As the new financial year gets near, it is essential to make well-informed decisions regarding investments to save money on taxes in the financial year 24-25. This is especially true for individuals who continue under the previous tax system. No matter what tax-saving alternative you choose, just allocating money randomly is not a good idea.

Give these choices significant thought and make sure they are in line with your financial objectives and requirements for tax savings. You will be able to maximize the effectiveness of your tax-saving investments before the deadline.

What is a financial plan?

A financial plan is a document outlining a person’s present economic situation as well as their short- and long-term financial objectives. It contains techniques for achieving such aims.

A financial plan can assist you in establishing and planning for necessities such as managing life’s risks (e.g., health or disability), income and spending, and debt repayment.

It can provide financial advice to help you accomplish your commitments and goals. It can also help you track your progress toward economic stability over time.

Financial planning entails a comprehensive assessment of one’s current economic condition (income, spending, debt, and savings) and future aspirations. It can be developed alone or with the assistance of a trained financial planner.

Benefits of a Financial Plan

- A financial plan is a thorough evaluation of your income and expenses.

- It can help you comprehend your financial situation at all times.

- It outlines crucial short- and long-term financial objectives.

- It clarifies what activities you must take to attain your various financial goals.

- A financial plan can help you focus on essential short-term goals like paying off debt and saving for emergencies.

- It increases the likelihood of reaching financial milestones and overall financial success (however you define it).

- It can help you focus your efforts over time and track your success.

- It can keep you out of financial difficulty and relieve any tension or concern you may have had.

Knowledge of the Tax Regimonies

Individual taxpayers can select between two different tax regimes from the fiscal year 2020-21. These tax regimes are the existing or old tax regime and the new concessional tax regime. When comparing these two tax regimes, the rates of tax that are payable for a particular tax slab are different.

The only time tax-saving investments will reduce your taxable income is when the previous tax system is in effect. Long-term investments, on the other hand, help you save money on taxes and develop wealth for you over the long run. It may be concluded that the bulk of these investments benefit your current and future wealth. Let’s have a better understanding of how business owners and salaried employees might reduce their tax burden.

Here are some of the tax-saving investment alternatives that you might consider investing in. These options can help you save the most amount of money possible on taxes and build a solid financial future for yourself.

Section 80C

Section 80C is the most popular section of India’s Income Tax Act of 1961. This area contains a vast array of tax-efficient investments. Many of these investments can potentially result in tax-free returns in the future.

Section 80C deductions are allowed based on gross total income or taxable income. If you do not have taxable income in a given fiscal year, you cannot claim deductions under this clause. In other words, Section 80C investments made with tax-exempt income will not result in tax returns.

Certain critical family expenses are also included on the list of 80C qualifying outflow. You can also deduct emergency medical expenses under other sections like 80D, 80DD, and so on.

The following are the most popular tax-saving investments under Section 80C:

Equity-linked Savings Scheme

The Equity-Linked Savings Scheme, or ELSS, is a pure equity mutual fund that invests in selected equity equities. ELSS is a pure equity mutual fund that invests 90-95% of its assets in equity stocks. The scheme also has a three-year lock-in period, which is among the shortest for a tax-saving investment.

However, the suggested holding term for your ELSS investments is 5 to 10 years. SIPs into ELSS must be scheduled with at least a three-year cushion. This is because each SIP into the scheme is subject to a 3-year lock-in period.

Senior Citizen Savings Scheme

The Senior Citizen Savings Scheme (SCSS) is part of the Indian government’s small savings portfolio. This tax-saving strategy enables senior citizen investors to receive quarterly interest on their assets. Individual accounts allow for investments of up to Rs 15 lakh.

The investment yields a better rate of return than other deposits with a similar five-year term. The scheme has no lock-in term. As a result, you may remove funds from the account before they are due. However, a penalty is imposed for early withdrawals.

You can also prolong the account for an additional three years once it matures. The current interest rate on the senior citizen savings scheme is 7.4% per year (effective April 1, 2020). The interest on deposits is not subject to TDS.

National pension system

The National Pension System is a progressive retirement investment option open to all Indian citizens. NPS enables you to make investments in market portfolios of fixed-income corporate, governance, and equity investments.

The tax-saving program enables you to invest in a variety of funds based on your risk tolerance. Based on your age, you can invest up to 75% in equity funds.

Alternatively, you can invest in an automated mode, in which your asset allocation changes automatically as you mature.

After reaching the age of 60, you can make withdrawals from your account. You are allowed to withdraw up to 60% of the total corpus tax-free. The remaining 40% must be put into a pension fund.

You can also claim an additional Rs 50,000 in tax deductions through NPS.

Life insurance premium

Life insurance policies are also eligible for tax breaks under Section 80C. Term life insurance, endowment plans, moneyback policies, and other types of life insurance policies are also eligible for tax savings.

You only need to verify that your entire investment in a life insurance policy throughout a fiscal year does not exceed 10% of the base death benefit amount.

Public Provident Fund

The Public Provident Fund (PPF) is one of India’s safest long-term tax-saving investments. Every financial year, the Indian government announces the interest rate. The PPF is an entirely tax-free savings scheme. This means that your invested money, fund interest, and maturity values are all tax-free.

PPF is exclusively available to domestic individual investors. The scheme has a 15-year maturity. However, partial withdrawals are permitted beginning with the sixth year of investment.

The arrangement also permits you to borrow money throughout the five-year lock-in term.

National Savings Certificate

The National Savings Certificate, or NSC, is a five-year fixed-return instrument. The certificate has a sovereign guarantee. Thus, provides a secure return on investment.

The interest on NSC is taxed. However, it is expected that the certificate will be reinvested during its validity period. Thus, NSC interest is only taxable at maturity.

Tax saving Fixed Deposits

You might save money on taxes by making fixed deposits at your bank or post office. The deposits have a maturity of five years. Tax-saving FDs, unlike standard FDs, cannot be lined. When you make partial withdrawals, your tax savings on the deposit must be reversed.

The interest on the deposit is taxable each year and would be subject to a TDS deduction if the total amount reaches Rs 10,000.

Home loan repayment

If you take out a home loan to buy or build a property, you can deduct the principal repayments. The tax deduction is available for up to Rs 1.5 lakhs if you are under 60 years old and up to Rs 2 lakhs if you are 60 or older.

The interest paid on the house loan might also be included in your tax estimations. However, you can do so while calculating your income or losses from real estate.

Tuition costs

Tuition expenses paid for your children’s full-time education are also eligible for tax deduction under Section 80C. The costs can cover school or college education. The deduction is limited to expenses for up to two children.

Sukanya Samriddhi Yojana(SSY)

Sukanya Samriddhi Yojana is one of the most essential tax-saving investing choices. SSY, launched as part of the government’s “Beti Bachao, Beti Padhao” campaign, aims to improve the lives of female children. The plan allows taxpayers to make recurring deposits into their accounts while earning interest. Sukanya Samriddhi Yojana is also eligible for deductions of up to Rs. 1.5 lakh under Section 80C of the Income Tax Act. The minimum investment is Rs.250, and the scheme matures 21 years or when the girl kid marries, whichever comes first after account opening.

Interest on the SSY Account, which is compounded annually, is exempt from tax under Section 10(11A) of the Income Tax Act.

Section 10(11A) of the Income Tax Act exempts maturity proceeds and withdrawal amounts from taxation.

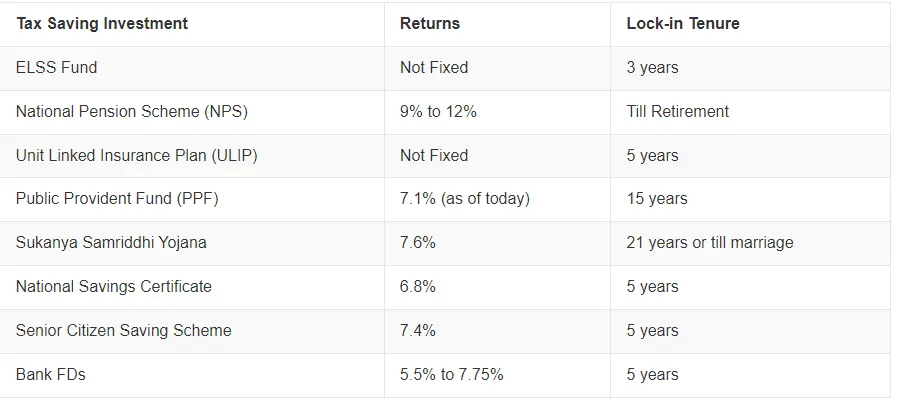

Check the table below for other information.

Also Read: Maximizing Tax Efficiency: Tips And Strategies For Regular Taxpayers

Section 80-CCD

Section 80CCD of the Income Tax Act of 1961 has been added to define the tax breaks available through your NPS contributions. Employees and self-employed individuals can both contribute to NPS. In addition to EPF, your employer can make contributions to your NPS account.

Section 80CCD contains two subsections that define the tax treatment of self- and employer-made contributions to your NPS account:

- Section 80CCD(1)

Defines the tax treatment of self-contributions to the NPS Tier-I Account. The section is divided into two parts: Section 80CCD (1) and Section 80CCD (1B). The first section is part of Section 80C and allows a tax deduction of up to Rs 1.5 lakhs for self-contributions.

You may contribute up to 10% of your salary or 20% of your annual revenue (if self-employed) to your NPS account. If you contribute more than these restrictions, you can save an additional Rs 50,000 in taxes under Section 80CCD (1B).

Thus, the total deduction for self-contribution to the NPS account is up to Rs 2 lakhs.

- Section 80CCD(2)

Section 80CCD (2) specifies the tax treatment of an employer’s contribution to an NPS account. The employer’s contribution of up to 10% of your salary is tax-free in your hands. Any contributions in excess of the maximum are considered perquisites and are taxed as part of your income.

Section 80D

Section 80D is an additional deduction to section 80C. The tax savings are available on the premiums paid for obtaining health insurance coverage for the following:

- Self, spouse, and children.

- Parents.

You can claim separate deductions for both health insurance coverages. Medical expenses for the treatment of specific disorders for senior citizens are also eligible for deduction under section 80D.

You can claim up to Rs 25,000 for health insurance premiums paid if the eldest insured person is under the age of 60. The ceiling for senior citizen health coverage (and medical expenses) is Rs 50,000.

Section 80D also allows for a deduction of up to Rs 5000 for preventive health checkups.

As a result, the maximum deduction available under Section 80D is Rs 1,00,000.

Section 80E

Section 80E sets the conditions for deducting interest on an education loan. The tax deduction is provided for education loans taken out to pursue higher education. The deduction is only accessible for up to eight years. So, you can try to repay the entire amount within this time frame.

This deduction has no maximum limit. The tax deduction is only available for education loans used for post-secondary education. Higher education should be pursued in a recognized institution.

Section 80EE

Section 80EE allows you to deduct interest payments on your home loan. The tax deduction is capped at Rs 50,000 per year. This deduction is distinct from the deduction for loss of dwelling property (section 24B). To qualify for this deduction, your house loan must meet the following conditions:

- The loan must have been secured in FY 2016-17.

- The loan amount should be up to Rs 35 lakh.

- The value of the residence you purchased with the loan should not exceed Rs 50 lakhs.

- You did not own any other property before buying the house.

- The loan was approved by a financial institution or home financing firm.

Section 80G

In several ways, the deduction under Section 80G rewards your philanthropic work. You can claim the deduction if you donate to any of the charitable institutions listed in Section 12A. You can claim the deduction if it fits the conditions listed below:

- Contributions must be made from taxable income.

- Cash donations cannot exceed Rs 2000.

- More significant contributions should be made via check or draft.

Both resident and non-resident Indian taxpayers can claim a deduction under section 80G. The tax deduction maximum might be either 100% or 50%, depending on the institution’s registration.

What are the best tax saving schemes in India?

- Public Provident Fund(PPF)

- Sukanya Samriddhi Yojana(SSY)

- National Pension System(NPS)

- Employee Provident Fund (EPF)

- Sukanya Samriddhi Yojana Interest Rates

- National Savings Certificate.

- House Rental Allowance

- NSC Interest Rate

How Do You Plan Your Tax Savings for the Year?

You should plan your taxes for the year. However, the majority of tax planning occurs during the investment stage. While investing, you might choose tax-saving investments with an EEE classification.

- Investments in the scheme are deductible.

- Interest earned in the scheme is tax-free.

- Maturity values (including withdrawals) are exempt from tax.

This way, you won’t need to establish a separate tax strategy once you’ve set your goals and made your investments. Your investments should always be motivated by your financial objectives, not the short-term necessity to save taxes. You must maximize your tax savings within the scope of your goal-based investments.

Tax Saving Advice for Salaried and Non-Salaried Taxpayers

You can do the following while investing to maximize your tax savings for the year:

- Use tax-saving investments like ULIP, ELSS, PPF, and NPS for long-term goals.

- Set aside 10-15% of your salary for retirement investments like EPF, NPS, and PPF.

- Self-employed individuals can contribute up to 20% of their annual income to NPS.

- Term life and health insurance policies are essential additions to your emergency preparedness.

- Generate long-term capital gains by investing in the following:

- Equity stock investments must be held for at least 12 months.

- Invest at least 36 months in debt funds or gold.

This eliminates the need for a separate tax-saving plan, allowing you to maximize your tax savings through goal-based investing.

Some Additional Income Tax Saving Tips

The finest tax-saving measures result in an automatic reduction in tax liabilities. If you invest in accordance with your financial plan, the following investments will maximize your tax savings:

- Have term life insurance coverage; the premiums are deductible under Section 80C.

- Have health insurance coverage for yourself and your family. The premium is deductible under Section 80D.

- Plan for retirement by investing in NPS (also available to self-employed individuals) or EPF. The investment enhances your deductible under section 80C. Section 80CCD(1B) allows you to save an additional Rs 50,000 by investing in an NPS.

- Invest in Unit Linked Insurance Plans (ULIPs) for long-term goals such as child education and marriage.

- Use ELSS funds to invest in equity funds.

Why Start Early?

Starting at the beginning of the fiscal year rather than waiting until the fourth quarter helps avoid hasty judgments. Early planning allows your investments to compound, which enables you to reach your long-term financial goals. Tax savings should be seen as a benefit rather than the primary goal.

Begin by assessing your current tax-saving expenses, such as insurance premiums, children’s education fees, Employee Provident Fund (EPF) contributions, home loan repayments, etc.

Aim to begin investing within the first quarter of the fiscal year. This technique allows you to stretch out your investments throughout the year, reducing financial stress at the end of the year and allowing for more informed decision-making.

Wrapping It Up

Financial planning is critical to ensuring a safe and secure future. Setting a budget, analyzing your costs, and investing in the proper areas will help you develop a thorough financial strategy. Do not skip evaluating and updating your financial plan as needed to ensure that you are on track to meet your financial objectives. You can also get expert advice from financial advisors if necessary.

Also Read: GST Calculator Online – Simplify Your Daily Finances And Taxes

Also Listen: Tax implications on savings bank interest under the new tax regime

FAQs

-

How many tax-free instruments can you get?

Individuals can make unlimited tax-free investments.

-

How can I claim all of my tax deductions?

The tax deduction can be claimed by filing the ITR for the relevant fiscal year.

-

What is the maximum amount of investment allowed under Section 80C?

The maximum deduction is $1,50,000 from total taxable income.

-

How can I lawfully lower my taxes?

Investing in government-approved tax-free investment vehicles allows you to lawfully minimize your tax liability.

-

What exactly does tax planning entail in financial planning?

Tax planning is the process of examining a financial strategy or scenario through a tax lens.

-

Is the new tax regime from 2024 to 2025?

Nirmala Sitharaman, the finance minister, has declared no adjustments to income tax slab rates in the interim Budget of 2024. The income tax slabs and rates will stay constant in the fiscal year 2024-25, beginning April 1, 2024.

-

Which scheme’s interest is tax-free?

The Public Provident Fund is an outstanding tax-free investment offered by the government for retirement planning. It is convenient if you don’t have a structured pension plan.

-

What are the different types of tax planning?

Tax planning strategies include tax diversification and investments in schemes such as the PPF, National Pension System, Sukanya Samriddhi Yojna, and others.

-

What’s the difference between tax and financial planning?

Good financial planning leads to savings. Similarly, proper tax planning enables us to invest appropriately in tax-saving plans and use the savings wisely in our budgets.

-

Which businesses are tax-free in India?

Under Section 10(1) of the Income Tax Act, all earnings from agricultural land or operations are free from taxation.