Introduction

The future of GST software is going to change finance a lot. As technology gets better, GST software will make managing taxes and money easier for businesses and this will make a revolution in finance. With the advanced GST solutions and include AI and cloud based GST softwares makes the process smoother, fewer mistakes, and following the rules better. We’ll look at the evolution of GST softwares, Technologies and many more!

Evolution of GST Software

- Introduction of GST in India: The evolution has started with the introduction of the Goods and Services Tax (GST) regime in India in July 2017. This makes a significant shift from the previous complex tax structure to a unified tax system, requiring businesses to adopt new software solutions to comply with the updated tax laws.

- Basic Software Solutions for Indian Market: Initially, GST softwares are offered basic functionalities such as tax calculation, invoicing, and basic reporting to meet the specific requirements to businesses operating under the GST regime. These solutions helped businesses transition smoothly to the new tax system.

- Expansion of Features for Indian Businesses: As businesses adapted to the GST regime, software solutions evolved to cater to their growing needs. Features such as GST return filing, e-way bill generation, matching of input tax credits, and compliance with GSTN (Goods and Services Tax Network) requirements became essential components of GST software.

- Integration with Indian Accounting Systems and ERP: Integration with popular accounting systems such as Tally and ERP systems became important for GST software providers to offer seamless data flow and suitable with existing business processes in India.

- Cloud-Based Solutions for Indian Businesses: Cloud-based GST software solutions gained popularity in India, offering benefits such as accessibility from anywhere, scalability to accommodate the dynamic nature of Indian businesses, and automatic updates to comply with changing GST laws and regulations.

- Mobile Apps for Indian Users: With the widespread adoption of smartphones, GST software providers developed mobile applications to meet the needs of Indian businesses and tax professionals. Mobile apps offered features such as GST registration, return filing, payment of taxes, and access to GSTN portal services on the go.

- Automation and AI for Indian Tax Compliance: Automation and AI technologies have been increasingly integrated into GST software to automate repetitive tasks, ensure accurate tax calculations, and provide intelligent insights for businesses to comply with GST regulations efficiently.

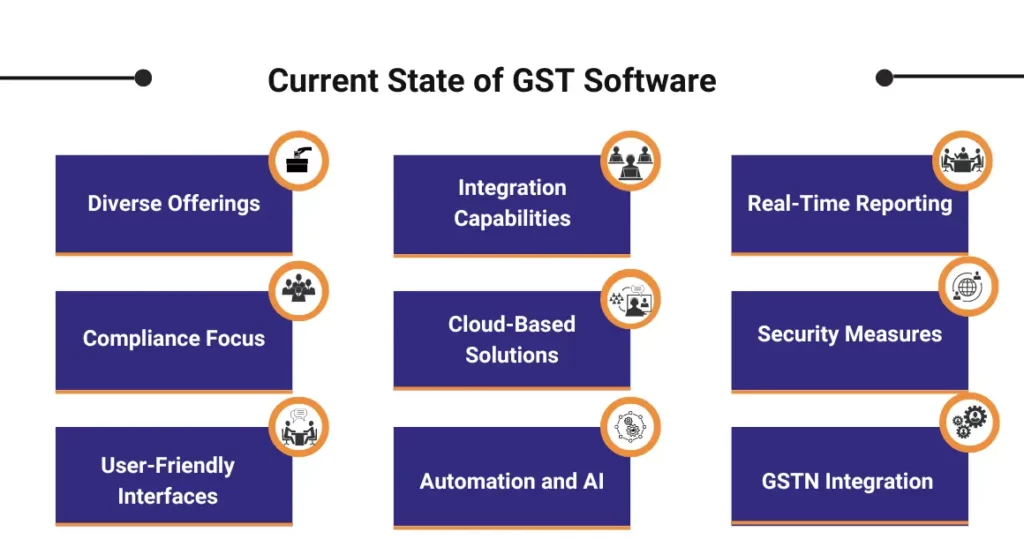

Current State of GST Software

Here’s a simple overview of how GST software is right now. It’s always changing because of new technology and rules. The current state of GST software have:

- Diverse Offerings: Today, the market offers a wide range of GST software solutions, meeting the needs of various business sizes and industries. From standalone applications to integrated ERP systems, businesses have diverse options to choose from based on their specific needs and budget.

- Compliance Focus: With frequent updates and changes in GST regulations, compliance remains a top priority for GST software providers. The software is designed to ensure businesses stay compliant with GST laws, including timely filing of returns, accurate tax calculations, and adherence to GSTN guidelines.

- User-Friendly Interfaces: New GST software makes it easy for users like accountants and business owners. They can manage GST tasks without needing lots of training or being tech experts, thanks to simple menus and easy-to-use screens.

- Integration Capabilities: Integration with other business systems such as accounting software, inventory management, and CRM systems is a key feature of current GST software. It seamlessly exchanges data between different systems and reduces manual errors.

- Cloud-Based Solutions: Cloud-based GST software has gained popularity due to its accessibility, scalability, and automatic updates. Businesses can access their GST data from anywhere with an internet connection, facilitating remote work and collaboration.

- Automation and AI: Automation features, powered by AI and machine learning, are increasingly integrated into GST software to automate routine tasks like data entry, invoice generation, and reconciliation. This improves efficiency and accuracy while reducing manual effort.

- Real-Time Reporting: Some advanced GST software solutions offer real-time reporting capabilities, allowing businesses to monitor their GST compliance status and financial performance in real-time. This enables proactive decision-making and timely adjustments to business strategies.

- Security Measures: Data security is a critical aspect of GST software. Providers implement robust security measures such as encryption, access controls, and regular security audits to safeguard sensitive financial information from unauthorized access and cyber threats.

- GSTN Integration: Integration with the Goods and Services Tax Network (GSTN) is essential for GST software to facilitate seamless communication with government portals for tasks such as return filing, payment processing, and GSTIN verification.

Advancements in Technology

Let’s talk about how technology has made GST software better. It’s given it new features and made managing taxes easier. Let’s take a closer look at how technology has helped improve GST software.

- Artificial Intelligence (AI) and Machine Learning: GST software now uses smart computer programs to do repetitive jobs, like entering data and calculating taxes. These programs can understand lots of information to help businesses plan taxes better and follow the rules.

- Robotic Process Automation (RPA): GST software now uses robots to do tasks that people used to do by hand, like copying information from invoices. These robots can do it quickly and accurately, which helps businesses work faster and make fewer mistakes.

- Blockchain Technology: Blockchain technology makes GST transactions more secure and transparent. It keeps a record of all transactions in a way that can’t be changed, which helps prevent cheating and mistakes. Some GST software uses blockchain to share documents safely and keep track of transactions.

- Data Analytics and Business Intelligence (BI): GST software now has special tools that help businesses understand their finances better. These tools can show trends and risks in the money coming in and going out. Businesses can use this information to make smart decisions about taxes and money.

- Cloud Computing: GST software that is in the cloud can be accessed from anywhere, anytime. It’s like having your tax information stored online. This means it’s always available, secure, and gets updated automatically, helping businesses follow the latest tax rules.

- Mobile Technology: Apps for GST on phones and tablets let users do tax jobs on the go. They make it easy for businesses to send in tax forms, create e-way bills, and use GSTN services from anywhere. This helps businesses work faster and be more responsive.

- Natural Language Processing (NLP): GST software now understands human language, so users can talk to it like they talk to people. This makes it easier to use because users can ask questions or give commands naturally, without needing to type or click.

- Predictive Analytics: GST software can guess what might happen in the future with taxes, cash flow, and following rules by looking at past data and market trends. This helps businesses plan ahead, fix problems before they happen, and save money on taxes.

Automation in Financial Processes

Automating financial tasks has changed how businesses handle money, making things faster, more accurate, and cheaper. Here’s how automation has made a difference in different money-related jobs.

- Data Entry and Transaction Processing: Automation helps enter financial data quickly and accurately, saving time and reducing mistakes.

- Invoice Processing: With automation, invoices can be checked and approved faster, making sure payments are made on time and avoiding errors.

- Expense Management: Automating expenses means employees can submit them online, get them approved faster, and get reimbursed quickly, without lots of paperwork.

- Budgeting and Forecasting: Automation makes budgeting easier by analyzing past data and making predictions, helping businesses plan their finances better.

- Reconciliation and Financial Close: Automated systems match transactions and generate reports automatically, making it easier to balance accounts and close financial books on time.

- Compliance and Regulatory Reporting: Automation helps generate reports and filings accurately and quickly, making sure businesses follow regulations and avoid penalties.

- Payment Processing: Automated systems schedule and process payments, reducing manual effort and ensuring bills are paid on time.

- Financial Analysis and Reporting: Automation creates reports and dashboards with important financial information, helping managers make decisions based on real-time data.

Also Read: How Does A GST Software Can Revolutionize The Overall Accounting Practices?

Enhanced Data Analytics

It refers to the utilization of advanced analytical techniques and technologies to extract valuable insights from financial data.

- Big Data Integration: Future GST software may analyze vast amounts of financial data, offering businesses a detailed view of their operations to inform strategic decisions.

- AI and Machine Learning Algorithms: With AI-powered analytics, GST software can identify trends and anomalies in financial data, empowering businesses to make proactive decisions and optimize resource allocation.

- Real-Time Analytics: Offering real-time insights, future GST software enables businesses to monitor financial performance instantly, facilitating agile decision-making and compliance management.

- Predictive Analytics for Tax Planning: By leveraging predictive analytics, GST software helps businesses forecast tax liabilities, identify savings opportunities, and ensure compliance with evolving tax laws.

- Customized Reporting and Dashboards: Future GST software provides customizable reports and dashboards tailored to business needs, offering visual insights into key financial metrics for informed decision-making.

Improved User Experience

GST software has significantly improved user experience by implementing several user-friendly features and functionalities:

- Intuitive Interface: GST software now features user-friendly interfaces with easy navigation, ensuring users can access features effortlessly without confusion.

- Guided Setup and Onboarding: Users benefit from step-by-step setup wizards and tutorials, simplifying the initial configuration process and reducing the learning curve for new users.

- Automation of Routine Tasks: Repetitive tasks like data entry and tax calculations are automated, freeing users from manual work and allowing them to focus on more strategic aspects of their business.

- Customizable Templates and Workflows: Users can personalize templates and workflows to match their specific needs, ensuring a tailored experience that maximizes efficiency.

- Multi-Device Accessibility: With support for multiple devices, users can manage tax-related tasks from anywhere, enhancing flexibility and convenience.

- Integration with Third-Party Tools: Seamless integration with other software systems eliminates data silos and improves efficiency by enabling smooth data exchange between platforms.

- Real-Time Collaboration: Real-time collaboration features enable users to work together on documents simultaneously, fostering teamwork and facilitating quicker decision-making.

- Prompt Customer Support: Accessible customer support services provide timely assistance, ensuring users can resolve issues or get answers to their questions promptly.

Also Read: How Does Unique GST Software Fit The Unique Needs Of Your Business?

Conclusion

The future of GST software promises a revolution in finance. With its evolution, current state, technological advancements, automation, enhanced analytics, and improved user experience, GST software will streamline financial processes, empower businesses, and drive efficiency, paving the way for a transformative impact on the financial landscape.

Also Read: Future Of GST Billing Software: Al, Machine Learning, And Beyond

FAQ’s

-

How has GST software evolved over time?

- GST software has evolved from basic tax calculation tools to sophisticated platforms with advanced features.

-

What is the current state of GST software?

- The current state of GST software offers diverse solutions with user-friendly interfaces and integration capabilities.

-

How are advancements in technology influencing GST software?

- Advancements in technology like AI and blockchain are enhancing the capabilities of GST software.

-

How does automation impact financial processes in GST software?

- Automation streamlines tasks like data entry and invoice processing, improving efficiency and reducing errors.

-

What are the benefits of enhanced data analytics in GST software?

- Enhanced data analytics provide deeper insights into financial data, enabling better decision-making and planning.

-

How does GST software improve user experience?

- GST software offers intuitive interfaces, customization options, and multi-device accessibility for a seamless user experience.

-

Can GST software handle complex financial tasks automatically?

- Yes, GST software automates tasks like tax calculations and compliance reporting, saving time and ensuring accuracy.

-

How does GST software ensure compliance with tax regulations?

- GST software monitors compliance in real-time and generates reports automatically, helping businesses adhere to tax laws.

-

Does GST software offer support for collaboration among users?

- Yes, some GST software platforms support real-time collaboration features for improved teamwork and communication.

-

What are the future implications of GST software in finance?

- The future of GST software promises to revolutionize finance with enhanced efficiency, accuracy, and strategic insights for businesses.