Do you need help with the reconciliation of GSTR-6 with GSTR-2A? Fret not, as we have got you covered. This article will guide you through reconciling these two significant GST returns. Reconciliation is critical to ensure that the data mentioned in GSTR-2A aligns with the data in GSTR-6. By successfully negotiating these returns, you can avoid potential errors or discrepancies that could lead to compliance issues. So, if you want to streamline your GST return filing process and stay on top of your tax obligations, keep reading. We will provide valuable insights and step-by-step instructions to simplify the reconciliation process.

What is GSTR-6?

GSTR-6 is a monthly return filed by Input Service Distributors (ISD). It includes information about the Input Tax Credit (ITC) received by the ISD and the distribution of that ITC.

What is a Form GSTR-2A?

GSTR-2A Form is an automatically generated statement of inward supplies for a recipient. Form GSTR 2A is not a return but a view-only document that displays all invoices uploaded by your suppliers.

This GSTR 2A is a dynamic report that suppliers update by uploading invoices for goods or services sold to you. It is critical in determining the Input Tax Credit (ITC) you can claim in your monthly or quarterly GSTR-3B return. Data must be reflected in GSTR-2A/2B to claim ITC, making this report vital. Unlike GSTR-2A, GSTR-2B is auto-generated monthly and remains static.

Scenarios where GSTR-2A is generated

- The supplier uploads B2B transaction details in their Form GSTR-1 / 5.

- ISD details are auto-populated upon submission of Form GSTR-6 by the Input Service Distributor.

- TDS and TCS details are auto-populated when the counterparty files Form GSTR-7 and 8, respectively.

- Importing goods from overseas is auto-populated from the bill of entry received from the ICEGATE Portal of Indian Customs.

How is the GSTR-2A form generated?

Form GSTR-2A is generated through the following methods:

- It is generated after suppliers save, file, or submit Form GSTR-1 when the counterparty adds invoices, credit notes, or debit notes or makes amendments to Form GSTR-1 or Form GSTR-5.

- Form GSTR-6 is submitted to distribute credit through ISD credit invoices or ISD credit notes.

- The counterparty files Form GSTR-7 and GSTR-8 to claim TDS and TCS credits, respectively.

Discover the essential insights into GSTR-2A in GSTR-2A and GSTR-2B: A Guide for Taxpayers.

Understanding GSTR-2A Reconciliation

GST reconciliation is the meticulous process of aligning and cross-verifying the information provided by suppliers with the procurement data maintained by the recipient. It involves carefully comparing GSTR-2A, which comes from suppliers, with the recipient’s purchase records.

Details available in GSTR-2A

PART A

- Invoice details of inbound supplies received from a registered entity by a company, excluding supplies subject to reverse charge.

- Inbound supply is subject to tax through a reverse charge mechanism.

- All debit and credit notes and any modifications made during the current cycle.

PART B

- This section pertains to input service distributors and their branches. It reflects the ISD credits and any adjustments made during the current tax period.

PART C

- It applies to businesses involved in TDS transactions or online sales through an e-commerce platform, encompassing TDS and TCS credits received, including any associated amendments.

Importance of Reconciliation of GSTR-2A

- It enables you to verify that no Input Tax Credit (ITC) is overlooked on invoices where the supplier has reported their GST liability. However, the buyer still needs to utilise the credit in their returns.

- Regular GSTR-2A reconciliation helps identify absent invoices in GSTR-2A and enables you to take appropriate actions to ensure the supplier uploads them.

- In some cases, invoices might be uploaded with incorrect values. Reconciliation enables you to address and rectify such discrepancies.

- Reconciliation is essential to avoid claiming ITC multiple times for the same invoice.

- Identifying and uploading missing suppliers’ invoices is crucial to maintaining comprehensive purchase records, ensuring regulatory compliance and accurate financial reporting.

- Additionally, GSTR-2A reconciliation helps prevent duplicate purchase records or invoice entries, avoiding discrepancies and ensuring data consistency.

Also Read: Role And Responsibilities Of An Input Service Distributor (ISD) Under GSTR-6

How to View GSTR 2A on the GST Portal?

Step 1: Go to the official GST portal.

Step 2: Log in using your credentials.

Step 3: From the dashboard, select “Services.”

Step 4: Click “Returns” and then choose “Dashboard Returns.”

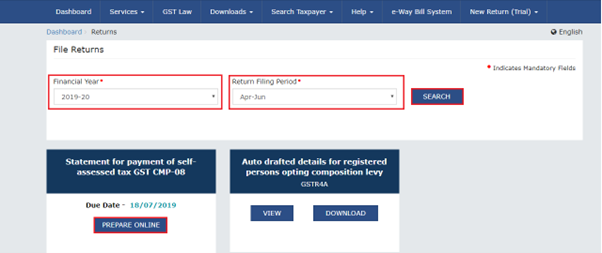

Step 5: On the “File Returns” page, specify the “Financial Year” and “Return Filing Period,” then click “Search.”

Step 6: Under GSTR 2A Download, click “View.”

Step 7: You will be directed to the GSTR-2A ‘auto-drafted’ details page, where you can access the relevant information by selecting the appropriate titles.

Reconciliation of GSTR-2A with GSTR-6

- Claim Input Tax Credit (ITC) for the relevant financial year if it has yet to be claimed previously, or reverse any ineligible ITC if it still needs to be identified and addressed earlier.

- Comparing Export Data in GSTR-1 Table 6A with GSTR-3B Declarations

- Aligning GSTR-1 Table 6A Export Details with ICEGATE Shipping Bills

- Analysing Annual Income Tax Return Against Annual GST Return

Declaration of Turnover from Business(at PAN level)

- Matching Purchase Register with GSTR-2A for the Entire Fiscal Year

- Analysing GSTR-1 Against GSTR-3B

- Comparing Yearly ITC in GST-3B with GSTR-2A

Conclusion

Reconciliation of GSTR-6 with GSTR-2A is an essential exercise businesses must undertake to ensure accurate reporting and compliance with GST regulations. GSTR-6 is the return filed by Input Service Distributors (ISD) to distribute the input tax credit among its branches or units. On the other hand, GSTR-2A is an auto-generated return that captures all the inward supplies received by a registered taxpayer. By reconciling these two returns, businesses can identify discrepancies or mismatches between the input tax credit claimed and the supplies received. This reconciliation process helps identify errors or omissions and rectify them before filing the annual return. It ensures businesses can claim the correct input tax credit and avoid penalties or interest charges for non-compliance. So, reconciling GSTR-6 with GSTR-2A is crucial to maintaining accurate records and complying with GST regulations.

Frequently Asked Questions(FAQs)

-

Can a taxpayer download and keep a copy of my Form GSTR-2A for future reference?

You can download and keep a copy of your Form GSTR-2A for future reference. It is available for viewing and downloading in Excel and JSON formats on the GST portal.

-

When a taxpayer needs to download details in Form GSTR-2A to view in Returns Offline Too

Taxpayers should download the details in Form GSTR-2A and view it in the Returns Offline Tool when the number of invoices exceeds 500. Once the file is generated, a download link will appear, and you can download the JSON file by clicking on it.