The composite scheme It’s like a tax shortcut. Small businesses opt for this to simplify their tax process. They pay a fixed amount of tax based on their sales turnover. They don’t have to worry about claiming tax credits on what they buy – it’s a straightforward deal. So, why was this scheme brought in? Well, the idea is to reduce the burden on small businesses. You know, those local shops, small restaurants, and other tiny businesses that don’t have loads of time or resources to deal with complex tax stuff.

The Composition Scheme is mainly for businesses with not-so-huge turnovers. It’s kind of a special deal for the little guys. They can opt for this scheme and pay taxes at a fixed rate without going through all the detailed accounting and record-keeping that bigger businesses have to do.

Small business can benefit from this scheme like they get a break from the headache of keeping track of every little detail. Instead of dealing with lots of paperwork, they just pay a set percentage of their sales as taxes. It’s simpler and can be a relief for businesses with tight budgets and not a lot of time on their hands.

You must have one question, how is this different from regular GST? Well, in the normal GST system, businesses need to keep detailed records of everything they buy and sell. It’s a bit like keeping a diary of every transaction. But with the Composition Scheme, it’s more like a flat-rate deal. Small businesses get to keep it simple and focus on running their show without getting caught up in tax complexities.

Let’s understand the benefits, eligibility criteria, procedures and many more!

Benefits of composition scheme for small businesses

-

Reduced Compliance Burden:

- Small businesses often lack the resources for extensive record-keeping and complex tax calculations. The Composition Scheme significantly reduces the compliance burden by streamlining reporting requirements.

-

Fixed Tax Rates:

- Instead of dealing with fluctuating tax rates, businesses under the Composition Scheme pay taxes at a fixed percentage of their turnover. This provides predictability, making it easier for small businesses to plan and manage their finances.

-

Increase Liquidity:

- With predictable tax liabilities and reduced administrative overhead, businesses can better manage their cash flow, ensuring they have more resources available for day-to-day operations.

-

Benefits of Paying a Fixed Percentage Instead of Regular GST:

- Paying a fixed percentage of turnover provides businesses with stability and predictability in their tax payments. This contrasts with the regular GST system, where tax rates can vary, leading to uncertainties in financial planning.

-

Simplified Record-Keeping:

- Businesses under the Composition Scheme are not required to maintain detailed invoices and records, simplifying their record-keeping processes. This reduction in paperwork is particularly advantageous for businesses with limited administrative capabilities.

Also Read: GST Registration – Who Can Opt For The Composition Scheme?

Eligibility criteria for composition scheme under GST

If your business makes less than Rs. 1.5 crore a year (or Rs. 75 lakh in special states), you can choose this scheme.

- Service providers, excluding restaurants, can join if their yearly turnover is up to Rs. 50 lakh.

- But, some suppliers can’t use this scheme, like:

- People providing services (except for food places like hotels).

- Makers of certain goods like ice cream or tobacco.

- Those who sell things between states.

- People who sell through online platforms.

- Temporary or non-local sellers.

- Buyers from unregistered sellers (unless they already paid GST).

- People not taxed under CGST/SGST/UTGST Act.

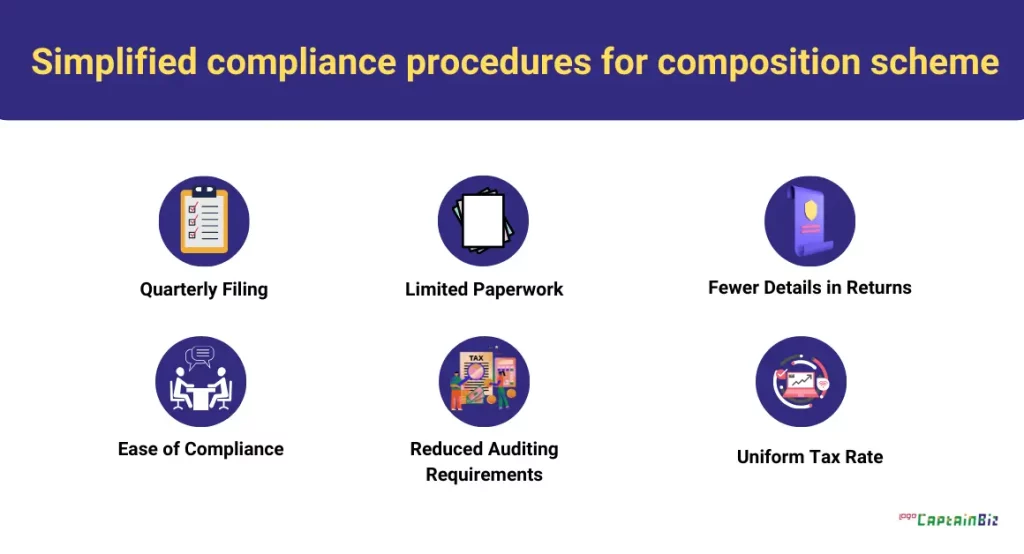

Simplified compliance procedures for composition scheme

Under the GST composition scheme, small businesses benefit from streamlined compliance procedures, offering a more straightforward approach to meeting their tax obligations. The key aspects include:

-

Quarterly Filing:

- Unlike regular taxpayers who file monthly returns, businesses under the composition scheme file simplified returns on a quarterly basis. This reduces the frequency of compliance activities, easing the administrative burden on small enterprises.

-

Limited Paperwork:

- The documentation and paperwork requirements for businesses opting for the composition scheme are significantly reduced. This simplicity allows small businesses to focus more on their operations rather than being bogged down by extensive record-keeping.

-

Fewer Details in Returns:

- The returns filed under the composition scheme require less detailed information compared to regular returns. This makes the overall filing process quicker and more accessible for small businesses with limited resources.

-

Ease of Compliance:

- The composition scheme is designed to be user-friendly, ensuring that even businesses with limited accounting expertise can comply with GST regulations. This simplicity is particularly advantageous for micro and small enterprises.

-

Reduced Auditing Requirements:

- Businesses under the composition scheme are subject to fewer auditing requirements. This means that the compliance process is not only simplified during filing but also in terms of post-filing audits, making it more manageable for small enterprises.

-

Uniform Tax Rate:

- The composition scheme involves a flat tax rate on the turnover, eliminating the need for complex calculations. This simplicity in tax calculation contributes to the overall ease of compliance for small businesses.

Also Read: GST Registration For Composite Taxpayers, Composition Scheme Under GST: A Guide

Tax implications of composition scheme for small businesses

The tax implications of the composition scheme under the Goods and Services Tax (GST) for small businesses are crucial considerations for those opting for this simplified taxation method. The key aspects include:

-

Flat Tax Rate:

- Businesses under the composition scheme are subject to a fixed or flat rate of tax on their total turnover. This fixed rate simplifies the tax calculation process, offering predictability in tax liabilities.

-

Ineligibility for Input Tax Credit (ITC):

- One notable implication is that businesses registered under the composition scheme cannot avail themselves of Input Tax Credit. Unlike regular taxpayers who can offset the taxes paid on purchases against their sales taxes, businesses in the composition scheme do not have this benefit.

-

Simplified Tax Calculation:

- The composition scheme streamlines the tax calculation process by eliminating the complexities associated with input tax credit calculations. Small businesses opting for this scheme benefit from a straightforward and easy-to-understand method of determining their tax liability.

-

Limited Tax Liability Scope:

- While the composition scheme offers simplicity, it may not be suitable for businesses with substantial input tax credit claims or those engaged in inter-state transactions. Businesses need to evaluate whether the fixed tax rate aligns with their specific operational and financial structure.

Evaluating the suitability of composition scheme for your business

Evaluating the suitability of the composition scheme for a business involves a thorough assessment of various factors to determine whether this simplified tax compliance option aligns with the specific needs and characteristics of the enterprise. Here’s a step-by-step guide on how to evaluate the suitability of the composition scheme for a business:

-

Understand Eligibility Criteria:

-

- Review the eligibility criteria for the composition scheme, which typically includes a threshold limit on the annual turnover. Ensure that your business falls within the specified turnover range set by the tax authorities.

-

Assess Nature of Business Activities:

-

- Consider the nature of your business activities. Certain types of businesses, such as service providers or those engaged in inter-state transactions, may have limitations or may not be eligible for the composition scheme. Evaluate whether the nature of your business aligns with the scheme’s requirements.

-

Evaluate Turnover Pattern:

-

- Analyze the turnover pattern of your business. The composition scheme is designed for businesses with relatively lower turnovers. If your turnover fluctuates significantly or exceeds the threshold, the regular GST scheme may be more suitable.

-

Consider Input Tax Credit (ITC) Requirements:

-

- Evaluate the importance of claiming Input Tax Credit (ITC) for your business. The composition scheme restricts businesses from claiming ITC. If your business heavily relies on ITC for reducing tax liability, the composition scheme may not be the most suitable option.

-

Calculate Tax Liabilities:

-

- Compare the tax liabilities under the composition scheme with those under the regular GST scheme. Use past financial data to estimate how the fixed percentage of turnover compares to the tax obligations in the standard scheme. This comparison will help in understanding the cost implications.

-

Review Compliance Capabilities:

-

- Assess your business’s ability to meet compliance requirements. If your business prefers simplified compliance procedures, has limited resources for extensive record-keeping, and can fulfill the quarterly filing requirements, the composition scheme might be a good fit.

-

Examine Interstate Transactions:

-

- If your business is involved in inter-state transactions, carefully consider the limitations of the composition scheme in this context. The scheme is generally more suitable for businesses with intra-state operations.

-

Future Growth Considerations:

-

- Think about the potential growth of your business. The composition scheme may be appropriate for small businesses, but if you anticipate significant expansion, the limitations on eligibility and turnover may become restrictive.

-

Consult with Tax Professionals:

-

- Seek advice from tax professionals or consultants who can provide insights tailored to your specific business situation. They can help assess the nuances of the composition scheme and guide you in making an informed decision.

-

Evaluate Overall Business Goals:

-

- Consider the long-term goals and vision for your business. The choice between the composition scheme and the regular GST scheme should align with your business strategy, financial objectives, and operational preferences.

Conclusion:

In conclusion, the GST Composition Scheme helps small businesses by making taxes simpler. It reduces paperwork, lowers tax rates, and has easier filing. Small businesses should think about if they qualify and if it fits their needs. Even though it has benefits, like a fixed tax rate, it also has limits, like no Input Tax Credit. Businesses need to weigh the good and bad, considering their future plans and how they work. Getting advice from tax professionals is crucial for making smart choices in using the composition scheme. It’s about making taxes easier for small businesses while considering what’s best for them.

Also Read: GST: Everything You Need To Know

FAQ’s

-

What is the GST Composition Scheme?

- The GST Composition Scheme is a simplified tax compliance option designed for small businesses, offering reduced paperwork and a flat tax rate.

-

What is the turnover limit for businesses under the Composition Scheme?

- The turnover limit for the GST Composition Scheme is up to Rs. 1.5 crore for individuals selling goods (Rs. 75 lakh for special category states) and Rs. 50 lakh for service providers (excluding restaurants) in a financial year.

-

What are the key benefits of the Composition Scheme for small businesses?

- Benefits include lower tax rates, reduced compliance burden, simplified quarterly filing, and limited paperwork for eligible small businesses.

-

How does the regular GST scheme differ from the Composition Scheme?

- The regular GST scheme involves monthly filing, complex compliance requirements, and the ability to claim Input Tax Credit, whereas the Composition Scheme offers simplified procedures and a flat tax rate.

-

Who is eligible for the Composition Scheme under GST?

- Small businesses meeting specific turnover criteria and engaged in eligible business activities are eligible for the Composition Scheme under GST.

-

What are the simplified compliance procedures under the Composition Scheme?

- Businesses under the Composition Scheme file quarterly returns, face reduced documentation requirements, and benefit from a more straightforward compliance process compared to the regular GST scheme.

-

Can businesses claim Input Tax Credit (ITC) under the Composition Scheme?

- No, businesses under the Composition Scheme are not eligible to claim Input Tax Credit (ITC) for taxes paid on their purchases.

-

How are tax implications different for businesses under the Composition Scheme?

- Businesses under the Composition Scheme are subject to a flat tax rate on their turnover and do not have the option to claim Input Tax Credit, simplifying the overall tax calculation process.

-

How can businesses evaluate the suitability of the Composition Scheme?

- Businesses should assess their turnover, nature of business activities, ITC requirements, and compliance capabilities to determine whether the Composition Scheme aligns with their specific needs.

-

What is the turnover threshold for service providers under the Composition Scheme?

- Service providers (excluding restaurants) with an annual turnover of up to Rs. 50 lakh are eligible for the Composition Scheme under GST.