Introduction

A business entity can’t get all the activities done in house because it may involve a lot of costing and may require expertise. Therefore, many parts of the production process or business process are outsourced to external entities. E.g. A car manufacturing company may outsource its sheet stamping because it requires specialization and expensive machinery.

However, what if the job worker sells the goods sent for job work directly from their location and they never come back to the premises of the manufacturer? Moreover, the job work model may act as an escaping provision to prevent payment of tax on sales. Therefore, the law always monitors job work activity, be it under the pre-GST regime or under the GST regime.

A manufacturer must fill out form GST ITC-04 to send goods for job work. This article also contains a detailed discussion about sending goods for job-work.

1. What is a job worker?

- Term Job work is defined under Section 2(68) of CGST Act as “job work” means any treatment or process undertaken by a person on goods belonging to another registered person and the expression “job worker” shall be construed accordingly.

- In common parlance, under job work, the owner of the goods sends the goods to the job-worker for carrying out a specific activity, and the job-worker returns the goods to the owner after completion of the process. Moreover, ownership of the goods remains with the manufacturer only and the job worker gets the consideration for his job work activity.

- E.g. Maruti Suzuki sent 100 sheets for stamping to the job worker. Job-worker returns such sheets after stamping and charges consideration for his stamping services. Also, ownership of the goods lies with Maruti Suzuki throughout the process.

- We send goods to the job-worker under Delivery challan and return them under Delivery challan. The business also issues a Tax Invoice only for job work services if the job worker registers under GST.

2. What is GST ITC-04?

- As per Section 143 of CGST Act, a registered person must follow the detailed procedure for sending goods for job-work. However, the registered person must return the same within the time period prescribed under Section 143 of CGST Act. For example, the registered person must return inputs within 1 year and capital goods within 3 years.

- If the job worker does not return the goods within the above-mentioned period, we consider the goods supplied on the date we sent them to the job worker, and also the registered person is liable to pay GST on them.

- Moreover, a registered person files GST ITC-04, a detailed form to furnish information about goods sent for job work, goods returned from job workers, and goods sold directly from the premises of the job worker on a half yearly basis.

3. Information to be furnished in GST ITC-04

The relevant parties furnish Form GST ITC-04 in 4 parts, wherein they must provide the following information in each part:

-

Table-4: Details of Input or capital goods send for job work

- GSTIN of job worker

- State (In case of unregistered Job worker)

- Job worker’s Type, i.e., SEZ or non-SEZ

- Job work sends goods through challan number.

- Challan date

- Type of goods sent for job work, i.e., Input or capital goods

- Description of goods

- Select the Unique Quantity code (UQC) from the available drop down list;

- Quantity

- Taxable value

- Applicable taxes, IGST, CGST & SGST

-

Table-5A: Details of Input or capital goods received back from the job worker to whom such goods were sent for job work and losses and wastage

- GSTIN of job worker

- State (In case of unregistered Job worker)

- Original Challan number issued by principal

- Original Challan date

- Challan Number issued by the Job worker

- Challan date issued by the job worker

- Nature of job work done

- Description of goods

- Unique Quantity code (UQC), It is required to be selected from drop down list available;

- Quantity of goods returned to the principal

- Quantity of Losses and wastage

-

Table-5B: Details of Input/ Capital Goods received back from the Job worker other than job worker to whom such goods were originally sent for job work; and losses and wastage

- GSTIN of job worker

- State (In case of unregistered Job worker)

- Original Challan number issued by principal

- Original Challan date

- Challan Number issued by the Job worker

- Challan date issued by the job worker

- Nature of job work done

- Description of goods

- Select the Unique Quantity code (UQC) from the available drop down list;

- Quantity of goods returned to the principal

- Quantity of Losses and wastage

This table is applicable when one job worker sends goods from their location to another job worker for further processing.

-

Table-5D: Details of Input/ Capital Goods sent to job worker and subsequently supplied from the premises of Job worker; losses and wastage

- GSTIN of job worker

- State (In case of unregistered Job worker)

- Original Challan number issued by principal

- Original Challan date

- Invoice number issued by Principal

- Invoice date issued by the Principal

- Nature of job work done

- Description of goods

- Select the Unique Quantity Code (UQC) from the available drop-down list.

- Quantity of goods returned to the principal

- Quantity of Losses and Wastage

This table applies when the supplier sends goods directly from the location of job work upon payment of taxes and does not bring them back to the location of the principal.

4. What is the frequency and Due date of filing of ITC-04?

Till 30th September, 2021, businesses had to file ITC-04 on a quarterly basis. However, with effect from 1st October 2021, they are required to file ITC-04 at the following frequency and corresponding due date:

| Aggregate Annual Turnover | Frequency of filing of GST ITC-04 | Due date of filing of GST ITC-04 |

| More than 5 Crores | Half Yearly basis | 25th of the month following the end of half year.

I.e., April to September: 25th October October to March: 25th April |

| Less than 5 Crores | Yearly basis | 25th of April of the following year. |

5. What is the procedure of ITC-04 return filing ?

You can file GST ITC-04 either through the online method, i.e., by furnishing information in GST ITC-04 directly on the GST portal, or through the offline method, i.e., by furnishing information in the offline utility downloaded from the GST portal and uploading the JSON file.

Also, Let’s discuss both the methods in details:

-

Online Method

- Dealers are required to login at the GST portal with GST login credentials.

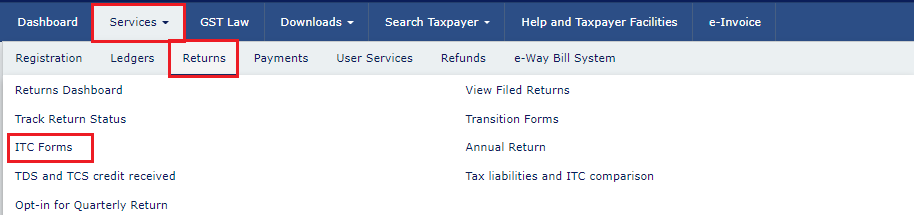

- Form GST ITC-04 is available at following path:

Services>ITC forms> GST ITC-04

- Post selection of Form, principal is required to select the financial year and period for which form is to be filed.

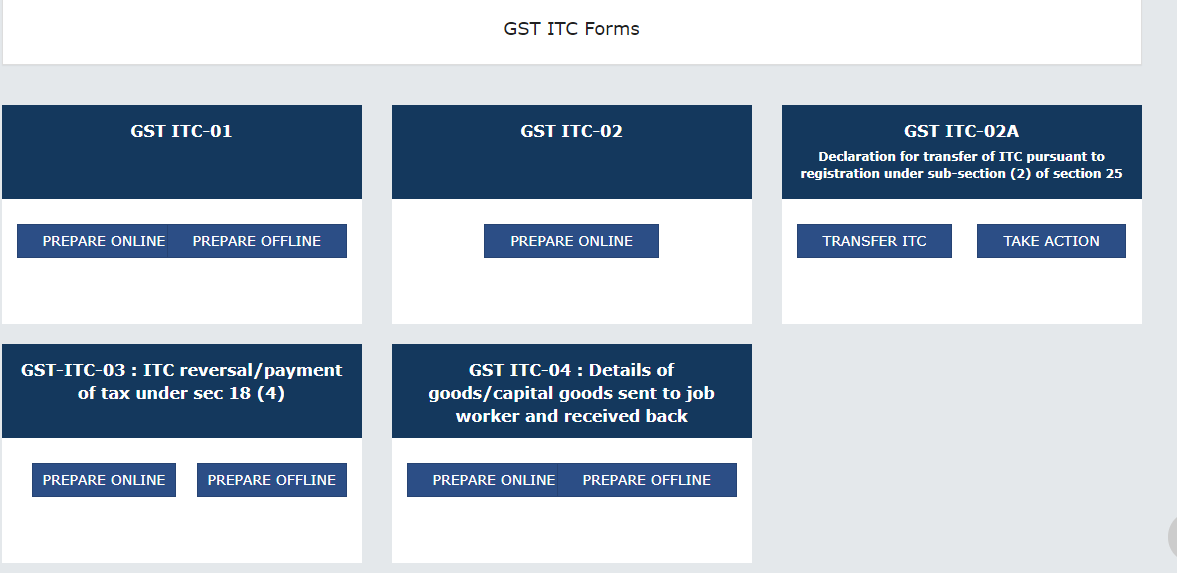

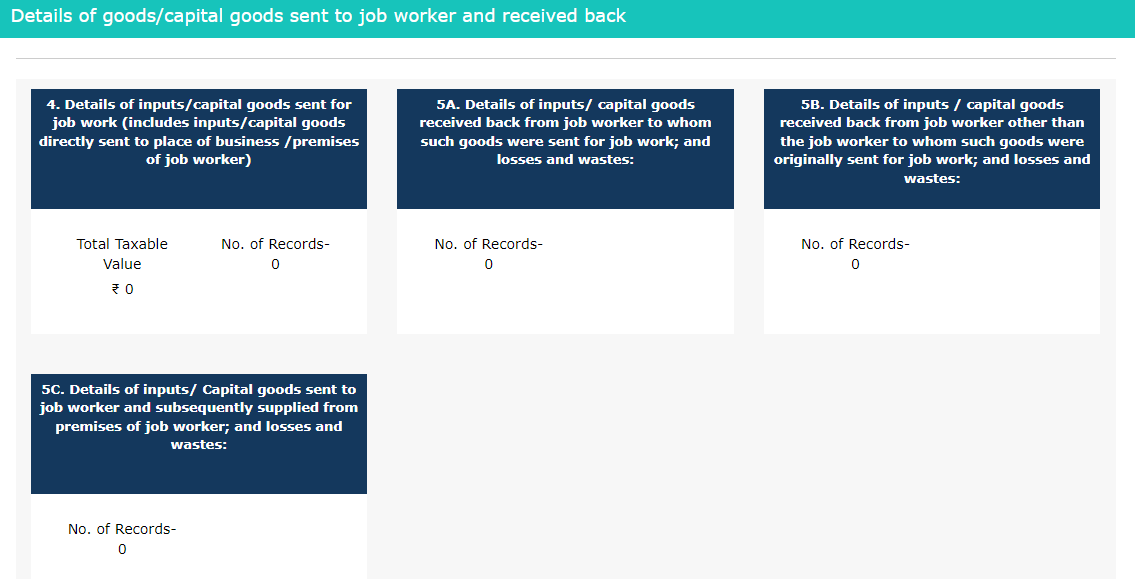

- Post this, system will display 4 tables in following manner:

- Details can be filed by clicking on the respective table.

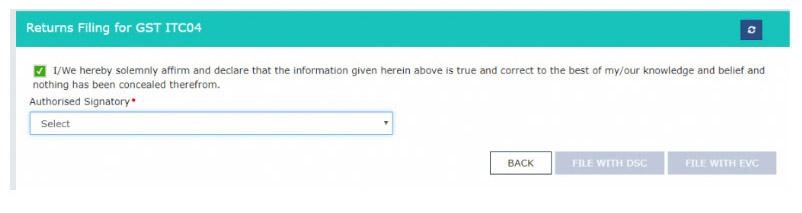

- Post furnishing of entire information, GST ITC-04 can be submitted with DSC or EVC.

-

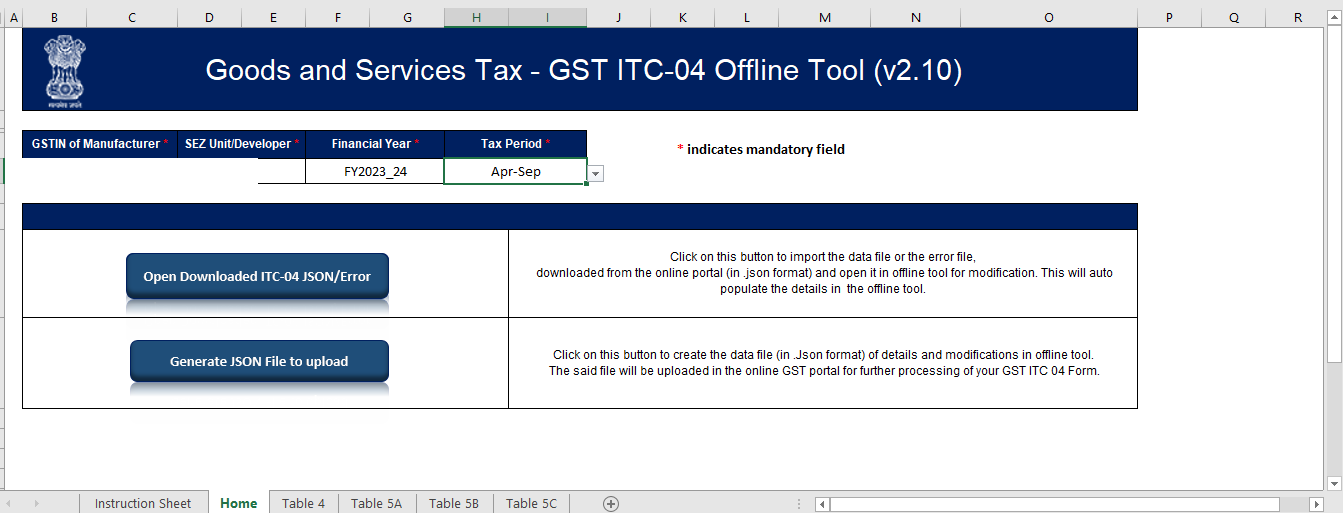

Offline Method

- For offline filing purpose, offline tool can be downloaded from GST portal at following path:

Downloads> Offline Tools> ITC04 Offline tool

- System will provide a zip file containing the excel utility of GST ITC-04.

- All tables are provided under different tabs in following manner:

- You need to generate a JSON file after validating the information entered in different tabs, and you can upload this JSON file on the GST portal at the following path:

Services>ITC forms> GST ITC-04> Prepare offline

- You can file the uploaded GST ITC-04 with EVC or DSC Postal validation through the GST portal.

Also Read: The Benefits Of Claiming ITC On Capital Goods