The idea of reverse charge mechanisms has become apparent in the complicated world of taxes as an essential tool to guarantee tax compliance and prevent tax evasion. Tax liability is transferred from the provider to the recipient of goods or services under a reverse charge arrangement.

However, it is crucial to comprehend and abide by the need for a legitimate tax invoice for reverse Charge inward supplies for this method to function flawlessly.

What is Reverse Charge?

Understanding reverse Charge and its purpose is necessary before delving into the requirements for a valid tax invoice. Reverse Charge is a tax collection mechanism that shifts the burden of paying taxes from the supplier to the recipient.

Its purpose is to prevent potential tax evasion and guarantee that the government gets paid for its due money. Accordingly, businesses that engage in reverse charge transactions must comprehend and abide by the requirements for a valid tax invoice.

Critical Requirements for a Valid Tax Invoice

Supplier’s Details

The supplier’s information should be visible on a legitimate tax invoice. The supplier’s legal name, physical address, and Goods and Services Tax Identification Number (GSTIN) are all included. Tax authorities need accurate supplier information to identify and audit enterprises.

Recipient’s Details

The recipient’s information is just as significant as the supplier’s details. The recipient’s name, address and GSTIN must appear on the tax invoice. Doing this may ensure the recipient is registered correctly and eligible for any Input Tax Credits.

Invoice Serial Number

The invoice must have a distinct serial number that is consecutive. Consistency in the invoice numbering scheme facilitates precise record-keeping for the supplier and the recipient.

Invoice Date

One crucial detail is the date of issue of the invoice. It facilitates the determination of the supply time, which is necessary for the computation of taxes.

Description of Goods/Services

It is imperative to provide a comprehensive account of the items or services rendered, encompassing their quantity, unit cost, and overall worth. Accurate tax calculation and cross-verification are facilitated by itemization clarity.

SAC or HSN Code

Specifying the Service Accounting Code (SAC) for services or the Harmonized System of Nomenclature (HSN) code for commodities is necessary. For accurate tax computation and classification, these codes are necessary.

Taxable Value

It is necessary to expressly declare the entire taxable worth of the delivered goods or services, excluding taxes. This number is utilized in the computation of taxes and Input Tax Credits.

Applicable Taxes

The necessary taxes, including CGST, SGST, IGST, and any applicable cess, shall be listed on the invoice. The tax rates and amounts must be specified individually.

Tax Amount

Each type’s (CGST, SGST, and IGST) tax liability under reverse Charge should be adequately stated. This facilitates the appropriate payment of taxes and the Input Tax Credit claim.

Signature

The supplier’s signature or the signature of an authorized representative must appear on the tax invoice. A legitimate signature gives the paper legitimacy.

Current Situation in Reverse Charge Mechanism (RCM)

Currently, services like insurance agents, workforce supply companies, goods transport agencies, etc., are subject to the reverse charge mechanism in the service tax system.

A partial reverse Charge is not a notion, unlike service tax. Tax on the supply is payable in full by the recipient.

Similar to the transportation of products, it was difficult for the previous administration to collect service tax from the many unorganized sectors.

The reverse charge mechanism will boost compliance and tax revenues due to the effort made to put the services by the present law.

RCM Supply Under GSTR Forms – GSTR 1 & GSTR 2

Suppose the supplier is registered, but the products or services are subject to the reverse charge mechanism. In that case, the supplier cannot claim the input tax credit because the receiver will be paying the taxes rather than the provider.

Under the reverse charge process, product importers must pay taxes to the government on their imports. Not to mention the import duties.

GSTR 1 must include specifics on the fees associated with the inward supply of goods or services. The form GSTR 2 contains the inward supply details.

Regardless of turnover, a person who is subject to pay tax using the reverse charge mechanism must register under GST.

The reverse Charge pays the input tax credit to the seller of goods or services. The input tax credit may only be utilized for business expansion as the sole requirement.

The following services are on the list that the reverse charge mechanism will cover:

- Goods Transport Agency

- Recovery Agent

- Director of a company or corporate body

- An individual advocate or firm of advocates.

- An insurance agent

A Case in Which Reverse Charge Under GST Will Be Applicable

Supply by Unregistered Provider

When an unregistered individual sells products or renders services to a registered individual, the registered individual—the one receiving the goods or services—becomes liable for paying taxes if the supply is taxable supplies. Absence of a reverse charge mechanism for stores that are exempt.

The registered dealer is responsible for paying the tax and will be subject to all act provisions, just like if he were the supplier of the products or services. Since it would be tough to collect taxes from an unregistered dealer, the idea behind this is to deter tax avoidance.

It would encourage transparency and raise tax compliance. The registered dealer will be able to claim input credit for the taxes he has paid via the reverse charge system.

The new system attempts to force all registered persons to purchase items only from registered dealers by requiring greater compliance under the Act.

Who Is In Charge of Paying GST Under RCM?

The recipient of RCM must pay GST on goods and services. Nevertheless, the seller of the goods must specify on the invoice whether RCM tax is owed in order to comply with GST rules.

The following considerations should be addressed when making RCM GST payments:

- Recipients of goods or services may only claim ITC on RCM tax amounts if those goods or services are utilized in the course of conducting business or to further that business.

- A composition dealer shall pay tax at regular rates rather than composition rates if he releases himself from duty under RCM. They are also ineligible to receive GST credit.

- There may be a GST compensation cess applied to RCM taxes owed or charges.

Regarding Services Offered by E-commerce Operator

The recipient of services from e-commerce operators is responsible for paying taxes on those services. The agent of such an e-commerce operator will be responsible for paying tax if the assessee does not have a physical location inside the taxable area.

The assessee must designate a representative who will be responsible for paying GST if there isn’t one.

For Services

A list of services for which the reverse charge mechanism under GST will be applicable has been notified by CBEC.

| No. | Provider | Recipient |

| 1 | Goods transport agency | Casual Taxable person, body corporate, partnership firm, any society, factory, any person registered under CGST, SGST, IGST Act |

| 2 | Recovery Agent | Banking Company, NBFC or any financial institution |

| 3 | A director of a company or a body corporate | A company or a body corporate |

| 4 | An individual advocate or firm of advocates, An arbitral tribunal | Any business entity |

| 5 | An insurance agent | Any person carrying on insurance business |

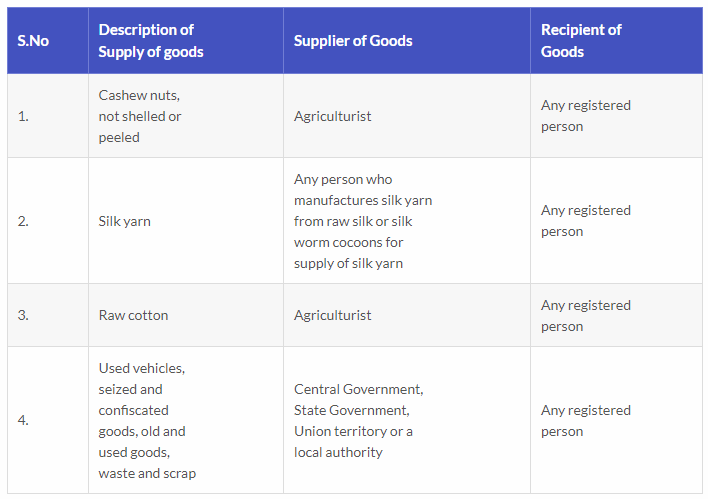

Supply of Goods Under RCM

Time of Supply

The term “time of supply” in the context of GST refers to a specific moment when the goods or services are provided or performed. It enables us to ascertain the tax rate, value, and return filing deadlines.

The recipient has the right to pay GST under the Reverse Charge Mechanism. On the other hand, the lead time for deliveries of goods and services under reverse Charge differs from that of supplies under forwarding charge.

Wrapping It Up

The reverse charge mechanism is a crucial tool for guaranteeing tax compliance and revenue collection in the complex world of taxation. It is imperative that all requirements for a legitimate tax invoice be met in order for this system to function as intended.

Companies must be careful to keep correct records and make sure that their invoices fulfill all requirements. This practice not only mitigates legal problems and associated penalties but also facilitates seamless commercial operations inside the reverse charge framework.

FAQs

What invoice guidelines must be followed when using the reverse charge mechanism?

After receiving goods or services from the provider, the buyer or recipient of the goods or services submits an invoice under the reverse charge process.

Inward supplies under reverse Charge: what are they?

You can account for purchase returns, cancellation of advance payments, inbound supply of taxable services, and advance payments under reverse Charge.

Does an invoice have to mention RCM?

Every tax invoice must state whether the tax related to the supply included in the invoice is payable on reverse Charge in accordance with section 31 of the CGST Act, 2017.

Does RCM need an e-invoice?

Yes, all of your invoices, including RCM invoices from the supplier, must be recorded if you are eligible for e-invoicing.

What separates a supplier invoice from a tax invoice?

A tax invoice is a document issued by a company that is a vendor for value-added tax (VAT), whereas an invoice is a document issued by a company that does not.

In RCM, who pays GST?

The recipient of a reverse charge is responsible for paying GST. As a result, the supply time for goods covered by reverse Charge differs from that of goods covered by forward Charge.

What is the reverse charge rule under GST?

Reverse Charge refers to a situation where the beneficiary of goods or services is required to pay taxes on those supplies, rather than the supplier, for the notified categories of supplies.

Is RCM required to appear in GSTR 1?

The supplier must include in his GSTR-1 the invoice-by-invoice sales subject to RCM.

What are the requirements for applying an e-invoice?

GST-registered individuals whose total revenue in any of the preceding fiscal years (2017–18 to 2021-22) exceeds Rs. 20 crore are eligible to use e-invoicing.

Is RCM required for GST?

The recipient of goods or services is required to pay GST. Nonetheless, the supplier of the products is required by the GST statute to indicate on the tax invoice whether or not RCM tax is due.