India recorded impressive GST collections in May 2025 which showed that the country’s economy has improved and enforced new compliance measures well. GST is an extensive indirect tax levied on the sale and consumption of goods and services in the concerned country apart from acting as a good source of government revenue. This paper seeks to establish the trends of GST collection during the fiscal month of May 2025 about the current collected amount and gives some predictions and factors affecting the current trend.

These trends enable people to understand how businesses are operating, the efficiency of the government- tax plans for it, and what we are likely to expect in the following months. Such patterns would help the policy makers to analyze how the economic activities affected the GST collections in the same way, and decide in advance the probable future growth of GST collections in India.

Factors Contributing to the Growth in GST Collection

-

Economic Recovery

Following the COVID-19 pandemic, the Indian economy has shown slow and gradual signs of growth. Factors such as increased industrial production, growth in consumption and expansion of investment have led to an improved GST revenue.

-

Improved Tax Compliance

The government has worked to enhance compliance in the country by enhancing the ease of doing business, simplifying the tax system, and combating tax evasion through the Integrated GST Returns System. Therefore, the adoption of e-invoicing and general implementation of main measures such as enforcement has been an important vehicle that has slowed down tax evasion.

-

Digital Transformation

The effectiveness of digital transaction tracking mechanisms due to the advancement of businesses through digitalization and the use of digital payment systems to transact on, has enhanced tax compliance. The enhanced compliance with GST systems concerning the simplification of links with banking and other financial applications also help in the monitoring and collection phases.

Also Read: How GST Has Helped The Government To Increase Tax Revenue?

GST Collections of May 2025

For the fiscal May in 2025, India’s gross Goods and Services Tax (GST) collections totaled ₹1. 73 lakh crore. This is fixed to a 10% year on year through a significant rise of domestic transactions by 15%. 3% and moderation of imports by 4. 3%. Even after the refunds, the total receipts collected in May 2025 towards the GST amounted to ₹1. 44 lakh crore, reflected a growth of six. The banking sector also experienced a tremendous growth of 43 lakh crore.

Breakdown of May 2025 Collections:

- Central Goods and Services Tax (CGST): ₹32,409 crore;

- State Goods and Services Tax (SGST): ₹40,265 crore;

- Integrated Goods and Services Tax (IGST): ₹87,781 crore, including ₹39,879 crore collected on imported goods;

- Cess: ₹12,284 crore, including ₹1,076 crore collected on imported goods.

The gross GST collections in the FY 2025-26 till May 2025 stood at ₹3.83 lakh crore. This represents an impressive 11.3% year-on-year growth, driven by a strong increase in domestic transactions (up 14.2%) and marginal increase in imports (up 1.4%). After accounting for refunds, the net GST revenue in the FY 2025-26 till May 2025 stands at ₹3.36 lakh crore, reflecting a growth of 11.6% compared to the same period last year.

Breakdown of collections in the FY 2025-26 Till May 2025

- Central Goods and Services Tax (CGST): ₹76,255 crore;

- State Goods and Services Tax (SGST): ₹93,804 crore;

- Integrated Goods and Services Tax (IGST): ₹1,87,404 crore, including ₹77,706 crore collected on imported goods;

- Cess: ₹25,544 crore, including ₹2,084 crore collected on imported goods.

Also Read: January- February 2024 GST Collection: A Game-Changer In Economic Recovery

Inter-Governmental Settlement

The Central Government supported ₹38,519 crore to CGST and ₹32,733 crore to SGST in t May, 2025, out of total net IGST collected ₹67,204 crore. This would mean that CGST would gross ₹70,928 crore and SGST ₹72,999 crore in May, 2025 on gross basis but net of regular settlement. Likewise in the FY 2025–26 up to May this year the central government released ₹ 88,827 crore to CGST and ₹ 74,333 crore to SGST from the net IGST collection of ₹ 154,671 crore. As a result, the total collection of CGST will be ₹1,65,081 crore and that of SGST will be ₹ 1,68,137 crore calendar year wise in FY 2025-26 up to the month of May on regular basis after adjustment.

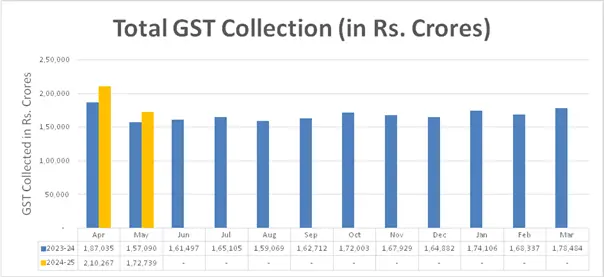

The chart below shows trends in monthly gross GST revenues during the current year.

| Category | Details |

| Total Collection | Significant increase observed in overall GST collection. |

| Year-on-Year Growth | Noticeable growth compared to the same month in the previous year. |

| Month-on-Month Growth | Positive growth trend observed compared to the previous month. |

| Component Breakdown | Includes contributions from CGST, SGST, IGST, and Cess components. |

| Sector-wise Collection | Major contributions from manufacturing, services, retail, real estate, and other sectors. |

| State-wise Collection | High collections reported in key states like Maharashtra, Karnataka, Tamil Nadu, Gujarat, and Uttar Pradesh. |

| Trends Observed | Improved compliance, Economic recovery and Increase in digital transactions |

| Future Projections | Ambitious targets for the next fiscal year Continued focus on compliance and simplification and Expected sectoral growth in manufacturing and services |

Current Trends and Challenges

-

Shifting Economic Dynamics

When it reaches May 2025, the GST collection has faced shifting economic characteristics that have been affected by the occurrences in the world economy, government strategies across the country, and the volatility of the market. Indeed, as economies look forward to building back, following the disruptions that the world has had to grapple with in recent years, starting with the COVID- 19 pandemic, the GST frame work evolves to capture the new normal of consumers’ behavior disruptions in the supply chains, and even radical changes in business models.

-

Legislative Amendments

Changes in the laws that are enacted by parliaments commonly called legal reforms are a key driver of GST collections. In May 2025, it would be critical for businesses to be aware of any changes in GST rates that may occur, as well as changes in other applicable compliance regulations such as particulars and procedures. By the updated governmental regulations it is possible to avoid noncompliance with the set of the rules, as well as avoiding penalties or legal consequences.

-

Technological Advancements

Technology innovation also makes an outstanding contribution to improving GST collection and compliance, effective tax management, and a transparent system. For example, solutions like GST-compliant accounting tools, e-invoice solutions, and electronic payment solutions help in the simplification of taxes, reducing additional loads and paving way for better tax optimization.

Strategic Considerations for Businesses

-

Proactive Compliance Measures

When considering the strategies for managing the collection of GST in 2025 May, the proactive compliance strategy is helpful to reduce the possible risk on compliance while achieving the best outcome on tax collection. This involves record keeping, returning documents at the appropriate time and strict compliance with the GST rules.

Expanding the usage of relevant technology-enabled compliance tools and soliciting professional help further increases the compliance effectiveness while decreasing the risk of compliance failures.

-

Optimal Tax Planning Strategies

Strategies used in tax planning are vital ,particularly for organizations interested in achieving the best balance of GST while still enjoying maximum tax deductions. Understanding and researching for various exemptions and concessions and analyzing opportunities which exist for tax savings, economically organizing transactions and structuring business transactions in ways that will assist reduce a business’s obligation for taxes while promoting profit and revenue are some ways on how one can reduce taxes. Everyone can seek advice from the tax professionals or advisors which will be definitely helpful in understanding and working out unique tax planning strategies based on your goals.

Also Read: Maximizing Tax Efficiency: Tips And Strategies For Regular Taxpayers

-

Embracing Digital Transformation

The necessity of using digital tools is one of the most important trends for companies operating in the context of the modern GST. It ends up hidden in various tasks within companies, and if digital solutions are adopted in a company, tax issues can be made less cumbersome since companies get real-time visibility into tax compliance. The digital transformation in generation involves everything from automated invoicing and accounting to the

blockchain for supply chain management; embracing a digital presence as a key factor ensures that the business organizations are in a position to meet the challenging regulatory compliances and rapidly changing dynamics in the global market efficiently.

Conclusion

The latest GST collection in May of 2025 reveals several trends and perspectives worth discussing. They further pointed out that the steady rise in GST revenue indicates an incremental recovery in economic activities in course of time buoyed by the government’s stimulus and policy measures. The study shows that the GST is a well-received tax as e-commerce, digitized services, and essential commodities have formed the significant portion of the amounts collected. This is clearly a change in the pattern of consumption and growing influence of technology in facilitating economic activities.

FAQ

-

What major trends are determining the May 2025 GST collection prospects?

The potential factors that drive the May 2025 GST collection scenario are the post pandemic economic status worldwide, In addition, advancement in technology and implementation of various reforms policies for a better and efficient compliance system.

-

How the Legislative Amendments Affect GST Collections in May 2025?

Notably, changes that regulators make to the laws enacted by parliaments often impact the general GST rates, the specific compliance measures needed and procedural frameworks governing its collection, which in turn, influence the GST collection patterns and the taxpayers’ obligations.

-

What are the major challenges encountered by businesses in May 2025 in adhering to the processes for GST compliance?

A business may not understand the tax laws that regulates GST thus leading to noncompliance; The rules and regulations governing GST may be continually changing hence creating another problem to a business; Another issue that affects the compliance of GST is the failure by a business to adopt various technological tools in order to enhance compliance.

-

what is the favorable role of technology in the context of enhancing the strict processes of GST collection?

Modern technology helps in augmenting the concepts of GST in effective collection processes with the help of electronic invoicing, tax filing, and a real-time analytical solution for compliance issues that can increase the level of accuracy and efficiency in the GST functions.

-

What ways can the use of data analytics for GST collection work for businesses in the analysis illustrated in the context of May 2025?

Employing the knowledge management approach with reference to data analytics on GST, it is possible to gain useful insights into the liabilities of a business and acquire the necessary idea on how to optimize the tax burden and improve the overall efficiency level.

-

How international trade treaties affect the collection of GST in May 2025?

Some of the aspects of IIP that may affect GST revenue involve the taxation of cross border services, changes in import-export taxes and Regulations regarding cross border transactions and activities.

-

What extent is that GST collection useful for government revenue and fiscal policy in the month of May 2025?

The collection of GST is also a critical source of revenue for a government agenda and funding of necessary social services and facilities as well as actively contributing to economic stability and social goals and projects within a fiscal policy agenda.

-

What Parties can do to maximize their tax compliance?

Companies should strengthen their management of GST compliance by integrating corporate tax management systems, reviewing tax returns for compliance, and consulting professionals to enhance efficiency in GST compliance and seek potential tax savings.

-

What ways can businesses receive information on the new and emerging trend in GST collections and legalities in May 2025?

From the above typical insights, businesses can keep abreast by following updates from regulators, attending forums or seminars, and consult with or hire a tax consultant to be in harmony with recent development in GST compliance and standard.

-

How may the market situation in terms of GST collection by May 2025 affect SMEs and startup firms?

The vision of GST collection in the year 2025 can alter the situation of SMEs and startups primarily because this line of businesses has plenty of compliance cost issues, bureaucratic factors, and cash flow problems. To meet their legal obligations effectively, seek funding opportunities from the government and adopt existing information technologies to ensure tax compliance and meet customer expectations and market competitiveness, knowledge about the GST regime is crucial for SMEs and Startups to continue to grow and succeed in a fluid environment.