Introduction

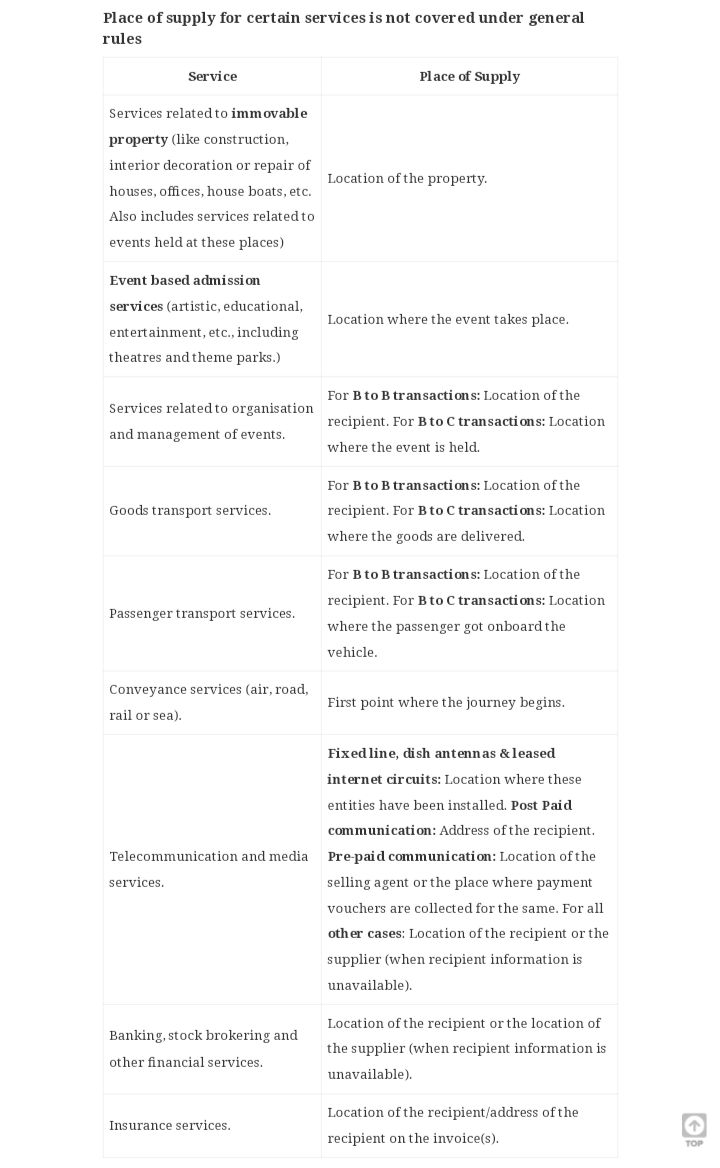

The place of supply is the location of the recipient of goods, and determining it is a crucial aspect of modern commerce. It influences not only taxation but also regulatory compliance and logistical strategies in a business.

In India, GST (Goods and Services Tax) is the taxation system that is followed across the nation. According to GST, the place of supply is the recipient’s location of the goods or services. GST is a destination-based tax, meaning that the state where the goods and services are consumed will be allowed to levy tax, not the state from which the supply was made.

https://www.zoho.com/in/books/gst/what-is-place-of-supply-under-gst.html#:~:text=Place%20of%20Supply%3A%20In%20most,different%20for%20goods%20and%20services.

It is important to know the place of supply for High-Value, perishable, and specialized products. Under GST in India, high-value products face problems for accurate valuation, while perishable goods may enjoy exemptions for efficient trade, and specialized products require tailored considerations in the determination of the “Place of Supply.” So, here we are with this article to dive into the details of the place of supply for High-Value, perishable, and specialized products and their importance.

High-Value Goods Place of Supply

Under our country’s taxation system, GST, there is no category called “High-Value goods.”. This term is quite subjective and might be used to refer to goods of significant value in terms of money. The place of value for High- High-value goods is simply the location of the recipient of the goods. The place of supply helps in determining the applicable GST rate and jurisdiction for taxation. For high-value goods, this is particularly important. Here is a simple elaboration of the High-Value Goods Place of Supply:

-

Goods with Movement:

When the goods are in movement, i.e., need to be delivered from one location to another, the place of supply is where the goods are delivered to the recipient. Therefore, the destination where the goods physically reach is important to know, as the applicable GST rate is determined accordingly.

-

Goods without Movement:

When there is no physical movement of goods, the location where goods are located at the time of delivery becomes the place of supply. These kinds of goods are important to determine transactions involving high-value goods. It is so because, although the physical location is not changed, ownership or control is transferred.

-

Interstate vs. Intrastate Transactions:

As we know, GST is a destination-based tax, and interstate and intrastate transactions are highly distinct. For interstate transactions (across state borders), integrated GST (IGST) is applicable. However, for intrastate transactions, Central GST (CGST), State GST (SGST) or Union Territory GST (UTGST) are applicable.

-

Documentation and Compliance:

Documentation is a crucial part of the taxation system. Hence, proper documentation of the place of supply of high-value goods is essential for GST compliance.

-

Cross-Border Transactions:

For specialized goods involved in international transactions, understanding the place of supply becomes even more complex, involving considerations of import and export regulations.

Also Read: Factors Influencing the Place of Supply for Goods: Movement, Delivery, and Ownership

Perishable Goods Transaction Location

First of all, we need to know what perishable goods are. So, as the name suggests, these are the items that have a limited shelf life. These are goods that are simply prone to decay or spoilage within a short period of time. Thus, it affects the GST taxation procedure, as nature may impact aspects like logistics, storage, and transportation. The applicable GST rates for perishable goods would depend on their transaction location.

-

Climate-Controlled Storage:

It is important to consider locations with facilities that can regulate temperature and humidity. The climate of storage must be controlled to preserve the quality of perishable goods.

-

Proximity to Suppliers:

The transaction location must be chosen in such a way that it is close to your suppliers. It is to minimize transit time and reduce the risk of spoilage during transportation.

-

Transportation Infrastructure:

For perishable goods transportation without getting the goods spoiled, ensure that the area has well-developed transportation networks. It must include reliable roads and efficient logistics services for timely deliveries.

-

Ownership or Control Transfer:

Transaction location mainly comes into play when there’s no physical movement of goods. The transaction location is relevant when ownership or control of perishable goods is transferred.

-

Technology Integration:

To ensure the safety of perishable goods, look for locations that provide technological advancements. These advancements include tracking and monitoring goods throughout the supply chain, thus enhancing visibility and control.

Place of Supply for Specialized Products

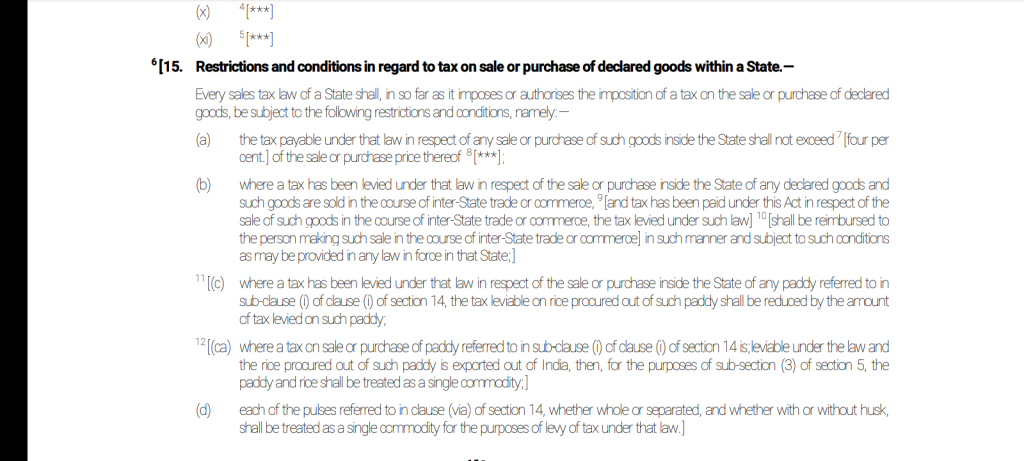

Under our nation’s taxation system, GST, specialized products fall under the category of “declared goods.” These are the goods that are considered of special importance throughout the country or in a specific state. Examples of these specialized products can include certain agricultural products, essential commodities, and items crucial for the economy.

![]()

https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://www.indiacode.nic.in/bitstream/123456789/15258/1/3_cst_act_central_sales_tax_act_1956.pdf&ved=2ahUKEwjorrGA4ICDAxWqUGwGHYQGC6UQFnoECBAQBg&usg=AOvVaw1uZ7MGsLmjQTYaF4dmhwXv

Generally, these goods have uniform tax rates across states to promote a seamless and efficient national market. But still, it’s essential to know the place of supply for specialized products.

-

Declared Goods Category:

Make sure that your specialized goods fall under the category of “declared goods.”. It attracts uniform tax rates across states to promote a seamless and efficient national market.

-

Customization Impact:

The place of supply is determined by considering if the product needs customization or not. The customization is regarding the recipient’s location.

-

Mobility Consideration:

As declared goods include goods important for economic activity, the place of supply might be linked to mobility and the location where the product is effectively utilized.

-

Consumer Location:

Sometimes there is a direct supply of goods to the consumer. In such cases, the place where the consumer is situated or intends to use the specialized product can influence the place of supply.

-

Professional Advice:

Due to the complexity of determining the place of supply for specialized products, seeking professional advice, especially from legal or tax experts, is advisable.

Also Read: Determining the Place of Supply for Different Categories of Imports: Goods vs Services

GST on High-Value Goods

The High-Value goods have GST levied based on the applicable tax slab. These are the goods that include luxury items, premium electronics, and certain demerit goods. Such goods are often categorized under higher tax rates, like 18% or 28%. The taxation system, which considers such distinctions in the applicable tax slab, generates revenue while ensuring a fair distribution of the tax burden on goods with higher value.

-

Tax Slabs:

In our country, High-Value goods fall under a specific tax slab. In GST, this tax slab has a higher applicable GST rate, which is often 18% or 28%. Thus, you need to know about such goods.

-

Luxury Items:

These High-Value goods may include luxury watches, high-end electronics, premium automobiles, etc. These goods fall into the higher tax brackets because of their luxury status.

-

Demerit Goods:

These high tax brackets are applied to goods with negative externalities as well, thus making these specialized goods. These goods include tobacco and certain alcoholic beverages, i.e., demerit goods.

-

Categorization Criteria:

The categorization under GST of the goods has its criteria. For high-value goods, such criteria often include factors like market value, brand perception, and the nature of the product.

-

Revenue Generation:

Taxing high-value goods at higher rates contributes significantly to government revenue, helping finance public services and infrastructure projects.

Also Read: GST: The Complete Guide

Specialized Goods Taxation Place

As is already known, GST is a destination-based tax. Thus, a specialized goods taxation place is the location where unique or specialized products are considered to be consumed or utilized. The taxation place for specialized goods will make you understand the applicable tax jurisdiction. It will also ensure the compliance with relevant laws governing these distinct products.

-

Product Characteristics:

Specialized goods have their own unique features and characteristics. So, determining those specialized goods properly, plays a crucial role in determining their taxation place under GST.

-

Mobility Consideration:

The taxation of specialized goods that are transportable may be linked to where the goods are effectively utilized or consumed.

-

Customization Impact:

When customization of the goods is required, the place of supply or taxation can be influenced by the location where the customization is carried out or tailored to meet specific requirements.

-

B2B and B2C Distinctions:

Keep in mind that the taxation rules may differ for business-to-business (B2B) transactions compared to business-to-consumer (B2C) transactions. This affects the tax liabilities to a major extent.

-

Legal Framework:

It is very essential to adhere to the legal framework. This includes GST regulations as well. Different jurisdictions may have specific rules governing the taxation placed on specialized goods.

Conclusion:

In conclusion, understanding the place of supply for specific categories of goods—be it high-value items, perishable goods, or specialized products—is crucial in the taxation procedure of our country, i.e., GST.

As we observed, the taxation dynamics are very different for each category. This can be observed with high-value goods attracting different rates and considerations while perishable goods are influenced by transaction locations, and on the other hand, specialized products have distinct criteria.

These categories are important in business operations, including the impact on pricing, legal compliance, and the role of unique features. Businesses are constantly engaged in transactions. When these transactions involve high-value or specialized goods, it becomes important to stay informed, seek professional advice, and adapt to the ever-evolving GST regulations to ensure seamless compliance and strategic financial management.

Frequently Asked Questions (FAQs)

-

What are high-value goods?

This term is quite subjective and might be used to refer to goods of significant value in terms of money.

-

What kinds of products fall under high-value goods?

The High-Value goods may include luxury watches, high-end electronics, premium automobiles, etc.

-

What are perishable goods?

These are the items that have a limited shelf life. These are goods that are simply prone to decay or spoilage within a short period.

-

What are specialized goods?

These are the goods that are considered of special importance throughout the country or in a specific state.

-

Under which category do specialized goods fall?

Under India’s taxation system, GST, specialized products fall under the category of “Declared Goods.”

-

Why is a place of supply important in the GST taxation procedure?

GST is a destination-based tax, meaning that the state where the goods and services are consumed will be allowed to levy tax, not the state from which the supply was made. Thus, the place of supply is important in the GST taxation procedure.

-

What is the GST applied on high-value goods?

High-level goods are often categorized under higher tax rates like 18% or 28%.

-

What are a few conditions that must be met while choosing a perishable goods transaction location?

Climate-controlled storage, proximity to suppliers, transportation infrastructure, ownership or control transfer, and technology integration are a few of the conditions.

-

What is the importance of legal compliance in the context of specialized goods taxation?

Adhering to the legal framework, including GST regulations, is crucial for businesses dealing with specialized goods to ensure compliance with taxation laws in different jurisdictions.

-

What are demerit goods?

Demerit goods are those that have negative externalities, such as tobacco and certain alcoholic beverages. They often attract higher tax brackets under GST.