Introduction

GST invoice format is a document from a seller to a buyer, detailing goods or services with incorporated Goods and Services Tax (GST). The receipt includes specifics like product descriptions, quantities, prices, and GST rates, crucial for clarity and tax compliance. Generating GST invoices is essential for clarity and tax compliance. The importance of GST invoicing lies in creating transparency, aiding businesses in tracking transactions, and serving as crucial documentation for tax purposes. Understanding GST invoice components is key to accurate billing and compliance. While GST invoices streamline processes, it’s essential to be mindful of GST invoice mistakes to avoid, ensuring a trustful business environment between buyers and sellers.

Components of a GST Sales Invoice

A GST sales invoice is like a special paper that tells the story of a sale. It has different parts that together make sure everything is clear and fair.

-

Seller and Buyer Information:

- It starts with who sold something (seller) and who bought it (buyer). Their names and addresses are there so everyone knows who’s involved.

-

Invoice Number:

- Each invoice gets its own number. It’s like a code that helps keep track of all the papers. If there’s a question or problem, this number makes it easier to find the right invoice.

-

Date:

- The date is when the sale happened. It helps everyone know when things took place and is crucial for keeping records straight.

-

Description of Goods or Services:

- This part talks about what was sold. If it’s a thing, like a computer, it describes it. If it’s a service, like fixing a car, it says what service was provided.

-

Quantity:

- For things being sold, this part tells how many. If it’s a service, this might not apply. For example, if it’s a computer, it says how many computers were sold.

-

GST Rates:

- GST is like a tax, and this part says how much tax is added to the cost. It’s important for everyone to know the tax amount.

-

Total Cost:

- This is the big number. It’s the total amount of money for the sale. It includes the cost of the item or service and the GST tax added to it.

Importance and Benefits of Proper GST Invoicing

Proper GST invoicing is crucial for maintaining clarity and fairness in business transactions, providing an accurate record of sales for transparent financial tracking. It ensures accurate tax reporting, prevents legal issues, and fosters trust between buyers and sellers, contributing to the smooth operation of businesses and reinforcing reliability and integrity.

Here are the benefits of proper GST Invoicing

-

Legal Compliance:

- Avoid Penalties: Generating invoices in accordance with GST regulations helps businesses adhere to legal requirements, avoiding penalties and legal issues.

-

Input Tax Credit (ITC):

- Claiming Benefits: Proper invoicing ensures that businesses can claim Input Tax Credit on the GST they’ve paid on purchases. This reduces the overall tax liability.

-

Customer Confidence:

- Professionalism: Well-structured GST invoices enhance the professional image of a business. Customers are likely to have more confidence in transactions that are documented properly.

-

Government Benefits:

- Access to Schemes: GST-compliant businesses may have better access to government schemes and benefits, contributing to overall business growth.

-

Reduced Tax Evasion:

- Preventing Fraud: Proper invoicing practices reduce the likelihood of tax evasion and fraudulent activities, promoting a fair and ethical business environment.

-

Easier Audits:

- Simplified Audits: Invoices in line with GST standards simplify the audit process. Businesses can easily provide necessary documentation during tax audits.

-

National Presence:

- Ease of Doing Business: With a standardized GST system, businesses can operate seamlessly across different states in India, promoting the ease of doing business.

-

Vendor Relations:

- Smooth Transactions: GST invoicing facilitates smoother transactions between businesses, improving relationships with vendors and suppliers.

Also read: Impact Of GST: Invoice, Simplified Tax System And Reduce Compliance Burden

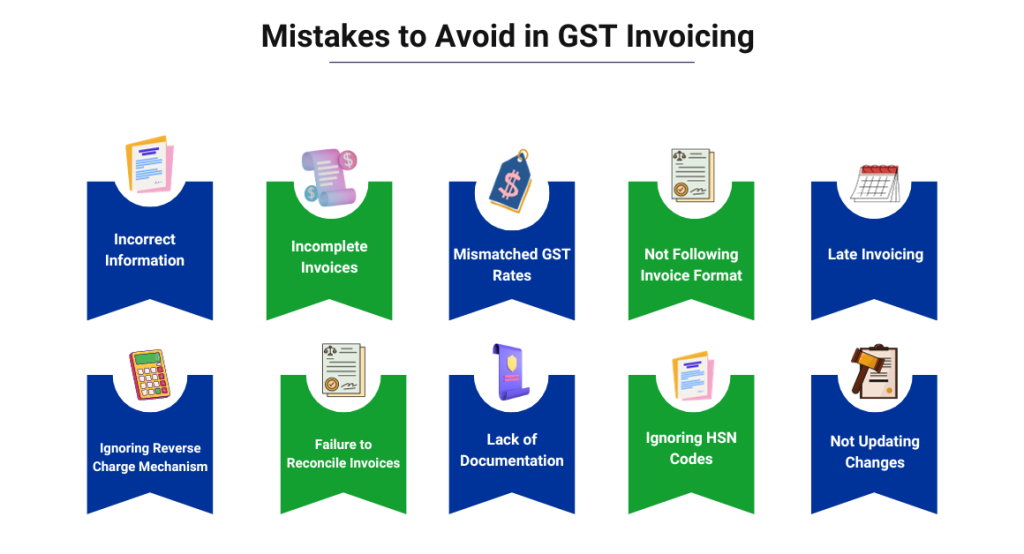

Common Mistakes to Avoid in GST Invoicing

There are a few common mistakes that businesses should avoid when it comes to GST invoicing:

-

Incorrect Information:

- Mistakes like wrong names, addresses, or GSTINs on the invoice can lead to confusion; accuracy is crucial.

-

Incomplete Invoices:

- Missing key details—invoice number, date, goods description, quantity, and GST rates—can cause confusion and legal issues.

-

Mismatched GST Rates:

- Applying incorrect GST rates is common; knowing the right rates for different goods and services is essential.

-

Not Following Invoice Format:

- Each industry has its format; not adhering to it can lead to non-compliance issues—use the right structure for your business.

-

Late Invoicing:

- Timely invoicing is crucial; delays can cause problems for both parties and affect financial records and legal compliance.

-

Ignoring Reverse Charge Mechanism:

- Some transactions require the buyer to pay GST; ignoring this can lead to incorrect tax payments.

-

Failure to Reconcile Invoices:

- Regularly reconcile invoices with accounts to avoid discrepancies and ease tax filing.

-

Lack of Documentation:

- Proper records are crucial for audits; maintaining organized documentation is essential.

-

Ignoring HSN Codes:

- HSN codes classify goods and services; ignoring or misusing them can lead to tax calculation errors.

-

Not Updating Changes:

- Update business details and GST registration changes on invoices to avoid non-compliance issues.

Also Read: Invoicing Under GST

How to Generate a GST Sales Invoice

Generating a GST sales invoice involves several steps to ensure that the document is accurate, complies with legal requirements, and provides clear information about the transaction. Here’s a detailed guide on how to generate a GST sales invoice:

-

Seller and Buyer Information:

- Include your business details and the buyer’s info, like names, addresses, and GSTIN, ensuring clarity in the transaction.

-

Invoice Number and Date:

- Assign a unique invoice number and date to track transactions, providing a clear timeline.

-

Description of Goods or Services:

- Clearly describe items or services sold, including quantity and price, for transparency and avoiding confusion.

-

Quantity and Unit Price:

- Specify item quantity and unit price, multiplying to find total amounts for each line item.

-

GST Rates and Amounts:

- Clearly state GST rates, calculate GST amounts for each item, and differentiate CGST, SGST, or IGST based on transaction details.

-

Total Amount and Grand Total:

- Sum up line item totals for a subtotal, add GST amounts to calculate the grand total payable by the buyer.

-

Payment Terms:

- Specify payment terms, due dates, and any applicable late charges for clear expectations.

-

Terms and Conditions:

- Include relevant sale conditions like warranties or return policies agreed upon by both parties.

-

Signature and Seal:

- Legally validate the invoice with the authorized person’s signature and seal for authenticity.

-

Save a Copy:

- Keep both digital and physical copies for record-keeping, crucial for accounting, tax compliance, and potential audits.

-

Use Accounting Software:

- Streamline the process and reduce errors by using GST-compatible accounting software for automated invoicing and management.

Also Read: How To Create A GST Invoice For An Online Business?

Understanding GST Invoice Format Variations

GST invoice format variations are differences in how invoices are structured to meet Goods and Services Tax (GST) rules. These differences may arise from industry-specific needs, transaction types, or the locations of the businesses, impacting how invoices are presented. Let’s understand in detail:

-

Industry-Specific Formats:

- Invoices can vary based on industries like manufacturing or retail, adapting to unique needs; for example, goods sales invoices may differ from service invoices.

-

B2B and B2C Formats:

- Business invoices (B2B) may include more details like GSTIN for both parties, while consumer invoices (B2C) might be simpler, highlighting transaction specifics.

-

Interstate and Intrastate Transactions:

- Invoices for transactions within a state may differ from those involving different states, with interstate invoices incorporating Integrated Goods and Services Tax (IGST) and state codes.

-

Invoice Type:

- Depending on the supply type (goods, services, export), invoice formats vary; for example, an export invoice might include Exporter Code and shipping details.

-

Credit and Debit Notes:

- Formats for credit and debit notes, correcting previous invoices, may differ, providing a means to rectify errors or changes in transaction details.

-

Digital and Manual Formats:

- Invoices can take digital or manual forms, with digital ones often structured for compatibility with accounting software amid the rise of digital systems.

-

Government-Prescribed Formats:

- Some governments set specific GST invoice formats, and businesses must comply to avoid non-compliance issues and ensure adherence to prescribed guidelines.

Significance of GST Invoice Matching

The importance of GST invoice matching is to guarantee accuracy and transparency in the tax system. It involves cross-verifying details provided by sellers in outward supply invoices with those declared by buyers in inward supply invoices, ensuring consistency and reliability in transactions.

-

Input Tax Credit (ITC) Reconciliation:

- GST invoice matching ensures businesses accurately claim Input Tax Credit, allowing them to offset taxes on purchases against taxes collected on sales, ensuring a fair tax system.

-

Prevention of Tax Evasion:

- Invoice matching helps prevent tax evasion by cross-verifying seller and buyer details, identifying discrepancies, and deterring attempts to manipulate the system.

-

Enhanced Accuracy and Compliance:

- Matching invoices enhances tax system accuracy, encouraging businesses to maintain precise records and comply with GST regulations, fostering transparency and accountability.

-

Resolution of Discrepancies:

- The GST invoice matching process resolves discrepancies between seller and buyer details, facilitating communication for error rectification and ensuring accurate tax reporting.

-

Reduced Litigation:

- Effective invoice matching reduces disputes and litigations related to taxes, as aligned details leave less room for disagreements between businesses and tax authorities.

-

Smooth Cash Flow:

- Timely and accurate input tax credit through GST invoice matching ensures a smooth cash flow for businesses, allowing quick processing of credit claims for operational needs.

-

Systematic and Transparent Taxation:

- Invoice matching contributes to systematic and transparent GST operations, aligning seller and buyer interests, promoting fairness, and establishing a level playing field in business taxation.

Conclusion

In conclusion, understanding GST invoicing is super important for businesses. This guide explained the different parts of a GST sales invoice, why it’s crucial to do it right, and common mistakes to avoid. Generating proper invoices and matching them correctly helps in smooth business operations. Mastering GST invoicing is like learning the rules of a game – it keeps things clear, builds trust, and sets businesses up for long-term success.

FAQ’s

-

What is a GST sales invoice?

A GST sales invoice is a special paper that shows details of a sale, like what was bought, its cost, and the added GST tax.

-

What info is in a GST sales invoice?

It includes seller and buyer details, invoice number, date, what was sold, quantity, unit price, GST rates, and the total cost.

-

Why is proper GST invoicing important?

Proper invoicing is key for clear transactions, fair taxes, and avoiding problems. It shows you’re playing by the rules.

-

What benefits come from proper GST invoicing?

Benefits include clear records, accurate taxes, avoiding trouble, smooth business, and everyone trusting each other.

-

What mistakes should I avoid in GST invoicing?

Avoid errors like wrong details, missing info, incorrect GST rates, or not following the invoice format.

-

How do I generate a GST sales invoice?

Include seller-buyer info, invoice number, date, item details, quantity, unit price, GST rates, and total cost. Sign and keep a copy.

-

Are there different GST invoice formats?

Yes, formats vary based on industries, transaction types, and locations. Use the right one for your business.

-

Why is GST invoice matching important?

Matching ensures accuracy in claiming tax credits and prevents errors. It’s like making sure everyone tells the same story.

-

What happens if invoices don’t match?

Discrepancies are resolved through communication. It helps in correcting errors and ensuring accurate transactions.

-

Why should businesses master GST invoicing?

Mastering GST invoicing is like playing a fair game in business – it keeps things clear, builds trust, and sets the foundation for success.