In the dynamic realm of business, achieving success hinges on expansion and growth. Companies incessantly pursue new markets, broader customer outreach, and heightened operational efficiency. As a result, they often establish additional business locations strategically positioned to unlock untapped potential. However, these strategic moves necessitate diligent adherence to India’s Goods and Services Tax (GST) framework for compliance purposes. This guide provides a comprehensive step-by-step process to help you register an additional place of business for GST. By following these instructions, your business operations will seamlessly align with tax regulations.

In the following sections, we will explore the specific requirements for registering additional places of business under GST. We’ll provide a step-by-step process to ensure a seamless transition into your business expansion strategies. Whether you’re an experienced business owner or just starting your entrepreneurial journey, this guide serves as your compass in the dynamic landscape of GST compliance. It empowers you to navigate complexities, realize advantages, and register additional places of business for GST smoothly.

By the end of this guide, you will have a comprehensive understanding of why and how to register your additional places of business, ensuring compliance, growth, and success in the diverse marketplace of India.

Understanding GST and Its Relevance:

The Goods and Services Tax (GST) in India is more than just a tax—it marks a fundamental transformation of the taxation system. A thorough understanding of its principles and significance is essential for successfully registering an additional place of business under GST

The Essence of GST:

GST is a value-added tax in India that replaced multiple indirect taxes, streamlining the taxation system by unifying levies from both central and state governments. This transition aimed to create a harmonized market and facilitate seamless commerce nationwide.

The Relevance of GST:

The Goods and Services Tax (GST) has brought about a significant transformation in the Indian business landscape, offering numerous key advantages

- Simplification: GST has simplified tax compliance by introducing a tax structure reducing the need for businesses to navigate through taxes.

- Input Tax Credit: Businesses have the opportunity to claim Input Tax Credit (ITC) for taxes paid on inputs, which in turn reduces their tax liability. This provision offers an advantage.

- One Nation, One Tax: In terms of taxation the concept of “One Nation, One Tax” refers to the implementation of Goods and Services Tax (GST), across the country.

- Digital Transformation: GST is supported by an online portal, which promotes digital compliance and transparency.

A clear understanding of GST is essential for successfully registering additional places of business. With this knowledge, businesses can confidently navigate the complexities of the taxation system while ensuring full compliance with laws and regulations. In the following sections, we will explore why businesses might require additional places of operation and how these establishments can offer various benefits.

Furthermore, establishing extra business sites can yield significant cost savings. For example, setting up a distribution center in a high-demand region enables firms to reduce logistical costs and delivery times.

The Strategic Need for Additional Places of Business:

Businesses are always seeking growth and expansion, adapting to new opportunities. One effective strategy is establishing additional locations to achieve various objectives. Let’s explore the key reasons why companies choose to expand their presence.

Market Reach and Accessibility:

Establishing additional business locations is a strategic move to expand market reach. Operating from multiple locations allows businesses to connect with diverse customer bases, unlocking new markets and growth opportunities.

Cost Optimization:

Furthermore, establishing additional business locations can lead to substantial cost savings. For instance, setting up a distribution center in a high-demand region helps businesses cut down on logistical expenses and reduce delivery times, enhancing overall efficiency and customer satisfaction.

Enhanced Services:

Expanding to new locations enables businesses to enhance customer service. By setting up local showrooms, service centers, or retail outlets, companies create convenient touchpoints, improving accessibility and customer engagement.

Resilience and Business Continuity:

Geographically diversifying your locations also enhances the resilience of your business. In case one location faces unforeseen challenges like natural disasters or local economic downturns, other locations can continue operations seamlessly.

Competitive Advantage

Expanding to new locations can enhance a business’s competitive position by increasing visibility in diverse markets and potentially capturing a larger customer base. This strategic move yields numerous advantages, strengthening the organization’s standing amidst rivals. Increased market exposure coupled with an extended reach leads to heightened competitiveness and greater opportunities for growth.

Considering strategic reasons, businesses often choose to establish additional places of operation. However, expansion brings the responsibility of ensuring compliance with the GST framework. To achieve this, businesses need to comprehend the requirements for registering extra business locations under GST, which will be explored in the following section.

Requirements for Registering an Additional Place of Business:

To register an additional place of business for GST, the following requirements must be met:

– The new business location must be in a different state or union territory than your existing registered GSTIN. Intra-state additional locations can be registered through the same GSTIN.

– You should have a valid PAN number linked to your name and permanent address.

– The additional place of business must have a valid address proof like rent agreement, lease agreement or property documents.

– Business activity details like supply of goods or services from the new location must be specified.

Registration Process:

Here are the step-by-step instructions to register an additional place of business on the GST common portal:

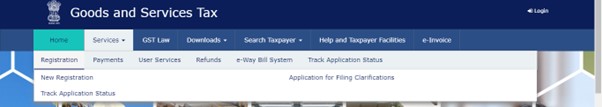

- Log in to the GST portal using your GSTIN credentials.

- Go to the Services option and select Registration.

- In the Registration module, click on Additional Place of Business.

- To register an additional place of business, start by filling in the required details such as address, business constitution, and name.

- Next, upload the necessary documents, including address proof and identity verification.

- Before submitting the application, carefully review all the provided information to ensure accuracy.

- Then, proceed with the applicable registration fee payment using net banking, credit/debit cards, or other available methods.

- Once approved, you will receive the Additional Business Place registration certificate.

Complete GST Registration Via Authentication of Aadhaar for a New User

Documents Required:

You need to submit scanned copies of the following key documents while registering for an additional place of business online:

– Address proof of the new location

– Identity proof of the authorized signatory

– Cancelled cheque containing the bank name, type of account and IFSC code.

– Digital signature or EVC of the authorized signatory who will digitally sign the application.

– Any other details asked in the respective state GST registration form.

Timeline for Registration:

Once you submit the complete information and documents online, the additional GST registration process takes around 7 working days on an average. However, the timeline may vary across states and the type of business entity. You will receive an email and SMS notification regarding the application status.

Important Points to Note:

- Additionally, any changes in business activity or address require an updated registration for the additional place of business.

- Moreover, you must incorporate the new location in all your GST returns and compliance activities.

- Furthermore, it is essential to maintain separate books of accounts for each GST-registered place as per regulations.

Frequently Asked Questions

Q1. How long is the additional business registration valid for?

The additional GST registration is permanently valid unless you discontinue business operations from that place. You must inform the jurisdictional tax authority within 30 days of closure or change.

Q2. What if I start a branch office in another state after obtaining additional GSTIN?

When opening an inter-state branch, a separate GST registration is required for the new state, as an additional GSTIN only covers intra-state branch additions.

Q3. Can I add multiple additional places of business under one registration?

Yes, you can register multiple additional locations simultaneously or separately over time under a single primary GSTIN across states or within the same state.

Q4. What fees are applicable for additional GST registration?

A state-specific registration fee ranging from Rs. 500 to Rs. 10,000 applies depending on the taxpayer category and annual turnover threshold limits.

Registering an additional place of business ensures you comply with GST rules while expanding operations. Following the exact steps and providing necessary documents helps complete the process smoothly. Let me know if you need any clarification on this process.

Q5. What is the timeline to update registration details for an additional place?

Any changes to the additional place of business, such as address, constitution, or name, must be updated in the registration details within 30 days of the modification. Otherwise, a late fee may apply for updates beyond the stipulated timeline.

Q6. Can additional locations be added later after obtaining primary registration?

Yes, additional places of business can be registered separately at any time even years after obtaining the primary GST registration. Importantly, there is no deadline to apply for additional GSTINs, allowing businesses the flexibility to expand as needed.

Q7. Do I need to inform tax authorities if closing an additional place?

Yes, you are required to inform the jurisdictional GST officer within 30 days of closure, discontinuation, or change of additional business places registered under GST. Moreover, this requirement aligns with the cancellation and surrender procedures.

Q8. What if I have multiple businesses eligible for separate registrations?

Even if you are eligible to register each business separately due to their independent turnover, constitution etc., you can opt to register all units together under a single registration for convenience if located within the same state.

Q9. What is the procedure for clubbing additional places together?

To club multiple additional registration certificates under one GSTIN, you need to submit an application with required documents on the GST portal. Generally takes 1-2 weeks for approval depending on state authorities.

Q10. Why register separately if operating under same management?

While optional, maintaining separate GSTINs for individually identifiable business places helps in complying with exact tax regulations for each location. It also enables targeted compliance management and record keeping for audits.

Summary:

If expanding operations across state borders, follow guidance from a GST consultant regarding separate registrations or composition scheme applications as per case requirements. Maintaining adequate books of accounts separately for each registered place is equally important under GST regulations.

Some businesses may need to register divisions or units separately if they exceed turnover limits. Therefore, reviewing the registration eligibility criteria helps in applying appropriate GST procedures. Additionally, any doubts must be clarified directly with the jurisdictional tax authority to ensure transparent compliance.

Keeping relevant registration, returns and compliance documents safely is advisable as these may be required during assessment proceedings or to avail Input Tax Credits. While mainly an online process, additional place registrations still need supporting scanned documents as applicable.

Overall, properly registering additional business locations not only helps establish your brand presence but also streamlines tax obligations as per GST laws. Moreover, leveraging qualified professionals as needed for registration, annual returns, or other specific queries can simplify the process. Furthermore, with diligent record-keeping, businesses can smoothly carry out cross-state operations after expanding through additional GSTINs.

To summarise the key points:

Requirements for additional registration include valid PAN, address proof and business details

- Complete the application process, within an average of 7 days.

- Maintain account books for all registered locations.

- Notify authorities of any cancellations or changes within 30 days.

- Optionally combine registrations in the state. if desired.

- Consultants are available to provide assistance with inquiries or conversions.

- Keep all documents securely for compliance requirements.

Conclusion

In conclusion, registering additional places of business under GST is crucial for businesses operating across various locations in India. This process ensures adherence to the Goods and Services Tax framework, enabling effective management of taxation complexities. If you have any queries or need guidance during the GST registration process, feel free to seek assistance from knowledgeable professionals.

This comprehensive guide not only equips you with vital knowledge but also provides step-by-step instructions to successfully complete the registration. Consequently, it fosters compliance while establishing a solid foundation for sustainable growth in India’s dynamic marketplace.

As you expand your business horizons, always remember that GST registration empowers you to seize opportunities, streamline operations, and navigate taxation intricacies with confidence. Moreover, it enables you to navigate taxation intricacies with confidence. So, begin your journey towards seamless multi-location operations here, supported by this trustworthy companion.