Understanding and filing GST reports is essential for every business registered under the GST regime in India. Accurate reporting not only helps in maintaining legal compliance but also facilitates smoother financial operations. Each report—GSTR 1, GSTR 3B, and GSTR 4—serves a specific function in the taxation system, from declaring taxable sales to finalizing net tax liabilities.

This guide will help you understand GSTR 1, GSTR 3B, and GSTR 4 reports, explaining their purposes, who should file them, and their filing deadlines. Proper handling of these reports will ensure you stay compliant with GST regulations and manage your tax liabilities effectively.

I. Essentials of GSTR 1, GSTR 3B, and GSTR 4

| Form Name | Purpose | Who Should File | Filing Frequency | Deadline |

| GSTR 1 | Detailed report of outward supplies | Regular taxpayers | Monthly/Quarterly | Monthly by 11th next month; Quarterly by last day of the month following the quarter |

| GSTR 3B | Monthly summary of inward and outward supplies | All GST registrants | Monthly | 20th of the following month |

| GSTR 4 | Annual return for composition scheme | Taxpayers under the GST Composition Scheme | Annually | April 30 of the following financial year |

Understanding GSTR 1

GSTR 1 is the form used by GST registered businesses to report their sales. It’s important because it allows the government to track taxable transactions and facilitates the proper crediting of input tax credits to recipients. Businesses with an annual turnover above Rs. 1.5 crore need to file GSTR 1 monthly by the 11th of the following month. Those below this threshold have the option to file quarterly.

Breakdown of GSTR 3B

GSTR 3B is a monthly summary return that every GST registrant needs to file. This form is simpler than GSTR 1 as it does not require invoice-level information. Instead, it summarizes the total values for sales and purchases, calculating the net tax liability or refund due. All businesses must submit GSTR 3B by the 20th of the month following the tax period.

Insights into GSTR 4

GSTR 4 is specifically for businesses registered under the GST Composition Scheme. This scheme allows qualifying smaller businesses to pay GST at a fixed rate of turnover and file returns annually, simplifying GST compliance. The return must be filed by April 30th following the end of the financial year.

II. Step-by-Step Filing Process for GSTR 1, GSTR 3B, and GSTR 4

-

How To File GSTR 1?

Filing GSTR 1 can be a straightforward process if you follow these detailed steps. Here’s a guide on how to file GSTR 1 accurately, along with some tips to help you avoid common mistakes:

-

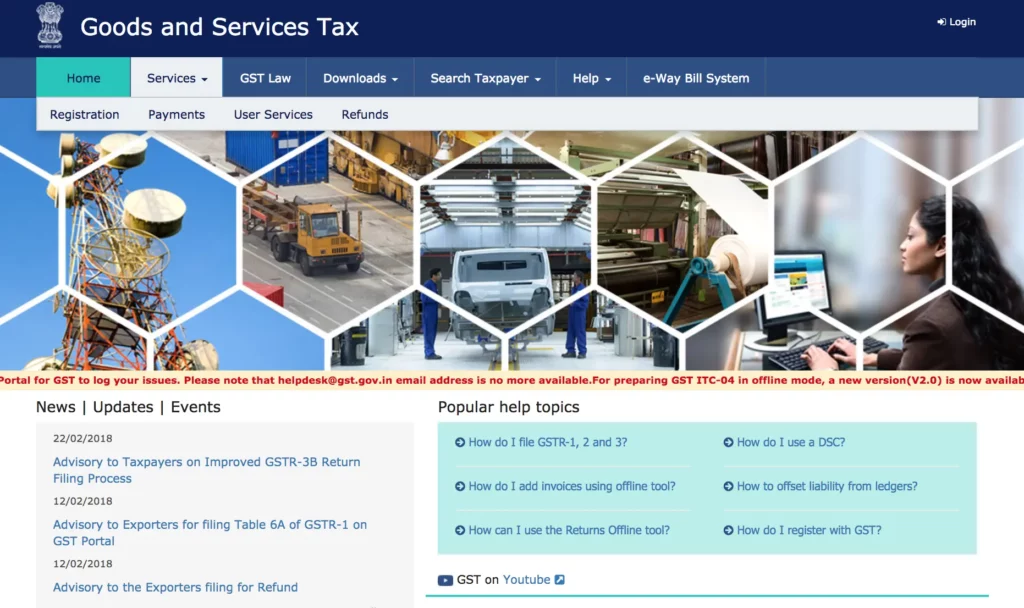

Login to GST Portal

- Visit the official GST portal (https://www.gst.gov.in/).

- Enter your credentials to log in to the dashboard.

-

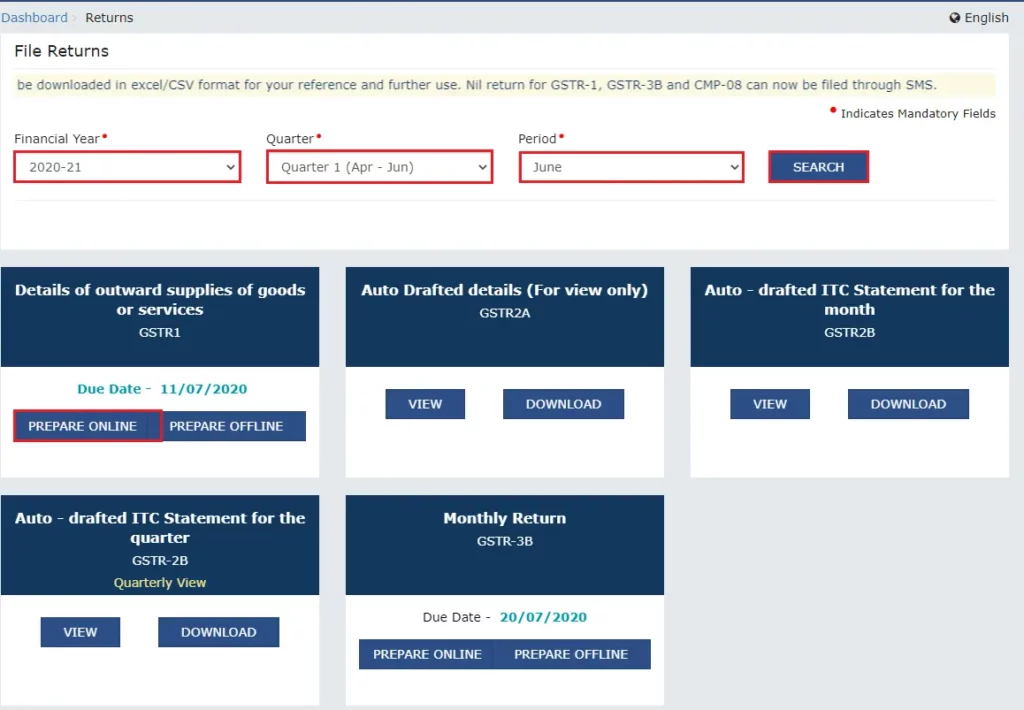

Navigate to GSTR-1 Form

- Once logged in, go to the ‘Services’ menu.

- Select ‘Returns Dashboard’ and then the relevant financial year and return filing period for which you need to file GSTR-1.

-

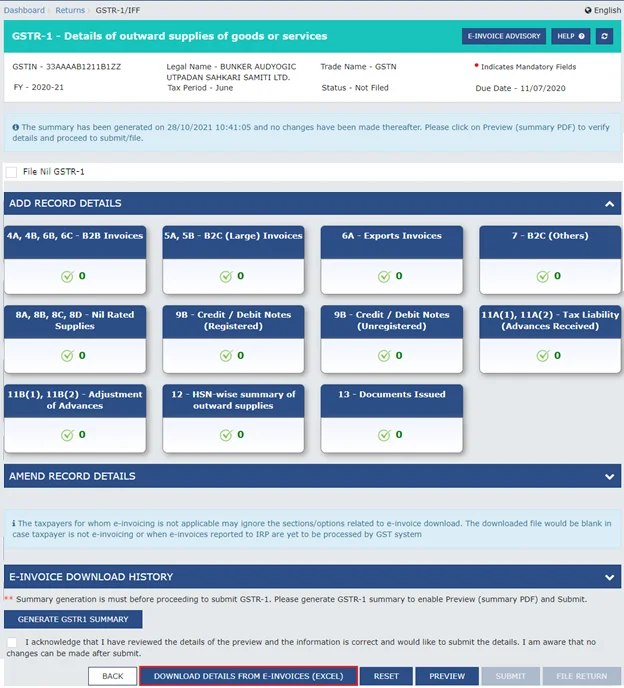

Prepare Online or Upload Data through JSON

- You can choose to prepare the return online if you have fewer invoices.

- For a large number of invoices, it’s advisable to use the offline utility tool to prepare the return and then upload the JSON file on the portal.

-

Enter Details in Various Sections

- Fill in the details in various sections of GSTR-1 including:

- B2B (Business-to-Business) Invoices

- B2C (Business-to-Consumer) Large Invoices

- Credit/Debit Notes (Registered/Unregistered)

- Exports Invoices

- Tax Liability (Advance received)

- Adjustments of Advances

- Ensure all mandatory fields are accurately filled to avoid errors.

-

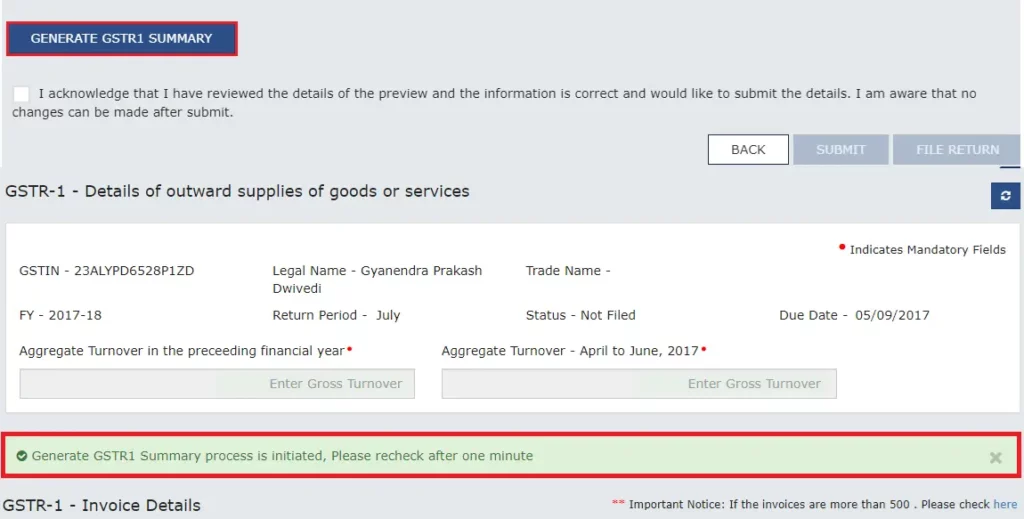

Validate and Generate Summary

- After entering all data, click on ‘Validate’ to check for any errors or missing information.

- Once validation is successful, generate the summary of your return to review the data before final submission.

-

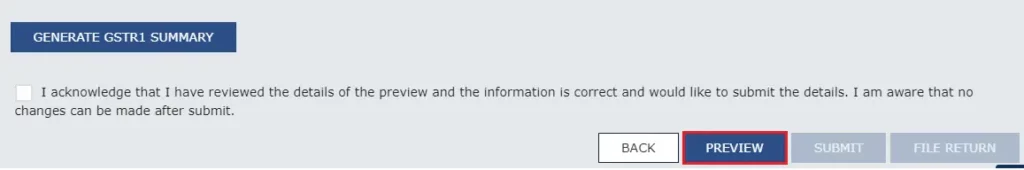

Preview Draft GSTR-1

Before submitting, you can preview the draft GSTR-1 to ensure all entries are correct. This helps in identifying any discrepancies or errors in the reported data.

-

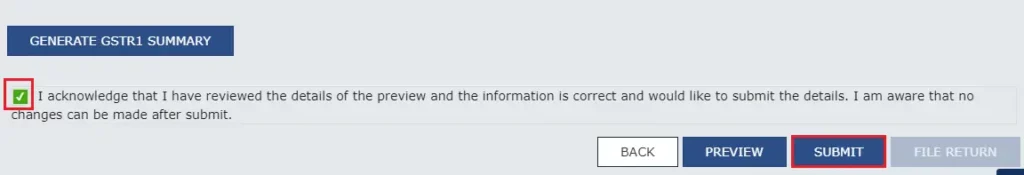

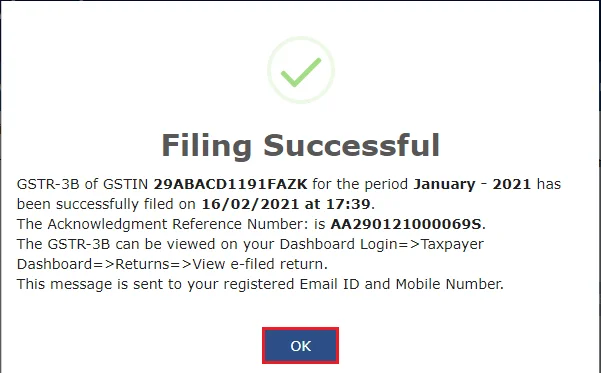

Submit GSTR-1

Post verification, submit the GSTR-1. Remember, once submitted, you cannot make any changes to the figures reported. On submission, an ARN will be generated which can be used for future references.

-

File GSTR-1 with Digital Signature Certificate (DSC) or EVC

File the GSTR-1 using a Digital Signature Certificate (DSC) or an EVC (Electronic Verification Code). The choice depends on the type of business and its regulations.

Also Read: GSTR 1 Details: Everything You Need To Know

Tips for Avoiding Common Mistakes

- Accuracy in Reporting: Double-check all invoice details for accuracy in amounts, GST rates, and GSTINs.

- Timely Filing: Adhere to the filing deadlines to avoid penalties.

- Regular Reconciliation: Regularly reconcile your sales records with your GSTR-1 entries to ensure that all transactions are accounted for and reported correctly.

- Use of Offline Utility: For large data sets, use the GST offline utility tool to prepare your return. This minimizes the chances of errors during data entry on the portal.

-

How To File GSTR 3B?

Filing GSTR 3B is an important monthly requirement for all GST-registered businesses. Here is a detailed, step-by-step guide to help you file GSTR 3B accurately, along with tips to avoid common mistakes:

-

Login to GST Portal

- Access the official GST portal at https://www.gst.gov.in/.

- Enter your login credentials to access your dashboard.

-

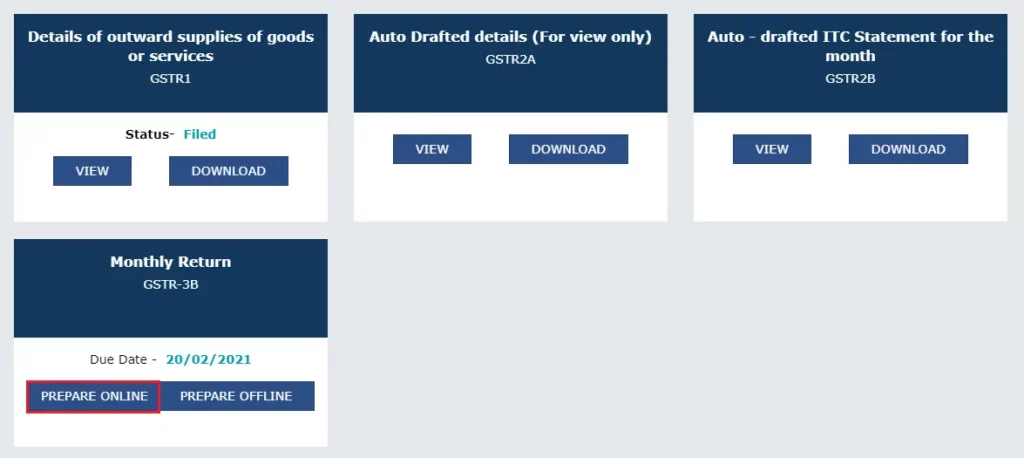

Navigate to the Returns Dashboard

- From the dashboard, click on the ‘Services’ menu.

- Choose ‘Returns’ and then ‘Returns Dashboard’.

- Select the financial year and the return filing period for your GSTR 3B.

-

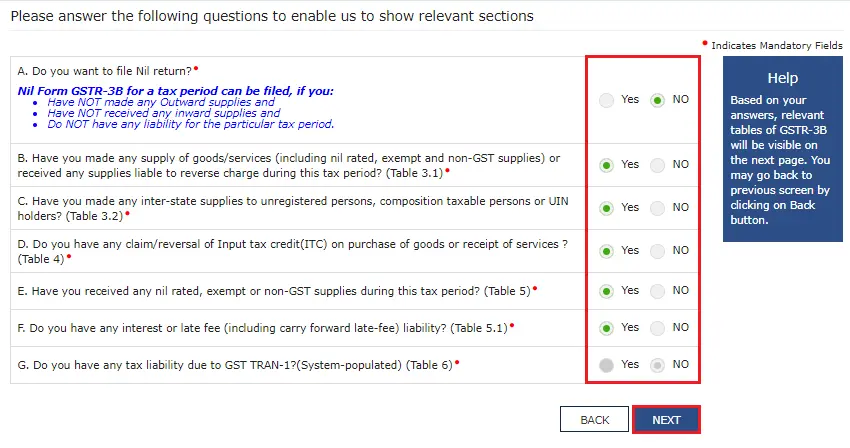

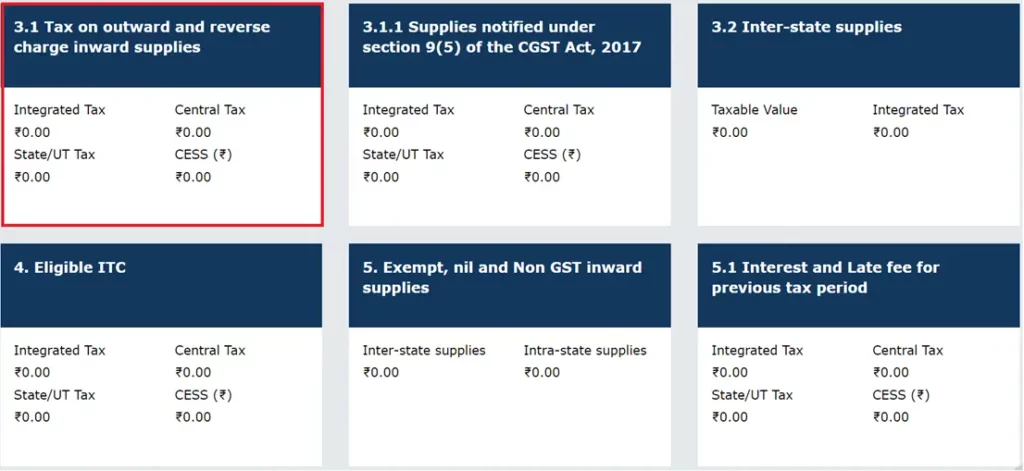

Prepare GSTR 3B

- Click on the ‘Prepare Online’ option under the GSTR 3B tab.

- You will be presented with various sections that need to be completed:

- 3.1 Details of Outward and Inward supplies liable to reverse charge

- 3.2 Of the supplies shown in 3.1, details of inter-state supplies made to unregistered persons, composition taxable persons, and UIN holders

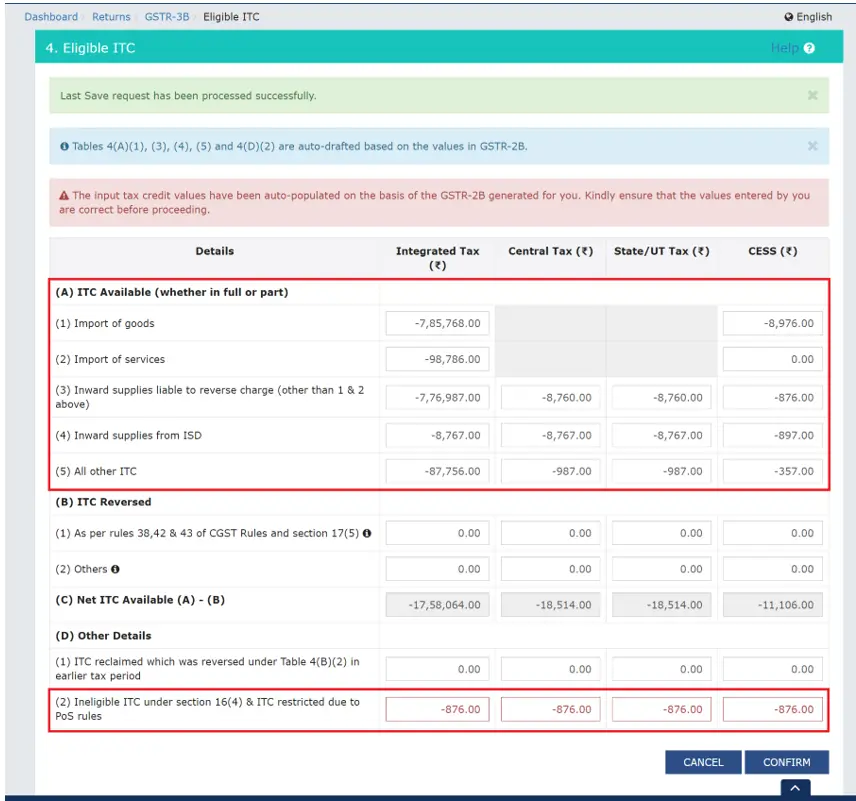

- Eligible ITC (Input Tax Credit)

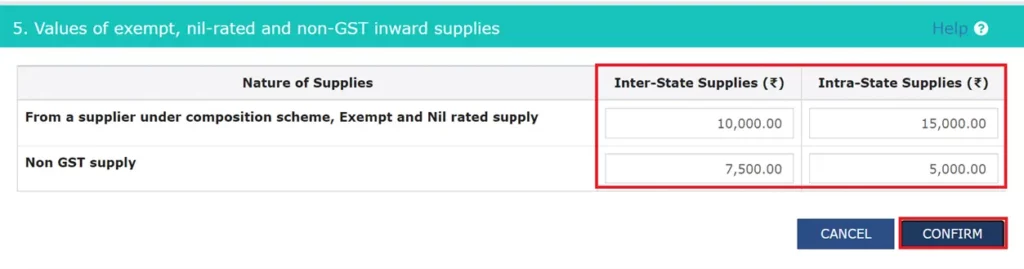

- Values of exempt, nil-rated, and non-GST inward supplies

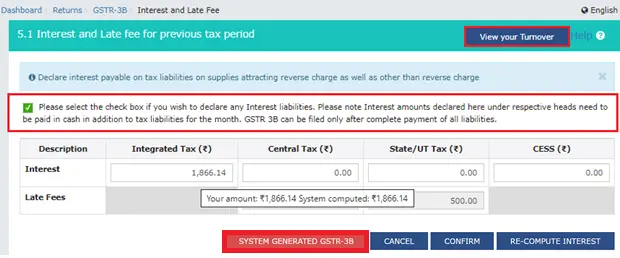

- 5.1 Interest and late fee payable

-

Enter the Required Information

Fill in all required details in each section. Ensure that you accurately report your total taxable sales, total tax due, and input tax credits.

-

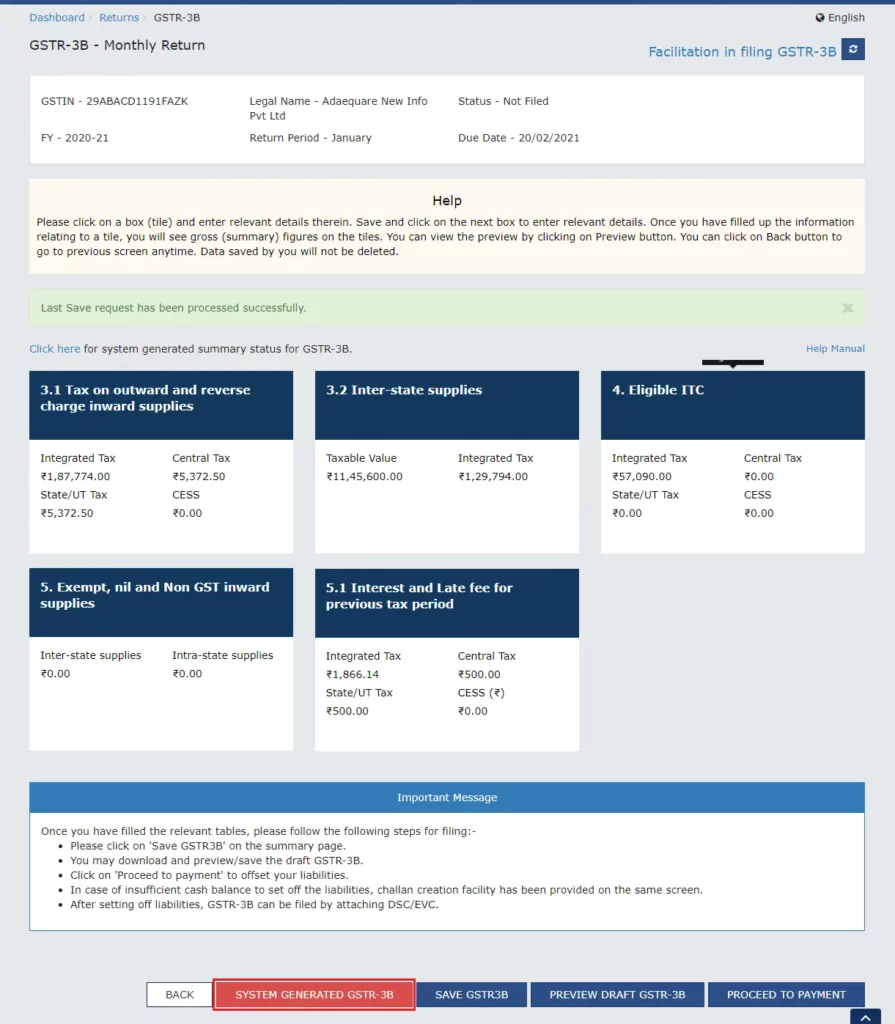

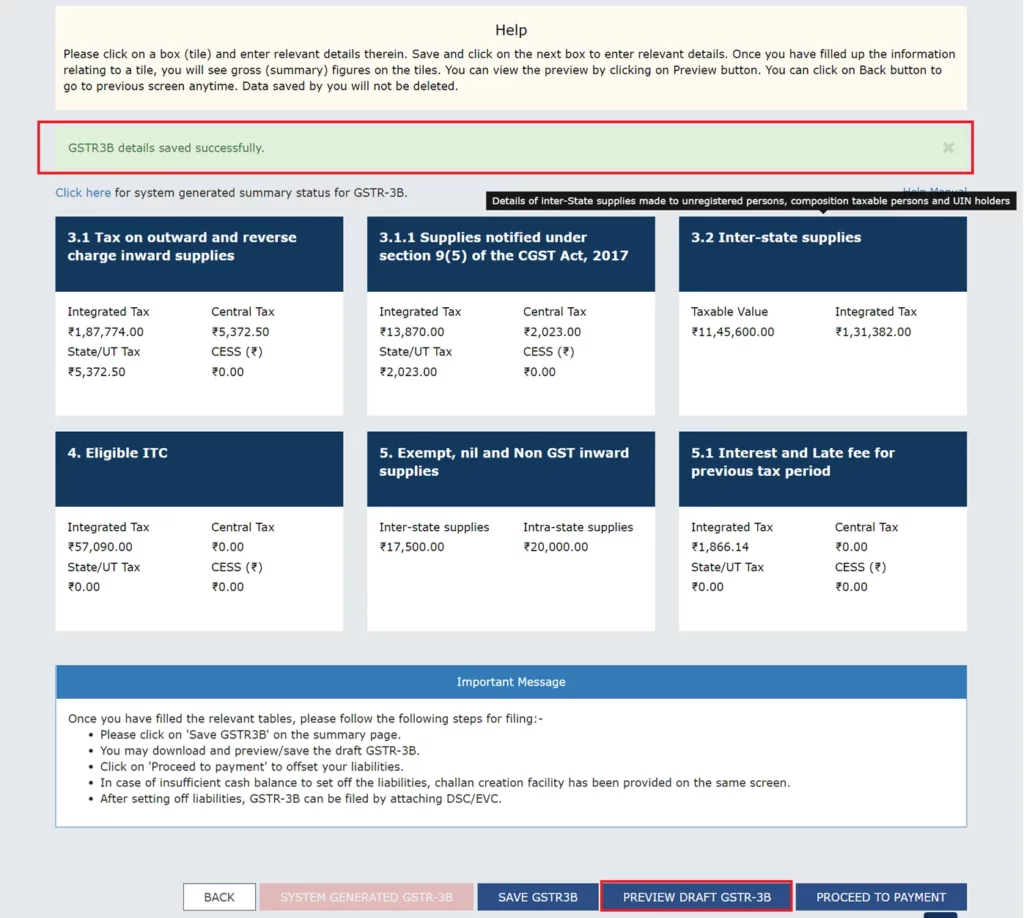

Save the Form

After entering all the details, click on ‘Save GSTR-3B’. This will validate your data and save the form. It is important to save your progress to avoid losing data in case of an interruption.

-

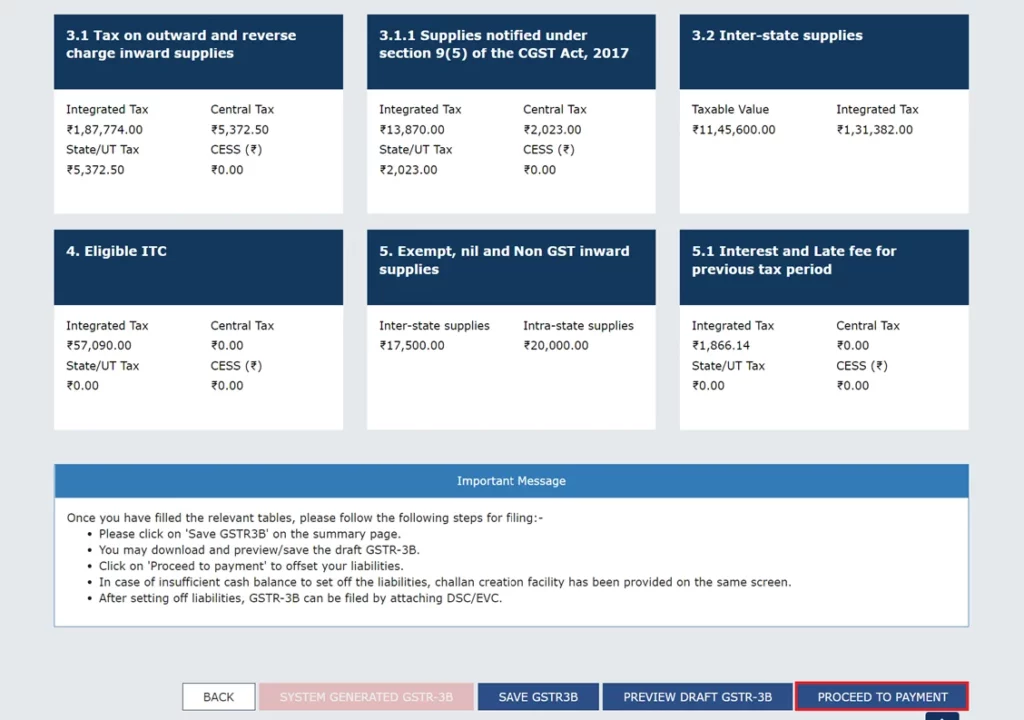

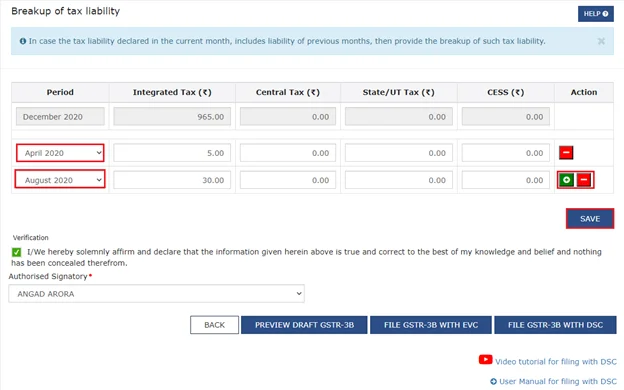

Submit GSTR 3B

- Before submission, review all entries carefully to ensure there are no errors.

- Click on the ‘Submit’ button to freeze your data. Remember, no changes are allowed after submission.

-

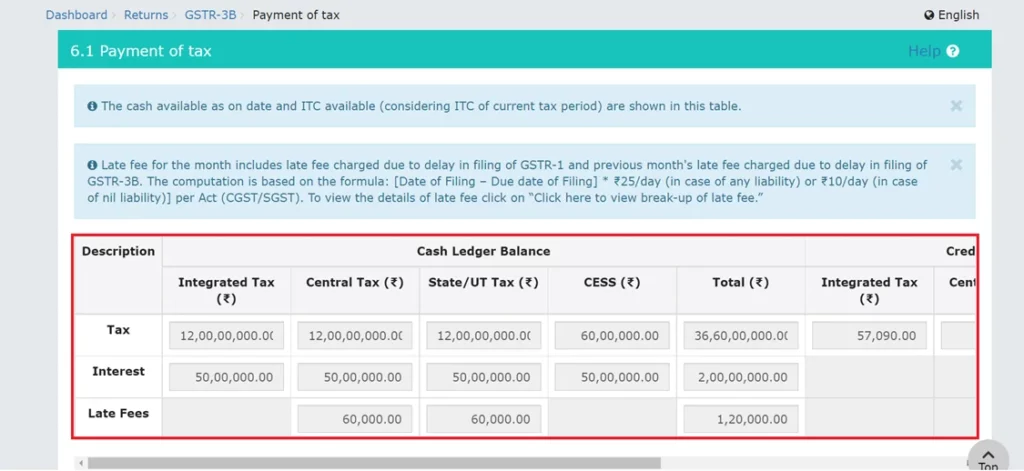

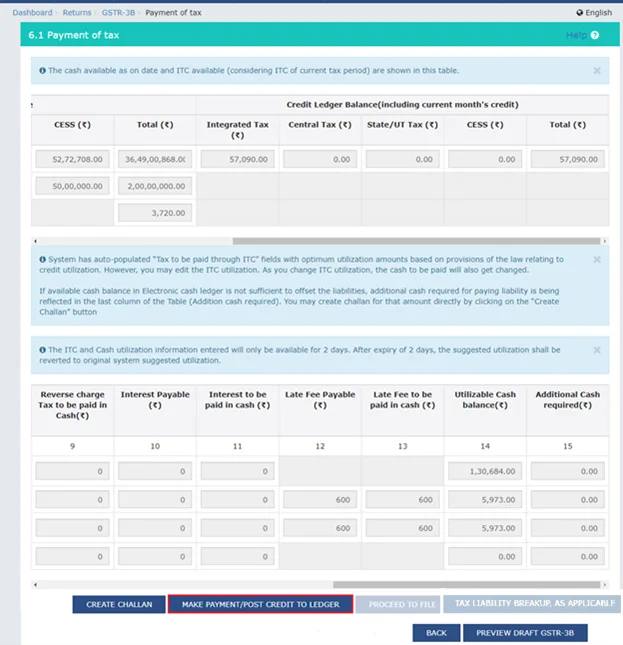

Pay Tax

- After submission, proceed to the payment section.

- Clear any tax liabilities by either offsetting the credit available or making a payment directly through the portal.

-

File GSTR 3B with DSC or EVC

Finally, file your GSTR 3B using a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC), depending on the requirement for your type of business.

Also Read: A Comprehensive Guide: How to File GSTR-3B with Accuracy

Tips for Avoiding Common Mistakes

- Accurate Data Entry: Double-check all figures for accuracy. Pay special attention to tax rates and taxable values.

- Timely Filing: Ensure you file the return by the 20th of the following month to avoid penalties and interest on late payments.

- Proper Input Tax Credit Utilization: Ensure correct reporting of eligible ITC. Match your ITC claims with the GSTR-2A to avoid discrepancies.

- Reconciliation: Regularly reconcile your books with the returns filed to maintain accuracy and compliance.

- Utilize Save Function: Regularly use the ‘Save’ function while filling out the form to prevent data loss.

-

How To File GSTR 4?

Filing GSTR 4 is an essential requirement for taxpayers who have opted for the GST Composition Scheme. This annual return summarizes a full year’s worth of tax data for small businesses. Here’s a detailed, step-by-step guide on how to file GSTR 4, including tips to help you avoid common mistakes:

-

Login to GST Portal

- Start by visiting the official GST portal at https://www.gst.gov.in/.

- Enter your login credentials to access the dashboard.

-

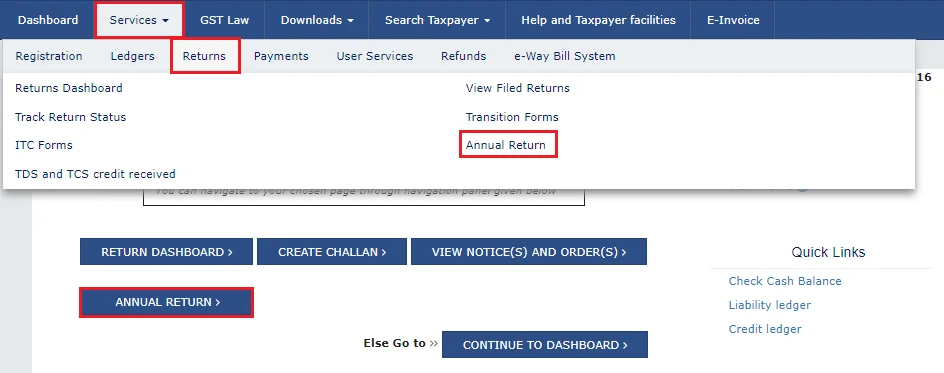

Access the Returns Dashboard

- Navigate to the ‘Services’ menu, select ‘Returns’, and then choose ‘Returns Dashboard’.

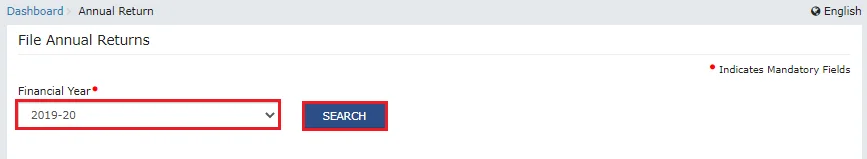

- From here, select the financial year and the period for which you need to file GSTR 4.

-

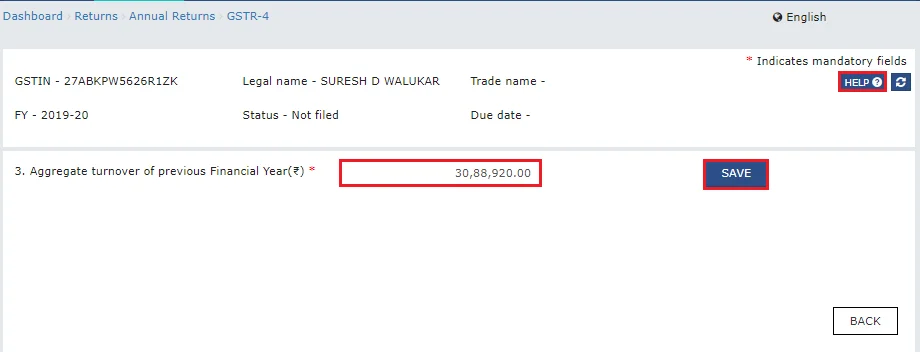

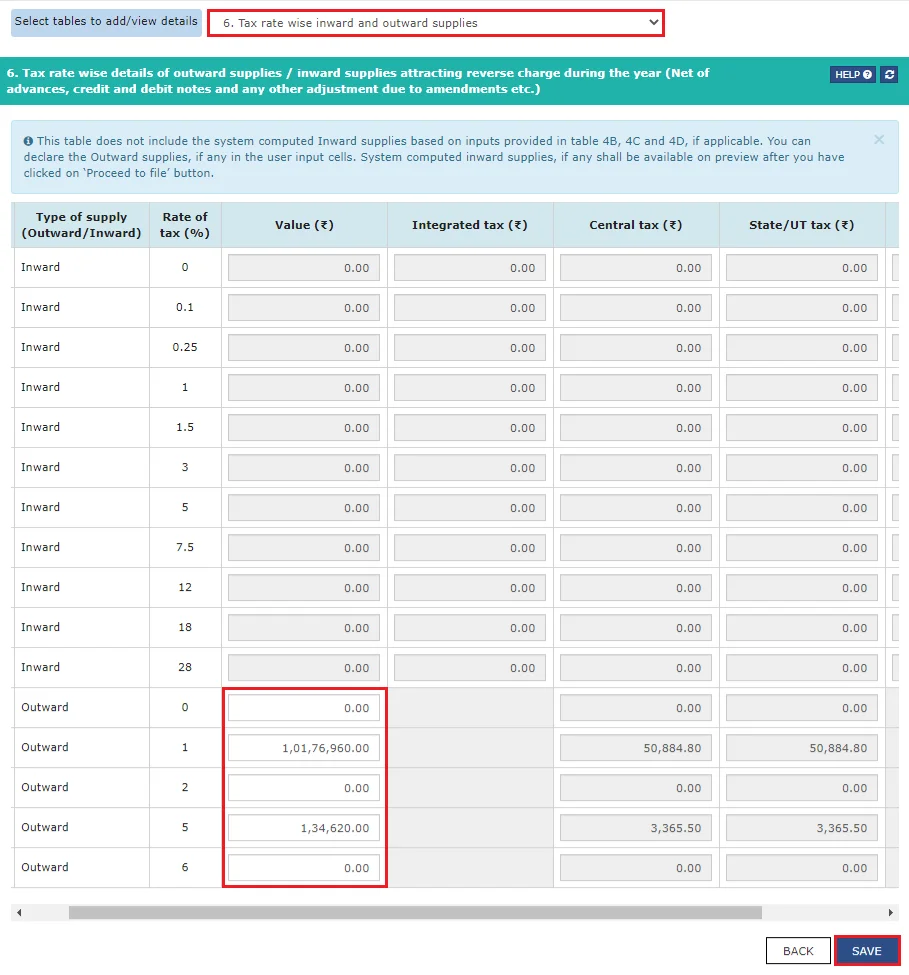

Prepare GSTR 4

Click on ‘Prepare Online’ under the GSTR 4 option. You will see various sections that need to be completed based on your business transactions throughout the year.

-

Enter Details

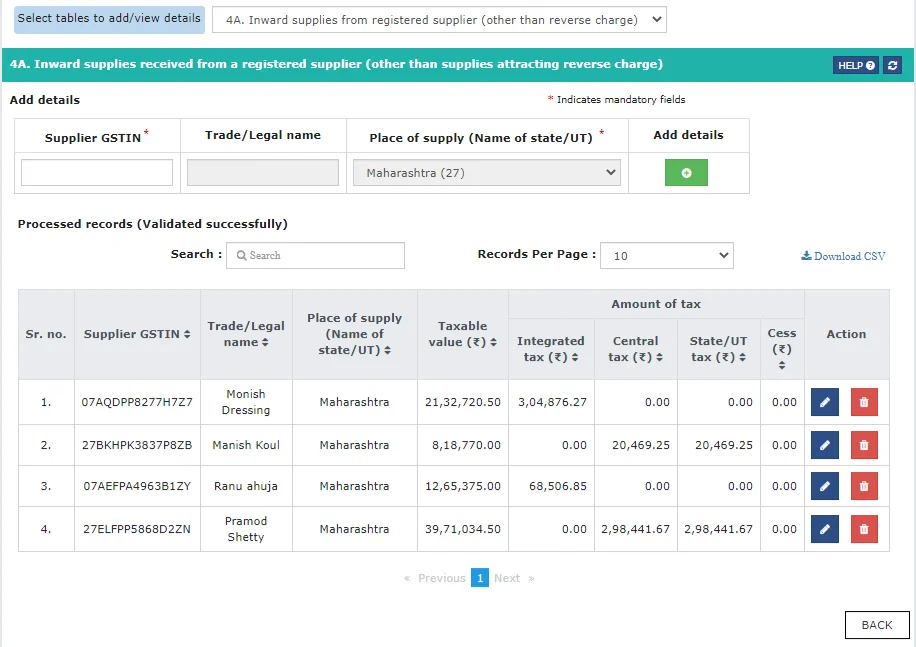

- 4A. Composition Taxable Person Supplies: Include details of your total turnover, including both taxable and non-taxable supplies.

- 4B. Inward Supplies: Report your purchases on which tax is payable on a reverse charge basis.

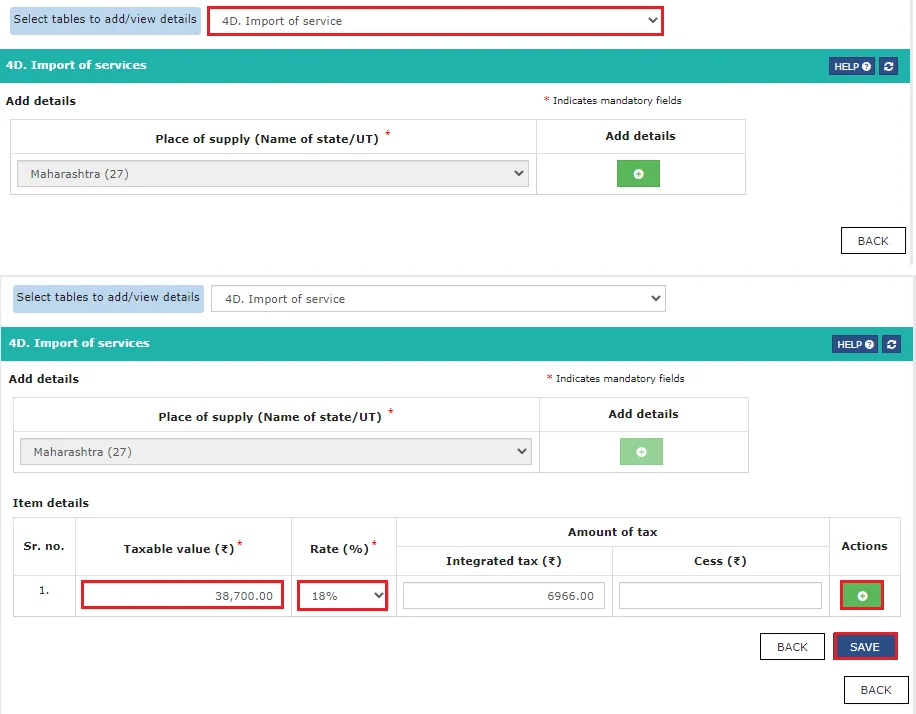

- 4C. Import of Services: Detail any services you imported.

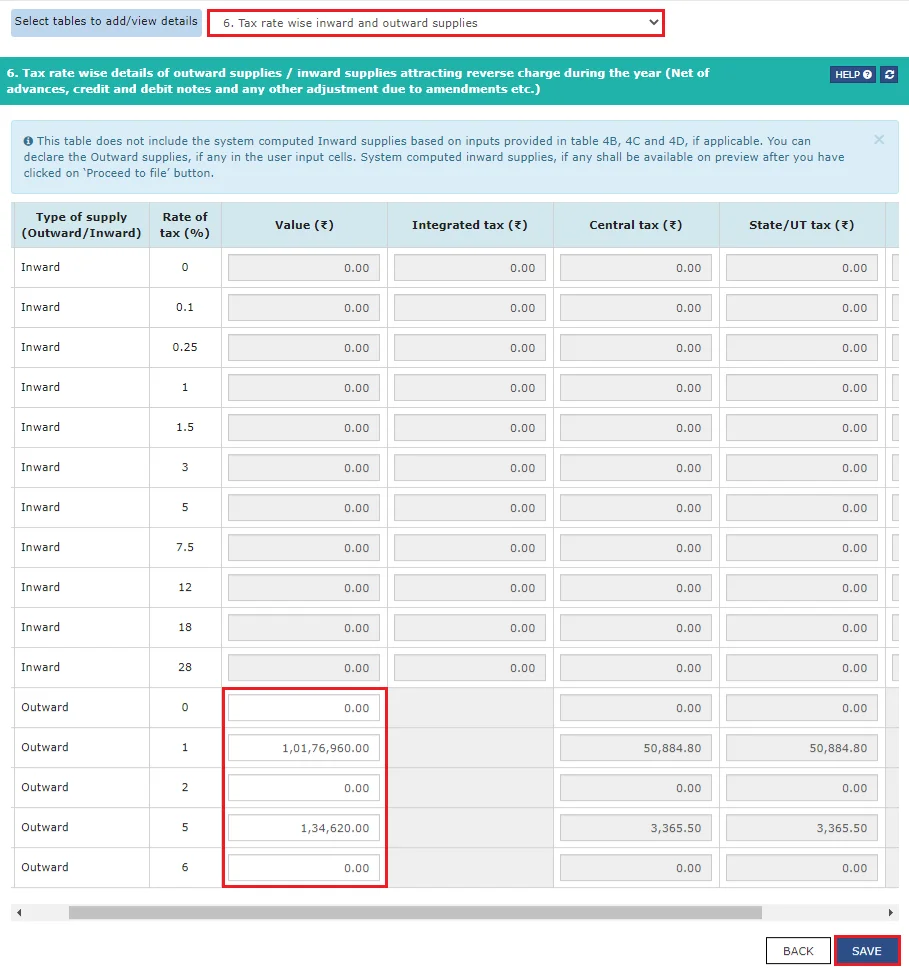

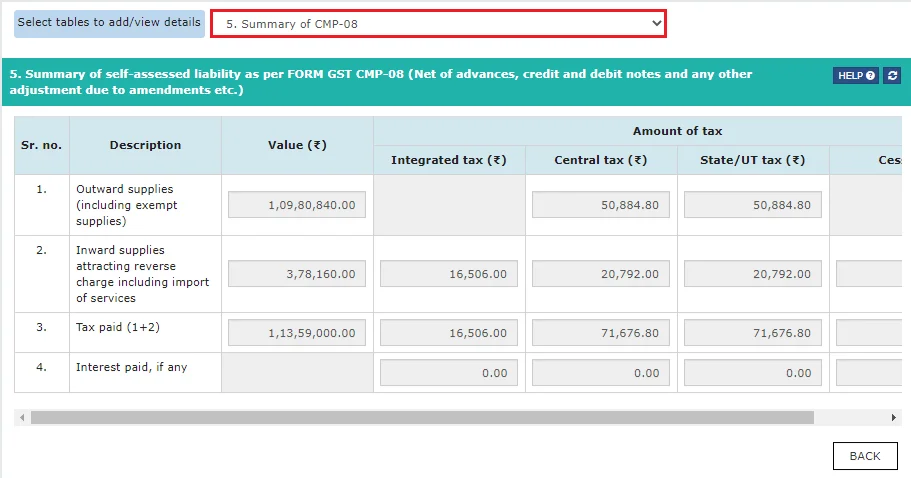

- 5. Tax, Interest, Late Fee Payable and Paid: Calculate and enter the tax due based on your turnover, and detail any interest or late fees if applicable.

-

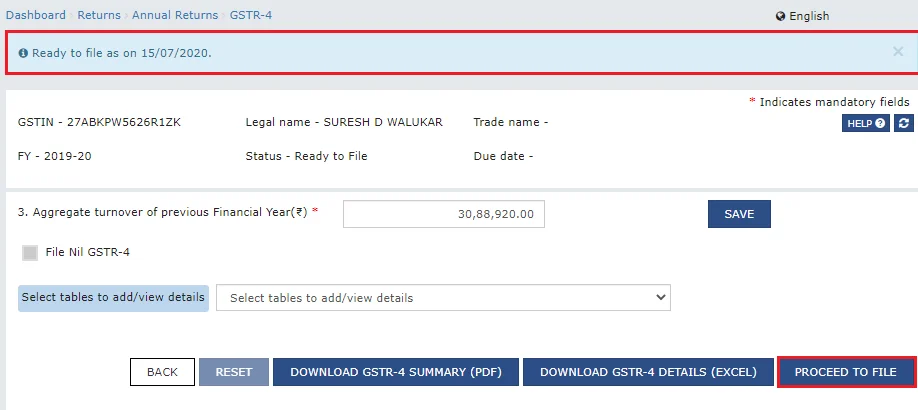

Verify the Data

Before proceeding, ensure all the information entered is accurate. Check the calculations for total turnover and tax due, and make sure you have complied with reverse charge mechanisms if applicable.

-

Save the Draft

Regularly save the form as a draft to avoid losing any data due to accidental closures or system errors.

-

Preview the Form

Before submitting, preview the completed form to ensure that all entries are correct and all necessary details have been included. This can help prevent errors that might cause compliance issues later.

-

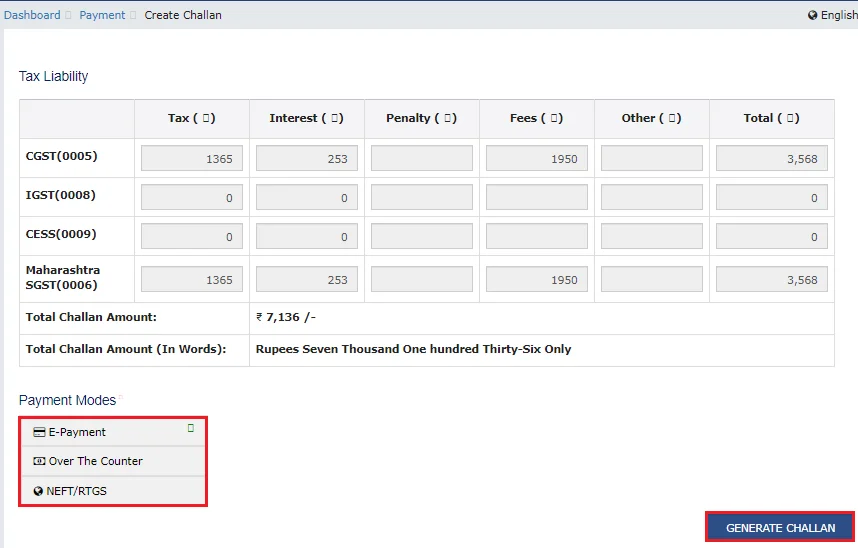

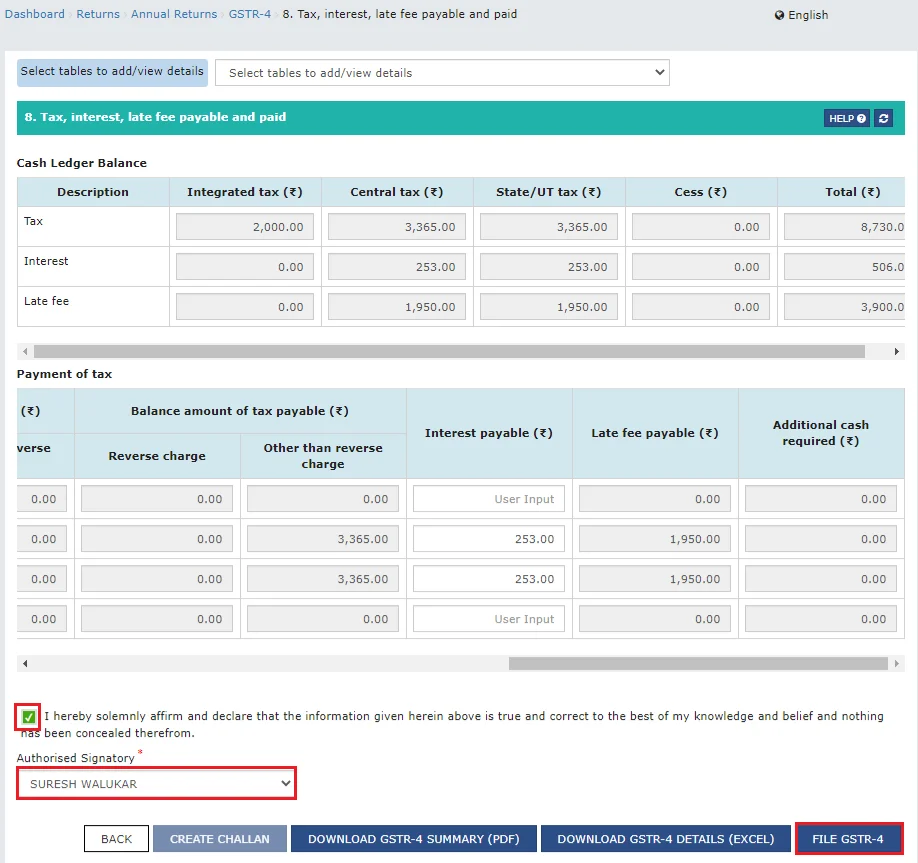

Pay the Tax Due

Proceed to make payment of any tax due. This can be done through the ledger maintained on the GST portal.

-

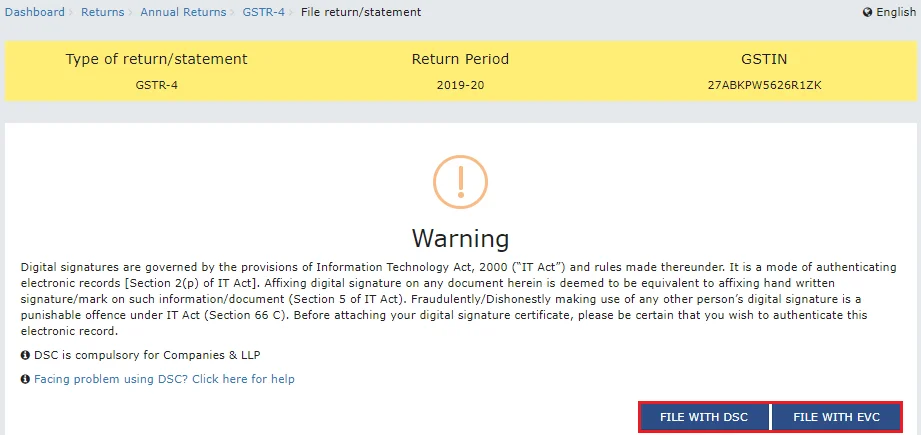

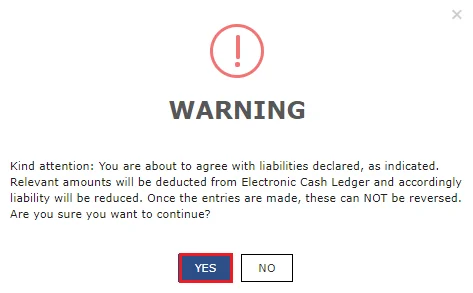

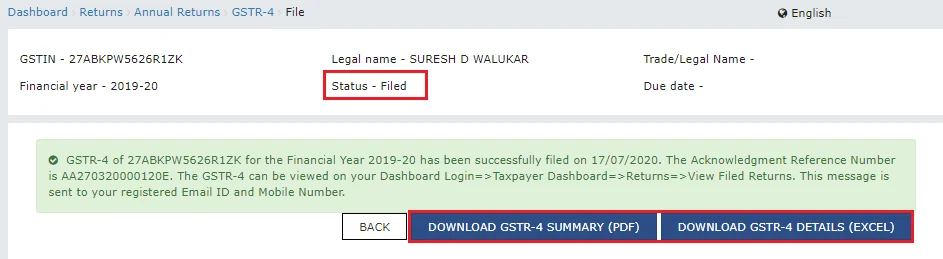

Submit and File GSTR 4

Once all sections are completed and the tax is paid, submit the form. You can file the return using a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC), depending on the legal requirements applicable to your business.

Also Read: How To File GSTR-4?

Tips for Avoiding Common Mistakes

- Accurate Reporting: Double-check all numbers for turnover and taxes. Errors in reporting turnover or tax could lead to penalties.

- Documentation: Keep all purchase invoices and supply details well-documented to ensure accuracy in the entries made in GSTR 4.

- Timely Filing: The deadline for filing GSTR 4 is the 30th of April following the end of the financial year. Avoid late filing to prevent any late fees or interest.

- Consult a Professional: If you are unsure about any aspect of your GSTR 4 filing, consider consulting with a GST expert. This can help clarify complex issues, especially concerning reverse charge mechanisms and tax calculations.

III. Common Errors and How to Avoid Them

Top Mistakes in Filing GSTR 1 and How to Rectify Them

Filing GSTR 1 can be error-prone, particularly for businesses dealing with large volumes of transactions. Common mistakes include incorrect GSTIN details, wrong invoice dates, or mismatched invoice values. To avoid these errors, ensure that all data entered matches the invoices exactly. Regularly cross-verify details with your customers to ensure consistency before filing. If mistakes occur, utilize the amendment section in the subsequent month’s return to make corrections.

Understanding GSTR 3B Errors

Over or under-reporting in GSTR 3B can lead to significant compliance issues. To avoid these errors, maintain a robust reconciliation process between your purchase records and the GSTR-2A, which shows input credit details as reported by your suppliers. Ensure that any discrepancies are resolved promptly to reflect accurate figures in your GSTR 3B. Utilize automated GST software that can help in reconciling transactions and flagging inconsistencies early.

Avoiding Penalties in GSTR 4 Filing

For composition dealers, ensuring compliance in GSTR 4 filing is crucial to avoid penalties. Key pitfalls include under-reporting sales or not filing the return on time. To prevent these issues, keep meticulous records of all sales transactions throughout the year and set reminders for the filing deadlines. Ensure all tax payments are completed before filing to avoid late penalties.

IV. Advanced Tips and Strategies

Optimizing Your GST Returns for Maximum Benefits

Maximizing the benefits from GST filings involves understanding the nuances of tax credits and liabilities. Implement strategies such as timely claiming of input tax credits and ensuring all eligible credits are accounted for. Regularly review your GST filings for any possible tax saving opportunities, such as ensuring all exports are accompanied by the correct documentation to claim zero-rated tax benefits.

How to Use Data from GSTR Reports for Better Financial Planning

The data contained in your GSTR reports is a goldmine for financial planning. Analyze the trends in your input tax credits and tax liabilities to forecast future cash flows more accurately. This analysis can help in budgeting and financial planning, providing insights into seasonal fluctuations in tax liabilities and opportunities for cost savings. Additionally, use this data to enhance compliance and reduce the risk of audits by maintaining consistency in your filings.

V. Integration of GSTR Filing with Business Software

Integrating GSTR filing with accounting software streamlines the entire tax filing process, significantly reducing the time spent on manual entries. By automating data entry and calculations, businesses can minimize human errors and ensure accuracy. This integration facilitates real-time compliance checks, ensuring that all filings are consistent with GST regulations, which simplifies the compliance process and frees up resources for other critical business activities.

Modern software solutions like CaptainBiz are designed to make GST compliance as straightforward as possible. CaptainBiz automates GSTR filings, ensuring that data flows seamlessly from sales and purchase records to GST returns. Key features include automatic calculation of tax liabilities, error detection mechanisms that alert users before submission, and direct submission capabilities to the GST portal, all of which help to ensure error-free filing and compliance.

VI. Regulatory Updates and Future Trends

Recent Changes in GSTR Filing Requirements

Recent updates to GSTR filing requirements have brought several significant changes that directly impact how businesses manage their GST compliance:

- Filing Deadlines Adjusted: The due dates for filing various GST returns have been revised. For example, the deadline for GSTR-1 filing for taxpayers with a turnover above Rs. 1.5 crore is now the 11th of the month following the quarter.

- Tax Rate Changes: There have been updates to GST rates for various goods and services as decided in the latest GST council meetings, impacting how businesses calculate their tax liabilities.

- Input Tax Credit Rules Updated: The rules regarding the claim of input tax credits have been tightened. Businesses now need to ensure that credits claimed match the invoices uploaded by their suppliers in GSTR-1, aligning with the provisions of rule 36(4) which restricts the claim of unmatched credits to 5% of eligible credits from matched details.

- Introduction of Quarterly Return Filing and Monthly Payment (QRMP): Small taxpayers with an aggregate turnover of up to Rs. 5 crore can opt for QRMP scheme, allowing them to file GSTR-3B and pay tax on a quarterly basis, while paying tax monthly through a simple challan.

Future of GST in India

The GST framework in India is continuously evolving to simplify compliance and broaden the tax base. Upcoming changes may include further simplification of the filing process, introduction of new forms, and possibly the implementation of a new automated matching system for input tax credits. Businesses can prepare for these changes by investing in robust GST software that can adapt to regulatory changes, and by regularly training their finance teams on the latest GST rules and technologies.

VII. Simplify Your GST Filings with CaptainBiz

Are you ready to take control of your GST compliance and streamline your business operations? CaptainBiz offers a powerful GST billing software solution that’s trusted by over 46,000 small and medium businesses across India.

Why Choose CaptainBiz?

- All-in-One Solution: CaptainBiz is designed to handle all your invoicing, inventory management, and GST compliance needs efficiently.

- Trusted and Recommended: Our platform is not only trusted by tens of thousands of businesses but also recommended by the GST-Network for its reliability and ease of use.

- Risk-Free Trial: Get started with a 14-day free trial of CaptainBiz today. No credit card required, just sign up and start experiencing the convenience of streamlined GST billing: Start Your Free Trial Today!

With CaptainBiz, ensure timely payments, manage inventory more effectively, and reduce operational costs, all while ensuring compliance with GST regulations. Sign up now and join thousands of businesses who have transformed their operations with our trusted GST billing solution.

Also Listen: GSTR Filing Process with CaptainBiz – Tutorials

VIII. Frequently Asked Questions (FAQs)

-

What is GSTR 1 and who should file it?

GSTR 1 is a monthly or quarterly return that must be filed by registered GST businesses to report the details of their outward supplies. Any GST registered business that makes outward supplies of goods and services is required to file GSTR 1, except those registered under the composition scheme.

-

How does GSTR 3B differ from GSTR 1?

GSTR 3B is a simplified monthly return that summarizes the total values of sales and purchases and the GST payable. Unlike GSTR 1 which details individual transactions, GSTR 3B is a consolidated summary that helps in the payment of taxes due.

-

How does CaptainBiz simplify the GST return filing process?

CaptainBiz streamlines the GST return filing process by automating data entry, calculations, and report generation. With features that directly integrate with the GST portal, users can effortlessly generate accurate GSTR reports, such as GSTR-1, GSTR-3B, and GSTR-4. The platform ensures that all GST filings are compliant with the latest regulations, reducing the burden of manual checks and minimizing the risk of errors.

-

What are the filing deadlines for GSTR 1?

For businesses with an annual turnover above Rs. 1.5 crores, GSTR 1 should be filed monthly by the 11th of the following month. For those below this turnover, it is filed quarterly by the last day of the month following the quarter.

-

Who needs to file GSTR 4 and what does it involve?

GSTR 4 is filed by taxpayers who are registered under the GST composition scheme. It is filed annually by the 30th of April following the financial year, summarizing turnover, tax paid, and other requisite details for composition taxpayers.

-

How to file GSTR 3B?

Filing GSTR 3B involves logging into the GST portal, selecting the return dashboard, choosing the financial year and tax period, filling in the summary details of outward supplies and input tax credit, verifying the auto-populated details, paying the due taxes, and finally submitting the return.

-

What common mistakes occur in filing GSTR 1 and how can they be rectified?

Common errors include incorrect GSTIN, mismatched invoice details, or incorrect tax amounts. These can be rectified in the subsequent month’s return or through amendments in the section provided in GSTR 1.

-

How can integrating GSTR filing with accounting software benefit a business?

Integrating GSTR filings with accounting software streamlines the data entry process, reduces errors, and ensures compliance by automating the extraction and consolidation of transaction data directly for the returns.

-

What are some strategies to optimize GST returns for maximum benefits?

Strategies include timely and accurate filing to avoid penalties, utilizing input tax credits fully, maintaining thorough documentation to support claims, and regularly reviewing GST updates to stay compliant.

-

What unique features does CaptainBiz offer to enhance GST compliance for businesses?

CaptainBiz provides a comprehensive suite of features designed to enhance GST compliance. These include automated reconciliation of purchase invoices to ensure credit maximization, real-time error detection in data entry, and intuitive dashboards for monitoring compliance status. Additionally, CaptainBiz supports seamless e-way bill generation and management, making it an All in One GST Billing tool for businesses looking to improve their GST operations efficiently.