Getting your tax invoices right for goods is more than just paperwork – it’s a crucial part of your financial responsibilities. With tax regulations constantly evolving, it’s vital to stay informed and compliant. This article breaks down the process of creating a tax invoice format for goods, ensuring that you meet all tax invoice compliance standards without any hassle. Whether you’re a seasoned business owner or new to the game, we’ll provide you with clear, concise guidance on how to get your tax invoices spot-on.

| Compliance Focus | Practical Tips | Reason for Importance |

| Invoice Clarity | Use clear, non-technical language for product descriptions. | Ensures the invoice is understandable to both parties and auditors. |

| Digital Compliance | Incorporate digital invoicing with auto-populated fields. | Reduces errors, streamlines process, and ensures accuracy. |

| Tax Detailing | Break down taxes for each item, even if rates are the same. | Facilitates easier tax calculations and audits. |

| Real-Time Updating | Implement systems for real-time invoice generation upon delivery. | Enhances accuracy in billing and reduces delays. |

| HSN Code Accuracy | Regularly update HSN codes as per latest tax norms. | Prevents disputes and ensures compliance with GST updates. |

| Regular Audits | Conduct periodic internal audits of issued invoices. | Identifies and corrects discrepancies promptly. |

| Training and Awareness | Regular training for staff on GST updates and invoice software. | Keeps the invoicing process compliant and up-to-date. |

| Record Keeping | Maintain digital archives of all invoices for the required period. | Ensures availability of records for compliance and reference. |

| Customer Communication | Clearly communicate invoice structure to customers beforehand. | Builds trust and transparency, reducing disputes. |

| Feedback Integration | Incorporate feedback from audits and customer interactions. | Continuously improves the invoicing process and compliance. |

Historical Context of Tax Invoice Compliance

The journey of tax invoice compliance has seen significant changes over the years. What started as a simple documentation process has transformed into a complex system governed by detailed regulations. These changes reflect the government’s efforts to streamline tax processes, prevent fraud, and improve transparency in business transactions.

Analyzing Key Changes in Compliance Standards

Recently, there have been notable amendments in GST laws impacting the format and structure of goods tax invoices. These changes often include modifications in the mandatory fields, adjustments in the GST rate slabs, and updates in the electronic submission process. It’s critical for businesses to stay informed about these changes to ensure their invoicing processes remain compliant.

Understanding these changes is crucial for maintaining compliance:

- Lowered Threshold for E-invoicing: The threshold for mandatory e-invoicing has been reduced, bringing more small and medium-sized businesses under its purview. This means that businesses with a lower annual turnover are now required to adhere to e-invoicing standards, thereby increasing the scope of compliance.

- Introduction of New HSN Codes: Changes in the Harmonized System of Nomenclature (HSN) codes have been implemented. Businesses must ensure that they use the correct HSN codes corresponding to their goods, as these codes play a crucial role in determining tax rates and compliance.

- Revised GST Rate Slabs: There have been adjustments in GST rate slabs for various goods. Businesses need to stay updated on these rate changes to correctly calculate and charge GST, ensuring that their invoices reflect the current tax rates.

- Enhanced Digital Compliance Measures: With an emphasis on digital transactions, there have been updates in the electronic submission process of tax invoices. This includes more robust digital tracking and reporting systems, designed to make the process more efficient and reduce errors.

- Mandatory Fields in Tax Invoices: Recent changes have specified certain mandatory fields that must be included in every tax invoice. This includes detailed descriptions of goods, GST rates, and additional information pertinent to the transaction, ensuring that invoices are more comprehensive and informative.

Each of these points highlights the evolving nature of GST compliance, underscoring the need for businesses to continually adapt their invoicing practices to align with the latest legal standards and technological advancements.

Technology’s Role in Ensuring Compliance

Digital advancements have revolutionized the way businesses approach tax invoice compliance. Modern software solutions now offer features that automatically update formats as per the latest guidelines, ensuring businesses are always on the right side of the law. Utilizing such tools not only simplifies the invoicing process but also significantly reduces the chances of errors.

Here’s how technology plays a pivotal role:

- Automated Format Updates: Advanced invoicing software automatically incorporates the latest GST rules and format changes. This means businesses don’t have to manually update their invoices each time there’s a change in the Format for Goods Tax Invoice, ensuring ongoing compliance with minimal effort.

- Error Reduction: Digital tools significantly reduce human error in invoice creation. Features like auto-population of fields and automatic tax calculations help in Creating a Compliance-Friendly Goods Invoice Format, ensuring that every invoice generated is accurate and compliant.

- Easier Audit and Compliance Tracking: Technology simplifies the tracking of invoices for audit and compliance purposes. Digital records can be easily stored, retrieved, and analyzed, aiding in Meeting Tax Invoice Standards for Goods and providing a clear audit trail.

- Enhanced Efficiency and Time-Saving: The use of technology streamlines the entire invoicing process. From creating to sending out invoices, technology speeds up these tasks, freeing up valuable time and resources that can be better used elsewhere in the business.

By leveraging these technological advancements, businesses can ensure that they are not only meeting the legal requirements for Goods Invoice but are also doing so in the most efficient and error-free manner possible. This adoption of technology is a crucial step in Best Practices for Goods Tax Invoice Formatting and maintaining overall tax compliance.

Step-by-Step Guide to Creating Compliant Invoices

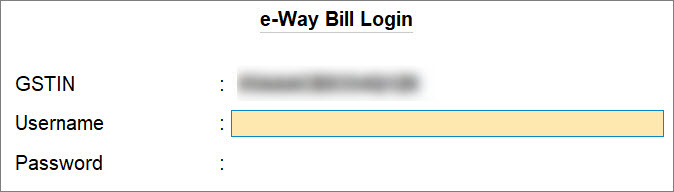

- Start with Accurate GSTINs: It’s imperative to list both the supplier’s and buyer’s GST Identification Numbers (GSTIN) correctly on every invoice. Accurate GSTINs are essential for the legitimacy of the invoice and for enabling both parties to claim Input Tax Credit (ITC) accurately. Errors in GSTINs can lead to compliance issues and complications in tax processing.

- Include Comprehensive Details of Goods: Each item on the invoice should have a detailed description, including the Harmonized System of Nomenclature (HSN) code. This level of detail is necessary for tax categorization and helps in the precise calculation of GST. The inclusion of HSN codes also ensures uniformity in the classification of goods across the GST system.

- Display Tax Rates and Amounts Clearly: Clearly state the Central GST (CGST), State GST (SGST)/Union Territory GST (UTGST), and Integrated GST (IGST) rates, along with their respective amounts. This clarity is essential for transparency in tax liabilities and helps in accurate tax filing and reporting. Misrepresentation or omission of tax rates can lead to legal penalties and accounting discrepancies.

- Adhere to Invoice Numbering and Dating: Invoices should be sequentially numbered and correctly dated to maintain an organized record. Sequential numbering aids in tracking invoices and is crucial for audits and reconciliations. The invoice date is important for determining the tax period and for maintaining an accurate timeline of transactions.

- Incorporate Mandatory Fields: Align your invoices with the latest GST regulations by including all mandatory fields such as supplier details, recipient details, place of supply, and others. These fields are not just formalities but are necessary for the legal validity of the invoice. Regularly updating your invoice format as per GST amendments is crucial to ensure ongoing compliance.

Common Pitfalls to Avoid in Invoice Formatting

When formatting tax invoices for goods, it’s crucial to avoid certain pitfalls that can lead to compliance issues and administrative headaches. Here’s a closer look at these common mistakes and how to steer clear of them:

- Omitting Mandatory Information: One of the most common errors in invoice formatting is the omission of essential details. Every tax invoice must include specific information, such as the GSTIN of both parties, HSN codes of goods, and a detailed breakdown of taxes. Neglecting these vital components can result in a document that fails to meet the Goods Invoice Format requirements, potentially leading to non-compliance with Tax Invoice Compliance Standards. Ensuring that all mandatory fields are accurately filled out is a key aspect of Creating a Compliance-Friendly Goods Invoice Format.

- Inaccurate Tax Calculations: Another critical area is the accurate calculation of taxes. Invoices must reflect the current GST rates applicable to the goods being sold. Errors in tax computation can not only cause discrepancies in financial records but also impact the business’s and its clients’ ability to claim accurate ITC. Regularly updating and verifying tax rates within your invoicing process is essential in Meeting Tax Invoice Standards for Goods.

- Neglecting Timely Updates: The GST laws and regulations are subject to periodic updates and amendments. Failing to promptly update your invoice format to reflect these changes can lead to significant compliance issues. This includes updating the Format for Goods Tax Invoice to incorporate any new mandatory fields or tax rate changes. Staying informed about the latest GST amendments and adapting your invoice format accordingly is a critical Best Practice for Goods Tax Invoice Formatting.

By being mindful of these common pitfalls and taking proactive steps to avoid them, businesses can ensure that their tax invoices are not only compliant but also serve as accurate financial records. This diligence in invoice formatting is crucial in maintaining smooth business operations and upholding compliance standards.

Conclusion

Keeping your tax invoice format for goods in line with compliance standards is a continuous process. It demands diligence, an understanding of legal requirements, and an acceptance of technological assistance. By following these guidelines, businesses can ensure seamless compliance, avoid legal pitfalls, and maintain a streamlined tax process.

Frequently Asked Questions (FAQs)

-

How do recent GST changes affect my goods tax invoice?

Recent GST changes may alter the Goods Invoice Format, especially regarding tax rates and HSN codes. Staying abreast of these changes is vital for maintaining Tax Invoice Compliance Standards, ensuring your invoices accurately reflect current tax laws.

-

What are the best tools for ensuring my invoices are compliant?

Utilizing advanced GST-compliant invoicing software is key for Creating a Compliance-Friendly Goods Invoice Format. These tools automatically update with the latest GST changes, reducing the risk of errors.

-

How often should I review my invoice format for compliance?

Regularly reviewing your Format for Goods Tax Invoice is crucial. Ideally, review your invoice formats quarterly to ensure they align with the latest GST updates and compliance standards.

-

What are the penalties for non-compliant goods tax invoices?

Non-compliance can lead to penalties including fines and delayed ITC claims. Ensuring your Goods Invoice Format meets Tax Invoice Compliance Standards is essential to avoid these consequences.

-

How can I stay updated on future trends in tax invoice compliance?

Stay informed through GST bulletins, professional accounting forums, and tax consultants. This helps in Meeting Tax Invoice Standards for Goods and anticipating future changes.

-

What should I do if I find discrepancies in my invoicing process?

Address discrepancies immediately. Rectify any errors in the Format for Goods Tax Invoice and consult a tax professional if necessary to ensure compliance.

-

Are digital invoices more compliant than paper invoices?

Digital invoices, when created using compliant software, can be more reliable and easier to manage than paper invoices. They offer better compliance with Goods Invoice Format standards due to automated features.

-

What role does the HSN code play in my goods tax invoice?

The HSN code categorizes goods, determining the applicable tax rate. It’s an integral part of the Tax Invoice Components, ensuring accuracy in tax calculations.

-

How crucial is accurate GSTIN in my tax invoices?

Accurate GSTIN is vital in Tax Invoice for Goods for both parties. It ensures proper tax credit claims and legal compliance, playing a critical role in the invoice’s validity.

-

What are some common errors to avoid in goods tax invoice formatting?

Common errors include incorrect GSTIN, missing HSN codes, and inaccurate tax calculations. Avoiding these mistakes is part of Best Practices for Goods Tax Invoice Formatting, ensuring compliance and accuracy.