Tax compliance can be complex for some individuals to understand, and in the realm of Goods and Services Tax (GST), reconciling GSTR- 2B is crucial to stay updated, and hence it is crucial to understand the process to get its benefits.

In this blog, we will understand a step-by-step process for the GSTR- 2B reconciling process. Let’s dive in and understand more about it.

Reconciling GSTR- 2B with Purchase Records

The process of GST compliance is considered complete if the information of both outward and inward supplies are made in the books and reconciled with the data available on the GST portal, but because of the involvement of the counter-party, multiple systems and users, discrepancies creep in frequently makes the process of reconciliation important.

The filing process starts when the supplier uploads the details of outward supplies in GSTR-1 then the buyer receives the supply details in their GSTR-2A. The buyer can approve, reject, modify or add the details of the supply and files GSTR- 2. After this, the supplier receives the modified supply details in GSTR- 1A, and the supplier can approve or reject the updated supply details.

All kinds of approval, rejection or modification can be done in the GST portal. The supplier or the buyer has to login in to the GST portal using their credentials and check the status of every voucher, and the GSTR- 2 report in the system shows the status reconciliation feature that allows you to mark the position of every transaction manually, depending on the usage and online status which helps you to track the status of every transaction uploaded without having to login in the GST portal.

Read More: Know what is GSTR-2B | Generation and Availability of GSTR – 2B

Steps to Reconcile GSTR- 2B with Purchase Records

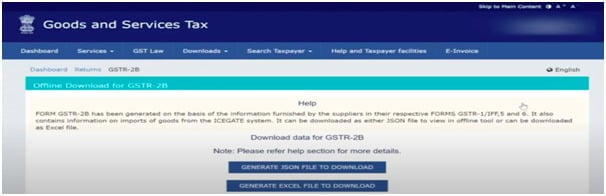

Step 1: Import GSTR- 2B JSON File from the GST Portal. GSTR- 2B can be downloaded by clicking here.

Step 2: Import Purchase Register in Government Template.

Step 3: Run Matching and view results, and you should take action on matched and mismatched documents.

Step 4: Signup to get the most out of your ITC claims

- Download 2B form GSTN directly

- Integrate with CaptainBiz

- Vendor communication enabled

captainbiz.com/ (FREE DEMO) CLICK HERE!

Cases where ITC Remains Unavailable in GSTR- 2B

In some conditions, ITC remains unavailable in the new form of GSTR- 2B in the following instances:

- If the recipient belongs to another state, even if the place of the supplier and the supply is the same, ITC will be unavailable.

- If the supplier has not filed their GSTR-1, ITC remains unavailable.

- If the supplier does not mention the transaction details in their GSTR- 1.

- If the supplier fails to pay the GST to the government.

- If either of the parties does not receive the entire payment or the goods and services.

- If the claim has been made late after the time limit provided in section 16(4) of the CGST Act (30th September of the next financial year or the date of filing annual returns).

- If the ITC is not eligible per the situations mentioned in the Blocked ITC Rule.

Related Read: Unlocking the Potential of GSTR-2B Reconciliation

The Bottom Line

Remember, the GSTR- 2B process is not only a checkbox for you but a business strategy that helps you find out the discrepancies, rectify errors and improve your daily operations. Hence, understanding the process for your business growth and success is crucial.