Introduction

GST, or Goods and Services Tax, simplifies the tax system by combining various indirect taxes on the sale of goods and services. For example, if you buy shoes for Rs. 1,000 with an 18% GST rate, the GST amount is Rs. 180, making the total cost Rs. 1,180, ensuring the government receives its share of tax.

A proforma invoice serves as a preview or early bill version sent by sellers to buyers before delivering goods or services, adhering to GST compliance. This document, following GST proforma invoice requirements and format, includes details like product descriptions, estimated costs, and important terms. It ensures both parties agree on what’s being sold and at what cost, acting as a pre-deal agreement. The impact of GST on proforma invoices is significant, influencing their format and compliance rules to maintain transparency and prevent misunderstandings in transactions. We will deep dive into the details of Proforma Invoice.

The Role of Proforma Invoices in GST

GST is like a rulebook for taxes when buying or selling. Think of proforma invoices as the early outline of what’s going to be bought or sold, a first step in the process. They act as a guideline to follow GST rules, providing a clear picture of tax implications before finalizing everything. The purpose is to make details clear before any money changes hands, like a movie preview showing what the deal involves and its cost with GST.

In transactions, proforma invoices benefit both the buyer and seller, ensuring everyone understands the deal. It’s a way of saying, “Here’s our plan, and here’s the cost with GST.” This transparency avoids surprises and ensures everyone is on the same page before the actual transaction occurs.

Also Read: Proforma Invoice under GST

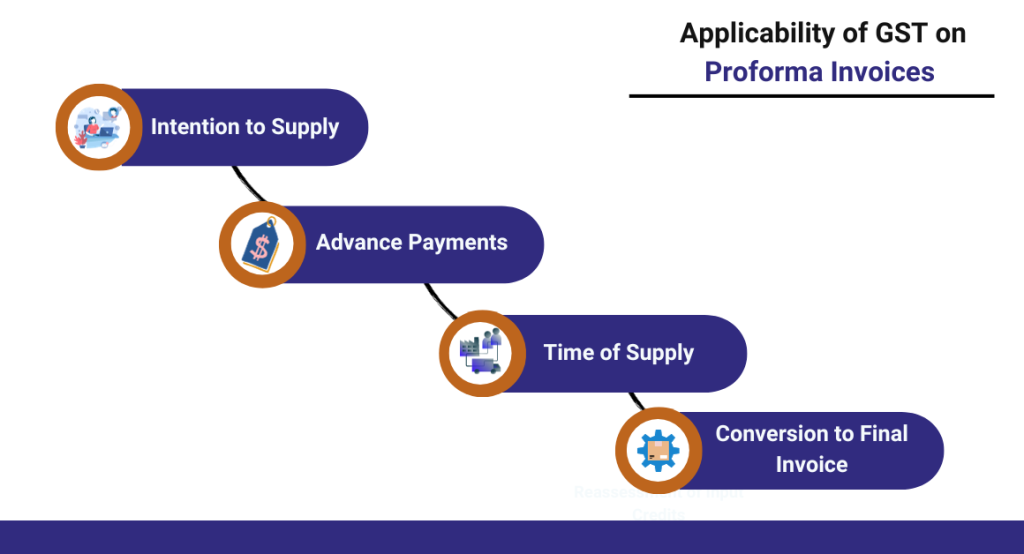

Understanding the Applicability of GST on Proforma Invoices

Understanding the Applicability of GST on Proforma Invoices is about knowing when and how to follow tax rules (GST) for early invoices. It involves figuring out situations and rules for when these tax rules apply to the ‘preview’ invoices created before actual transactions. It’s about understanding when and how taxes are relevant in the planning stage. The application of GST on proforma invoices can vary based on specific factors.

-

Intention to Supply:

- Proforma invoices, indicating an intention to supply or estimate costs, don’t trigger GST as they aren’t the actual supply; GST is applied when goods or services are delivered.

-

Advance Payments:

- Advance payments based on proforma invoices are subject to GST; sellers receiving advance payments must pay GST on the advance amount according to the relevant tax rate.

-

Time of Supply:

- GST applies when goods or services are supplied, usually when the invoice is issued, payment is received, or goods/services are delivered. Since proforma invoices don’t signify the final supply, GST isn’t applicable when they are issued.

-

Conversion to Final Invoice:

- When a proforma invoice transforms into a final commercial invoice during the actual supply, GST becomes applicable, following GST laws for accurate details and invoicing requirements.

Benefits and Challenges of Using Proforma Invoices under GST

Benefits of Using Proforma Invoices under GST |

Challenges of Using Proforma Invoices under GST |

| Clarity in Transactions:

Proforma invoices provide a clear preview of the transaction details, helping both the buyer and the seller understand the terms and conditions before the actual supply occurs. |

Advance Payments Subject to GST:

While proforma invoices allow for advance payments, these payments are subject to GST. Sellers must be mindful of the applicable tax rates on any advance amounts received. |

| Estimation of Costs:

They serve as a useful tool for estimating costs, allowing parties involved to plan their finances accordingly. |

Timing Issues in GST Application:

Due to the nature of proforma invoices being preliminary and not representing the final supply, GST is not applied when the proforma invoice is issued. This timing aspect can lead to complexities in managing the taxation process. |

| Intent to Supply Without Immediate GST Impact:

As proforma invoices indicate an intent to supply and are not the final transaction, they do not immediately trigger GST. This provides flexibility during the planning stages. |

Conversion to Final Invoice Compliance:

When converting a proforma invoice to a final commercial invoice, it becomes crucial to ensure compliance with GST rules. The final invoice must accurately reflect the taxable value, applicable tax rates, and adhere to invoicing requirements. |

Also Read: Commercial Invoice Vs. Proforma Invoice: What’s the Difference?

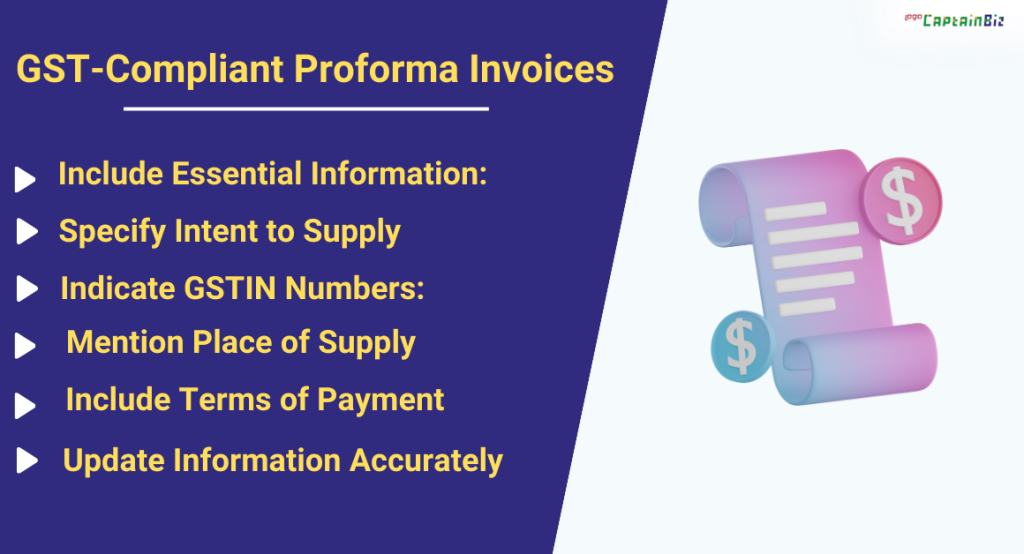

Best Practices for Creating GST-Compliant Proforma Invoices

Here are the best practices:

-

Include Essential Information:

- Ensure your proforma invoice has all the crucial details—names, addresses, clear descriptions, quantities, prices, totals, and applicable taxes—to meet GST compliance requirements.

-

Specify Intent to Supply:

- Clearly state on the proforma invoice that it’s an intent to supply, not the final transaction. This avoids confusion about why GST isn’t immediately applicable.

-

Indicate GSTIN Numbers:

- Include the GST Identification Numbers (GSTIN) of both parties for transparency and identification, meeting GST compliance requirements.

-

Use Sequential Invoice Numbers:

- Assign unique, sequential invoice numbers to proforma invoices for organized record-keeping, making it easier to track and manage transactions.

-

Mention Place of Supply:

- Clearly specify the place of supply on the proforma invoice. This ensures accurate tax calculation based on GST rates and compliance with regulations.

-

Include Terms of Payment:

- Outline payment terms, discounts, deadlines, and currency on the proforma invoice for transparency, avoiding payment disputes and ensuring smooth transactions.

-

Update Information Accurately:

- Regularly update proforma invoice information to reflect changes, keeping the document accurate and compliant with current GST regulations.

-

Seek Professional Advice:

- When in doubt, consult tax experts for guidance on navigating complex GST compliance. Professional advice ensures proforma invoices meet the latest legal standards.

Ensuring GST Compliance in Proforma Invoices

-

Understand GST Rules:

Familiarize yourself with the Goods and Services Tax (GST) rules and regulations applicable to proforma invoices. This understanding forms the foundation for creating compliant documents.

-

Include GSTIN Numbers:

Ensure that the proforma invoice includes the Goods and Services Tax Identification Number (GSTIN) of both the buyer and the seller. This helps in identifying the parties involved and contributes to GST compliance.

-

Clearly State Intent to Supply:

Explicitly mention on the proforma invoice that it represents an intent to supply and is not the final transaction. This clarity helps in avoiding confusion about the preliminary nature of the document and the non-immediate applicability of GST.

-

Provide Comprehensive Information:

Include all necessary details in the proforma invoice, such as the names and addresses of both parties, a detailed description of goods or services, quantities, unit prices, total values, and any applicable taxes. Comprehensive information ensures compliance with GST requirements.

-

Specify Place of Supply:

Clearly indicate the place of supply on the proforma invoice, as it determines the applicable GST rates. Providing accurate information about the place of supply ensures proper tax calculation and adherence to GST regulations.

-

Use Sequential Invoice Numbers:

Assign unique and sequential invoice numbers to proforma invoices. This practice aids in organization and record-keeping, contributing to GST compliance and facilitating easier tracking of transactions.

-

Regularly Update Information:

Keep the information on proforma invoices up-to-date. Any changes in transaction details or pricing should be reflected promptly, ensuring that the document remains accurate and compliant with current GST regulations.

-

Seek Professional Guidance:

If uncertain, consult with tax experts or professionals well-versed in GST regulations. Professional advice can help navigate complex compliance requirements and ensure that proforma invoices align with the latest legal standards.

Also read: Invoice Terms And Conditions For Indian Businesses

Future Trends and Developments in GST and Proforma Invoices

-

Digital Transformation:

The future may witness increased emphasis on digitalization in GST processes and proforma invoice generation. Automation and electronic documentation may become more prevalent, streamlining the overall workflow.

-

Integration with Technology Platforms:

Expect greater integration of GST and proforma invoicing with advanced technology platforms. This may include seamless integration with accounting software, ERP systems, and other tools to enhance efficiency and accuracy.

-

Real-time Reporting:

Future trends may lean towards real-time reporting in GST. This means that businesses may need to provide instantaneous updates on transactions, impacting the way proforma invoices are created and processed.

-

Blockchain for Transparency:

Blockchain technology might play a role in ensuring transparency and traceability in GST transactions. This could extend to proforma invoices, providing an immutable record of preliminary transactions.

-

Increased Regulatory Compliance:

Anticipate a continued focus on regulatory compliance. Future developments may introduce more stringent compliance requirements in GST, impacting the creation and handling of proforma invoices.

-

Enhanced Data Analytics:

The future could witness increased use of data analytics in GST processes, aiding in better decision-making. Proforma invoices may be subject to advanced analytics for insights into transaction patterns and compliance adherence.

-

Global Harmonization:

There may be efforts towards global harmonization of tax systems, influencing how GST is applied internationally. This could have implications for businesses creating proforma invoices for cross-border transactions.

-

Environmental Considerations:

Future trends may incorporate environmental considerations, leading to sustainable practices in GST processes. This could extend to proforma invoices, influencing how businesses approach documentation and resource usage.

Conclusion

To wrap it up, how businesses handle taxes (GST) and early invoices (proforma) is changing. In the future, things might become more digital, with quicker reporting and new technologies. Businesses might use blockchain for clearer records. Following rules, working globally, and thinking about the environment could also become more important. Businesses need to keep up with these changes to make sure they follow the rules and work efficiently.

FAQ’s

-

What is GST, and how does it relate to proforma invoices?

GST is a tax on goods and services. Proforma invoices are like early bills before the real one, and GST can apply to them based on certain factors.

-

Why are proforma invoices important in GST?

Proforma invoices help show what’s going to be bought or sold. They play a role in understanding the deal before it’s final, especially in the context of GST rules.

-

When does GST apply to proforma invoices?

GST is usually applied when there’s an actual supply of goods or services. Proforma invoices, being early and not final, don’t attract GST immediately. It applies when the real transaction happens.

-

What are the benefits of using proforma invoices under GST?

Proforma invoices offer clarity in transactions, help estimate costs, show the intent to supply without immediate GST impact, and facilitate advance payments.

-

Are there challenges in using proforma invoices under GST?

Yes, challenges include GST on advance payments, timing issues in GST application, and the need for compliance when converting proforma to final invoices.

-

How can I create a GST-compliant proforma invoice?

Include essential information, specify the intent to supply, indicate GSTIN numbers, use sequential invoice numbers, mention the place of supply, include payment terms, and keep information updated.

-

Why is it important to state the intent to supply on a proforma invoice?

Stating the intent to supply clarifies that the proforma invoice is not the final transaction, helping avoid confusion about why GST is not immediately applied.

-

What happens if I receive advance payments based on a proforma invoice?

Advance payments are subject to GST. If you get an advance payment against the proforma invoice, you need to pay GST on that advance amount.

-

What is the role of time of supply in GST and proforma invoices?

GST is usually applied at the time of supply, but since proforma invoices are not the final supply, GST isn’t applicable when the proforma invoice is issued.

-

How might GST and proforma invoices change in the future?

In the future, there might be more digitalization, real-time reporting, integration with technology, and considerations for environmental sustainability in GST and proforma invoices.