I. Introduction

Goods and Services Tax registration is a basic requisite for businesses operating within India, acting as a gateway to legitimate business operations under the GST framework. However, there are scenarios where businesses might need to consider either surrendering or cancelling their GST registration. This could be due to a variety of reasons, ranging from strategic business decisions to mandatory compliance requirements.

In this blog, we will understand the reasons behind the surrendering of GST registration and the GST registration cancellation process, exploring both the procedures involved and the impacts on the business. We aim to provide a comprehensive overview that helps businesses understand when and how to approach these decisions responsibly and the GST registration closure procedure, ensuring compliance and minimising potential disruptions to their operations.

II. Reasons for Surrendering GST Registration

Whether due to regulatory shifts, business scale, or operational changes, the reasons behind this decision are varied and carry important implications for compliance and financial management. Let’s explore these reasons in detail to understand when and why a business might decide to take this step:

- Threshold Limit: For many businesses, falling below the GST threshold limit presents a practical reason to surrender their GST registration. This move can simplify tax obligations and reduce administrative burdens, especially for small businesses or those experiencing a downturn.

- Business Closure: The discontinuation or closure of a business necessitates the surrendering of GST registration. It’s a procedural step that legally closes the business’s tax files with the authorities, ensuring that no further GST obligations are accrued.

- Change in Business Model: Significant changes in the business model, such as shifting from taxable to exclusively non-taxable goods or services, can render the maintenance of a GST number unnecessary and cumbersome. In such cases, businesses might opt for voluntary surrender of GST registration to align their compliance status with their operational reality.

- Voluntary Surrender: There are instances where businesses choose to surrender their GST registration voluntarily, even if not compelled by law. This decision might be driven by the desire to simplify operations or due to changes in the business environment that make compliance more challenging than beneficial.

III. Steps to Surrender GST Registration

Initiation

The process of surrendering GST registration begins by the business owner deciding to cease GST operations. This can be initiated through the GST portal by logging into the taxpayer’s dashboard. It is crucial to ensure that all pending returns are filed and any outstanding tax payments are cleared to avoid complications during the surrender process.

Documentation

To surrender GST registration, the following documents and information are generally required:

- A written application stating the reason for the surrender.

- Copies of the GST registration certificate.

- Details of stocks, including inputs and capital goods, held on the date when the surrender is applied for, along with the respective tax invoices.

- Latest tax paid receipt.

Online Submission

Here is a step-by-step guide on submitting the surrender application through the GST portal:

- Login to the GST portal and navigate to the ‘Services’ section.

- Select ‘Amendments’ and then choose ‘Surrender GST Registration’.

- Fill in the required fields, attach necessary documents, and submit the form.

- Confirm the submission with appropriate verifications, such as an OTP or digital signature.

Follow-up

After the surrender application is submitted, the GST authority will verify the details and documents provided. If there are open tax liabilities or credits, the business must settle these according to GST norms. Once all conditions are met, the GST authority will approve the surrender, and the GSTIN will be cancelled officially.

IV. Process of Cancellation of GST Registration

Understanding the GST registration cancellation process is crucial for compliance. Whether it’s a voluntary surrender of GST registration or an authority-initiated cancellation, each scenario has specific surrendering GST registration requirements that must be met to ensure a smooth GST registration closure procedure and mitigate the impact of cancelling GST registration on the business’s operations.

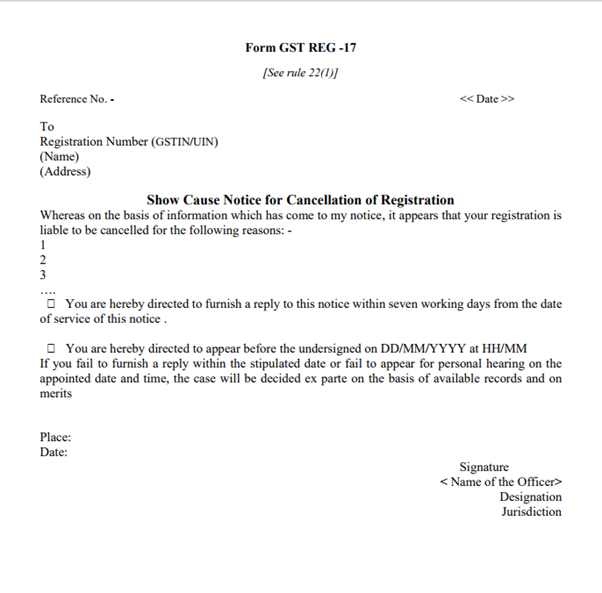

Authority-Initiated Cancellation

The GST authority may cancel a registration due to non-compliance or discrepancies, such as:

- Non-filing of returns for a specified period.

- Violation of GST regulations.

- Fraudulent activities detected during audits.

- In such cases, the authority sends a notice to the registered entity, demanding an explanation before proceeding with cancellation.

Business-Requested Cancellation

Businesses may request cancellation of their GST registration directly via the GST portal. The steps involved are:

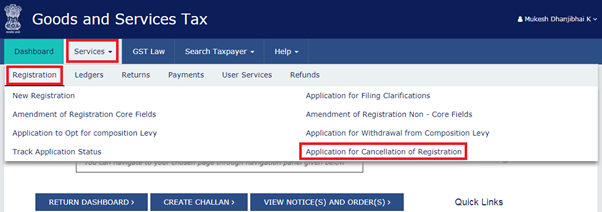

- Log into the GST portal.

- Navigate to the ‘Services’ section and select ‘Cancellation of Registration’.

- Fill in the required details, state the reason for cancellation, and submit any required documents.

- Submit the application and wait for the confirmation from GST authorities.

Legal Implications

The legal framework for the cancellation of GST registration ensures transparency and fairness in the process. Businesses must understand that once their registration is cancelled, they are no longer eligible to collect GST from customers or claim input tax credits. Legal implications also include the need to maintain financial records for a specified period post-cancellation for audit purposes.

V. Impact of Surrendering or Cancelling GST Registration

Financial Implications

When a business decides to surrender or cancel its GST registration, it directly impacts its financial operations. The immediate effect is seen in tax liability adjustments; the entity is no longer required to collect GST, which may alter pricing strategies and affect revenue. Additionally, the business must ensure that all due tax credits are claimed and any outstanding liabilities settled before the cancellation is finalised. Failure to manage these financial adjustments correctly can lead to monetary losses or penalties.

Operational Impact

The operational changes following the surrender or cancellation of GST registration are significant. For instance, the business can no longer issue GST invoices, affecting how billing and contracting are handled. This shift may require adjustments in business models, especially for B2B companies, where clients often require GST-compliant invoices to claim tax credit themselves.

Compliance Changes

Post-cancellation, the compliance requirement for the business changes. The entity must file a final GST return, often referred to in the GST registration cancellation process, which is an essential part of the GST registration closure procedure. Additionally, businesses must retain their financial records for a specified period, as stipulated by GST law, for potential audits by tax authorities.

Long-Term Effects

Long-term effects of not being a GST-registered entity can be both advantageous and limiting. On one hand, the business is relieved from the constant compliance requirements, such as periodic GST filings and audits, which reduces administrative burden. On the other hand, it might lose competitive edge in markets where being GST registered is seen as a sign of credibility and reliability.

VI. Conclusion

In summary, surrendering or cancelling GST registration is a significant decision that impacts a business’s finances, operations, and compliance obligations. Understanding the requirements and processes for both surrendering and cancelling registration is crucial to ensure that businesses remain compliant and manage transitions smoothly. Given the complexity and potential long-term effects, it is highly recommended that businesses seek expert advice before choosing to surrender or cancel their GST registration.

VII. Frequently Asked Questions (FAQs)

-

What are the steps involved in the GST registration cancellation process?

The GST registration cancellation process involves submitting an application on the GST portal, providing necessary documentation, and fulfilling any pending tax liabilities. After submission, the GST authorities review the application, and if everything is in order, the cancellation is approved, typically within 30 days.

-

What are the requirements for surrendering GST registration?

Surrendering GST registration requires meeting specific criteria such as business closure, turnover below the threshold limit, or changes in business structure that exempt you from GST. The business must ensure all tax liabilities are cleared and submit the final GST returns alongside the surrender application.

-

How can a business voluntarily surrender its GST registration?

A business can opt for voluntary surrender of GST registration by logging into the GST portal and filing an application with reasons for the surrender, such as discontinuation of business or turnover falling below the prescribed threshold. This should be accompanied by necessary documents like pending returns and tax payment proofs.

-

What is the impact of cancelling GST registration on a business?

Cancelling GST registration can relieve a business from the duty of filing monthly returns and managing compliance obligations associated with GST. However, it also means the business cannot claim input tax credits and might affect their credibility with B2B customers who benefit from those credits.

-

What is involved in the GST registration closure procedure?

The GST registration closure procedure involves submitting a cancellation request via the GST portal, clearing any outstanding tax liabilities, filing all due returns, and providing necessary documentation to substantiate the reasons for closure, such as proof of business cessation or turnover records.

-

What happens after a business applies for GST registration cancellation?

After a business applies for GST registration cancellation, the GST authorities review the application to ensure all tax liabilities are cleared and all necessary documents are submitted. If approved, the cancellation becomes effective from the date specified in the application, and the business is notified about the status.

-

Are there any penalties for not following the proper GST registration cancellation process?

Yes, failing to follow the proper GST registration cancellation process can result in penalties. These can include fines for non-compliance and continued liability to pay GST as per statutory requirements until the registration is officially cancelled.

-

Can a business reactivate its GST registration after voluntary surrender?

Yes, a business can reactivate its GST registration after a voluntary surrender if it meets the eligibility criteria for registration again. The business would need to apply afresh for GST registration through the GST portal.

-

What documents are needed to surrender GST registration?

Documents required for surrendering GST registration typically include a copy of the original GST registration certificate, relevant financial documents showing the last date of business or reduced turnover, and any pending GST returns.

-

How long does it take to complete the GST registration closure procedure?

The time to complete the GST registration closure procedure can vary but usually takes about 30 days from the date of application, provided all documents are in order and no discrepancies need to be resolved.