Introduction

In the complex world of global business, it’s crucial for companies to truly grasp the detailed rules that control how services are offered in different parts of the world. These rules are like the basic structure that guides how business transactions with services happen. They affect everything from the steps companies have to follow, to the legal aspects involved, and even the big decisions that companies make. This blog aims to deeply explore these rules, shining koa light on what companies need to do to follow them, smart ways to deal with any challenges, the legal details that need attention, and the best practices to always stick to the rules when providing services. Understanding and following these rules is key for businesses to thrive in the global market.

1. Understanding Rules Governing the Place of Supply for Services:

Learning about place of supply rules isn’t just about following rules; it’s a chance for businesses to do better. This part talks about how businesses can use what they know about these rules to do well in competition, handle taxes better, and make it easier to do business across borders. By looking closely at the details of these rules, companies can find ways to be smarter in how they work, going beyond just following the rules. This helps them not only do what the rules say but also do well in the market and do their best overall. It’s like turning what you know about rules into a strong tool for success in business and dealing with other countries.

Also Read: Place Of Supply For Services: Definition And Regulatory Framework

2. Compliance Requirements for Adhering to Services-Related Place of Supply Rules:

In the service industry, following rules is really important, and it’s crucial to pay close attention to the specific rules of each location. This part of the discussion goes deep into the exact things that businesses must do to follow the rules and make transactions smooth. These things include careful paperwork and sticking strictly to the rules about reporting. It’s super important for businesses to understand and do these tasks correctly. Doing them right helps protect against getting fined and keeps the relationship friendly with the people who oversee the business.

Also Read: Understanding The Place Of Supply Rules For Goods: A Comprehensive Guide

3. Strategies for Navigating Complexities in Services-Related Supply Regulations:

Understanding and following service supply regulations can be tricky, requiring careful thought. This part offers businesses simple but valuable advice to handle these challenges well. Whether it’s using technology smartly to improve how things work or ensuring clear communication among everyone involved, these suggestions are meant to help businesses succeed in a changing regulatory environment. By paying attention to these insights, companies can navigate the complexities of regulations and thrive.

4. Legal Considerations in the Application of Rules to Services-Related Places of Supply:

Ensuring the proper application of place of supply rules is crucial, and legal factors play a vital role in this regard. This section delves into important legal aspects that businesses need to be mindful of. These include variations in rules based on different geographical locations, contractual obligations, and potential legal consequences. Taking a proactive approach to address these legal facets gives businesses the ability to anticipate and address conflicts before they escalate, helping them avoid legal complications. In essence, a thorough understanding and careful consideration of legal considerations empower businesses to navigate the complexities and potential pitfalls associated with place of supply regulations.

Also Read: Legal Provisions and Case Studies on Determining the Place of Supply for Services

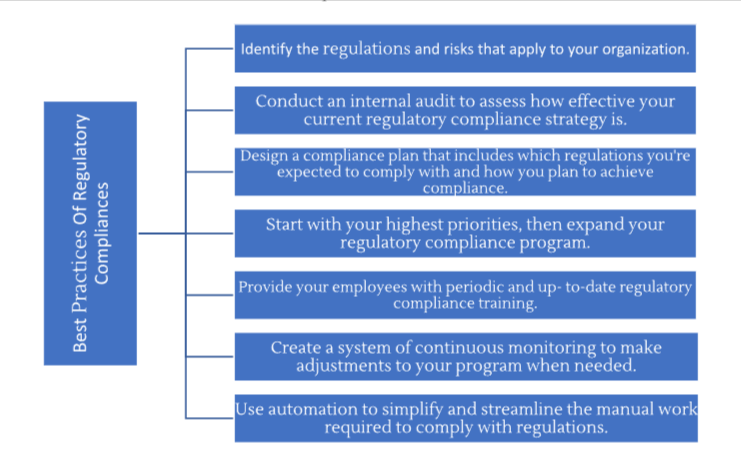

5. Best Practices for Maintaining Compliance with Services-Related Supply Regulations:

Businesses must consistently adhere to regulations to maintain ethical and lawful operations. This section delves into optimal strategies for ensuring ongoing compliance with the rules governing the services they offer. A crucial aspect involves routinely educating their workforce and seeking guidance from legal and tax professionals to conduct regular assessments. By instilling these practices, businesses can establish a robust framework that reinforces their commitment to adherence, fostering a culture of responsibility and integrity. This continuous dedication to regulatory compliance not only safeguards the company but also enhances its reputation and trustworthiness within the broader business landscape.

6. Maximizing Benefits through a Thorough Understanding of Service-Related Place of Supply Rules:

Knowing where to apply supply rules is more than just following instructions. It’s like a good chance for businesses to do better. This part explains how businesses can use what they know about these rules to stay ahead, handle taxes well, and make cross-border transactions easier. It’s about understanding the details so that companies can be smart and get the most out of these rules, making things smoother for them. In short, it helps businesses deal with taxes in a better and more successful way.

Conclusion

In conclusion, knowing where services come from is super important for businesses. It’s a big and crucial part of how businesses work. When companies understand and follow the rules, plan things smartly, think about the legal stuff, use the best methods, and do things the right way, they can handle problems well. This helps them take advantage of a well-organized system for providing services. So, understanding how services are supplied sets businesses up to do really well in the tricky world of business.

FAQ’s

-

What is the significance of the place of supply in the services industry?

The place of supply in the services industry is really important because it decides which country’s tax rules apply to the service. Think about getting a service online, such as web design. The place where you, the customer, are situated determines the tax rules to follow. This ensures that governments get the correct taxes and promotes fair business practices between countries. In short, it’s about making sure everyone follows the same rules when paying taxes for services.

-

How do international transactions affect the place of supply rules?

International transactions can impact the place of supply rules by determining which country’s tax regulations apply. These rules decide where a service or goods are considered to be supplied for tax purposes. The cross-border nature of international transactions adds complexity, and understanding the applicable place of supply rules is crucial for determining tax liabilities in different countries.

-

Are there industry-specific variations in place of supply regulations?

Yes, different industries often have specific rules about how and where they get their materials or products. These rules are called “supply regulations.” For example, the regulations for getting materials in the healthcare industry might be different from those in the technology industry. Each industry has its own unique way of managing and controlling the flow of supplies to ensure everything works smoothly.

-

What technologies can assist in ensuring compliance with place of supply rules?

To ensure compliance with place of supply rules, businesses can leverage technologies such as automated tax calculation software and geographic information systems (GIS). These tools help accurately determine the location of a transaction, ensuring that the correct tax rules and rates are applied in accordance with the specific regulations of that particular place of supply.

-

How often should businesses review and update their compliance procedures?

Businesses should regularly review and update their compliance procedures at least annually. This helps ensure that they stay current with any changes in laws or regulations, keeping their operations in line with legal requirements and industry standards.

-

Can non-compliance with place of supply rules result in legal consequences?

Yes, not following the rules for where you should pay taxes can lead to legal problems. If you don’t comply with the correct place of supply rules, you might face penalties or other consequences from tax authorities. It’s important to understand and follow these rules to avoid legal issues.

-

Are there any common misconceptions about place of supply rules?

Yes, a common misconception about place of supply rules is that it’s always determined by the physical location of goods. In reality, it can be based on various factors like the customer’s location or the type of service provided, making it important to understand the specific rules for each situation.

-

How can businesses stay informed about changes in place of supply regulations?

To keep track of changes in supply location rules, businesses can regularly visit official government websites, sign up for newsletters related to their industry, or join industry associations that share timely updates. It’s crucial to stay informed to make sure you follow any new rules or requirements.

-

Can outsourcing services impact the determination of the place of supply?

Yes, outsourcing services can affect the determination of the place of supply. When a service is outsourced, the location where the service is performed or the supplier is based can influence tax regulations and rules governing the place of supply. This can have implications for taxation and other regulatory considerations.

-

What role does documentation play in ensuring compliance with place of supply rules?

Maintaining accurate records is really important to show that you’re following the rules. It’s crucial to keep accurate documents of things like transactions, contracts, and important messages for audits. For example, when it comes to the place of supply rules, having clear and accurate documents helps companies show they’re doing things the right way in terms of where they’re supposed to pay taxes. It’s like having a guidebook to make sure you’re on the right path and following the rules for selling in different places.