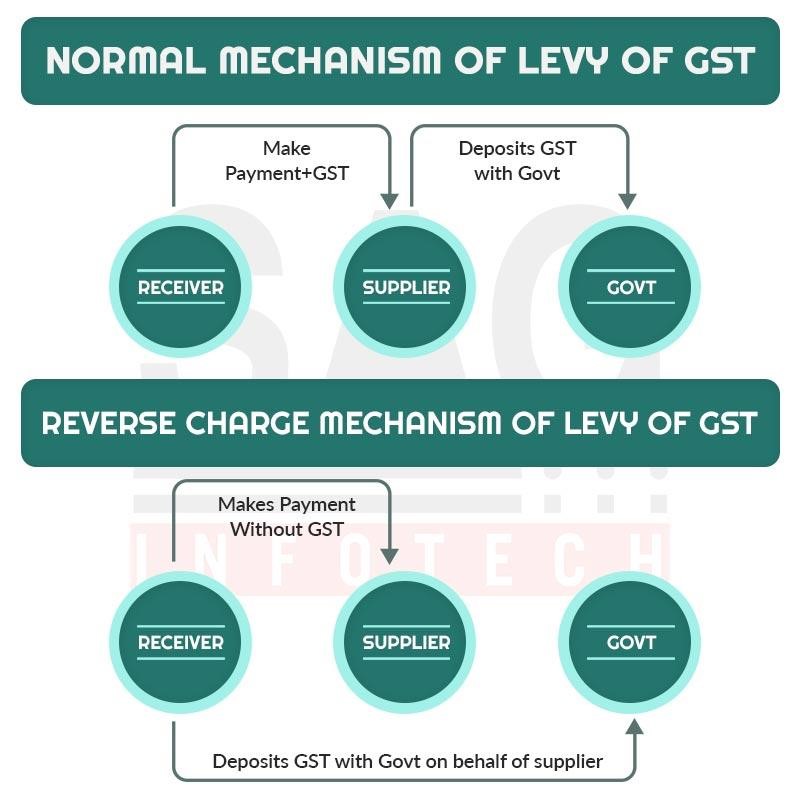

Under normal GST rules, goods and service suppliers must prepare GST invoices. But, in the case of the reverse charge mechanism, it is necessary for the recipient of the goods and services to prepare the invoice.

-

Reconciling RCM tax invoices for accuracy

The GST Council has made it compulsory for businesses to reconcile every invoice with the transactions made during the financial period. Reconciliation of tax invoices is one of the most effective parts of GST rules. Properly reconciling tax invoices ensures that all financial records remain accurate and up-to-date. Below are some necessary steps that you need to follow for the proper reconciliation of tax invoices.

- First, you need to collect all tax invoices related to RCM, or the reverse charge mechanism. Both suppliers and recipients must reconcile all invoices.

- Checking all primary information is necessary to check the accuracy of the invoices. Here, you need to check the following details-

- supplier’s and recipient’s names, addresses,

- GSTIN of the recipient,

- Invoice number

- Invoice date

- Type of goods or services offered.

- You cannot complete the entire reconciliation process unless you review each transaction detail carefully. It is necessary to check whether all the transactions have been done in accordance with the terms and agreements or not. The areas to check are

- Quantity of goods

- Description of the goods

- Unit price

- Discounts, if applicable

- Checking the tax calculation is another important thing that you need to do while you are reconciling RCM GST invoices. This validation of invoices is necessary to ensure that tax calculations have been done with accuracy. Accurateness in tax calculation is necessary to ensure proper payment of tax and avoid any default in tax deposits.

- Cross-verification of ITC, or input tax credit, is one of the most important areas to check before you pay the tax. The ITC should match the tax amount mentioned in the invoice.

- Following tax regulations is important before making a tax payment. Compliance with the tax regulations is mandatory to avoid any tax complications. So, all should mention all essential details as per tax regulations authority.

- The next step is checking the documentation. You need to check all supporting documents, like receipts of goods and purchase orders, that contain all the required information.

- In case you find any flaws in the invoice documentation, you need to resolve them without delay. You should inform the discrepancies to both the recipient and supplier of the goods and services of the discrepancies to resolve the issues immediately.

- Reconciliation of invoices also needs accurate record keeping. Maintenance of proper records of all tax-related documents is necessary for proper tax maintenance.

Following the above steps is extremely helpful for the perfect reconciliation of tax invoices in the reverse charge mechanism.

Also Read: Mandatory Information To Include In A Tax Invoice For Reverse Charge Outward Supplies

2. Matching invoice details and ensuring consistency

The GST Council suggests that matching invoices is extremely necessary to avoid any type of tax irregularity. The importance of matching invoice details is mentioned below.

- Maintenance of accuracy in the financial statement– Invoice matching seems to be one of the most important tools to ensure authenticity in the financial statement. In addition, maintaining consistency in data across invoices will enhance the reliability of financial records.

- Following Tax Regulations– Every business organization should follow the tax regulations and maintain its financial records accordingly. Properly matched invoices help ensure tax compliance and payment of error-free taxes.

- Avoid legal issues– Proper matching of tax invoices helps erase any type of tax complication. Following tax regulations and reconciling invoices help reduce legal issues.

- Ensure budgeting– Maintenance of accurate and steady details in the invoices is necessary for the preparation of an effective budget. Business organizations can prepare necessary financial plans with the help of proper reconciliation of budget.

Reduction in mistakes and fraud– Invoices with errors in information will create loads of problems in accurate tax payments. Inaccurate invoices may generate some fraudulent activities, and hence, monitoring of invoices is necessary.

- Matching invoices will help reduce fraudulent activities.

- Maintenance of customer rapport– Matching invoices is necessary to reduce inconsistencies in invoices. Proper reconciliation of invoices will help every business organization maintain good relations with customers as well as with suppliers.

- Enhance cash flow management– Every organization always wants to maintain the cash flow in the business, and proper inspection of invoices will ease this task.

Also Read: Tax Invoice For Goods: Key Components And Legal Requirements

3. Maintaining proper reconciliation records

The financial management of every organization should take care of maintaining proper invoices for accuracy in the financial statements. All can check the following steps for proper maintenance of records.

- At first, you need to opt for a proper document reconciliation process. So, it is necessary to clearly reconcile all the documents to maintain the authenticity of invoices.

- Regular reconciliation is necessary to keep the invoices absolutely error-free. All transactions, whether monthly, yearly, or quarterly, should be tallied with the invoices for a hassle-free legal process.

- Compare all transactions with the records and your bank statement to ensure that all entries have been made correctly. It is also necessary to ensure that invoice dates and descriptions of goods and services supplied match the real transactions.

- It is also necessary to check and reconcile all the discrepancies before filing the GST. If you find any flaw between the actual transactions held and entries made in the invoices, you need to correct the errors without any delay, unless you face legal problems.

- Every transaction contains essential documents, and these documents should be preserved properly. You need to ensure the reasons for any changes to the documents and preserve all records related to the changes properly.

- We also suggest implementing the necessary review and renewal processes for reconciliations. Here, it is necessary to ensure party reviews, and it is necessary to approve the reconciliation before you finalize it.

- At present, several automated systems are available in the market, and you can use them to automate the process. Implementation of automation is an essential tool to keep all records error-free.

- Implementing the reconciliation process will help retain the historical records of every business organization. Proper maintenance of historical errors is necessary for the reconciliation of past transactions.

4. Reporting RCM invoices in accordance with regulations

As per the Tax authorities, it is always a good option to report the reverse charge mechanism as per the regulations mentioned in the invoice. So, here you need to follow the steps below before you start reporting RCM invoices.

- First, it is necessary to understand the tax regulations implemented by the GST Council. The tax laws and regulations will vary depending on the tax jurisdiction. So, here, you need to understand the rules applicable to your business.

- Professionals also suggest maintaining every document related to the reverse charge mechanism with utmost accuracy. All relevant supporting documents related to goods transported, purchase orders, delivery notes, etc.

- Identification of all RCM transactions is necessary before reporting RCM invoices. So, you need to identify those transactions that fall under the scheme of the reverse charge mechanism. Suppliers don’t need to pay any tax while the transactions fall under RCM, so it is necessary to review all transactions carefully.

- While preparing the invoices for transactions relating to the Reverse Charge Mechanism, you need to mention “Reverse Charge Mechanism” on the face of every RCM-related invoice. It is also suggested that a special notation be mentioned on the invoice so that the recipient can understand that they need to pay the tax.

- Adding all mandatory information should be done without any error or delay. The information that is required by the tax authorities should not be overlooked. No essential information should be missed at the time of reporting RCM invoices.

- Tax calculations should be done accurately so that the recipient does not face any problems while paying the tax. You need to check the tax rates according to the goods and services offered and calculate the taxable amount based on the tax rates.

- On-time reporting is another essential part of reporting RCM invoices. Different jurisdictions may implement other dates for reporting RCM invoices. So, all you need to do is check those dates properly and follow the deadlines. All reporting relating to RCM invoices should be done by that time.

- It has been noticed that some businesses may need to file RCM returns separately as per the rules implemented by tax authorities. This system may be applicable in some jurisdictions, and business organizations need to follow those rules. Sometimes, you may need to add some additional requirements as per the rules implemented by the tax authorities.

5. Addressing discrepancies and resolving issues promptly

Invoice accuracy also depends on understanding the discrepancies and solving all those flaws. This process will help keep the RCM invoices accurate and maintain smooth business operations. All can check out the guide below to resolve the issues.

- At first, it is necessary to identify all errors and resolve the problems without any hassle. These errors may be related to errors in tax calculations, absence of description of goods & services, wrong taxable amounts, etc.

- Invoice discrepancies can be related to missing supporting documents. Different supporting documents, like purchase orders, delivery notes, etc., should be arranged before reporting the RCM invoices. So, if there is any discrepancy, all these essential documents should be arranged properly so that all flaws can be resolved.

- Communicate with the recipient of goods and services, and an internal team is also necessary to resolve all discrepancies.

- It is also necessary to ensure tax treatment relating to every transaction. You should also verify whether the tax rate has been applied appropriately or not.

- If you cannot ensure the tax discrepancies, you can take the help of tax professionals to get the best result. The tax professionals will help you get the best guidance regarding the necessary tax treatment.

- Regular audits are necessary to ensure that no invoice has any discrepancies.

Conclusion

The above guide will help readers to understand the necessity of RCM invoice reconciliation. Reconciliation of invoices is helpful to ensure tax invoices are free from all errors, and this process also helps in accurate tax payments.

Also Read: Reverse Charge Mechanism

FAQs

-

What is the time of supply as per RCM?

As per the Reverse Charge Mechanism, the supply of goods should be the earliest of 1) the date of receipt of goods, 2) the date of payment, and 3) the date that comes immediately after the 30th day of goods issued by the supplier.

-

What are the main processes of invoice reconciliation?

You need to reconcile the bank statement with all invoices relating to goods supplied and received. Here, it is necessary to mention that all entries should be free from any errors.

-

Do you need to mention RCM on the invoice?

Every transaction that falls under the reverse charge mechanism should be properly invoiced, mentioning RCM on the face of the invoice. This process will help to identify every RCM transaction within a particular tax period.

-

Why is invoice reconciliation important?

Every GST invoice under RCM should be reconciled to ensure accuracy in tax calculations and the payment of exact taxes. The reconciliation process is also helpful in enjoying accurate input tax credits.

-

Who is liable to pay tax under RCM?

Unlike other GST payments, recipients of the goods and services are required to pay the tax. The recipient receives the goods from unregistered dealers, and hence, the recipient is liable to pay the tax as per the Reverse Charge Mechanism.