Initially, there used to be a wide range of taxation policies, each devised for a specific purpose. The complex nature of India’s taxation policies created a range of issues in business and finance. This is why implementing a new taxation system has been in the talks since 2000. However, it took 17 years to be implemented.

In 2017, the Goods and Services Tax replaced the pre-existing taxes like VAT, excise duty, etc. However, replacing these taxes with one tax was a bold and complex move, as the GST was expected to replace multiple parameters while ensuring a better and more effective taxation system. This is also why GST is diverse and complex in nature.

Moreover, such a significant change in taxation is expected to have an immense impact on a country and its financial system. If you are unaware of the impact of GST on businesses, read this article till the end. It will also walk you through GST’s evolution, structure, and framework in India.

Evolution of GST

The evolution of Goods and Services Tax in India is a complex journey that spans over two decades, involving multiple governments, committees, and legislative processes.

The idea of GST was first proposed in the early 2000s, and it underwent several stages of development before finally being implemented on July 1, 2017. Here is a brief overview of the history and timeline of the evolution of GST in India:

2000

- An Empowered Committee of State Finance Ministers is formed to discuss the implementation of GST.

2006

- Finance Minister P Chidambaram announced the plan to implement GST on April 1, 2010.

2009

- The Empowered Committee of State Finance Ministers submits India’s first GST discussion paper.

2010

- President Pranab Mukherjee announced a postponement in the introduction of GST, suggesting a new date of April 2011.

2011

- The Constitution (115th Amendment) Bill, which focused on the introduction of GST, was introduced in the Lok Sabha.

- The Lok Sabha referred the GST Bill to the Standing Committee for a thorough review.

2013

- The Constitution (115th Amendment) Bill is reported on by the Standing Committee on Finance.

2014

- The Bill expires due to the dissolution of the Lok Sabha.

- The Constitution (122nd Amendment) Bill, focused on introducing GST, was introduced in the Lok Sabha by Finance Minister Arun Jaitley.

2015

- The Lok Sabha approved the Bill and referred it to a Rajya Sabha Select Committee.

- The Select Committee submits its report.

- A committee led by the Chief Economic Advisor provides a report on the probable GST rates.

2016

- Both the Rajya Sabha and the Lok Sabha passed the Bill, which was then announced as the Constitution (101st Amendment) Bill.

- Assam became the first state to ratify the bill.

- President Pranab Mukherjee signed the bill into law.

- The Union Cabinet approves the setting up of the GST Council, which holds its first meeting in New Delhi.

2017

- The Integrated GST (IGST) Bill, the Central Goods and Services Tax (CGST) Bill, the GST (Compensation to States) Bill, and the Union Territory GST (UTGST) Bill were introduced in the Lok Sabha.

- The Bills are passed by both the Lok Sabha and the Rajya Sabha, leading to the notification of the GST Acts.

- The GST Council notifies GST rates and cess on goods and services.

- On July 1, 2017, GST was officially rolled out.

The years following the implementation of GST have witnessed various amendments, introductions of new provisions, and adjustments in response to feedback and changing economic conditions.

Also Read: The Evolution Of India’s Tax System And GST

GST Structure and Framework

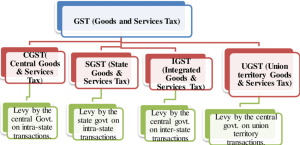

The Goods and Services Tax system in India is designed with a comprehensive framework to simplify the indirect tax structure, streamline compliance, and promote a unified market.

The structure involves a multi-tiered tax rate system, while the framework includes various acts, councils, and procedural components.

Source – https://www.researchgate.net/figure/Goods-and-Services-Tax-Framework_fig1_344385374

GST Tax Rate Structure

The GST tax rate structure in India comprises five slabs. This tiered system classifies goods and services into different tax brackets based on their nature and economic significance.

| Tax Slab | Description |

| 0% | Essential goods and services |

| 5% | Basic amenities and goods of moderate importance |

| 12% | Standard rate for goods and services |

| 18% | Goods and services of higher importance |

| 28% | Luxury items and sin goods |

Components of GST Structure

Some of the essential components of the Indian GST structure are:

1. Central GST

The central government imposed CGST. It applies to moving goods and services within the same state or union territory. This streamlines taxation on intra-state transactions.

2. State GST

State governments levied SGST to tax transactions within a state. This ensures that goods sold and consumed locally are subject to state-level taxation.

3. Integrated GST

IGST was designed for interstate supplies. It is imposed on transactions involving two or more states or union territories. This simplifies the tax process for businesses operating across state borders.

4. Union Territory GST

UTGST is applied to the supply of services and goods within union territories governed by the central government. It ensures a uniform taxation system in these regions.

The Framework of GST in India

The Indian GST system has the following framework to ensure an effective taxation policy:

1. GST Acts

The GST framework in India is governed by four key acts – CGST, IGST, SGST, and UTGST. Each act outlines the tax applicability, ensuring a coherent and standardised approach to indirect taxation.

2. GST Council

It is a constitutional body that comprises state governments and finance Ministers from central and. It is critical in setting GST rates, suggesting exemptions, and amending laws.

3. Input Tax Credit

Input Tax Credit (ITC) under GST permits businesses to offset tax paid on inputs and services. This prevents a decline in tax collection and promotes a seamless flow in the production and service chain.

4. GSTN

As the IT backbone, GSTN manages the registration, filing, and processing of returns. It assigns unique 15-digit GST Identification Numbers (GSTIN) to taxpayers.

5. Threshold Limit

Businesses with turnover below the specified threshold are exempt from GST registration. This limit provides relief to small enterprises and minimises compliance burdens.

6. Composition Scheme

Small taxpayers can choose a fixed-rate scheme without Input Tax Credit benefits. This simplifies compliance and tax calculations for businesses with lower turnovers.

7. E-Way Bill

Mandatory for goods above a specified value, the E-way Bill ensures transparency and documentation for the movement of goods, facilitating efficient tax administration.

8. GST Returns

Periodic filing of returns, such as GSTR-1 and GSTR-3B, is based on business size and type. It promotes regular compliance and transparency in tax reporting.

9. GST Audits

Certain businesses undergo GST audits to verify compliance with tax laws. This ensures adherence to regulations and maintains the integrity of the tax system.

10. Exports and Imports

Exports are zero-rated, encouraging international trade, while imports are subject to IGST, ensuring parity in tax treatment for domestic and foreign goods and services.

Also Read: What is the GST Rate Structure for Sales and Purchases? A Comprehensive Summary

Impact of GST on Financial Sector

The introduction of GST significantly impacted the financial sector by bringing both challenges and opportunities. Here is a breakdown of the impact of GST on businesses and the overall financial sector:

1. Increased Tax Burden

Financial services faced elevated costs with a service tax increase from 15% to 18%. This rise in tax rates impacts customers on bank charges, mutual fund transactions, and insurance premiums. As a result, the compliance complexities also heightened across states.

2. Improved Input Tax Credit

GST allowed financial institutions to claim ITC. This further leads to cost optimisation and encourages investments in technology. Such a significant improvement in Input Tax Credit (ITC) under GST enhanced operational efficiency and competitiveness in the sector.

3. Streamlined tax Regime

GST streamlined the tax regime by eliminating the declining effect of multiple indirect taxes in the financial services sector. It promoted transparency and efficiency, further creating a unified national market.

4. Challenges and Opportunities

The implementation of GST brought challenges like technological adjustments and operational restructuring. However, it also presented opportunities for optimisation and required financial institutions to explore regulatory uncertainty with agility.

GST and International Trade

The arrival of the GST in India significantly reshaped international trade. While its impact contains both advantages and challenges, it has proven to be an effective solution for exporters and importers. Here is how GST impacted international trade:

1. Exports

GST brings significant benefits to exports, treating them as “zero-rated” to eliminate taxes in the export process. This allows exporters to claim refunds on GST paid, improving liquidity.

2. Imports

GST introduces indirect taxation on imports, potentially raising costs and making imports less attractive. Importers face new compliance requirements, including managing Input Tax Credit (ITC) under GST. However, concerns about anti-dumping measures against Indian exports have emerged.

3. Opportunities for Service Exports

GST brings clarity to the taxation of international services, enhancing transparency and fostering a conducive environment for businesses. With access to Input Tax Credit (ITC) and standardised digital invoicing, costs are reduced, improving the competitiveness of service providers in the global market.

4. Ongoing Challenges and Adaptations

Ongoing concerns revolve around determining the ideal GST rate structure for industries heavily dependent on imports. Despite efforts to streamline through GST, challenges in logistics, infrastructure, and compliance persist, highlighting the need for continual adaptations.

Successful integration of GST with existing free trade agreements and efficient dispute resolution requires ongoing negotiations and policy adjustments.

Also Read: GST And The Global Tax Landscape

Conclusion

Just like any other thing, GST also has both boon and bane. Its implementation in India has definitely created both obstacles and opportunities. The simplified processes and greater export competitiveness have been significant positives of GST.

However, questions still remain about the proper GST rate structure and the impact on import-dependent companies. Therefore, continuous discussions and policy modifications are critical to realise the ideal application of GST.

Frequently Asked Questions

Q1. How is GST calculated?

A straightforward formula emerges: GST Amount equals (Original Cost multiplied by GST Rate Percentage) divided by 100. The Net Price is then calculated by adding the Original Cost to the GST Amount.

Q2. What is RCM in GST?

The RCM requires the recipient of Goods/Services to be responsible for paying and depositing GST with the government, shifting the usual process where the supplier receives GST from the recipient and subsequently remits it to the government under the normal GST levy mechanism.

Q3. Who Collects GST in India?

Operating under a dual structure, GST consists of Central GST (CGST) imposed by the Central Government and State GST (SGST) levied by State Governments.

Q4. How is the GST Limit Calculated?

Individuals who provide services must register if their total revenue exceeds ₹20 lakh (for regular category states) or ₹10 lakh (for special category states).

Q5. What is the TDS for GST?

TDS (Tax Deducted at Source) must be deducted at a rate of 2 per cent on payments made to suppliers of taxable services and goods, provided that the total value of such supply under a single contract surpasses two lakh fifty thousand rupees.

Q6. What is GSTR 3B?

Form GSTR-3B is a simplified summary return, enabling taxpayers to declare their GST liabilities for a specific tax period and fulfil these obligations. Regular taxpayers are obligated to file GSTR-3B returns for each tax period.

Q7. Who Gives a GST refund?

According to the GST refund procedure, the GST officer must process the refund application within 60 days of its filing. If the refund is not received within 60 days, interest must be charged on the overdue amount.

Q8. What is the 50000 Limit in GST?

Gifts with a value of up to ₹50,000 per year from an employer to an employee fall outside the scope of GST. However, gifts exceeding ₹50,000, made without consideration during business, are subject to GST.

Q9. Can you File GST Without CA?

Previously, businesses with an annual turnover exceeding ₹5 crores were obligated to obtain audit certification from Chartered Accountants (CAs) for their GST returns. However, the CBIC has now announced that such businesses can self-certify their GST returns. While businesses can still choose to have CAs file their GST returns, it is no longer mandatory.

Q10. What is a 90 Refund Under GST?

Under GST law, there is a provision for a refund of 90% of the total claim, specifically for claims related to refunds arising from zero-rated supplies. The provisional refund is to be disbursed within 7 days after the acknowledgement is provided.