Introduction:

GST, or Goods and Services Tax, is a system for taxes. It’s a way the government collects money when people buy things. Instead of having many different taxes, GST combines them into one. This makes it simpler. When you buy goods or services, a bit of the money you pay is for GST. It’s like a small part that goes to the government. GST is used in many countries to make sure taxes work smoothly.

When it comes to taxes, the Goods and Services Tax (GST) is the set of rules to follow. If your business involves selling physical goods, it’s crucial to comprehend the nuances of GST registration for goods. This guide navigates through the specifics, distinguishing the taxation aspects related to goods from services.

We will go through the basics of GST, the process for goods registration, and the benefits for businesses selling goods. Small businesses will learn how GST registration impacts them. We’ll also explore the limit and factors to consider before registering. Lastly, we’ll clear up common misunderstandings about GST registration for goods, including the GST registration limit and threshold for GST registration on goods.

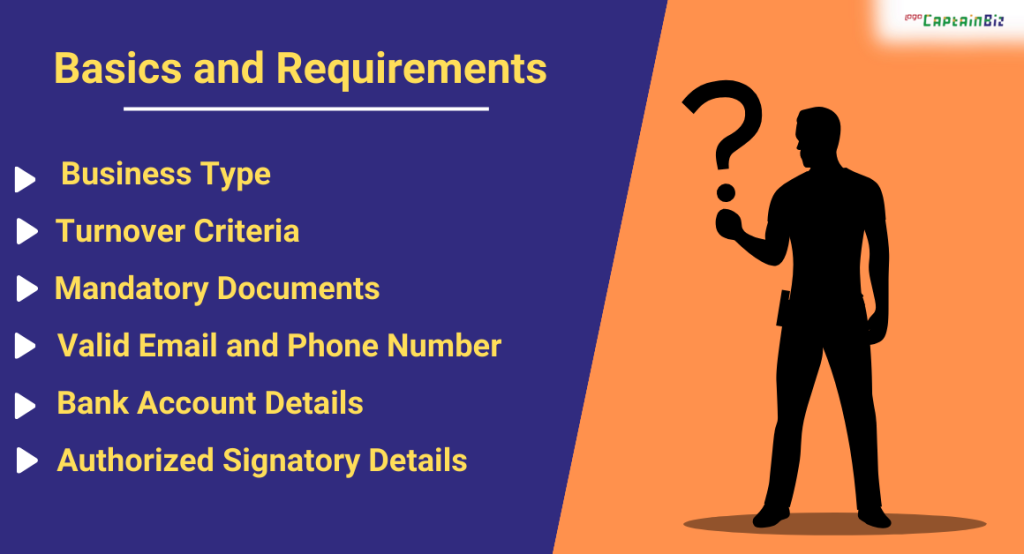

GST Registration: Basics and Requirements

Understanding GST Registration, it’s like learning the rules of a game. GST registration means agreeing to follow specific rules about taxes. These rules are like a guidebook that tells businesses how to handle taxes in the Goods and Services Tax (GST) system.

You need to follow a basic requirement for GST registration such as:

-

Business Type:

Identify the type of business you are running, as different rules apply for various categories like regular taxpayers, composition scheme businesses, and others.

-

Turnover Criteria:

Check the turnover criteria for GST registration. As of now, businesses with an annual turnover exceeding the prescribed limit (which may vary) are required to register.

-

Mandatory Documents:

Prepare and submit essential documents such as proof of business registration, address proof, identity proof of the authorized signatory, bank account details, and photographs.

-

Valid Email and Phone Number:

Provide a valid email address and phone number for communication and receiving the One-Time Password (OTP) during the registration process.

-

Bank Account Details:

Furnish details of the business’s bank account, including the bank name, account number, branch address, and the account’s IFSC code.

-

Authorized Signatory Details:

Clearly identify and provide information about the authorized signatory who will be responsible for GST-related communications and compliance.

Following the basic steps in the GST registration and requirement process is super important for businesses. It means playing by the government’s rules for taxes.

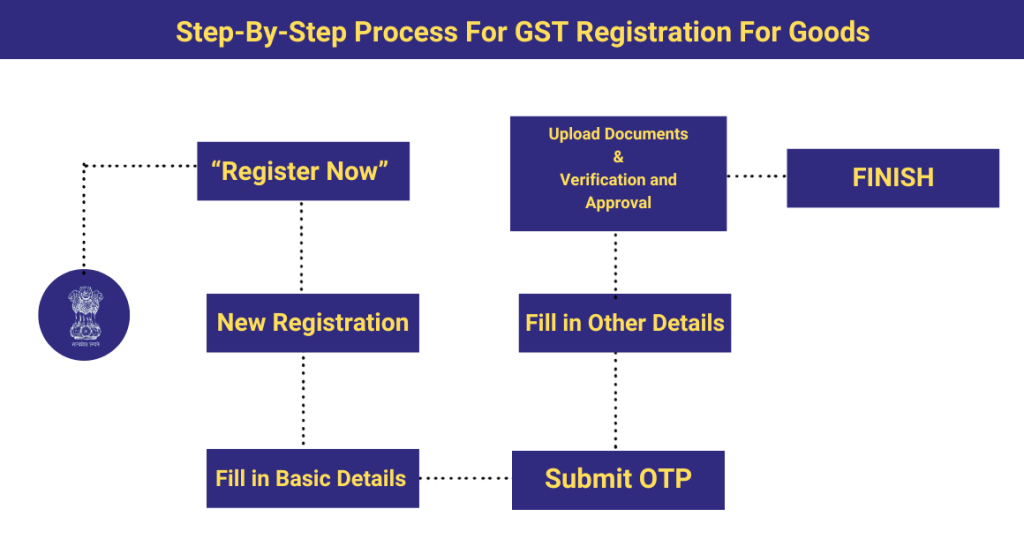

Exploring the GST Registration Process for Goods

Here is a step-by-step process for GST registration for goods:

-

Visit the GST Portal:

Begin by accessing the official GST portal at https://www.gst.gov.in/

-

Click on “Register Now”:

On the homepage of the GST portal, click on the “Register Now” button.

-

Select “New Registration”:

Choose “New Registration” from the drop-down menu. This is for businesses that are registering for the first time.

-

Fill in Basic Details (Part A):

Provide details such as the legal name of the business, type of taxpayer, and the state in which the business operates.

-

Submit OTP for Verification:

OTP will be sent to the registered mobile number and email. Enter the OTP to verify the provided information.

-

Fill in Other Details (Part B):

Proceed to fill in Part B of the form, which includes business details, the principal place of business, additional places of business, and partners or directors.

-

Upload Documents:

Upload necessary documents, including proof of business registration, address proof, bank account details, and photographs of the authorized signatory.

-

Verification and Approval:

The application undergoes a verification process by the GST authorities. Once verified, the authorities approve the application.

-

Receive GSTIN:

Upon approval, the business is issued a unique Goods and Services Tax Identification Number (GSTIN).

-

Start Using GSTIN:

With the allocated GSTIN, the business can now commence using it for transactions and compliance.

Also read: What Are The Documents Required For GST Registration For Goods?

Benefits and Advantages of GST Registration for Goods

GST registration for goods brings several benefits and advantages for businesses. Here’s a detailed explanation of these advantages:

- Legitimacy and Compliance:

- Explanation: GST registration establishes the legitimacy of a business in the eyes of the government.

- Advantage: It ensures compliance with tax regulations, fostering a trustworthy relationship between the business and regulatory authorities.

- Input Tax Credit (ITC):

- Explanation: Registered businesses can claim Input Tax Credit, allowing them to reduce the tax paid on inputs from the tax payable on the final output.

- Advantage: This leads to cost savings and improved profitability.

- Smooth Interstate Trade:

- Explanation: GST is a destination-based tax, which simplifies interstate trade by eliminating the complexities of multiple state taxes.

- Advantage: Businesses can engage in smoother and more efficient interstate transactions.

- Market Competitiveness:

- Explanation: GST registration enhances a business’s competitiveness as many vendors and customers prefer dealing with registered entities.

- Advantage: It opens up opportunities for collaboration and expansion in the marketplace.

- Access to Wider Customer Base:

- Explanation: Registered businesses can cater to a wider customer base, including other GST-registered businesses.

- Advantage: It broadens the business’s reach and potential for growth.

- Government Contracts and Tenders:

- Explanation: Many government contracts and tenders require GST registration as a prerequisite for participation.

- Advantage: It enables businesses to access government opportunities, contributing to increased revenue.

- Legal Protections:

- Explanation: GST registration offers legal protection to businesses, preventing them from facing penalties for non-compliance.

- Advantage: It ensures a secure and legally compliant business environment.

- Facilitation of E-Commerce Transactions:

- Explanation: E-commerce platforms often require sellers to be GST registered.

- Advantage: It allows businesses to participate in online marketplaces, expanding their customer base and sales channels.

- Simplified Tax Filing:

- Explanation: GST replaces multiple indirect taxes, simplifying the tax filing process for businesses.

- Advantage: It reduces the administrative burden and the likelihood of errors in tax compliance.

- Improved Creditworthiness:

- Explanation: Being GST registered enhances a business’s creditworthiness in the eyes of financial institutions.

- Advantage: It improves the ability to secure loans and financial support for business expansion.

Impact of GST Registration on Small Businesses

When small businesses register for GST, it can bring several changes. Let’s break it down:

-

Less Hassle in Taxes:

Before GST, there were many different taxes. Now, it’s simpler. Small businesses don’t have to deal with a bunch of different tax rules.

-

More Customers to Sell to:

Being registered makes it easier to sell to other businesses. More customers mean more opportunities to sell goods and grow.

-

Savings on Purchases:

With GST, small businesses can save money on the things they buy for their business. It’s like getting a discount on what they need.

-

Easier Online Selling:

If a small business wants to sell online, being GST registered is often a must. It opens up the chance to reach customers through the internet.

-

Fair Play in the Business Game:

When everyone follows the same GST rules, it’s like playing a fair game. Small businesses can compete on an equal footing with others.

-

Avoiding Penalties:

If a small business should be registered but isn’t, there could be fines. Registering ensures they avoid penalties and stay on the right side of the law.

-

Getting Loans Becomes Easier:

Banks and lenders often see GST registration as a good sign. Small businesses might find it easier to get loans or financial help.

Also read: Tax Planning Tips For Small Businesses

Also read: Benefits Of GST For Small Business

GST Registration Limit and Threshold: Factors to Consider

When we talk about the “GST Registration Limit and Threshold,” we mean there’s a certain level of business activity that decides if a business needs to register for GST or not. Here are some simple things to think about:

-

Turnover Matters:

If a business sells a lot of things and the total money they get is more than a certain limit, they need to register for GST.

-

Location Counts:

Sometimes, the rules can change based on where the business is. Different places might have different limits.

-

Keep an Eye on the Numbers:

Businesses need to pay attention to how much money is coming in. If it crosses the set limit, it’s time to register for GST.

-

Don’t Miss the Deadline:

Once a business hits the limit, they usually have a specific time to get registered. Missing this deadline might lead to some issues.

-

It’s Like a Membership:

Think of GST registration like getting a membership card. When a business hits a certain level, it joins the GST club and follows the rules.

-

It’s for Everyone’s Benefit:

The idea is to make sure businesses that are doing well contribute their fair share to taxes. It’s a way to keep things fair for everyone. So, the GST Registration Limit and Threshold are like checkpoints for businesses to join the tax system when they reach a certain size.

Also read: Understanding GST Threshold Limits And Exemptions: Essential Guide

Common Misconceptions about GST Registration for Goods

There are a few common misconceptions about GST registration for goods that often lead to confusion. One misconception is that only large businesses need to register. In reality, the registration requirement is based on turnover, and even small businesses surpassing the threshold must register.

Another misconception is that GST is an additional burden on businesses. While it involves tax compliance, it also provides benefits like input tax credit and simplifies the taxation process. Some believe that registration is a complex and time-consuming process, but with online platforms, the procedure has become more streamlined.

Additionally, there is a misconception that GST registration is only necessary for businesses engaged in inter-state trade. In truth, it applies to intra-state transactions as well. Clearing up these misconceptions helps businesses understand the importance and applicability of GST registration, ensuring they comply with the necessary regulations without unnecessary concerns.

Conclusion

Following the GST registration for goods is like a smart move for businesses. It’s not just about rules; it brings benefits. Businesses save money, get more customers, and play fair in the market. Even small businesses can grow and be trusted. Clearing up misunderstandings is essential. Everyone, big or small, should join in for a fair and transparent business world. In a nutshell, GST registration is a wise step for businesses of all sizes.

FAQ’s

-

What is Goods and Services Tax (GST)?

This question aims to provide a brief overview of GST, setting the stage for readers unfamiliar with the concept.

-

Why is GST Registration Necessary for Businesses?

This addresses the fundamental importance of GST registration and its implications for businesses.

-

What are the Basic Requirements for GST Registration?

This question delves into the essential criteria and documentation needed for businesses to register under GST.

-

How Does the GST Registration Process Work for Goods?

Here, the focus is on the step-by-step procedure involved in registering goods under the GST system.

-

What Advantages Does GST Registration Offer to Goods-based Businesses?

This question explores the benefits and positive outcomes that businesses can expect after registering under GST.

-

How Does GST Registration Affect Small Businesses?

This addresses the specific impact of GST registration on smaller enterprises, considering their unique circumstances.

-

What Factors Determine the GST Registration Limit and Threshold for Goods?

This question breaks down the various considerations that influence the threshold at which businesses must register for GST.

-

Are There Any Benefits for Small Businesses in Registering for GST?

This emphasizes potential advantages and incentives for small businesses that might be contemplating GST registration.

-

What are Common Misconceptions Surrounding GST Registration for Goods?

This question opens the door to addressing and debunking prevalent misunderstandings about GST registration.

-

Can a Business Trade Goods Across States Without GST Registration?

This addresses the misconception that GST registration is only required for inter-state transactions, clarifying the applicability of GST for intra-state trade as well.