GST (Goods and Services Tax) is an indirect tax levied upon the trading of goods and services across the country. It was implemented on 1 July 2017 with a vision to apply a “one nation, one tax” system. After the advent of GST, the traditional taxation system has been completely changed. It has replaced various previous taxes such as VAT, service tax, excise duty, etc.

GST in India is a comprehensive, multi-stage, destination-based tax that has subsumed numerous previous indirect taxes. In simple words, GST has widely changed the entire business processes that have developed both ease and difficulty in doing business for MSMEs.

In this article, we have mentioned everything you should know about the tax implications of the new GST regime. Without any delay, let’s dive in !!

The Impact of GST on Micro, Small, and Medium Enterprises (MSMEs)

MSMEs are the actual growth drivers of an economy for any country and contribute significantly to their GDP. The traditional taxation system consisted of multiple taxes that have widely increased the administrative cost of goods manufacturers and distributors.

Similarly, there were heavy-duty taxes over service fields, including IT services, telecommunication services, insurance services, banking and financial services, business support services, and more. GST has both positive and negative aspects for the goods and services field that we’ll see below:

Positive Impact of GST on MSMEs:

We have mentioned some of the genuine positive impact of GST on micro, small, and medium enterprises (MSMEs).

- Ease of starting a business: SMEs generally operate throughout various states of India that require them to have VAT registration. It used to include the different taxation systems of other states in your business processes. Thus, GST has centralized the taxation system, which has eased the process of starting a new business.

- Simplifying tax compliance: GST has directly lowered the tax amounts and made tax compliance easy for SMEs. Moreover, businesses can even pay their taxes and file returns through online mode as well, which saves their time to focus more on the company.

- Enhanced transparency: GST is a centralized system and consists of a streamlined and transparent tax structure. It will reduce the possibility of any possible fraud and corruption.

- Reduced logistics cost: After the advent of GST, multiple entry taxes at regional toll booths have been removed. It has widely impacted the goods transportation between the states within India. Now, you won’t find long queues at the state borders anymore, which saves logistics and petrol costs for businesses.

- No distinction between goods and services: Businesses used to calculate VAT and service tax separately for providing goods and services. Here, GST has eased the entire process by removing the ambiguity between both. No distinction between the two reduces your tax evasion. Therefore, it is the significant impact of GST on micro, small, and medium enterprises (MSMEs).

Negative Impact of GST on MSMEs:

Though GST has been implemented for the benefit of businesses, it, too, has certain negative effects on the MSMEs.

- Pan-India businesses require multiple registrations: In the GST registration, you have to register your business for every state involved in the process. Simplifying it, if your company delivers goods and services across 4 states, then you have to register for GST in all 4 states.

- Technological difficulties: GST has a complete online mechanism, which makes it difficult for MSMEs to file GST returns. Hence, they generally have to outsource it to the CA, which increases the registration cost.

- Compete with large businesses: GST laws and systems are complex. The larger companies have better resources to cope with the GST laws, which creates an unfair advantage for the larger companies. Simply, it creates a negative impact of GST on micro, small, and medium enterprises (MSMEs).

- Monthly returns: In the GST, you have to file around 36 returns in the fiscal year. Here, you have to close your books every month, which takes a lot of time. It is essential to file your returns every month, as you won’t be able to claim your refunds, and your customers won’t be able to claim tax credits until you file the returns. If you miss any return, you will have to pay a penalty of Rs. 100/day.

What is the GST Compliance Checklist for Small Businesses?

GST compliance consists of various rules and regulations for the MSMEs such as file timely returns, make tax payments etc. It helps the MSMEs to maintain a good GST rating that increases the reputation of your business.

To maintain a good rating by the government for your business, you have to follow a compliance checklist. Below, we have mentioned a GST compliance checklist for small businesses that will help you maintain good ratings.

-

Issue GST Invoices

Business owners have to provide GST-issued invoices to all customers for goods and services. In the invoice, you have to mention your GST registration number, issue date, name and address of the customer, brief description of goods & services, and GST rate. Every business has to make sure that their invoices follow all the rules and regulations of GST. Otherwise, any discrepancy or error might lead you to a governmental fine and penalty.

-

Classify Transactions

As per the GST compliance, you have to classify all of your business transactions as “goods” or “services” with the help of HSN/SAC code mapping. You also have to revise your business, as many classifications of “goods and services” have changed in the new GST system compared to the old VAT (Value Added Tax) laws. For instance, restaurants used to be classified under the “goods,” but now they are considered as “services.” Therefore, you should frequently reclassify your items and make required changes in tax rates and exemptions.

-

GST Registration

GST Registration is the foremost step of the GST compliance checklist for small businesses. You can register for the GST only if your company has an annual turnover of Rs. 40 lakhs or 20 lakhs in some states. However, if you’re selling your goods and services in marketplaces such as Amazon, Myntra, and Ajio, you have to register for the GST, no matter what your annual turnover is.

-

Claim Input Tax Credit

Being a registered business, you can claim an input tax credit for anything you’ve purchased for your business. In this way, you can easily reduce your overall GST liability to a certain extent. However, you can claim input tax credit only if your supplier has filed their GST returns and you’ve included the purchase in your GST returns.

-

File GST Returns

If you’re running a registered business, you have to file the GST returns on a monthly, quarterly, or annual basis. It totally depends upon your business’s overall turnover. Also, make sure to file the returns on time. Otherwise, you have to bear penalties or temporary/permanent registration cancellation.

10 Simple Steps of GST Registration Process for New Businesses

Here are the ten simple steps to register your business for the GST. Just follow the process step-by-step, and you will get your registration on time.

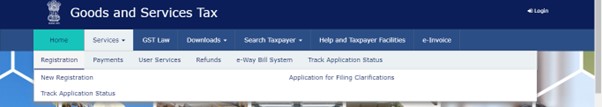

Step 1: Visit Official GST Portal

First, you have to visit the main GST portal through https://www.gst.gov.in/. Open the “Services” section and tap on the Registration and then New Registration option.

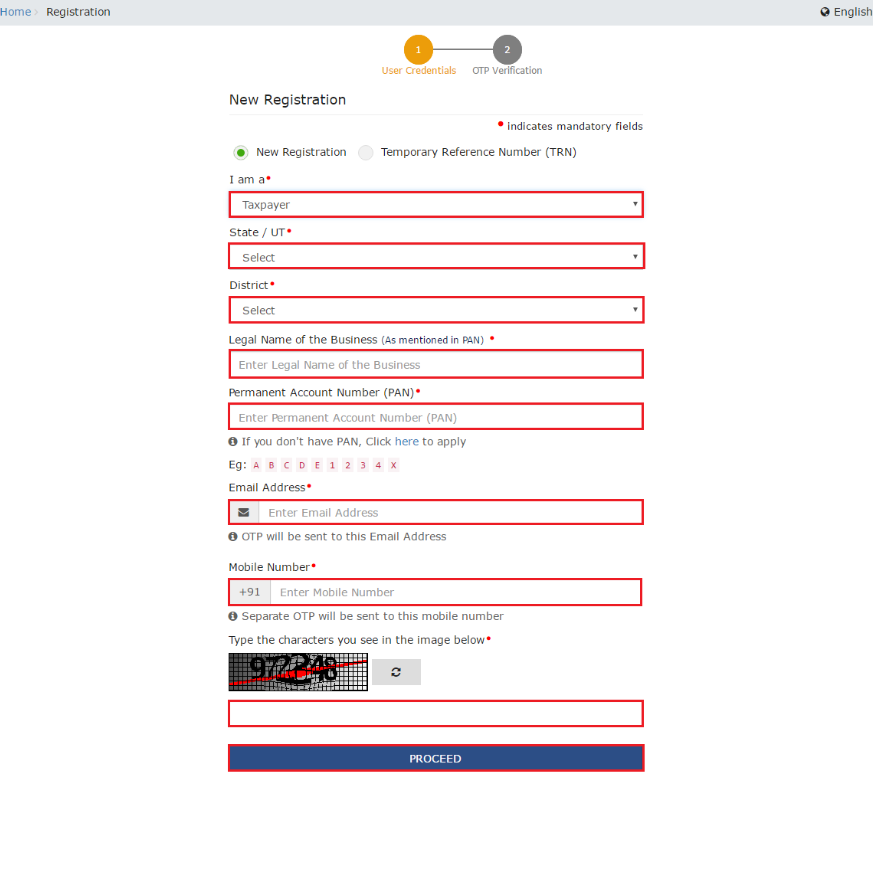

Step 2: Generate TRN Number

Now, you can see the registration form on your display. It is Part A of the GST REG-01 form, where you have to fill up all your required details mentioned below:

- Choose Taxpayer in the first blank.

- Fill up the state in which you belong or will start your business.

- Write down your business name as per the PAN card. The GST portal will automatically verify the PAN card details.

- Fill up the PAN number of the business or proprietor in this section.

- Enter the email of the on-paper owner or who has signatory authority.

- Finish the process by tapping on the Proceed button.

After confirming the proceeding, you will receive an OTP verification code over your validated email address and mobile number to complete your verification on time.

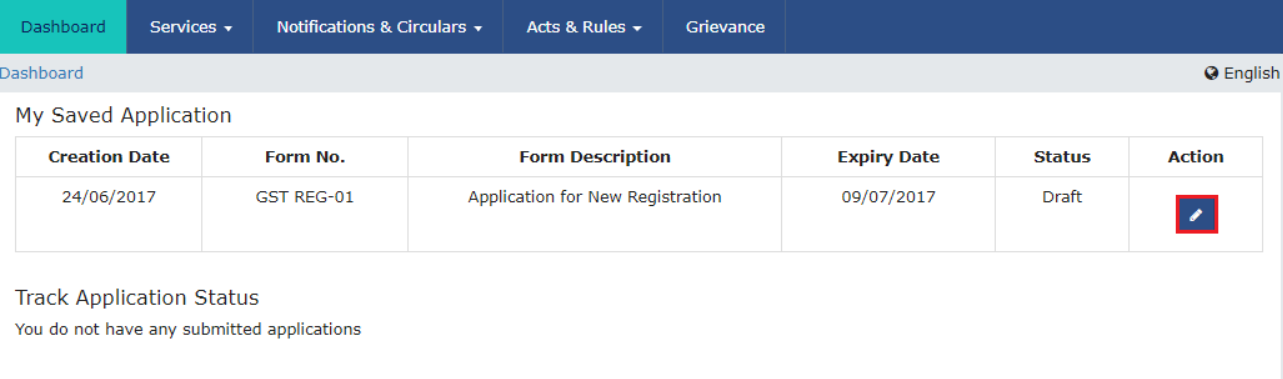

Step 3: Start GST Registration with TRN Number

Step 3: Start GST Registration with TRN Number

When you successfully verify the OTP, a TRN (Temporary Reference Number) will be generated. Once you get the TRN number, you can start your GST registration procedure over the portal.

Simply write down your TRN number and fill up the required captcha. You might also need to complete the OTP verification again.

Click on the red marked icon mentioned in the above picture to begin the GST registration.

Click on the red marked icon mentioned in the above picture to begin the GST registration.

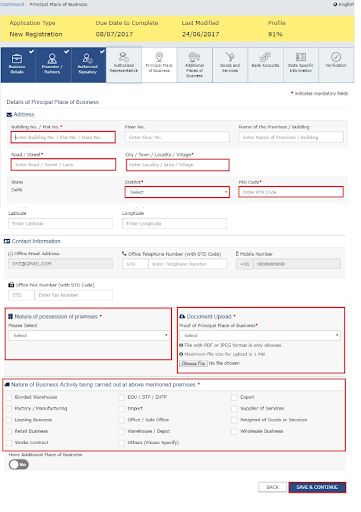

Step 4: Submit Business Details

While registering for GST, you have to submit various information regarding your business. You will see several blocks to fill up the required details, as mentioned in the below image.

Among all these blocks, you just have to choose the right fit for your business among the list provided.

Among all these blocks, you just have to choose the right fit for your business among the list provided.

Step 5: Submit the Information Regarding Promoters

Now, a tab will come where you must fill in the information regarding your company’s promoters and directors. If you’re registering for proprietorship, you should submit complete information regarding the proprietor.

Here’s the details mentioned that you have to submit about the promoters:

- You have to submit their personal information, including their name, gender, DOB, address, phone number, and email address.

- Fill up their designation.

- You might also need to share the DIN of Promoters for certain companies such as Private Limited Companies, Public Limited Companies, Unlimited Companies, Public Sector Undertakings, and Foreign companies registered in India.

- Take their citizenship details, PAN card, and Aadhaar card.

Moreover, If you’re providing the Aadhaar card, you can simply use the Aadhaar e-sign rather than a digital signature. It will make things simpler for you.

Step 6: Submit Information Regarding the Authorized Signatory

An authorized signatory is elected or nominated by all the promoters or partners of the company. This person will have the main responsibility of filing the GST returns on behalf of the company. He/She also has to handle all the necessary compliance of the company and has complete access to the GST portal to make any amount of transactions on behalf of the company.

Step 7: Principal Place of Business

The principal place of business means the main location within the mentioned State where you will operate your business. It helps to address the account books and records. Thus, if you’re going to register your company or LLP for the GST, it should have a registered office as a principal place of business.

Here, we have mentioned the following requirements for the principal place of business:

- Address of principal place of business.

- Contact details include Email Address, Telephone Number, Fax Number, and Mobile Number. Make sure also to provide the STD Code with your telephone number.

- Nature or possession of premises.

If you have set up the main office of your business in SEZ (Special Economic Zone) or work as a developer there, you have to submit all the relevant and required documents and certificates. You can upload them through your GST portal by selecting “Others” as a nature of possession of premises.

This section requires you to upload the necessary documents that prove ownership and occupancy. Here, we have mentioned three major documents that you have to submit.

- Own premises: You need to upload the documents that show your premises ownership, such as the Latest Property Tax Receipt / Municipal Khata copy / Electricity Bill.

- Rented or Leased premises: You can also upload a copy of a valid Rent / Lease Agreement attached with any document that shows the premises ownership. For instance, you can attach any document mentioned in the above pointer.

- Premises not covered above: You can also upload a copy of a consent letter and the premises ownership document. It might be required to upload the same documents for the shared properties.

Step 8: Enter the Additional Place of Business and Submit the Code

In this section of the portal, you have to upload the additional Place of Business. In simple words, if you’re a seller on any e-commerce platform or use the seller’s warehouse, you can add it as an additional place of business while filing your GST.

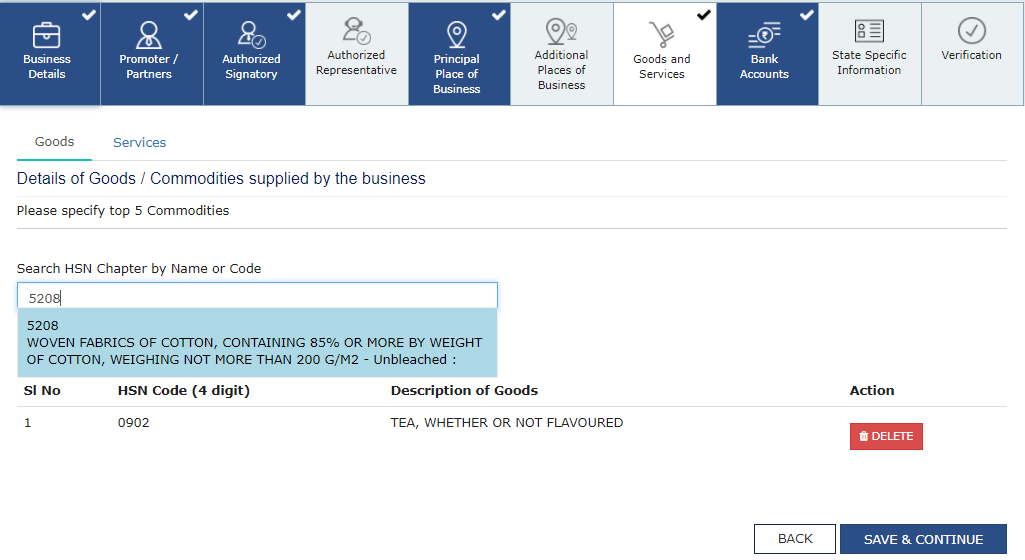

Next, you have to take your five best goods and services and submit their required codes. For goods, you have to enter the HSN code, and for services, you have to enter the SAC code.

Step 9: Fill Up Bank Details and Complete Verification

In this section, you have to write down your current number of bank accounts. Then, you have to fill up your relevant bank details such as a/c number, IFSC code, type of account, and more. You also have to upload your bank statement and passbook.

When you fill up all the details, it is time to verify them and tap on the verification checkbox. Then you have to fill up basic information such as choosing authorized signatory name, the name of the place where you have filled out your form, and end the process by digitally signing the application.

Step 10: ARN Generated

You will receive a success message over your required email address or mobile number when this signing up process finishes. In the message, you will get the ARN receipt that will allow you to track your application status anytime you want.

GST Tax Rate Change Under New Regime In 2023

GST has been introduced in India to structure its overall taxation system and reduce the multiple taxes. They have divided the taxes into five basic slabs including NIL, 5%, 12%, 18%, and 28%. The entire GSt process is regularly reviewed and improved by the GST council. Higher amount of GST is imposed on luxury items and lower amount imposed on the necessary items.

GST rates have been recently revised in the 41st GST Council Meeting held on Aug 27, 2020. Below, we have mentioned all the rates of goods and services under all slabs.

| Products | Tax Rate |

| Salt | 0% |

| Gur | 0% |

| Fresh Vegetables | 0% |

| Kajal | 0% |

| Eggs | 0% |

| Lassi | 0% |

| Health Services | 0% |

| Education Services | 0% |

| Curd | 0% |

| Unpacked Foodgrains | 0% |

| Unbranded Natural Honey | 0% |

| Unbranded Atta | 0% |

| Unbranded Maida | 0% |

| Besan | 0% |

| Milk | 0% |

| Phil Bhari Jhadoo | 0% |

| Palmyra Jaggery | 0% |

| Prasad | 0% |

| Unpacked Paneer | 0% |

| Children’s Drawing and Coloring Books | 0% |

| Products | Tax Rate |

| Fabric | 5% |

| Spices | 5% |

| Milk Food for Babies | 5% |

| Cashew Nuts | 5% |

| PDS Kerosene | 5% |

| Domestic LPG | 5% |

| Packed Paneer | 5% |

| Coal | 5% |

| Tea | 5% |

| Sugar | 5% |

| Coffee (except instant) | 5% |

| Agarbatti | 5% |

| Coir Mats, Matting, & Floor Covering | 5% |

| Life-Saving Drugs | 5% |

| Apparels (< Rs.1000) | 5% |

| Skimmed Milk Powder | 5% |

| Roasted Coffee Beans | 5% |

| Mishti/Mithai (Indian Sweets) | 5% |

| Raisins | 5% |

| Edible Oil | 5% |

| Packed Paneer | 5% |

| Products | Tax Rate |

| Computer | 12% |

| Umbrella | 12% |

| Almonds | 12% |

| Ghee | 12% |

| Butter | 12% |

| Mobile | 12% |

| Fresh Juice | 12% |

| Processed Food | 12% |

| Packed Coconut Water | 12% |

| Preparations of Vegetables, Nuts, Fruits, or other parts | 12% |

| Packed Coconut Water | 12% |

| Products | Tax Rate |

| Pasta | 18% |

| Soup | 18% |

| Toothpaste | 18% |

| Computers | 18% |

| Printers | 18% |

| Toiletries | 18% |

| Soap | 18% |

| Hair Oil | 18% |

| Icecream | 18% |

| Capital Goods | 18% |

| Corn Flakes | 18% |

| Industrial Intermediaries | 18% |

| Products | Tax Rate |

|---|---|

| Beedis are NOT included here | 28% |

| High-end Motorcycles (+15% cess) | 28% |

| Small Cars (+1% or 3% cess) | 28% |

| Consumer Durables such as AC and Fridge | 28% |

| Luxury and Sin Items Like BMWs, Cigarettes | 28% |

| And Aerated Drinks (+15% Cess) | 28% |

What are the GST Return Filing Deadlines for Small Businesses?

Here, we have mentioned all types of GST returns along with their generally required deadlines.

- GSTR-1: It is a monthly GST return filed by regular taxpayers to report their outward supplies. Generally, it is filed by the 11th of next month. Moreover, you can also file this tax quarterly if your overall turnover remains less than 1.5 Cr in the previous financial year. In the quarterly GST filing, you have to file the returns by the end of the month succeeding the quarter.

- GSTR-3B: It is a monthly GST return filed by the regulator’s taxpayers to declare someone as the summary of outward supplies, input tax credit, tax liability, and taxes paid. You have to file this return by the 28th of next month. You can also file this return if you come under the QRMP scheme.

- CMP-08: It is a statement-cum-challan filed by the taxpayer, registered under Section 10 of the CGST Act, on a quarterly basis to make the tax payment. This return has to be paid by the 18th of the month.

- GSTR-4: This return is annually filed by the taxpayer registered under the composition scheme to declare their yearly business. Here, you have to be registered under Section 10 of the CGST Act. It has to be paid by the 30th of the month, succeeding the financial year.

- GSTR-5: This return is filed by the non-resident taxable person to declare their outward supplies, inward supplies, credit/debit notes, tax liabilities, and taxes paid. This is supposed to be paid by the 20th of next month. However, it has been amended to 13th by budget 2022, which is still required to be notified by the CBIC.

- GSTR-5A: It is a monthly return filed by the non-resident OIDAR service provider by the 20th of next month.

- GSTR-6: The Input Service Distributor (ISD) has to fill out this return to declare the documents issued for the distribution service and the manner of distribution. It is also paid on a monthly basis on the 13th of next month.

- GSTR-7: It is a monthly return filed by the person required to deduct TDS to declare the details regarding TDS deducted, TDS collected, TDS paid, and TDS refunded (if needed). It is paid by the 10th of next month.

- GSTR-8: All e-commerce operators have to file this return to declare the information of all the supplies made through the e-commerce platform and TCS collected. It is also paid on a monthly basis, as it is on the 10th of every month.

- GSTR-9: All the regular taxpayers have to declare details regarding the inward supplies, outward supplies, ITC claims, ITC reversals, taxes paid, tax liability, and the relevant previous financial year. The due date is 31st December of the next financial year.

- GSTR-9C: It is an annual reconciliation statement between audited financial statements and GSTR-9. Taxpayers who have more than 2 Cr. of turnover in a financial year have to file this return. You have to pay it by 31st December of the next financial year.

- GSTR-10: It is a return filed by the taxpayer whose GST registration is canceled or surrendered. You can file this return within 3 months of the date of cancellation or date of cancellation order, depending upon which one is later.

- GSTR-11: It is a monthly return to be filed by the person with UIN and claiming a refund to declare the details of inward supplies to be furnished. You have to file this return by the 28th of the month following the month for which the statement is filed.

- ITC-04: It is a statement to be filed by a principal and job worker to declare the details of goods sent to or received from a job worker. It can be filed annually if your AATO (Annual Aggregate Turnover) is up to 5 crore., or half-yearly if less than 5 crore. You have to file this return by the 25th of April in the yearly condition. At the same time, you have to file this return by 25th October and 25th April in the half-year condition.

GST Return Filing-Types of Returns and Process of Filing

Conclusion

GST is taking the country to the “One Nation One Tax” system, and it has drastically eased the taxation process for micro, small, and medium businesses. Now, any new business can quickly get the registration just through an online portal, which doesn’t make them wait standing in hourly queues. In fact, the GST has eased previous multiple tax processes, such as VAT. However, the technicalities and regularities of GST laws and compliance create a few issues for MSMEs. We hope this guide helps you know all the essential things about the GST.

Frequently Asked Questions

Q.1 How much GST is imposed on the MSME sector?

The MSME sector has to pay the GST based upon the slab of 0%, 5%, 12%, 18%, and 20%. The exact slab is selected by the type of business you’re currently running.

Q2. Is GST applicable on MSME?

GST is applicable over any of the businesses whose annual aggregate turnover is up to Rs. 40 lakh or Rs. 20 in certain states. The taxation system that is essential for all the businesses in the country who can help in the growth of the economy.

Q3. How can you check my GST compliance?

You can easily check your GST compliance by using the Goods and Services Tax Identification Number (GSTIN). It allows you to check your GST ratings over the internet.

Q4. What is the GST compliance penalty?

GST compliance penalty is for those who are unable to make the tax payment or make short-term payment. You have to pay Rs. 10,000 minimum or 10% of your total unpaid taxes in the maximum situation.

Q5. What are the stages involved in GST?

From obtaining raw materials to providing the final products to the end consumers, you have to pay the GST on all the stages of the supply chain of your business. Government takes the GST at every level of business.

Q6. Can I get GST without any shop?

GST sees no difference between commercial and residential places. Thus, you can get the GST number by providing address proof under Reg 01, such as the electricity bill plus NOC.

Q7. What is the new tax regime for 2023-24?

Tax regime has changed for 2023-24 based upon the recent amendments and meetings. We have mentioned them below:

- NIL – Up to Rs. 3 lakh

- 5% – Ranges between 3-6 lakh

- 10% – Ranges between 6-9 lakh

- 15% – Ranges between 9-12 lakh

Q8. What are the benefits introduced under the new tax regime?

Budget 2023 introduced three new deductions: a standard deduction of Rs. 50,000 under the New tax regime applicable from FY 2023-24, a deduction under Section 57(iia) / family pension income, or a deduction of the amount deposited into Agniveer Corpus Fund under section 80 CCH(2).

Q9. Does GSTR-1 have a monthly or quarterly limit?

GSTR-1 has set up the quarterly limit for the businesses having the turnover lower than 1.5 crore and monthly limit for the businesses having the turnover more than 1.5 crore. You have to file it by the 11th of next month.

Q10. Is GST monthly return mandatory?

GST returns are mandatory to be filled monthly, quarterly, or annually based on the business.