In India, when it comes to transferring property, there is a process to be followed in terms of legality. One such is the use of a Sale Deed, which is an important document. A sale deed is one of the most essential legal papers in property transactions, indicating the formal transfer of title from seller to buyer. This document not only validates the sale but also serves as legal proof of ownership, guaranteeing that both parties are protected and that all terms are fully defined. Understanding the significance, format, and process of a selling deed is critical for anybody involved in real estate deals.

This article presents you with insight into the sale deed meaning, format, benefits, and other aspects.

What is a Sale Deed?

A Sale Deed is a legal document that completes the transfer of property ownership from the seller to the buyer. It is commonly known as a conveyance deed and provides the buyer with legal rights to the property while also serving as proof of the transaction. Without a recorded sale deed, the buyer cannot claim ownership or legal rights to the property. The document contains critical information such as the property description, conditions of sale, and payment details, ensuring that all parties have a clear record of the transaction.

The registration of a sale deed certifies the transfer, grants ownership rights, and protects both parties in the event of future problems. A registration receipt is received once the process is completed, indicating that the legal transfer has occurred according to Delhi Property Registration requirements.

This document contains the property description and payment terms, as well as information about the circle rate and verification of ID documents such as the Aadhaar Card and PAN Card, to assure legal compliance. Fees, such as e-stamp paper and demand draft, are part of the documentation to complete the registration procedure, which is controlled by the revenue department.

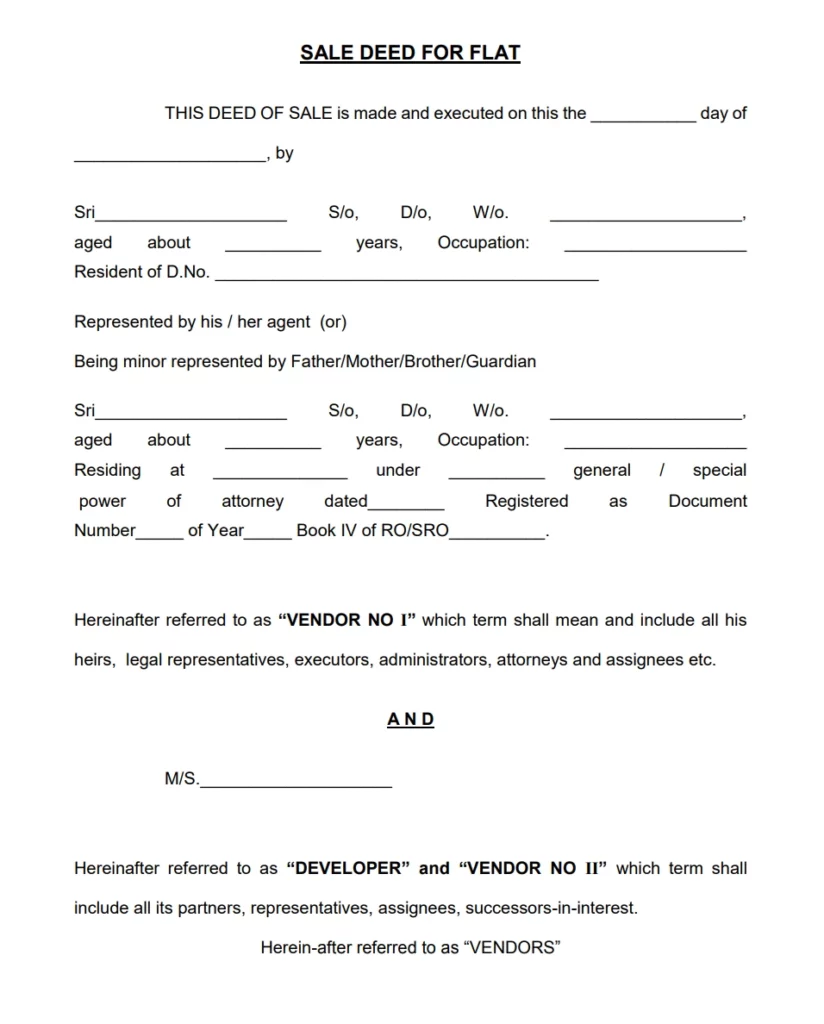

Sale Deed Format

Below is the ideal sale deed format:

Image source- https://www.myadvo.in/blog/sale-deed-in-india/

How is Sale Deed Executed?

According to the Indian Registration Act of 1908, it is important to register a transfer agreement of an interest in immovable property worth more than Rs.100. Thus, the sale deed of a property, such as a flat, building, or land, must be registered for the transaction to be legally binding. The sale deed is executed by two parties: the seller and the buyer. The seller is the individual who sells or transfers ownership of a property. The buyer is the one who acquires ownership of a property for consideration.

The selling deed must be recorded with the local Sub-Registrar’s Office. An unregistered sale deed is worthless in the eyes of the law.

What is the Importance of Sale Deed?

When it comes to property selling or transfer, a sale deed holds high importance.

- Legal Validity: A sale deed is a legally binding document that evidences the lawful transfer of ownership. Without a formal sale deed, the property’s ownership may be questioned, resulting in legal issues.

- Ownership Proof: The sale deed serves as conclusive evidence of ownership for the buyer. It acts as a record of the property’s true owner and works as evidence in disputes or legal proceedings.

- Property Title: The sale deed provides information on the property’s title, such as the present owner, previous owners, and any legal encumbrances. It will increase openness and help purchasers make educated selections.

- Access to Public Records: Once registered, the sale deed is part of the public record. This adds an extra level of security throughout the transaction.

- Preventing Fraud: Executing the sale deed helps to prevent fraud by validating the seller’s authority to sell and the presence of all needed documents, such as the Aadhaar Card and PAN Card. This verification ensures that the seller is the authentic owner of the property and has the legal right to sell it.

What is the Legal Framework involved in Sale Deed?

There are a couple of legal frameworks involved in a sale deed. It helps in the proper execution of the Sale Deed and protects both the buyer and the seller.

-

Sales Deed Registration Act

A Sale Deed must be registered under the Indian Registration Act of 1908 to be legally valid and proof of property ownership. Section 54 of the Transfer of Property Act and Section 17 of the Registration Act, 1908, require registration for all property transactions valued above ₹100. Without this registration, the sale is not legally recognized, and ownership rights are not enforceable. In case the Sale Deed gets breached after execution, legal action may be taken, including a claim for possession or ownership. Registering the deed ensures its legal status and protects the buyer’s rights.

-

Execution of the Sale Deed

A Sale Deed is executed when both the buyer and seller sign it in front of witnesses. The seller transfers property ownership to the buyer in exchange for payment. The deed must be signed by both parties, as well as at least two witnesses who submit their full names, signatures, and addresses.

To be legitimate, the Sale Deed must be registered with the Sub-Registrar’s Office. This registration renders the document legally binding. Before signing, the buyer must ensure that the property’s title is free of debts or disputes. The buyer or their lawyer normally prepares the Sale Deed, which is subsequently approved by the seller and finalized. Once registered, it verifies the legal transfer of ownership.

Key Elements Involved in Sale Deed

Parties Involved: The sale deed contains the names and addresses of both the seller and the buyer. It gives a clear picture of the parties involved.

- Property Description: The sale document contains detailed information on the property being sold, such as its boundaries, measurements, and address.

- Sale Consideration: The sale price and method of payment are specified. This section also describes all the advance payments made and the remaining balance.

- Rights and Obligations: The sale deed may include terms addressing the buyer and seller’s rights and obligations, such as the transfer of utility connections and the payment of property taxes.

- Passing the Title: The selling deed should specify when the property’s title will be transferred to the buyer. All property-related documentation must be handed over to the buyer. It should state that the seller will transfer possession of the property to the buyer after the registration process has been completed. It should also provide the actual date of handover of possession of the property.

- Indemnity: Check that the property’s title is free of any charges, disputes, or encumbrances, which means that no other person has a right to the property being transferred to the buyer. In such an instance, the seller will be held accountable for reimbursing the buyer against any loss. Before the selling document is finalized, the seller must pay all statutory costs such as property taxes, power bills, water bills, society and maintenance fees, and any other outstanding balances.

- Registration: The sale deed needs to be registered to get legal status. The buyer and seller, along with their witnesses, must be present at the registrar’s office on the designated date for the deed’s registration. Stamp duty and registration payments are required to complete the registration process.

Also Read: How To Calculate GST On Property Purchase?

Benefits of Sale Deed for Property Owners

The Sale Deed acts as the official legal document mentioning the transfer of property ownership from the seller to the buyer. Some of the benefits are-

- Legal Ownership Transfer: It serves as confirmation that ownership has been transferred from the seller to the buyer, confirming the buyer’s legal title.

- Protects Against issues: It explicitly defines the terms and conditions of the sale, shielding both parties from future transactional matters.

- Proof of Purchase: Serves as strong evidence of the transaction, as well as a record that can be utilized in future legal disputes or claims.

- Defines the Buyer’s Rights: The Sale Deed outlines all rights, interests, and ownership details, ensuring that the buyer’s interests are legally protected.

- Outlines Payment Details: This covers the total price, payment mode, and any installments or payment schedules to ensure transparency.

- Tax Advantages: Buyers can utilize the Sale Deed to obtain tax breaks on property purchases, such as mortgage interest deductions.

- Registered Document: It is a registered document that ensures that the transaction meets all legal requirements, such as paying stamp duty and registration costs.

- Avoids Fraudulent Sales: A registered Sale Deed helps to avoid potential fraud by authenticating the seller’s legitimacy and preventing multiple sales of the same property.

Documents Required for Sale Deed Registration

Before executing a sale deed, there are a few essential documents required to verify property ownership and ensure a legitimate transfer. These include:

- Original Property Title Deed

- Sale Agreement

- Encumbrance Certificate

- Identity Proofs of Both Parties

- Address Proofs of Both Parties

- Property Tax Receipts

- Completion Certificate & Occupancy Certificate

- Power of Attorney, if applicable

- Bank Release Certificate (for properties with loans)

Sale Deed Registration Process

The sale deed registration process is an important legal step that formalizes the transfer of property ownership. The following is a complete step-by-step guide to help you through the procedure.

1. Drafting Sale Deed

In this process, both the buyer and seller collaborate to prepare the sale deed. This document outlines overall terms and conditions of the property sale, such as payment terms, property description, and other relevant information.

2. Sign the sale deed

The sale deed must be signed by both the buyer and seller, as well as two witnesses. The signatures must be filled in before submitting for registration.

3. Visit the Sub-Registrar’s office

After signing the sale document, both parties must visit the local sub-registrar’s office within four months of execution. Delays in attending the office may result in penalties or rejection of the deed.

4. Provide identification documents

During the registration process, both parties must produce proper identity (such as an Aadhaar card or PAN card). This guarantees that all parties engaged are authenticated.

5. Stamp Duty and Registration Fees

Before the registration process is completed, both parties must pay the appropriate stamp duty and registration fees. These fees vary according to the property value and municipal rules.

6. Verify the Sale Deed

The sub-registrar will check the selling document to ensure the property title is clear and any outstanding taxes have been paid. If there are any irregularities, the registration procedure may be delayed or denied.

7. Receive the Sale Deed

Once the payment and verification are done, the sub-registrar will hand over the sale deed. You need to keep the original and take a copy of the same for future reference.

Charges of Sale Deed Registration

The overall charges for stamp duty and sale deed registration differ as per the property value. Stamp duty is a proportion of a property’s market value; however, it varies depending on possession status and value. Stamp duty is 5% of the market value for possession properties, and 0.1% for non-possession properties.

Sale deed registration fees range from ₹1,000 to ₹30,000, or 1% to 3% of the property value, depending on the state. Stamp duty is charged at 5% for properties priced above ₹45 lakh and 3% for those valued between ₹21 lakh and ₹45 lakh.

Cancellation of Sale Deed

If the other party does not agree, it is possible to cancel the sale deed by filing a cancellation suit in court. The buyer and seller can even cancel the sale deed mutually by registering a cancellation deed. When a sale deed is cancelled, the sale of the property is cancelled, and the property ownership reverts to the seller named in the cancelled sale agreement.

However, the Specific Relief Act of 1963 has set certain conditions for the cancellation of the sale deed. These are-

- The sale deed should be registered under the Indian Registration Act of 1908.

- The individual believes that the sale deed is voidable or that it will cause him/her injury.

- When the sale deed is cancelled, the court will send a copy of the cancellation decision to the sub-registrar office where it was originally recorded. The sub-registrar officer will take note of the facts surrounding the cancellation of the selling deed.

Points to Consider Getting Sale Deed

When executing a sale deed, there are crucial factors to consider ensuring the document is legally valid. Some of these are-

- Clear Description of the involved Parties: The sale deed must begin by properly identifying both the buyer and seller, including their names, addresses, and other pertinent information.

- Property Description: The sale document must include a detailed description of the property being sold, including its size, location, and borders. This eliminates ambiguity about the subject matter of the deal.

- Mention the sale price: The agreed-upon sale price and payment terms must be mentioned clearly. It should also include whether any part of the money has already been done before.

Conclusion

Consider the selling agreement to be a warm embrace between the buyer and seller. It is not enough to simply hand over a house or land; there is a legal procedure to follow. If you are the buyer, this is confirmation that you now own the property. If you’re the seller, it means you’ve transferred ownership rights. It’s like the end of a narrative where everyone understands what’s going on.

Also Read: What Impact Has GST Had On The Real Estate Sector?