In today’s Good and Service Tax regime, the reverse charge mechanism has emerged as a much-talked topic. In general, the supplier of the goods and services pays the service tax, but as per RCM, the liability for tax payment lies with the recipient of the goods and services.

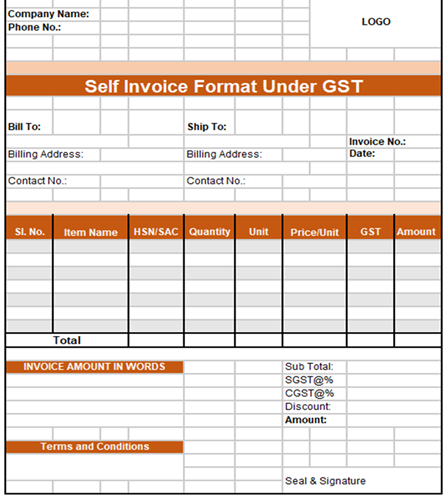

1. Standard tax invoice format for RCM transactions

A GST invoice mentions all the details of the transaction and adds the GST amount, both input tax and output tax. Every business person with GST registration should provide GST invoices to their customers.

Proper maintenance of RCM transactions is extremely important for all types of transactions relating to reverse charges. In particular, every standard RCM invoice should contain the appropriate recipient name, GST number, and other essential information relating to the reverse charge mechanism.

Every RCM invoice should contain the necessary information to ensure the accuracy of every transaction. You should include the following in every RCM invoice format:

- Suppliers’ Name and Address

- GSTIN number of the supplier

- Invoice number and date of transaction

- Name and address of the recipient of goods and services

- GSTIN number of the recipient

- Mention the type of service provided or goods delivered properly.

- Unit or quantity of products sold/purchased.

- Mention the HSN or SAC code in the invoice.

- Rate of tax and accurate calculation of taxable value.

- The amount payable by the recipient

- Signature of the authorized person

You must include the above information in the invoice as per the reverse charge mechanism.

Image- RCM Invoice Format

2. Compliance with tax authority guidelines

Moreover, the GST Council has mentioned necessary rules relating to tax compliance. Therefore, individuals or enterprises dealing under GST rules need to follow the guidelines implemented by the GST Council relating to tax compliance. Additionally, the council has shared the necessary rules relating to the proper and accurate maintenance of GST records. All need to follow the rules relating to

- Raising of GST invoices

- Mentioning the details relating to purchases and sales

- The process to file the tax returns

Many still want to know details about GST compliance. It is a rating process where the government gives a score to every business so that other organizations can check how compliant the company is with the tax authority.

Furthermore, every business organization must follow the compliance guidance mentioned by the GST Council. To stay updated, companies need to check updates relating to GST compliance guidance. Interestingly, the council has classified the compliance rules into three categories, and this compliance relates to registration, tax invoices, and return filing.

Compliance relating to GST Registration

First and foremost, getting registered under GST is the first step in GST compliance. Companies need to log in to the website gst.gov.in and complete the registration process. Importantly, the registration under GST is done based on the annual turnover of every organization.

Compliance to follow relating to Tax invoice

Compliance with the tax invoice is another criterion that every company carrying on business under GST rules should follow. This compliance is necessary to get the input tax credit on time.

At first, every business needs to prepare a pro forma invoice when they start selling their goods and services. It is necessary to incorporate the following details in the invoice:.

- Invoice number and date

- Buyer name

- Delivery and billing address

- GSTIN of the Party

- Destination: the supply

- HSN code (Harmonized System of Nomenclature) or SAC Code (Services Accounting Code)

- Description, type of goods, quantity, number of units, and total worth

- Tax Rate

- Taxable amount and any discount, if applicable

- is a reverse charge applicable to the goods and services?

- Signature of the dealer

Additionally, every business should mention every item with a proper description in the GST invoice to meet the required compliance requirements. Otherwise, if any business does not follow the compliance rules relating to GST invoices, the penalty will be levied as below.

- Rs 10000.00 or 100% of the tax amount, which is higher for non-issuance of tax invoice

- Organizations need to pay Rs 25000 for incorrect invoicing.

Compliance Relating to GST Return

Equally important, every business organization having GST registration should file GST returns within specified times. As outlined in the rules, the returns need to be submitted as per GST guidelines

- Monthly

- Quarterly

- Yearly

Finally, organizations need to submit GST returns depending on the business’s activity. For ease of use, individuals need to fill out the GST returns online.

3. Accurate and complete invoice information

Every invoice prepared under the Reverse Charge Mechanism should be filled out with the utmost accuracy. Specifically, details relating to the name, address, GSTIN number, types of goods supplied, tax rate, and total taxable amount should be entered with the utmost precision.

Furthermore, invoice accuracy ensures that every company follows the required GST rules. In addition, accurate invoice preparation avoids overpayments and duplicate payments as well. As a result, this practice reduces the risk of fraud and other tax complications.

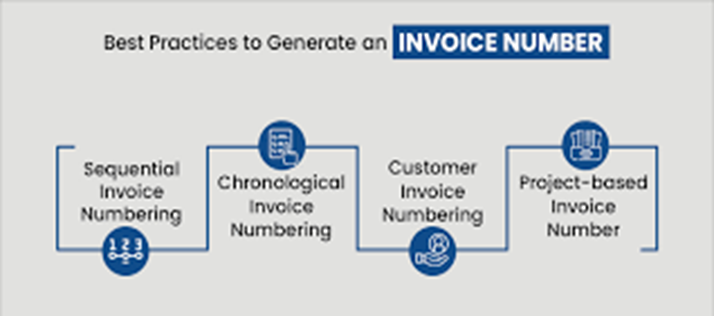

4. Proper invoice numbering and sequencing

Moreover, every invoice should have the necessary and appropriate number. To ensure compliance, the sequencing of every invoice must be maintained. For clarity, one can check the practices of invoice numbering below.

- The invoice number needs to start with a number like 01; 001, etc

- You can also add the date or month following the invoice number

- One should maintain the same sequence in every invoice

5. Maintaining invoice records for audit purposes

It is necessary to generate invoices for audit trails, and this process requires various methods to follow. Therefore, every business organization should take the proper steps to maintain invoices accurately for audit purposes. At present, proper maintenance of invoices can also be done by using advanced software. All can check the below steps to maintain proper invoicing for audit purposes.

- It is always necessary to update the information for audit and taxation purposes. All information should be up-to-date while maintaining the invoice.

- Every receipt and payment invoice should get filed without delay, unless it can cause a delay in the entire audit work. The authorized person should implement a system to file the invoices weekly or biweekly.

- Systematic filing is necessary for all payment and receipt invoices. Invoices should be categorized monthly and yearly. Apart from that, you can also prepare separate files for invoices depending on the category of payment and receipts.

- If you maintain software to prepare invoices, you must take a backup of the software at regular intervals. Moreover, these invoices will be required for audit and tax purposes even after one or two years. Hence, the software should be accessible for the long term.

- Only a fling of invoices is not sufficient. It is necessary to check whether all invoices are sequentially arranged or not.

A brief on the Reverse charge mechanism

GST, or Goods and Services Tax in India, comes with several tax patterns and rates. The Reverse Charge Mechanism, or RCM, is another important part of the Goods and Services Tax, where the recipient of the goods and services is required to pay the tax. As per RCM, the supplier of the goods and services does not need to pay the GST.

Applicability of RCM

The reverse charge mechanism comes into effect when there is a deal between an unregistered dealer and a registered dealer. Additionally, this tax mechanism is applicable in the case of an intra-state transaction. According to the regulations, this mechanism is applicable under sections 9(3), 9(4), and 9(5) as per the Central GST (CGST) and State GST (SGST) Acts.

Next, the suppliers need to mention the details of transactions relating to RCM as per GST Return -1. Specifically, Table 3D of the GST Return-1 is where every supplier needs to report these details. At the same time, the recipient must mention the purchase details as per the invoice in the GST ANX-1.

Once the details are filled out by the recipient, the information will be filled out automatically in Table 3B of the GST Return-1.

Supply of goods and services from Unregistered to Registered dealer

The GST Council has mentioned under Section 9(4) of the CGST Act that a reverse charge is applicable when an unregistered dealer supplies goods to a registered dealer. As outlined in this rule, the recipient of the goods is required to pay the GST in place of the supplier. For this purpose, the registered purchaser needs to do self-invoicing to pay the GST.

Furthermore, in the case of every intra-state purchase, the receiver of the goods and services must pay CGST and SGST under the RCM. Similarly, if the transaction is interstate, the buyer needs to pay the IGST.

Supply of goods and services via an e-commerce operator

At present, all businesses use e-commerce portals to deal with different goods and services. Additionally, transactions via e-commerce portals are attracted by the CGST Act under Section 9(5). Specifically, a reverse charge is applicable if a dealer deals in different types of goods and services through an e-commerce portal.

Also Read: Reverse Charge Mechanism

GST returns to fill

While you are going to fill out GST returns online, it is necessary to understand the type of GST returns available online.

- GSTR1: Business organizations that don’t need to pay any tax to the government need to fill out GSTR 1. Moreover, companies don’t need to pay any tax after filling out this online GST return.

- GSTR 3B: Business organizations need to fill out GSTR 3B to share the summary of GST liabilities during a particular period. The organization provides the details of the outward supplies in the return. Additionally, it calculates the tax liability and claims the input tax credit based on the detailed summary in the GST. Hence, taxpayers should fill out this form with utmost care.

- GSTR 9: Taxpayers whose turnover crosses 2 crores during a financial year fill out this GST return. Taxpayers need to file this return annually. Taxpayers also need to fill in all details of outward supplies made during the financial year. The taxpayers also need to mention the receipt of inbound supplies during the financial year. Then, the tax-payable amount is calculated. GSTR 9 is the consolidated form of GSTR 1, GSTR 2A, and GSTR 3B.

Also Read: GST Return Filing-Types Of Returns And Process Of Filing

Final Thought

As per GST guidelines, reverse charging has emerged as a crucial tool for creating tax compliance and proper collection of revenue. All the required details should be maintained in every invoice for RCM.

While preparing RCM invoices, every company should mention all the necessary and correct details in the invoice. This is necessary to overcome any legal issues and avoid unnecessary penalties.

Also Read: Mandatory Information To Include In A Tax Invoice For Reverse Charge Outward Supplies

Frequently Asked Questions (FAQs)

1. Is GST, as per the reverse charge, considered an input tax?

As per the GST council’s rules, businesses must treat the GST paid under the reverse charge mechanism as input tax. Moreover, they must ensure that the goods and services for which they claim ITC are used only for business purposes.

2. Is RCM applicable to payments made for hiring transport?

As per Section 9(3) of the GST Act, RCM applies to the GTA. So, RCM does not apply to the transport of goods. However, in case of the vehicle taken on rent or lease, RCM will be attracted under section 9(4)

4. Who is responsible for issuing tax invoices under RCM?

The recipients of the goods and services are responsible for issuing invoices under the reverse charge mechanism (RCM). The receiver must mention while filing GST that they have made the tax payment under the Reverse Charge Mechanism.

5. When is ITC claimed as per RCM?

The taxpayer, who pays tax under the reverse charge mechanism (RCM), can claim ITC in the following month. The recipient can take advantage of ITC, or input tax credit. Here, it is necessary to check that all the goods and services should be used for business purposes.

6. Can the RCM invoice be modified?

The invoice format of RCM can modify as per the company’s requirements. It should contain all the necessary information relating to the transactions. Furthermore, the company must follow the RCM invoice format in accordance with the GST guidelines.

7. What will happen if the RCM format is not followed?

As per the GST rule, the RCM invoice format should followed according to the guidelines. If taxpayers don’t follow the rules, then penalties will be levied.