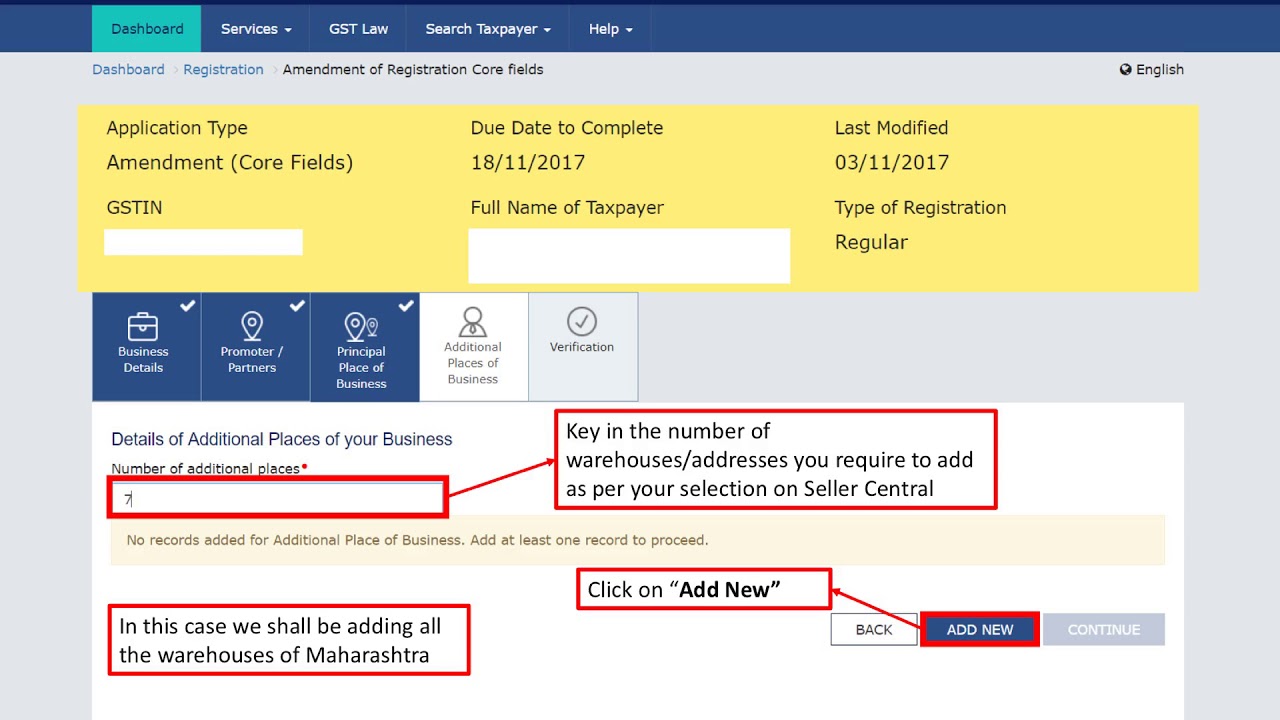

- Go to ‘Amendment of Registration’: To access the ‘Amendment of Registration,’ follow these steps: First, go to the ‘Services’ tab. Then, navigate to the dedicated section for amending your

- Choose ‘Add Additional Place of Business’: To start the registration process, first select “Add Additional Place of Business” under the option labeled “Choose.” Once selected, this action will initiate the necessary steps to register.

- Provide the Required Information: The required information for the additional place of business will be collected. This includes providing the address, proof of ownership or occupancy, bank account details, and an authorization letter for the authorized signatory.

- Attach Supporting Documents: Supporting documents should be attached by uploading all the required paperwork. This includes the PAN card and GSTIN of the primary place of business, proof of ownership or occupancy, bank account details, and photographs of the additional place(s) of business.

- Submit the Application: After providing the information and documents, submit the application.

- Verification and Approval: The authorities will thoroughly review your application, ensuring that all the necessary requirements are successfully met. Once validated, the additional place of business will seamlessly integrate with your existing GST registration.

- Update Records and Compliance: To ensure compliance and accuracy, it is crucial to regularly update your records for all locations. Additionally, if the new place of business operates differently, it is advisable to maintain separate accounts and records.

Now that you have registered the additional place of business, it’s time to explore how this registration will affect your tax obligations.

Also Read: Beginners Guide To GST Registration

Implications on Taxation:

Impact on Tax Liability:

As such, in order to deal with the tax liabilities individually when every location has it is own GSTIN. It is important to correctly report and pay the relevant GST for each specific venue.

Input Tax Credit (ITC) Benefits:

The advantage of multiple registrations is that it provides an opportunity for claiming Input Tax Credit (ITC). As a result, you can claim ITC at different locations, which helps minimize your tax payment liability. Furthermore, offsetting the taxes paid on inputs against those collected on sales effectively reduces the total tax payable.

Tracking and Compliance:

Compliance and tracking are important elements of accurate records tracking that is essential when goods and services transit between various places. This will go hand in hand with GST regulations.

Place of Supply Rules:

The place of supply plays an important role in guiding the calculation GST rates as well as compliance with the rules. Different rates, regulations, and shipping costs vary based on the supplier’s location relative to the recipient. Determining this “place of supply” correctly will enable applying proper GST rates and following the compliance requirements.

Returns and Filing:

As regards business locations, working on GST returns can be a complex issue since every place entails its specific returns and reporting duties.

Managing Cross-State Operations:

Handling transactions becomes more complex, especially with IGST and SGST, when your business operates in multiple states.

Impact on Pricing and Cost Structure:

This means that it could affect your pricing strategy and cost structure. There are also state-specific taxes that may have an impact on where you will fall within certain markets.

In summary, When you register business locations, under GST it introduces a dimensional tax environment that requires careful management and compliance. While it does offer the advantage of Input Tax Credit (ITC) benefits it also brings complexities in terms of tax liability record keeping and compliance requirements.

Compliance and Return Filing for Additional Places of Business:

For your expanded business to run smoothly it is important to handle compliance in addition and return filing elsewhere. Here’s how you can manage compliance effectively:

-

Meeting GST Compliance Requirements:

Therefore, each GST place of business should comply as if they were the first place of business. It involves issuing GST invoices, conducting audit of inward and outward supplies and proper filing of returns.

-

Record-Keeping and Documentation:

Each of these locations must maintain proper and accurate record-keeping. Additionally, it is crucial to track all transactions related to ITC consistently. This practice is essential for ensuring smooth audits and maintaining compliance with GST regulations.

-

Return Filing for Each Location:

Each place of business will prepare its own sets of returns to file namely; GSTR-1 for outward supplies, GSTR-3B as a summary return, etc. Make sure your submit these returns correctly, timely.

-

Tax Liability Assessment:

Accurately determine tax liabilities for every location. In addition, at a local level tax rates may vary across particular locations depending on the state or union territory they are situated within. They must work out the GST liability for each place of business, on an individual basis.

-

Input Tax Credit (ITC) Reconciliation:

The reconciliation of ITC is important so that you can have benefits and reduce your tax obligations. Be sure to reconcile ITC for every location separately and obtain allowable refunds.

-

Cross-State Operations:

In case your business is situated in various areas including the ones located across different borders, you have to deal with the interstate transactions. It involves comprehending the IGST and its effects on the transferance of products and services between various states.

-

Compliance with E-Way Bill Requirements:

In transporting the goods between your different shops adhere to E-way bill rules where possible. Create e-way bills for interstate or intrastate transport of goods.

-

Management of Separate Business Verticals:

A separate account should be maintained and records kept for every place if it involves other lines of business or constitutes a separate business vertical to meet GST standards.

-

Engage Professional Assistance:

However, handling the compliance and the return filing should be outsourced to professionals or by using GST-oriented accounting softwares to simplify and make errors free.

Therefore, maintaining proper records, returning filing, and determining accurate GST obligations on other places of business remains critical to successful compliance management and return filings.

Accuracy and compliance with GST regulations is key for each location to operate independently as its own entity. Businesses should remain up-to-date with such requirements in order to guarantee that they keep within the law limits and escaping of fines and complicated legal challenges.

Also Read:

GST Registration & Additional Place Of Business: Simplifying Compliance

The Benefits Of Each Type Of GST Registration

Conclusion:

The significance in comprehending the impacts of GST registration stems from the fact that in the dynamic and competitive business environment, knowledge is king! Through this process, you expand your venture while acquiring the necessary skills to manage the tax requirements of additional business locations for GST.

The repercussions are far beyond just procedural but strategic. These offer your company a chance in rewriting the path you are taking through growth, financial advantages, and a competitive edge. Therefore, stride forward resolutely using the knowledge attained through the journey on the GST registration of other sites. I have shown you a way through business expansion and compliance.

FAQs

To provide a comprehensive understanding of the implications of registering additional places of business for GST, here are some frequently asked questions:

-

What reasons do I have for choosing to register another place of business in GST?

It also increases your market share by extending your geographic area allowing you to reach more customers and enhance their willingness to do business with you.

-

What is required to be eligible for additional registration of additional place of business under GST?

Any business entity having more number of outlets in other states or union territories falls under this category.

-

What evidence is required in proving additional place of business for GST?

Documents that are usually required for a second occupation or dwelling could among others be evidence proving ownership or residence, particulars on the bank account, photos of the other place and authority letter to the authorized signatory.

-

Does one GSTIN allow me to register multiple places of business?

However, each extra location has different PAN and GSTIN.

-

How do I file returns and make payments for multiple places of business under GST?

You will not only fill in one location return per each place but also will be obliged to make returns separately from each place.

-

Discuss input tax credit as it relates to many offices.

You are allowed to use GST paid on inputs to offset GST collected on sale through ITC. Doing so, one gains a possibility to declare an incremental tax credit in the area of different enterprises.

-

Does one state or a territorial area have a different tax rate when dealing with another?

– It’s important for a business to consider the fact that GST rates are determined from the place of supply and recipient.

-

What is the Integrated Goods and Services Tax (IGST) and its effects on inter-state trade.

Inter-state sales tax commonly referred to as IGST is a part of GST. When goods or services are moved from one state to another, it’s vital to comprehend how IGST operates.

-

If another place of business is deemed as a different vertical, how do I ensure compliance with this?

To follow the stipulations of GST, maintain different accounts and records of businesses viewed as different business entities.

-

What is the essence of registering more than one business location for gst?

Some advantages are increased market reach, adherence to legal obligations, efficient operations, ITC incentives, market lead, and new openings for business growth.