Tax collected at source, or TCS, is an important component of the indirect tax system in India. It is intended to ensure that the transactions done through the e-commerce portal are accounted for and taxes are collected at the point of transaction. So that the government could ensure compliance and check tax evasion.

As per GST law, Section 52, CGST, 2017, any person who owns, operates, or manages a digital or electronic facility or platform for electronic commerce is called an e-commerce operator. Example: Amazon, Flipkart, Paytm, etc. These e-commerce companies are required to comply with the GST TCS provisions. GST registration is mandatory for e-commerce operators, irrespective of their aggregate turnover.

TCS is applicable to the net value of the goods or services supplied through the e-commerce portal. The e-commerce operator must remit the TCS collected to the government and file the return GSTR-8 by the 10th of the following month. After the return is filed and processed, credit is provided to the supplier in the electronic cash ledger. Here we discuss in detail the TCS credit in GSTR-8 and TCS certificates.

Also Read: Understanding The Provisions Of TCS (Tax Collection At Source) Under GSTR-8

Applicability And Registration Requirements For GSTR-8

TCS Compliance under GST

TCS compliance under GST comprises the following:

- Registration: It is mandatory for e-commerce operators to register under GST and obtain a tax deduction and collection account number.

- Collection of Tax: Collect tax at the prescribed rate from the supplier at the time of payment to the supplier for the goods or services sold.

- Payment of Tax: The e-commerce operator has to remit the tax collected at source within the specified due date.

- File return in form GSTR-8: The e-commerce operator has to file the monthly return in form GSTR-8, containing the details of the supplies and the tax collected and deposited.

- TCS Certificate: The e-commerce operator must issue a TCS certificate to the supplier, mentioning the TCS amount collected.

- Maintaining a proper record of all transactions as required under Section 35 of the CGST Act and of all the tax collections and returns filed

When is TCS not applicable?

TCS is not applicable in the following cases:

- When the supply is not affected by an e-commerce operator

- Exempted supplies affected by an e-commerce operator

- Activities specified under Schedule III of the Act shall be treated neither as a supply of goods nor as a supply of services.

Read More in detail: Applicability And Registration Requirements For GSTR-8

Calculation And Payment Of TCS Liability In GSTR-8

TCS credit in GSTR-8

TCS refers to the tax that is collected by the e-commerce operator when a supplier supplies goods and services through their portal, and the payment for that supply is collected by the e-commerce operator. For example, there are many e-commerce operators like Amazon, Flipkart, Paytm, etc. that display on their portal the products and services of other suppliers. When the consumer places an order for the product or service, the supplier supplies it to the consumer. The price of the product or service is collected by the e-commerce operator and passed to the supplier after deducting the TCS at a rate of 1%. The TCS is calculated based on the net value of the goods and services supplied through the e-commerce portal of the operator.

The tax collected at source by the e-commerce operator must be deposited in the government account, and the GSTR-8 must be filed by the 10th of the month following the tax month. After the return is filed and processed in GST, the credit gets auto-populated in Part C of GSTR-2A of the seller in the credit received section. When the seller accepts the entries, a summary is generated, along with the option for him to claim the TCS credit received.

The details of supplies furnished by the e-commerce operator in GSTR-8 will be matched with the corresponding details of outward supplies furnished by the concerned supplier in GSTR-1. If the details match, the tax collected by the operator will be credited to the cash ledger of the supplier who has supplied the goods or services through the operator. The supplier can then claim credit for the tax collected and reflected in the return by the operator.

If there is a mismatch, the GST authorities send notices to the e-commerce operator and the supplier. If this discrepancy is not rectified within the specified time, the amount is added to the output tax liability of the supplier. He then has to pay the difference along with interest. Hence, it is important for the suppliers to ensure that the TCS statements are correctly filed by the e-commerce operators. The GSTR-8, once filed, cannot be rectified. The errors, if any, have to be rectified in the subsequent GSTR-8.

Applicability And Registration Requirements For GSTR-8

Notification authority

An officer not below the rank of deputy commissioner can issue the notice to an operator, directing him to supply the details relating to the volume of the goods or services supplied, the stock of goods remaining at the warehouse or godown, etc. The operator should furnish such details within 15 working days. If he fails to do so, he shall be liable to a fine of Rs. 25000/-, apart from being liable for penal action under Section 122.

TCS certificate

The e-commerce operator is required to issue a TCS certificate to the seller within five days from the date of TCS collection. The seller can claim a TCS credit based on this certificate while filing his GST returns.

The TCS certificate contains the following details:

- Name of the seller and buyer

- TAN of the seller

- PAN of both seller and buyer

- Total tax collected by the seller

- Date of collection

- The rate of tax applied

The tax collected at source is reflected in the electronic cash ledger of the supplier once the GSTR-8 is filed and processed. Then there will be no need to issue the TDS certificate.

Steps involved in filing TCS credit received

The ‘TDS/TCS credit received’ tab gets auto-populated with the details from the GSTR-8 that are filed by the e-commerce operator. The supplier has to check the details entered by the collector with the records at his end and either accept or reject the details. The supplier can avail tax credit only after he follows these steps. The taxpayer has to follow the below steps for the same:

Step 1: Navigate to the GST website and login to the portal with valid credentials.

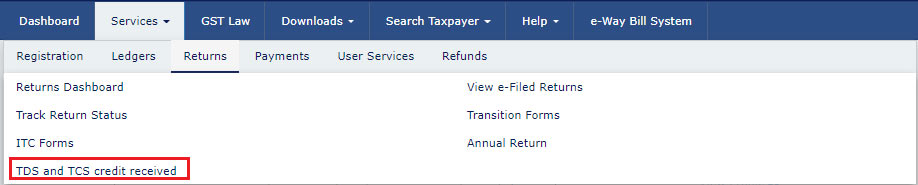

Step 2: Go to Services>Returns>TDS TCS Credit Received tile

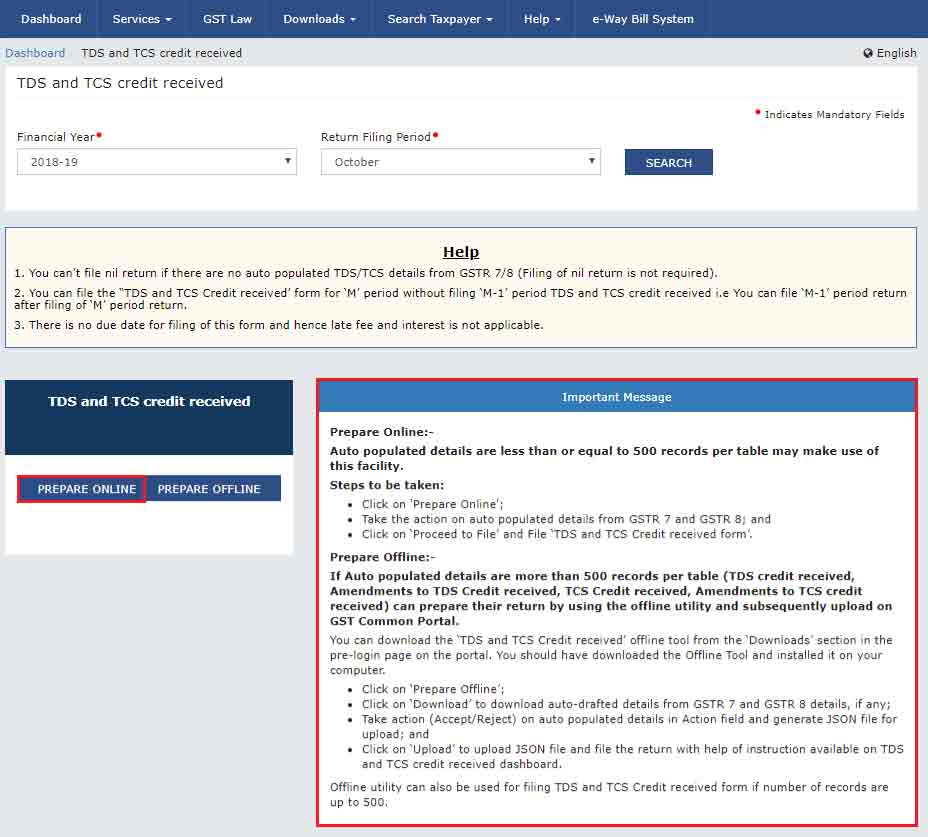

Choose the financial year and return filing period for which the return has to be filed, and click on search. Select the TDS TCS Credit Received and click Prepare Online.

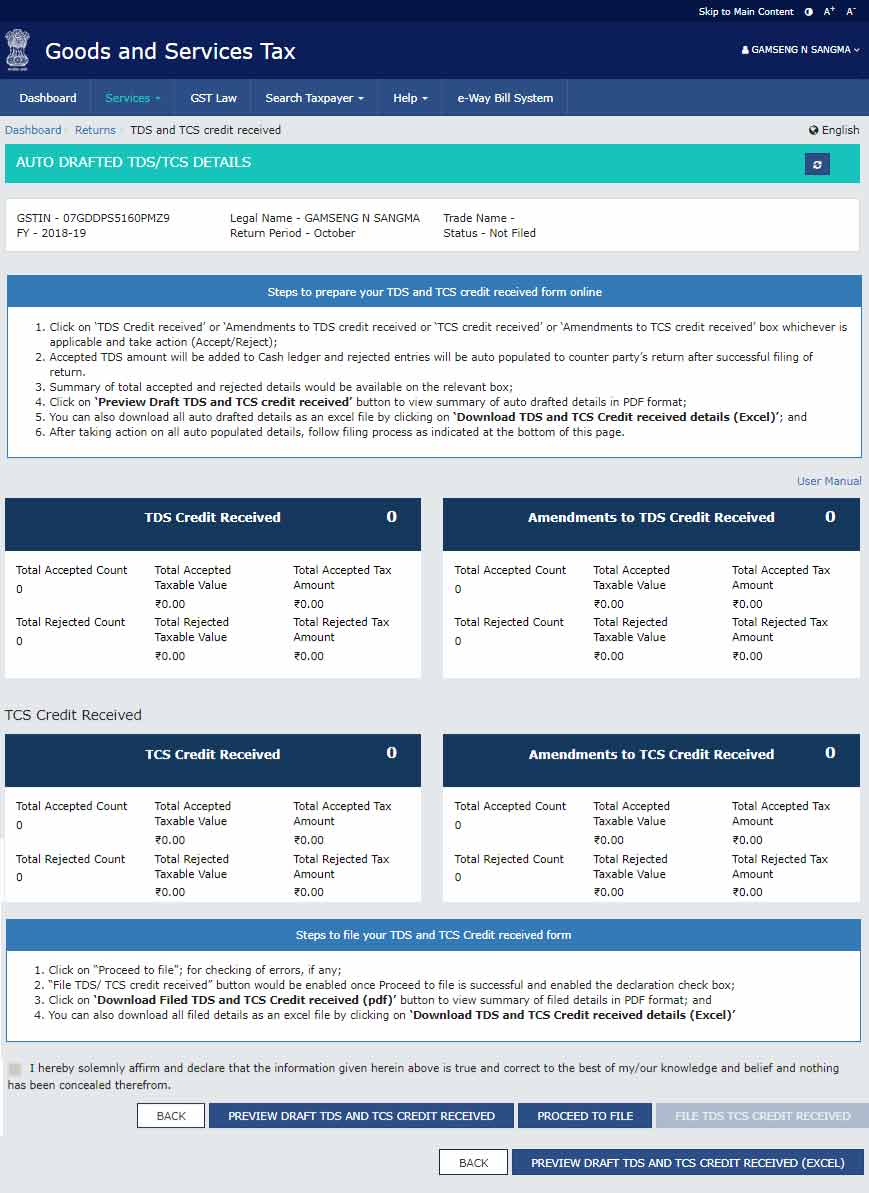

Step 3: After clicking on Prepare Online, four tables will appear on the page with auto-populated details.

1) TDS credit received

2) Amendment to TDS credit received

3) TCS credit received

4) Amendment to TCS credit received

The taxpayer has to take action by accepting or rejecting each record to take credit for TCS allocated to his GSTIN into his electronic cash ledger.

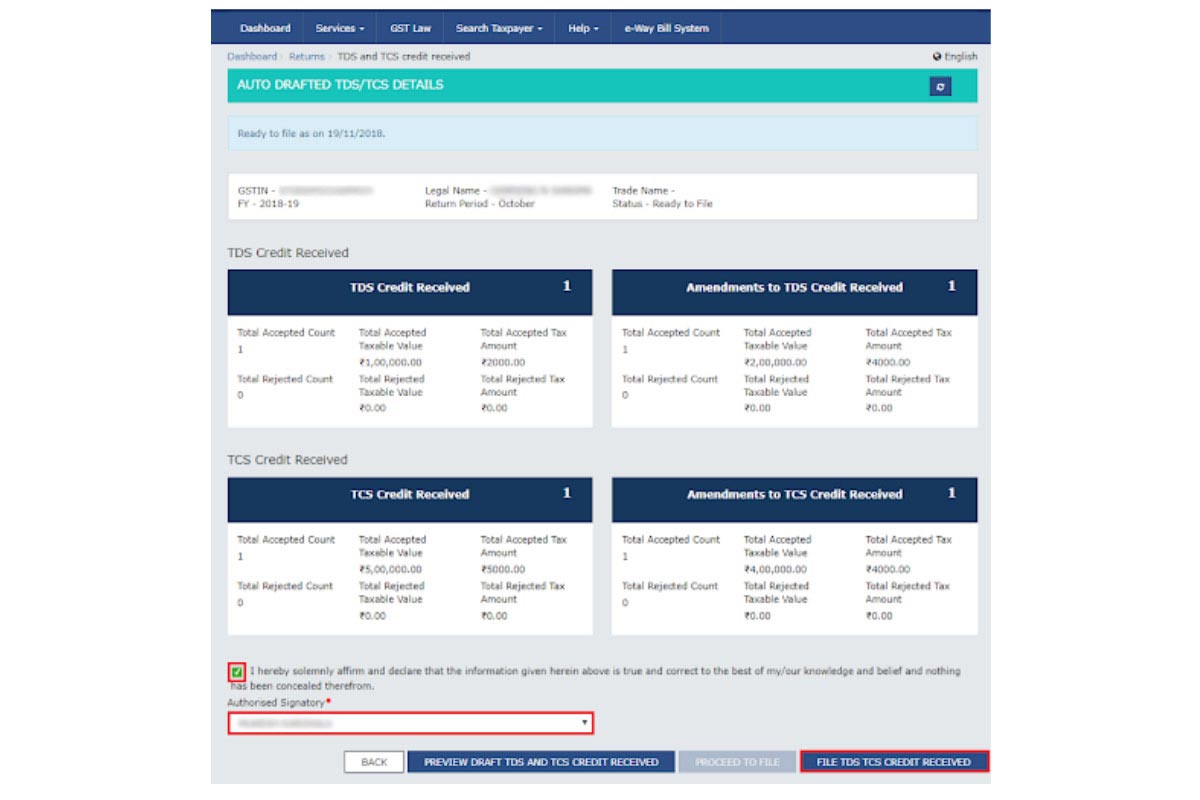

Step 4: Preview, verify the draft form, and proceed to file the details.

After clicking on the proceed to file option, the taxpayer has to submit the declaration and select the authorized signatory from the drop-down list. Then click on the file ‘File TDS/TCS Received’ button by clicking yes on the warning button.

Step 5: Submit the form either using a digital signature or an electronic verification code. The status of the submission turns to filed.

Conclusion

Businesses need to stay updated with the latest regulations and comply with the TCS provisions to avoid penalties and other consequences. By adhering to the GST provisions, businesses can contribute to the development of the economy while enjoying the benefits of GST registration.

Also Listen: Applicability And Registration Requirements For GSTR-8

Frequently Asked Questions?

- What is the rule for a foreign e-commerce operator?

If a registered supplier is supplying goods or services through a foreign e-commerce operator to a customer in India, such a foreign e-commerce operator would be liable to collect TCS on such supplies and would be required to obtain registration in each state or union territory.

- Is TCS applicable for supplies made by composition taxpayers?

Composition taxpayers cannot make supplies through an e-commerce operator.

- Is TCS applicable to supplies on which the recipient is required to pay tax on reverse charge mechanism?

No, TCS is not required to be collected on supplies on which the recipient is required to pay tax on reverse charge mechanism.