Introduction

Tax return filing refers to the annual filing of income and expenditure for a taxpayer. Based on the given information, tax is calculated. You must pay your yearly taxes. Suppliers can collect GST tax when they make a sales transaction. You must remit the collected tax to the government promptly. The government launched a GST portal to streamline tax monitoring. So, you can only file your returns online.

GSTR-1 filing is crucial according to the GST Act. It contains details and documents related to your outward supplies for the tax period. Taxpayers with an annual turnover of more than Rs. 5 crore must file a GSTR-1 return every month. If your turnover is less than Rs. 5 crore, you can file GSTR-1 quarterly leveraging the QRMP scheme.

Explore the significance of GSTR-1 and learn about GST filing mistakes and solutions in this blog.

Differentiating GSTR 1 from Other GST Returns

Multiple types of GST return forms are available. These forms have different due dates and requirements. However, only some will be applicable to you.

GSTR-1 captures details of your business’s outward supplies in a given tax period. GSTR-3B pertains to inward supplies during the tax period. Simply put, GSTR-1 is about reporting sales, while GSTR-3B is about reporting purchases.

GSTR 1 contains details such as invoice number, GSTIN, customer details, invoice value, taxable value, tax amount, tax rate, etc. No other GST forms are as granular as GSTR 1. For example, GSTR 3B contains only summary or purchase transactions. Even the annual GSTR 9 form doesn’t contain as much information as GSTR 1.

Understanding GSTR 1 in Detail

All registered taxpayers must file GSTR 1. The due date and tax period depend on your business turnover. At the start of the financial year, you can request to register under the QRMP scheme to file quarterly returns. If the annual turnover is more than Rs. 5 crore, you must submit GSTR 1 monthly.

The GSTR 1 form has a total of 13 tables or sections. You can fill in appropriate sections and leave other tables empty. For example, tables like Table 15 are for e-commerce operators, which does not apply to all suppliers. While filling out the applicable sections, ensure you enter all the correct details. Accuracy in GSTR 1 is crucial because the data from GSTR 1 will be used to auto-populate other GST forms. Discrepancies can trigger audits and result in penalties.

As per recent amendments in the GST Act, businesses with a turnover of Rs. 5 crore must generate e-invoices through the e-invoicing portal. It is integrated with the GST portal, and every verified and validated e-invoice will be auto-populated in GSTR 1.

Also Read: GSTR 1 Details: Everything You Need To Know

Exploring the Importance of GSTR 1 in GST Compliance

The GSTR 1 is a crucial document containing all details about outward supplies during the tax period, including the tax amount. It is the most detailed GST return form. The due date for monthly returns is the 11th of the following month or the 13th of the month in the quarter.

All registered taxpayers must file GSTR 1 before the due date with invoices, vouchers, and notes applicable for the tax period. Even if there are no outward transactions during the tax period, a nil GSTR 1 must be filed. You can file a nil GSTR return through SMS without using the GST portal. GSTR 1 must be filed accurately and timely for many reasons.

- Basis for other GST forms – GSTR 1 is the foundational GST return for other GSTR forms. For example, GSTR 2 and GSTR 3B are autopopulated using data from GSTR 1. Errors in GSTR 1 will lead to escalated errors in other GST forms.

- Cascading penalties – As per GST rules, you cannot file a GST return for the current tax period if you have not submitted the required tax forms in the previous tax period. Also, you cannot file GSTR 3B if you have not submitted GSTR 1. So, if you delay filing GSTR 1, it will also result in delayed filing of other GST forms. As a result, there will be cascading penalties, which can be avoided only by filing a GSTR 1 return on time.

- Claiming ITC – GSTR 1 is for outward supply transactions, but the customers of suppliers need suppliers to file GSTR 1 on time to claim their Input Tax Credit (ITC) under GST. The GSTR 1 and GSTR 3B values must be reconciled to calculate accurate tax liability after ITC for recipients of suppliers. So, by filing your GSTR 1 return accurately on time, you enable your customers to receive their due ITC promptly.

- Easy reconciliation – Managing GST returns every month or every quarter is better than managing return filing at the end of the year. Reconciling GSTR 1 with other GST forms at the time of monthly or quarterly return filing will help reduce errors.

- Avoid audit triggers – Authorities will send a notice if there are discrepancies between GSTR 1 and GSTR 3B. They may also suspend GSTIN if prompt actions are not taken. So, accurately reporting GSTR 1 will help you resolve issues immediately without triggering audits and inspections.

Common Mistakes and Challenges in GSTR 1 Filing

The complexity of GST laws with frequent updates can be limiting and daunting to businesses. Due to the heavy load on the servers on the return filing due dates, the GST portal could be slow or experience a glitch that can result in unknown data loss. If you don’t educate yourself about filing GSTR 1 correctly, you may make a few mistakes that can result in the rejection of ITC claims by your customers. So, learning GST compliance and reporting can help you and your customers. Some of the common mistakes while filing GSTR 1 are:

- Data entry errors

- Omission of invoices

- Misreporting supply type

- Late filing

- Mismatch in invoices, debit, and credit notes

- Erroneous details in terms of taxable value and tax amount

- Late filing of GSTR 1

Also Read: Common Errors And Mistakes In GSTR-1 Filing

GSTR 1 Filing Process Simplified

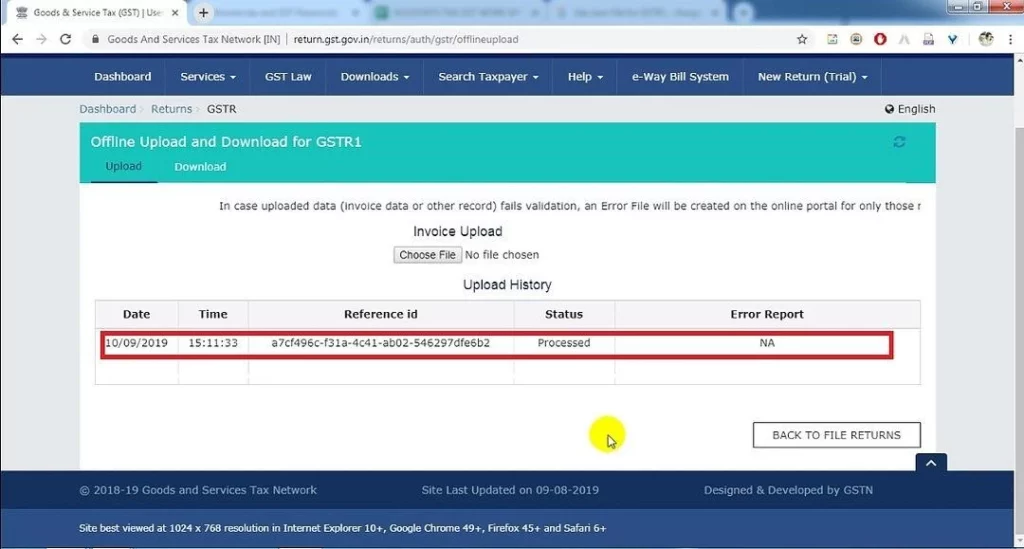

The crucial step in GSTR 1 filing is the reporting of invoices. You must set up an internal process to frequently upload invoices to the GSTR 1 return form instead of bulk uploading monthly or quarterly. It will help you avoid data entry errors and allow you more time to upload invoices correctly. You can visit the GST portal multiple times to upload invoices and details. You only need to submit the report once. An automated billing solution such as CaptainBiz will eliminate this burden for you as the software generates ready-to-upload GSTR 1 returns in JSON format anytime you need with a single click. Following is a simplified GST return filing process:

Step 1: Log in to GSTN portal

Step 2: Navigate to the Returns dashboard and select the Filing Period

Step 3: Upload JSON file

Impact of GSTR 1 on Business Operations

Filing GSTR 1 promptly and accurately ensures GST compliance for businesses. To continue your business operations, you need an active GSTIN. GSTR 1 return filing results in calculating accurate tax liability for you. Your customers will also auto-populate their GST forms and claim ITC based on your GSTR 1 return filing. More than GST compliance, GSTR 1 filing will also benefit your business operations.

GSTR 1 return filing gives valuable data and insights about your sales process. It improves business transparency and analyses of your own customer segments. GSTR 1 helps you reconcile with GSTR 2 and GSTR 3B for accurate ITC calculations to reduce GST liabilities. Accurate and timely reporting will help you avoid unnecessary audits and associated costs. Above all, accurate and timely reporting of GSTR 1 improves trust in your brand reputation.

Best Practices for GSTR 1 Compliance

Some of the best practices that can help with GSTR 1 compliance are:

- Generate GST-compliant invoices every time

- Issue GST invoices timely to your customers

- Maintain accurate records of all business transactions

- Validate all data at the source

- Reconcile regularly internally

- Use the auto-population feature wherever possible

- File returns well in advance to avoid late fees and penalties

Also Read: Overview And Purpose Of GSTR-1

Conclusion

GSTR 1 compliance is an ongoing process. It is a mandatory responsibility of registered taxpayers to file their returns accurately before the due date. Timely GSTR 1 filing minimises penalties and compliance risks. Also, GSTR 1 data offers detailed insights about your business sales management. Continuous monitoring and adoption of software tools for GST return filing are crucial for continued compliance and maximising business benefits.

CaptainBiz is a comprehensive business management solution that empowers Indian businesses with efficient and compliant GST billing. With many robust features, including inventory management, real-time financial control, and simplified tax filing, CaptainBiz streamlines your business administrative tasks.

Also Listen: GSTR Filing Process with CaptainBiz – Tutorials

FAQs

-

Is GSTR 1 as significant as annual GST return filing?

Yes, GSTR 1 is also a GST return filing requirement. It is a monthly or quarterly GST return that must be filed accurately. You cannot file your annual return unless you file GSTR 1 first.

-

Do I have to pay tax after filing GSTR 1?

No, the GSTR 1 form is for reporting all outward supply transactions. The details from GSTR 1 will be auto-populated in GSTR 3B and then used to calculate and report tax liabilities.

-

What happens if I fail to file GSTR 1?

Not filing GSTR 1 within the due date will increase tax liabilities in late fees, penalties, and other charges. Also, you cannot file other GST forms if you don’t file GSTR 1.

-

Is GSTR 1 only for sales reporting?

Yes, GSTR 1 is only for reporting all outward supply transactions. It means all sales transactions for registered taxpayers.

-

What information does GSTR 1 contain?

It includes invoice numbers and dates, recipient GSTINs, taxable value, tax rates, and tax amounts for all your outward supplies, categorised as B2B (to registered businesses) and B2C (to unregistered customers).

-

Are filing frequencies of GSTR 1 different for businesses?

Yes, businesses with an aggregated annual turnover of over Rs. 5 crore must file GSTR 1 return monthly. Other companies that have applied for the QRMP scheme can file GSTR 1 returns quarterly.

-

What should I do if I don’t have any sales for a tax period?

You must submit a nil GSTR 1 report indicating that no outward supply transactions were present for the tax period.

-

Can I omit to file GSTR 1 if there are no sales?

No, you must file GSTR 1 for the tax period even if there are no sales transactions. Not filing a nil GSTR 1 report will also result in late fees and penalties.

-

How can I avoid errors while filing a GSTR 1 return?

Maintain accurate accounting records, validate data at entry, and reconcile regularly. Use software like CaptainBiz to generate GST-compliant invoices and update GSTR 1 data automatically.

-

Can I revise GSTR 1 after filing?

No, you cannot revise GSTR 1 after filing for a tax period. If you find errors and discrepancies, you can make amendments in the following GSTR 1 return form in the amendments section.