Introduction

GST, or Goods and Services Tax, serves as a streamlined tax system for the purchase of goods or services, simplifying the prior complex tax structure. Introduced to prevent tax evasion, it impacts the cost of goods by adding a bit of tax at each production and sale stage, ensuring fair contributions from all involved. As businesses grow, crossing a set sales limit, they undergo the GST registration process, allowing them to collect and pay GST, contributing to government revenue. Additionally, businesses benefit from Input Tax Credit (ITC) under GST, reducing operational costs. Understanding GST rates and classifications is vital for businesses to comply with GST compliance and filing requirements. The overall impact of GST on various business sectors is significant, streamlining taxation processes and fostering fair contributions.

Understanding GST Structure

The GST structure in India comprises CGST, SGST, IGST, and UTGST for different transactions, each with specific roles, and tax rates (5%, 12%, 18%, and 28%) applicable based on item types, aiding businesses in determining tax obligations.

| GST Type | Explanation |

|---|---|

| CGST (Central GST) | Tax collected by the Central Government on intra-state transactions. |

| SGST (State GST) | Tax collected by State Governments on intra-state transactions. |

| IGST (Integrated GST) | Tax levied on inter-state transactions; collected by the Central Government. |

| UTGST (Union Territory GST) | Similar to SGST but applicable to Union Territories having a legislature. |

Multiple Tax Slabs:

- 5%: Applied to common goods and services.

- 12%: For items like computers and processed food.

- 18%: Commonly applied to items like smartphones and restaurant services.

- 28%: Reserved for luxury goods and certain services.

Also Read: What is the Structure of GST in India?

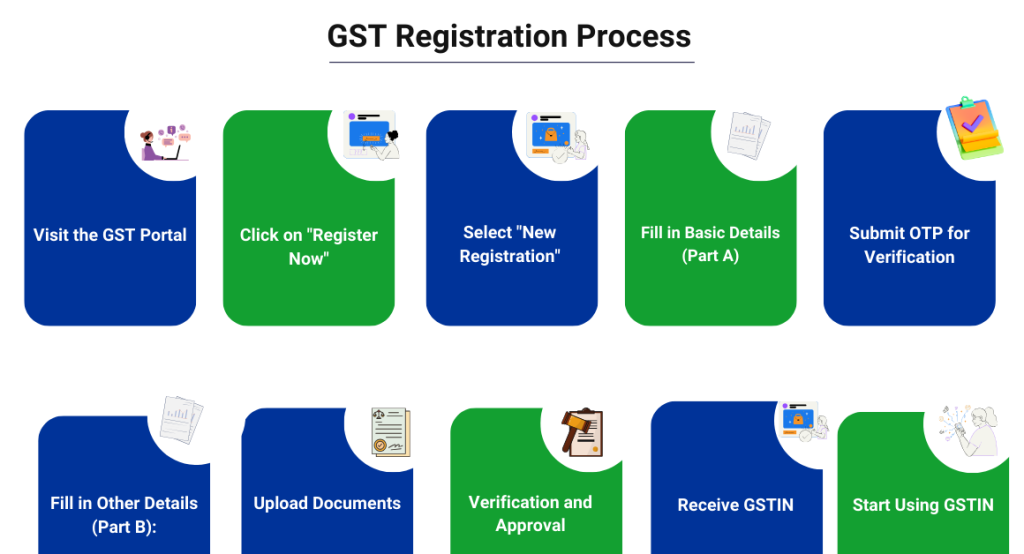

GST Registration Process

Here is a step-by-step process for GST registration for goods:

- Visit the GST Portal:

Begin by accessing the official GST portal at https://www.gst.gov.in/

- Click on “Register Now”:

On the homepage of the GST portal, click on the “Register Now” button.

- Select “New Registration”:

Choose “New Registration” from the drop-down menu. This is for businesses that are registering for the first time.

- Fill in Basic Details (Part A):

Provide details such as the legal name of the business, type of taxpayer, and the state in which the business operates.

- Submit OTP for Verification:

OTP will be sent to the registered mobile number and email. Enter the OTP to verify the provided information.

- Fill in Other Details (Part B):

Proceed to fill in Part B of the form, which includes business details, the principal place of business, additional places of business, and partners or directors.

- Upload Documents:

Upload necessary documents, including proof of business registration, address proof, bank account details, and photographs of the authorized signatory.

- Verification and Approval:

The application undergoes a verification process by the GST authorities. Once verified, the authorities approve the application.

- Receive GSTIN:

Upon approval, the business is issued a unique Goods and Services Tax Identification Number (GSTIN).

- Start Using GSTIN:

With the allocated GSTIN, the business can now commence using it for transactions and compliance.

Also Read: GST Registration for Regular Taxpayer: Process and Document Checklist

Scope of GST Applicability

GST applies to businesses based on turnover and transaction types; businesses with turnover above a specified limit must register, some can voluntarily register, and exemptions exist based on business nature, ensuring diverse contributions to taxes. Let’s break it down in details:

- Mandatory Registration:

- Businesses exceeding a specified turnover limit, called the turnover threshold, must register for GST, with the threshold varying for goods and services and subject to government regulations.

- Voluntary Registration:

- Businesses below the mandatory limit can choose to register voluntarily, allowing smaller businesses to benefit from GST, like input tax credit, and actively participate in the formal economy.

- Exemptions:

- Some businesses, regardless of turnover, may be exempt from GST based on the nature of their goods or services. Exemptions, covering essential goods, services, agriculture, and small businesses, aim to ensure a reasonable tax burden for specific activities.

GST Rates and Classification of Goods and Services

GST is categorized into different slabs based on the nature of goods and services such as:

- 0% (Nil Rate): Some essential goods and services fall under this category, ensuring that they are not taxed such as Fresh Milk and Pasteurised Milk, Rice (not labelled or pre-packaged), Fresh Fruits and Vegetables

- 5% Rate: This slab includes essential items like household necessities such as Sugar and Tea, Milk food items for babies, Hearing aids

- 12% Rate: Goods and services falling under this slab generally include items of common use such as Computers and Mobile phones, Packaged Ghee, Condensed Milk

- 18% Rate: Goods and services that are considered to be neither luxurious nor essential fall under this slab such as Mineral Water (natural or artificial), Cornflakes, Computer Monitors

- 28% Rate: This slab includes goods and services that are considered luxurious or are in the highest tax bracket such as Cigars and Cigarettes (tobacco-based), Pan Masala, Caffeinated Beverages, Dish Washing Machines

Goods and services under GST are classified using the Harmonized System of Nomenclature (HSN) for goods and the Service Accounting Code (SAC) for services, providing a uniform application of GST through specific codes. The classification is crucial as it determines the applicable tax rate for each item. The GST Council regularly reviews and adjusts tax rates based on economic conditions and revenue needs, emphasizing the importance for businesses to stay informed to ensure compliance with the law.

Also Read: GST Rate Updates 2024 – Goods And Service Tax Rates

Input Tax Credit (ITC) under GST

GST Input Tax Credit serves as a credit or discount for taxes paid on business purchases, preventing double taxation and reducing overall tax liability. This helps businesses maintain competitiveness by avoiding tax on tax. Additionally, claiming ITC results in reduced operational costs, lowering the effective cost of inputs. Moreover, businesses can utilize ITC to offset tax liability, leading to improved cash flow management.

Compliance and Filing Requirements

To adhere to GST regulations, businesses must consistently file accurate GST returns, updating their transaction records regularly to avoid penalties and other issues.

Here’s an overview:

-

GST Registration:

- Businesses with turnover above the threshold must register for GST, and voluntary registration is allowed for those below the threshold wishing to avail benefits.

-

GST Returns:

- Registered taxpayers file periodic returns detailing sales, purchases, and tax payments, with types like GSTR-1 and GSTR-3B based on business nature and turnover.

-

Input Tax Credit (ITC) Reconciliation:

- Businesses reconcile and claim ITC to avoid tax cascading, ensuring taxes are paid only on value addition at each supply chain stage.

-

Compliance with Tax Rates and Classification:

- Businesses correctly classify goods and services, complying with GST tax slabs and updating as per GST Council changes.

-

Timely Payment of Taxes:

- Taxpayers pay collected taxes within stipulated timeframes to avoid interest and penalties.

-

GST Audit:

- Certain high-turnover businesses undergo GST audit, examining financial records for GST law compliance.

-

Compliance with Anti-Profiteering Measures:

- Businesses pass on benefits to consumers, with anti-profiteering measures preventing unfair advantages.

-

Annual Return:

- Businesses file an annual return summarizing transactions for the entire financial year.

Impact of GST on Various Business Sectors

| Business Sector | Positive Impact | Negative Impact |

| Manufacturing Industry | – GST simplifies the tax structure, eliminating tax cascades, enabling manufacturers to save costs and enhance efficiency by benefiting from reduced tax burdens on inputs. | – Businesses may face challenges during the initial transition to the new tax system, involving adjustments to compliance procedures and accounting system updates. |

| Retail Sector | GST simplifies tax processes in the retail sector, fostering better compliance and transaction navigation by providing clearer tax structures and eliminating the complexities of multiple taxes. | –

Initially, businesses may face challenges adapting to new billing and invoicing requirements, requiring system updates and staff education on the changes. |

| Service Industry | The service industry gains efficiency through an improved input tax credit system, enabling businesses to offset taxes paid on inputs against taxes collected on outputs. | – Adjusting to changes in service tax rates may pose challenges, requiring businesses to update their pricing structures and communicate changes to clients. |

| IT and Technology | The IT and technology sector benefits from easier compliance and reduced paperwork under GST, enabling businesses to focus more on innovation and growth. | – Adapting to changes in software and billing systems may require investments and adjustments in IT infrastructure, posing initial challenges for some businesses. |

Inter-State Transactions and GST

In the Indian context, inter-state transactions between businesses involve the application of Goods and Services Tax (GST) rules. Integrated GST (IGST) is utilized for such transactions, acting as a unified tax for the entire country. The IGST rate, a percentage of the total goods value, ensures a fair distribution of taxes among the participating states. GST rates, categorized into slabs of 5%, 12%, 18%, and 28%, with additional rates for specific goods and a Nil rate for essential items, reflect a balanced approach to taxation. An example illustrates the process, where a company in Jaipur sells goods to Mumbai, incurring IGST. Transactions with Special Economic Zones (SEZ) units are also considered inter-state supplies under GST.

GST and Export-Import Transactions

GST plays a significant role in governing export and import transactions in many countries, including India. Here’s an overview of how GST is involved in export-import transactions:

Export Transactions:

-

Zero-Rated Supply:

- When goods or services are exported, they are taxed at a 0% rate under GST, ensuring that no GST is charged on the export value.

-

Export Documentation:

-

- Exporters need to provide specific documents such as a shipping bill, commercial invoice, packing list, and others to comply with GST regulations.

-

Claiming Input Tax Credit (ITC):

- Exporters can get a refund on the GST paid for inputs and input services, helping prevent the build-up of taxes in the production process.

-

Letter of Undertaking (LUT):

- Instead of paying taxes and seeking a refund, exporters can submit a Letter of Undertaking, simplifying the process and avoiding fund blockages.

Import Transactions:

-

Integrated Goods and Services Tax (IGST):

- When goods or services are imported, IGST is imposed, combining Central GST (CGST) and State GST (SGST) elements.

-

Customs Duty and GST:

- Customs duty is charged by customs, and GST is applied to the total value of imported goods, covering customs duty and other charges.

-

Input Tax Credit on Imports:

- Importers can claim a credit for the GST paid during import, using it against their GST liability on domestic supplies.

-

Valuation for Customs Duty and GST:

- Customs duty and GST are calculated based on the value specified in the Customs Act, with adjustments made in specific cases.

-

High Sea Sales:

- Sales that occur while goods are still in transit (high sea sales) have distinct GST implications, and the transaction value for GST is determined following specific principles.

Challenges and Common Mistakes in GST Compliance

GST is designed to simplify the indirect tax system, businesses often face challenges and may make common mistakes in complying with GST regulations. Here are some challenges and common mistakes:

Challenges:

-

Complex Regulations:

- Understanding GST rules, especially for businesses in multiple states, is challenging due to frequent changes in rates and regulations.

-

Classification and HSN/SAC Codes:

- Accurate classification of goods and services under the right GST rate is crucial, and determining the correct HSN or SAC code is essential to avoid errors.

-

ITC Reconciliation:

- Failure to reconcile Input Tax Credit (ITC) between buyer and seller books can lead to disputes and disrupt the seamless flow of credits in the supply chain.

-

E-Way Bill Compliance:

- Managing E-Way Bills for goods movement, especially in interstate transactions, poses a challenge for businesses.

-

Reverse Charge Mechanism (RCM):

- Applying the reverse charge mechanism, particularly for services received, requires understanding to avoid common mistakes.

Common Mistakes:

-

Late Filing and Non-Compliance:

- Failing to file GST returns on time or not complying with GST regulations can result in penalties and interest.

-

Incorrect Invoicing:

- Errors in invoicing, such as incorrect GSTIN, wrong tax rates, or incomplete information, can lead to compliance issues.

-

Mismatch in GSTR-1 and GSTR-3B:

- Discrepancies between the outward supply details in GSTR-1 and the summary return in GSTR-3B can lead to reconciliation problems.

-

Incomplete Record-Keeping:

- Inadequate maintenance of records and documentation can hinder the audit process and result in non-compliance.

Recent Developments and Amendments in GST Laws

- 7th October 2023: In the 52nd GST Council meeting on 7th October 2023, chaired by Union FM Nirmala Sitharaman, rules were approved for foreign-going vessels. If these vessels convert to coastal runs, they are now liable to pay 5% Integrated Goods and Services Tax (IGST) on the value of the vessel.

- 11th July 2023: During the 50th GST Council Meeting on 11th July 2023, decisions were made to address excess Input Tax Credit (ITC) claims in GSTR-3B compared to GSTR-2B above a certain limit. Intimations for such cases would be sent through DRC-01C to seek a response. Additionally, the GST rate on online gaming was set at 28% on the full face value.

Conclusion

In summary, businesses in India must prioritize a thorough understanding of GST applicability. This tax reform has far-reaching implications throughout the supply chain, demanding accurate compliance for optimal operational efficiency. By navigating the intricacies of GST, businesses can capitalize on benefits like input tax credits and ensure adherence to regulatory requirements. A nuanced understanding not only streamlines processes but also safeguards against penalties, positioning companies for sustained growth within the unified taxation framework.

Also Listen: GSTR 7 Applicability and Registration Requirements

FAQ’s

-

What is Goods and Services Tax (GST)?

GST is a comprehensive tax reform in India that replaced multiple indirect taxes. It is a unified tax applicable to the supply of goods and services.

-

How is GST structured in India?

GST in India is structured into Central GST (CGST), State GST (SGST), Integrated GST (IGST), and Union Territory GST (UTGST). These apply to intra-state, inter-state, and Union Territory transactions.

-

What is the GST registration process for businesses?

Businesses need to register for GST by submitting the required documents and details online through the GST portal.

-

When is GST applicable to a business?

GST is applicable when a business’s turnover crosses the prescribed threshold limit. Voluntary registration is also an option, and certain exemptions apply based on the nature of the business.

-

How are goods and services classified for GST rates?

Goods and services are classified into different tax slabs (5%, 12%, 18%, 28%) based on their nature. Essential goods may attract a lower rate, and certain items may be exempt.

-

What is Input Tax Credit (ITC) under GST?

ITC allows businesses to offset the tax they paid on inputs against the tax they collect on outputs, reducing the overall tax liability.

-

What are the compliance and filing requirements under GST?

Businesses need to regularly file GST returns, pay taxes on time, maintain proper records, and ensure correct classification of goods and services.

-

How does GST impact various business sectors?

GST can have both positive and negative impacts on different sectors, affecting factors like costs, compliance, and pricing strategies.

-

How does GST apply to inter-state transactions?

Inter-state transactions attract Integrated GST (IGST), which is paid to the Central Government and later shared with the destination state.

-

How does GST impact export-import transactions?

Export transactions are generally zero-rated, and import transactions attract Integrated GST (IGST). GST aims to make exports competitive and streamline import processes.