Introduction

Transfer of business either through Demerger, Amalgamation, sale of business, transfer through succession etc. is a very common business transaction which takes place not only in small business entities but also in a very large business entity. In certain cases, transfer of business is also required in case of change of constitution of business, e.g., a sole proprietorship wants to continue his business in a partnership firm, conversion of partnership firm to Company, dissolution of partnership firm and conversion into a partnership firm etc. Also, In these cases, both forms of business are separate legal entities and require the transfer of business from one entity to another entity.

In the case of a transfer of business, all assets and liabilities can be transferred through a legal agreement and regular book entries. But what about the Input Tax Credit lying in the electronic Credit ledger (ECL) of the transferor? How can the same be transferred under the GSTIN of the transferee on the GST portal itself? The GST Law contains a detailed provision related to the implication of the transfer of business and the manner of transfer of Input Tax credit from one GSTIN to another GSTIN.

This article contains a detailed discussion of transfer of Input Tax Credit in case of transfer of business.

1. What happens in case of transfer of Business?

- In the case of transfer of business from one entity to another entity, the transferring entity transfers the entire business to another entity on a going concern basis, along with all assets and liabilities of such business for consideration. The transferee continues the business under his own name.

- You can transfer through amalgamation, demerger, sale or conversion from one form of business to another, succession, etc..

- The transferor removes all assets and liabilities from their books for a consideration and the transferee records them in their books.

2. What is ITC-02 and when it is required to be filed?

- In the case of a transfer of business, a major issue that arises is how to transfer the ITC lying under one GSTIN to another GSTIN.

- Section 18 of the CGST Act, 2017, along with Rule 41 of the CGST Rules, 2017, provides detailed provisions related to the transfer of ITC in case of transfer of business.

- As per Section 18(3) of CGST Act, if a registered person changes its constitution, i.e., from LLP to Company, from Proprietorship to Partnership, etc., due to sale, merger, demerger, amalgamation, lease, or transfer of the business, then the transferor may transfer the balance lying in the Electronic Credit Ledger to the transferee.

- Specific provisions allow the transfer of ITC along with the transfer of liabilities. Therefore, in case of transfer of business, liabilities should be transferred along with assets.

- You can transfer such ITC by filing Form GST ITC-02 on the common GST portal.

Also Read: INPUT TAX CREDIT UNDER GST

3. What are the conditions for filing of GST ITC-02 ?

As per Section 18(3) of CGST Act, 2017 read with Rule 41 of CGST Rules, the authorities allow the transfer of Input Tax Credit subject to fulfillment of the following conditions:

- The transferor as well as the transferee of business should have a valid GST registration.

- Transferor is allowed to transfer ITC only if Liabilities are also transferred along with Assets.

- The transferor should have a balance in the Electronic Credit Ledger for the purpose of transfer. If the transferor is not having any balance lying in the electronic credit ledger, then he can’t transfer any credit.

- A Chartered Accountant or Cost Accountant in practice must obtain a certificate certifying that a transaction of sale, merger, transfer, etc., has been carried out by GST Law.

- In case of sale or transfer of complete business, the transferor may transfer the complete balance lying in the Electronic Credit Ledger. However, in the case of demerger, where the company transfers only a segment of business, the scheme shall specify the apportioning of input tax credit in the ratio of the value of assets of the new units.

- You can transfer ITC by filing a GST ITC-02.

- The transferee shall record the inputs and capital goods transferred in his books of accounts.

4. What is the time limit for filing of GST ITC-02?

There is no time limit specified under GST Law for filing of GST ITC-02. However, you should file the same in a reasonable time. If the transferor’s GST Registration is canceled due to the transfer of business, you can still file GST ITC-02 post cancellation of GST Registration.

5. What is the action required at the part of Transferee with respect to GST ITC-02?

The transferor does not transfer the Input Tax Credit merely by filing GST ITC-02. The transferee is also required to accept such a form. Below, we discuss the procedure of filing and acceptance in detail.

6. What Information is required to be furnished in Form GST ITC-02

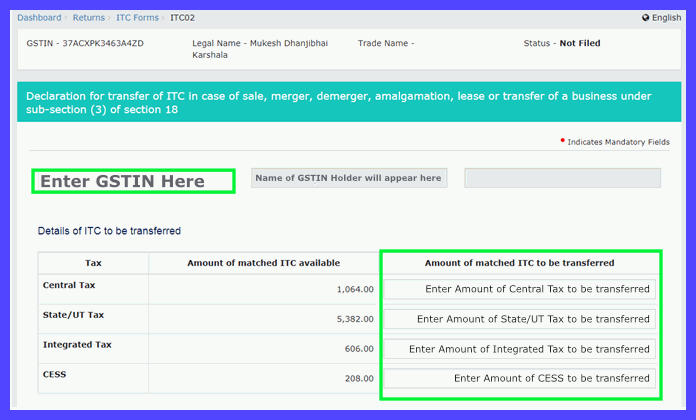

GST ITC-02 is not a very detailed form and most of the information is already pre-filled, such as the Name of the transferor, GSTIN of the transferor etc. The Transferor must manually furnish the following information:

- Basic details of the transferee, i.e, GSTIN. Trade name and Legal name shall auto-populate after filing GSTIN.

- ITC to be transferred under the head of IGST, CGST & SGST. System will display the balance appearing under all heads.

- Following Detail of Chartered Accountant or Cost Accountant certifying correctness of transaction:

- Name of firm issuing the certificate

- Name of the Certifying Professional

- Membership Number

- Date of Certificate

7. Which documents do you need to attach to GST ITC-02?

The transferor must attach a copy of the certificate from the chartered accountant or cost accountant. Additionally, you cannot file GST ITC-02 without attaching GST ITC-02.

8. What is the procedure for filing Form ITC-02?

I have attached the detailed procedure, along with screenshots, for filing Form GST ITC-02:

8.1 Form filing by transferee

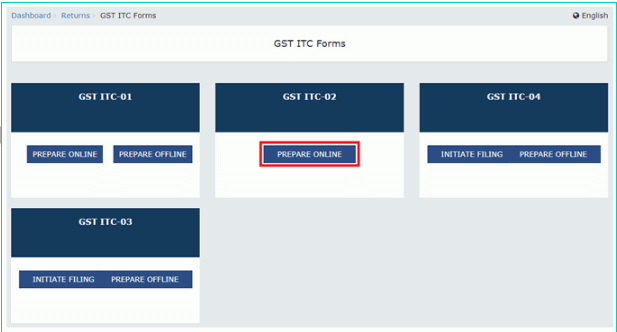

- Option to file form GST ITC-02 is available post login at the GST portal at following path:

Services>Returns>ITC forms > ITC-02 form

- Click on the prepare online button on the ITC-02.

- Provide the transferee’s GSTIN and the amount of ITC to be transferred under CGST, SGST, IGST, and Cess. The amount available in the Electronic Credit Ledger will display under “Amount of matched ITC available”.

- Update information of the professional certifying correctness of the transaction along with a copy of the certificate.

- After entering your complete information and attaching the required documents, click on the save button.

- Complete the filing process with the help of DSC or EVC and check the declaration of authorised signatory and click the button of declaration.

8.2 Acceptance by Transferee

After the transferor files the form, the transferee must accept GST ITC-02 through the following process:

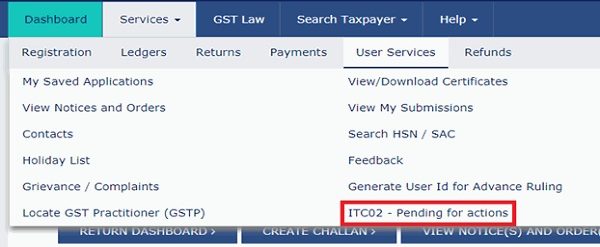

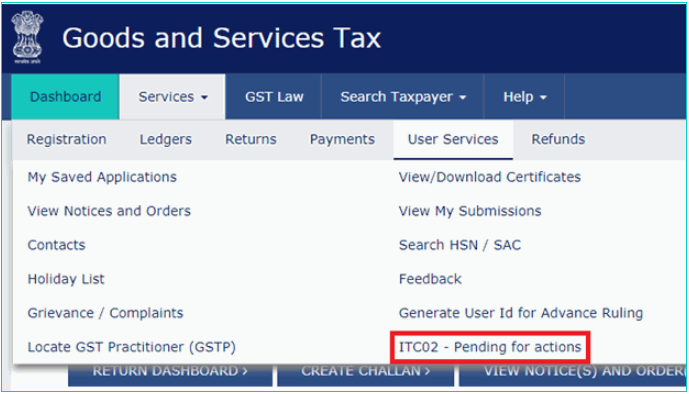

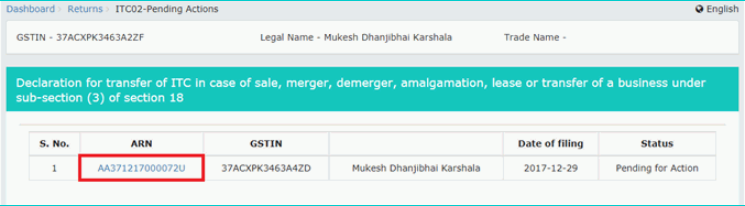

- The transferee can check the Form GST ITC-02 which is pending for his acceptance post login at GST portal at following path:

User service>ITC-02 pending for actions.

- Select the ITC-02 pending for action and system will display the ITC-02 pending for action alongwith following details:

- ARN

- GSTIN of transferor

- Legal Name

- Date of Filing

- Status

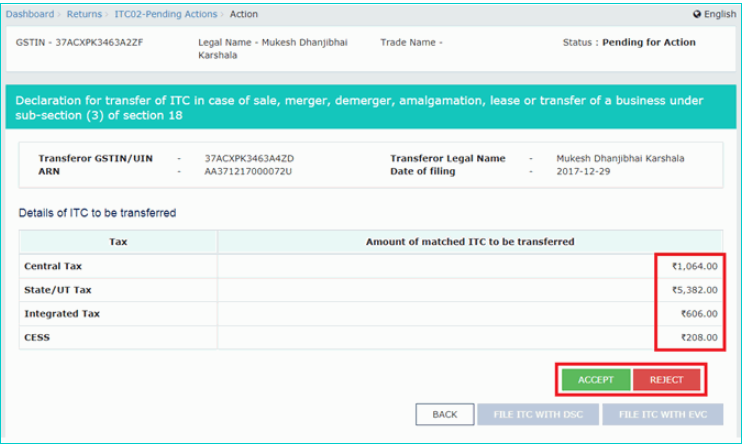

- You can access the detailed form by clicking on ARN.

- After clicking, the system will also show the ITC to be transferred.

- The Transferee can accept or reject the transfer.

- Upon clicking on the “Accept” button, the system will show the message about acceptance of transfer of ITC-02.

- Transferee can file the same by clicking on the declaration form and completing the filing process with EVS or DSC.

- After completion of the process, the transferred ITC will start appearing in the electronic Credit ledger of the transferee and will no longer be available in the Electronic Credit ledger of the transferor.

Also Read: How to report ITC to the government?