The reverse charge mechanism in GST is the process where the recipient of the goods and services is required to pay tax despite the suppliers of the goods. As per the GST Council, every GST invoice should be prepared and maintained with all required details.

A unique invoice serial numbering system for RCM transactions

The Council of Goods and Service Tax has made it mandatory for all taxpayers to follow the rules relating to the preparation of GST invoices. The GST Council enacted the rule on April 4, 2019. As per Rule 46(b) of the CGST Rule, 2017, the council has made it mandatory that every registered person issue a GST invoice following the rules below.

- unique serial number

- The serial number should not exceed 16 digit

- Serial numbers must contain alphabet, numbers, and special characters.

This instruction has come into effect for the financial year 2022-2023. This rule has mentioned clearly that every GST invoice should get started with the new series and number from the 1st of April every year.

Maintaining invoice sequence for RCM supplies

Maintenance of GST invoices is mandatory for all registered taxpayers. Professionals always suggest invoice sequences to avoid all types of GST fraud. Many are still not aware of the importance of appropriate invoice numbers and the maintenance of sequence.

An invoice number is a particular code that is assigned to every invoice that relates to a transaction. Every registered taxpayer must understand the essential components of GST invoices for RCM.

Sequence of Invoice Number

Every invoice number must be in the proper sequence. This is the most important and prime feature of every invoice. These numbers must be in series, which increases with every fresh GST invoice.

Date of Invoice Number

Many times, the date can also be added to the invoice number. The date in the invoice number is an easy way to identify the exact date when the transaction took place.

Customer Identifier

- Professionals also suggest adding a customer identifier to every invoice. It can be a unique code for every customer. Once you add any customer identifier to an invoice, it becomes easy to identify the customers.

Adding Location

Many businesses have many branches in different locations. Hence, it is always a good option to add a branch locator while preparing an invoice. This will help identify the actual branch from which the product was delivered or the services offered to the customers.

Maintaining Invoice Sequence

Maintenance of invoice sequence is necessary for an accurate audit trail.

Ensuring invoice authenticity and traceability

An invoice is one of the most significant tools to identify the goods sold or services provided to customers. It is possible to identify the actual transaction via the invoice, and it declares the authenticity of an invoice. If all the transaction details mentioned in the invoice are accurate, the invoice is known to be accurate.

Here are some essential points that all can follow to check the authenticity of every invoice.

Invoice Verification

The first thing you need to do is do invoice verification. This seems to be one of the most effective processes to check whether the transaction details mentioned in the invoice are actual or not. Once the transactions are matched with the invoice details, you can say that the invoice is actual or authentic.

Mentioning Accurate GSTIN

It is always necessary to check the GSTIN when you receive an invoice. Mentioning an accurate GSTIN is always the best practice to declare the authenticity of an invoice.

Authentic Invoice Contains

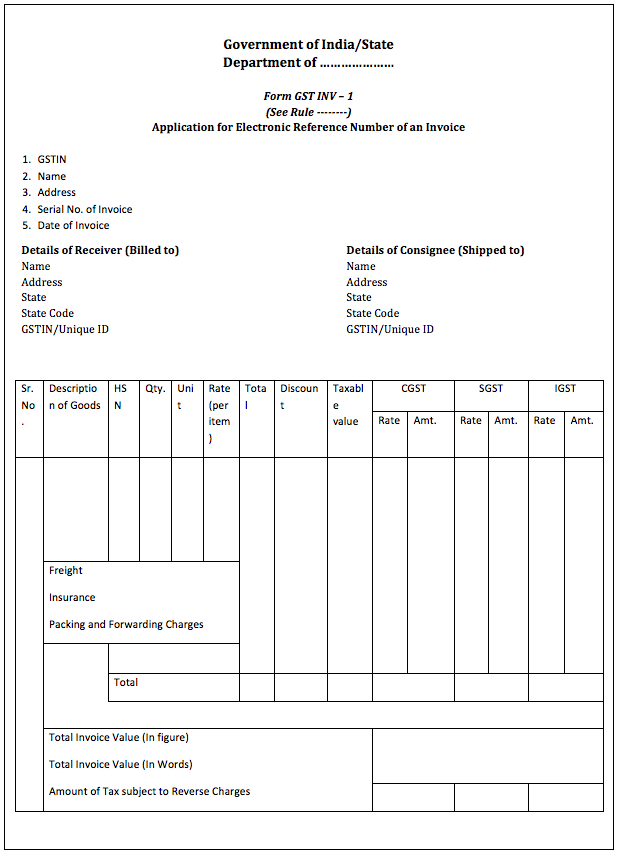

An authentic invoice should contain all transaction details, as follows.

- Purchase order

- Delivery note details

- Contact details of customers

- Suppliers’ detail

- Invoice date

- Type of goods supplied and description of the goods.

- Accurate Tax Rate

- Tax Amount

- Gross total Amount

- The net amount payable with tax

- GSTIN number

- Payment terms and conditions

Compliance with tax invoice numbering requirements

Every registered person should issue a GST invoice mentioning all essential elements. The GST invoices are required to be issued during the supply of goods or at the time of supply of goods.

Compliance with tax invoices and requirements is mandatory. Proper and sequential invoice numbers are essential to identifying every transaction. Invoice numbering is also essential to compliance with the GST requirement. Hence, assigning invoice numbers to every invoice should be done adequately. The numbering should be done sequentially. As per the rules, no invoice number should be repeated, and there should be no gap.

Invoice numbers don’t need to be only numeric. One can use both the alphabet and numbers as numbering for every invoice. Invoice numbers can also be added with a date, and this date must be updated according to the requirement.

Also Read: Mandatory Information To Include In A Tax Invoice For Goods

Managing invoice numbering for multiple RCM transactions

As per the rules implemented by the GST Council, every RCM transaction should have the proper invoice. Here, the recipient of the services or goods registered under GST needs to issue a GST invoice.

As per RCM, self-invoicing is done by the recipient of the goods and services. The registered purchaser issues an invoice mentioning all essential information relating to the transactions.

Also Read: Tax Invoice Format for Reverse Charge Outward Supplies: Meeting the Compliance Standards

Numbering of Invoices: Importance to check

Every business needs to follow several rules, and proper invoicing is one of the most essential tools to keep track of every transaction. The reverse charge mechanism in GST also requires proper invoicing. These invoices should be raised by the recipient of the goods and services. All can check below for the importance of proper invoicing.

Planned maintenance of record

Proper maintenance and numbering of invoices are necessary for adequate tracking of transactions.

- Every invoice should have a unique number to identify each invoice. It is easy to locate the specific invoices once they are required.

- Properly maintained invoices are eligible to keep track of the financial records of the organization. This will help you save time in preparing your financial statements.

- The maintenance of financial statements is helpful in taxation matters.

- Professionals suggest maintaining consistency in invoicing to avoid all types of errors. This process also helps in staying away from confusion.

Effective tracking of transactions

Proper invoicing is essential to tracking all sales and purchases in an organization. Invoicing numbering plays a vital role in tracking transactions. So, the areas where invoice numbering is important can be mentioned below.

- Sequential invoice numbers help in tracking the transactions.

- These numbers are essential for tracking the payment.

- Accurate invoicing is helpful in the proper maintenance of customer accounts. This is helpful when you have to deal with multiple customers.

- Sometimes, a customer may have queries regarding the invoice or transactions. You can only track the transaction or invoice via the invoice number, and it will be helpful to resolve the issue soon.

Tips to note while you add numbers to the invoices

It is always a great practice to do the invoice numbering in proper sequence. All need to prepare the invoice numbers with accuracy, following the rules below.

- It is always suggested to begin the invoice number with the current year, and a high number establishes that your business is renowned.

- It is also suggested that the proper format of the invoice be maintained. Changing the invoice format now and then can confuse the customer and decrease the reputation of the business.

- The number of invoices should be kept stable and in sequence.

- The invoice number should include the information in short form. This information should be mentioned in a code number, and this should be relevant to every business organization.

- The code you mention in the invoice can indicate the type of products or services that you offer. These codes can also be related to the customers.

- Different software is used at present to generate invoices for every organization. Here, it is suggested that a system that can generate the invoice automatically be used. This process will keep invoice numbers free of any mistakes.

Lower the chances of errors and mistakes

The prime aim of accurate invoicing is to lower the chances of mistakes and errors.

- Accurate and clear invoice numbers are helpful to identify the exact reference numbers. Vendors and customers can identify the transaction details according to the invoice numbers.

- It is possible to identify the discrepancies, if any, in the invoice with the help of invoice numbers. You can also resolve the errors in the invoices.

- Proper invoice numbering helps in the hassle-free payment process.

- In recent times, invoices have been prepared via software, and hence it is suggested to avoid using special characters in the invoice. This will prevent all types of technical issues.

- You can use simple separators if you need them.

Easy tracking of payment

Sequential invoicing is helpful for the easy tracking of payments. This process helps send reminders to customers.

- Proper utilization of invoice numbers assists in tracking the dues from customers.

- Every business organization can identify the payment status of any specific transaction with the help of invoice numbers.

- Invoice numbers are essential when sending reminders to customers. Automated invoicing is one of the most effective ways to identify whether customers have made the payment on time or not. Invoice numbering helps increase the cash flow.

Tax compliance

Invoice numbers are essential for all types of tax and legal compliance. Once you maintain accurate and sequenced invoice numbers, it helps meet legal and tax compliances as established by the jurisdiction.

Professionals always suggest adding accurate invoice numbers to save businesses from all types of legal issues. Invoice numbers help build trust with customers, and they will maintain transparency in every transaction. Invoice numbers also show how accountable you are to all your clients.

Again, if you are dealing with multiple customers, it is always a good option to add the project code or customer code to the invoices. This will help you sort the transactions and prepare financial reports for legal purposes.

Arranging Audits and Fiscal Reporting

Maintenance of invoice numbers is essential to the proper arrangement of audits. Auditing all financial reporting is an essential feature of carrying a business. The professionals will track the financial position of every business with the help of invoices.

It has been noticed that a well-maintained invoicing system will track the audit process. This helps save time and enhance productivity in any business organization. In the case of the return of goods and services, a separate invoice numbering system should also be followed. Separate invoice numbering is essential to identifying the credit notes.

Final Thought

The above discussion clarifies the necessity of invoice numbers in RCM. The numbering of invoices is essential for the effective and successful running of a business. In the reverse charge mechanism, a self-invoicing system is followed, and the recipient of the goods and services is required to add well-organized invoice numbers.

Also Read: Reverse Charge Mechanism (RCM) in GST

FAQs

-

Can you make an RCM invoice using Tally?

A – Yes, Tally software is designed for all types of financial transactions. You need to use the Accounting Vouchers option to prepare invoices as per the Reverse Charge Mechanism.

-

Is E-Invoicing applicable for RCM?

A- In general, the recipient of the goods and services is responsible for preparing invoices under RCM. For E-invoicing, every transaction under the Reverse Charge Mechanism requires proper compliance.

-

Are legal services offered by the advocate under a reverse charge mechanism?

A- As per the GST regulation, legal service providers who offer legal services to any business organization registered under GST, the recipient of the services, are required to pay GST under RCM.

-

Who is responsible for issuing invoices under RCM?

A- As per the Reverse Charge Mechanism, the recipient of the goods and services is responsible for generating invoices under RCM and paying the GST as per the rules.

-

Is the reverse charge applicable only to services?

A- The reverse charge mechanism is not only applicable to the services. This technology applies to both goods and services.