As per the rules implemented by the GST Council in India, inter-state transactions denote the transfer of goods or services from one state to another. GST is collected by the state where the goods are consumed by the consumers at the end of the transactions. Hence, GST is popular as a GST-based taxation regulation.

Concept of inter-state transactions under GST

All need to understand the basics of inter-state transactions as per the GST rules in India.

The key concepts are mentioned below.

In interstate transactions, the deal is made between the suppliers and the recipient, who are located in different states. The GST Council has implemented IGST, or Integrated Goods and Services Tax, in cases of interstate transactions. The central government collects the entire IGST amount. After that, the proportionate amount is distributed to the respective states.

Place of Supply

It is necessary to check the place of supply to determine whether the transaction falls under inter-state sales or not. Once the place of supply is identified, it becomes easy to calculate the actual tax rate and taxable amount.

Existence of GSTIN

GSTIN, or Goods and Services Tax Identification Number, is mandatory before starting any inter-state transaction. Every business organization should have a GSTIN number for proper identification of tax rates and calculation of tax amounts.

RCM for Inter-State Transaction

As per the rules of the reverse charge mechanism, the recipient of the goods and services is required to pay the tax. The RCM rules are applied to particular goods and services. This mechanism is also applicable to particular types of goods and services. This mechanism also ensures tax compliance along with tax collection.

E-Way Bill

In Inter-state movement, the E-way Bill determines the movement of the goods. As per the GST council, an E-way bill is required for the transport of goods after a certain distance. It is necessary to generate an E-way bill to confirm transparency in all types of inter-state transactions.

Also Read: Determining Place Of Supply In Intra-State Transactions General Principles

Scope of inter-state transactions

Every business organization should understand the scope of inter-state transactions. There is no doubt that the scope of the Inter-state transaction is extremely large, and it comes with various aspects of GST. All can check inter-state transactions below.

Business-to-business (B2B) transactions

Transactions of goods and services from one state to another state come within the rules and regulations of IGST. These inter-state transactions should always be conducted between business organizations. Inter-state transactions can be raw materials or finished goods.

Sales via e-commerce portals

At present, many companies are selling their products via e-commerce portals. With the significant rise in e-commerce portals, you can notice more inter-state transactions in recent days. Customers from different states are now eligible to purchase different goods from different states of the country. These platforms facilitate the sale of goods from one state to another.

Import and export of goods

Interstate movement of goods and services also covers the import and export of goods. When any business organization transfers its goods to other countries, these transactions are also considered an inter-state movement of goods.

Stock transfer

As per rules, it has been noticed that branch or stock transfer also comes under the purview of Inter-state movement of goods. Sometimes, business organizations shift their branches to different locations or states.

If these shifting of branches or transfer of goods are conducted in different states, then these are also known as inter-state transactions.

Transfer to SEZ

Transfer of goods to SEZ or Special Economic Zone in different states is also considered an Inter-state transaction. The SEZ locations come under special economic regulations.

Pan-India service providers

As per the GST council, service providers who have a pan-India presence can opt for inter-state transactions. As per this rule, these service providers can provide services to customers in different states.

Goods sent on a Consignment basis

Goods are sent on a consignment basis to other states and also come under the purview of inter-state transactions. Consignments or stock transferred to other states attracts the rules of Inter-state transactions.

Rented or leased transactions

Sometimes, a lease or rental agreement involves the movement of goods in other states. These movements of goods also attract inter-state transactions. This rule is applicable to both tangible and intangible assets.

Every business organization should understand the scope of inter-state transactions to ensure compliance with GST guidelines. Knowing the scope, it becomes easy to understand the tax liabilities, documentation, etc.

Distinction between inter-state and intra-state transactions

Several areas fall under the purview of inter-state transactions. One should not get confused with inter-state and intra-state transactions. Let’s check the probable differences between inter-state and intra-state transactions.

Geographical differences

In intra-state transactions, both suppliers and the recipient stay in the same place or state. Hence, transactions of goods occur within the same state.

In the case of inter-state transactions, goods or services are supplied to the recipient residing in a different state. Here, the supplier and the recipients are located in different states.

GST Revenue sharing

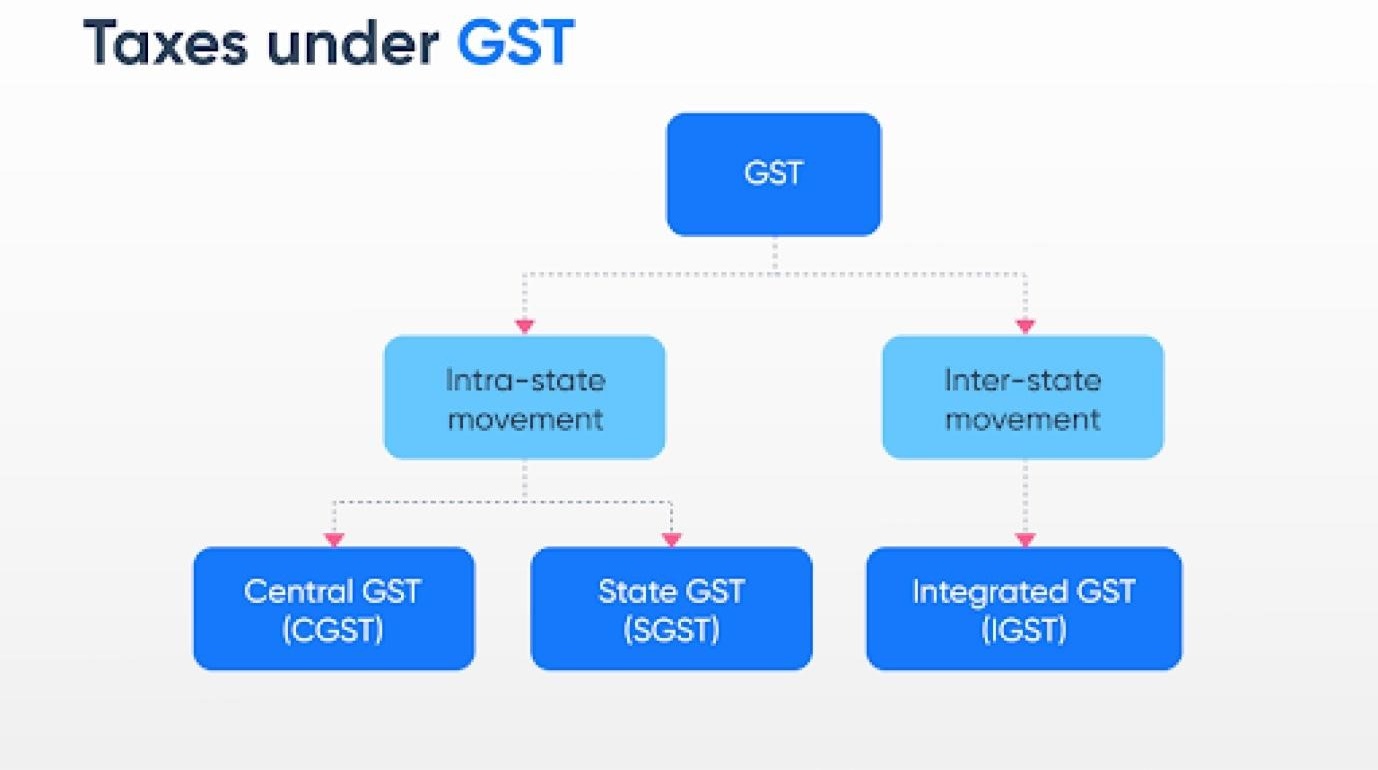

In the case of inter-state transactions, a tax levied on goods and services is known as IGST. Here, the entire tax is collected by the central government, and after that, the portion of tax revenue for the state government is transferred.

The GST council charges both CGST and SGST, and this tax is applicable. The states and the central government share the tax revenue.

Location of supply

The difference between inter-state and intra-state transactions and place of supply also plays a vital role. In the case of Inter-state transactions, goods are supplied to different states.

Intra-state supply is applicable when goods are transported within the same state. As per this rule, both the recipient and the supplier reside in the same place.

Invoicing

The format of invoices is different between inter-state and intra-state transactions. As per intra-state transactions, CGST and SGST are mentioned separately. It reflects the dual taxation structure within the state.

IGST is applicable in case of inter-state transactions, and hence, one single tax calculation is added to the invoice.

E-Way bill

An e-way bill is necessary in case of Intra-state transactions depending on the distance of goods supplied. The GST council has mentioned the threshold limit in case of intra-state transactions.

The requirement of an E-way bill is mandatory in case of inter-state transactions irrespective of distance.

ITC claim

There is a difference between claiming the input tax credit, or ITC, between the Inter-state and Intra-state supply of goods. In the case of Inter-state transactions, companies are eligible to claim both CGST and SGST ITC.

But, in the case of inter-state transactions, an input tax credit can be claimed on the IGST amount.

Location of Registration

Place of business registration is also another cause of the difference between inter-state and intra-state movement of goods. In the case of intra-state transactions, business organizations need to get registered in their place of business.

In the case of Inter-state transactions, business organizations should get registered in every place where they operate the business.

Every business organization should understand the basic differences between inter-state and intra-state transactions. This will help businesses to get complete knowledge of GST regulations and flawless invoicing.

Also Read: GST Interstate Vs Intrastate Supply: What Is The Difference

Significance of inter-state transactions in the GST framework

As per rules implemented by the GST Council, inter-state transactions play a vital role in this GST regime. All can check below the areas of significance in inter-state transactions.

Uniformity in Tax Structure

The prime aim of Inter-state transactions is to maintain uniformity in the entire tax structure within the country. The implementation of the GST framework has made it possible to abolish complicated tax structures in every state. This system helps in maintaining consistency in tax rates.

The fundamental principle of GST is “One Nation, One Tax.” Every inter-state transaction complies with this principle, and it also ensures IGST or a single integrated tax structure in the country.

No Cascading

Simplification in the tax structure and elimination of cascading effects are also significant in Inter-state transactions. As per this rule, businesses can claim ITC, or Input Tax Credit on the amount of tax, depending on the state of origin. This tax system is helpful in maintaining transparency in tax formats all over the country.

Smooth transportation of goods and services

The aim of implementing an inter-state GST system is to maintain the smooth flow of goods and services all over the country. This system applies to organizations engaged in trading goods nationwide.

Reduction in compliance burden

The next significant reason for the implementation of the inter-state tax format is to reduce the tax compliance burden on companies. Due to the reduction in compliance burden, companies can pay attention to core operations within their organizations.

Key factors determining the inter-state nature of a transaction

Every business organization and the tax authorities should understand the key factors to determine whether the movement of goods is of an inter-state nature or not. Let’s check the key factors below.

Place of supply of goods

The location of the suppliers and the recipients are prime factors to consider when deciding whether the goods are supplied within the state or across borders. In the case of the transportation of goods in different states, this transaction is considered an inter-state transaction. Again, another prime key factor is to identify the location of the suppliers and recipients.

Nature of goods supplied

The nature of the transaction is another significant key factor in determining whether the transaction is inter-state or not. The determination of the nature of the transaction entirely depends on the nature of the supply. If the destination of the goods or services is in a different state, the transaction is considered an inter-state transaction.

Movement of money

The movement of money also determines the nature of transactions. When the movement of money is across the state, the transaction is also known as an inter-state transaction.

Place of business operations

If it is noticed that business houses operate in different locations in different states, the transactions will also be considered as inter-state transactions. Transactions between different branches or locations are also considered as inter-state transactions.

Application of IGST

When the IGST tax rate is applicable on any transaction, it automatically attracts inter-state transactions. IGST is applicable only when there is cross-border movement of goods.

Customer nexus

The identification of inter-state transactions also depends on the economic transactions between the supplier and the recipients. The connection between the customers is also a key factor in determining the type of transaction.

Terms and conditions

Several terms and conditions are maintained between the suppliers and the recipients. These terms and conditions of transactions play a vital role in identifying whether the transactions are inter-state or not.

Final Thought

The above discussion clarifies the identification of inter-state transactions entirely depending on the nature of the transactions of goods. Here, it is necessary to maintain accurate invoices and fulfill other financial transactions. Proper identification of inter-state transactions helps determine the consumption of goods and services.

Also Read: What Is An Inter-State Supply?

Frequently Asked Questions (FAQs)

-

Which GST applies to the inter-state supply of goods?

A- When goods or services are transported to different states, the transaction is known as an inter-state transaction, and it attracts IGST. IGST applies to all goods and services transacted in other states.

-

Is RCM applicable to inter-state transactions?

A- In the case of inter-state transactions of goods, the recipient of the goods is required to pay IGST. Whereas, in the case of intra-state transactions under the reverse charge mechanism, the recipient should pay CGST and SGST.

-

Can IGST be utilized against SGST?

A- The taxpayer under IGST is eligible for credit in any percentage. But here, the taxpayer should utilize the IGST amount entirely in IGST credit before utilizing the amount for CGST and SGST credit.

-

Is IGST applicable to imports?

A- As per the GST Council, all imports are considered interstate supplies. Hence, an integrated tax rate is to be applied.