Introduction to GST and Professional Fees

The prices that professionals charge for their services are known as professional fees. Professional fees and GST together impact businesses and experts.

This article will examine the significance of GST on professional services, its influence on the applicability of GST on services, and its tax implications for professionals.

So, let’s begin our discussion on professional fees and GST, a powerful pair in the business world.

Understanding GST and its Application

An innovative tax system that alters our understanding of indirect taxes is the Goods and Services Tax. Businesses and individuals in India that provide taxable products or services need to pay GST when overall sales are above a certain level. It varies across states and union territories.

Companies must register for GST if their annual revenue exceeds Rs 40 lakhs. The threshold limit is Rs 10 lakhs for states under special categories. Manufacturers, service providers, and traders must pay GST on their taxable deliveries. Its use is extensive and has an impact on a wide range of corporate operations and personal tax situations.

Let’s examine a quick summary of GST and how it impacts various industries:

- Manufacturing and Trade: The GST simplifies the goods tax framework for the trade and manufacturing industries. It lessens the cascade effect of taxes by ensuring a smooth flow of credit through the supply chain.

- Service Industry: Applicability of GST on Services is mandatory in various service sectors, which include consulting, IT, and healthcare. A large number of professional services are subject to standardized taxes.

- Retail and Consumer Goods: GST has an effect on consumer goods pricing in the retail industry. It changes consumer spending habits, removes hidden taxes, and increases transparency.

- Real Estate: The real estate sector has seen significant changes as a result of GST. When it comes to the sale of properties that are still under development. It has an impact on real estate transaction taxes and property prices.

- E-commerce: The e-commerce industry now has uniformity due to the GST. It applies to both online and traditional enterprises, which guarantees fair competition for both types of transactions.

- Export and Import: GST applies to imports as well as exports in international trade. Businesses use the Input Tax Credit mechanism to gain from cross-border trade.

- Small and Medium Enterprises: SMEs must comply with GST. SMEs must be aware of the GST registration threshold and compliance requirements even though it simplifies tax procedures.

- Agriculture: While some agricultural products are not subject to GST, the industry is not completely unaffected. Agri Processing businesses and some agriculturally related services are impacted by GST.

Professional Services and GST

Professional services are intangible products or services that individuals or groups provide to customers. It helps them manage or improve a particular area of their businesses. For instance, an acting coach who instructs actors could provide a professional service.

A professional service provider may specialize in a certain field, such as digital marketing, and help businesses enhance their digital marketing initiatives. Professional services of this type could be contract, freelance, or private practice work.

Businesses may also provide their clients with expert services. For instance, a marketing firm could offer services to assist a company in raising brand awareness or customer engagement. Professional services made available by an individual or by a business may have set fees or billable hours. It is known as professional fees.

Incomes from businesses and professions are subject to similar taxation under the Income-tax Act, of 1961 (IT Act). In India, professionals who qualify as professionals for tax purposes such as:

- Architects

- Chartered accountants

- Cost accountants

- Company secretaries

- Doctors

- Engineers

- Lawyers

- Technical consultants

- Interior decorators

- Film directors

- Cameramen

- Artists

- Singers

- Authors, and

- IT specialists

GST Exemption Limit for Professionals

Small professionals with gross receipts under twenty lakhs are exempt from GST compliance as per the 13/10/2017 Notification No. 10/2017-Central Tax.

GST Rate for Professionals

In India, nearly all professional categories are currently subject to the 18% GST rate. Also, GST requirements for service providers are the same save for some particular exclusions permissible for healthcare services. After deducting any permitted setoffs, these professionals must register under the GST legislation, collect GST at the rate of 18% from their invoices, and deposit the money to the government treasury.

SAC codes play a major role in tax implications for professionals and their services. SAC codes are split into sections and headings and range in length from four to six digits. Each job function has a unique SAC code.

Other professional, technical, and business services are covered by SAC code 9983. The creation of invoices and the filing of GST returns require these codes.

The following are the some of SAC code and GST rates for professional services:

| SAC Code | Services | GST Rate |

| 998391 | Specialized design services including industrial, fashion, interior, and other design fields are available. | 18% |

| 998392 | Design originals | 18% |

| 998393 | Scientific and Technical consulting services. | 18% |

| 998394 | Original information or fact compilation. | 18% |

| 998395 | Translation and Interpretation services. | 18% |

| 998396 | Trademark and Franchises. | 18% |

| 998397 | Sponsorship and Brand Promotion services. | 18% |

| 998398 | Other Technical, Business, and Professional services. | 18% |

Documents Needed for Professionals To Register For GST

The following paperwork is frequently essential for a single professional to register for GST.

|

|

|

|

|

|

GST Registration for Professionals

Kindly adhere to the following procedures for registering for GST on professional services:

- Collect the documentation necessary for the GST registration.

- After your documents get approved, register on gst.gov.in.

- Kindly apply for GST registration after creating an account on gst.gov.in.

- After completing all required fields, apply for GST registration.

- Continue and obtain approval for your GST.

GST Return Submissions

Depending on the specifics of the case, monthly, quarterly, and annual filings are necessary after registration. GSTR 1 and GSTR 3B are important forms for GST.

Also Read: GST Registration for Services: Documents Required

Impact of GST on Professional Fees

A uniform taxing system for a range of services has been brought about by the Goods and Services Tax (GST), which may considerably impact professional fees. Experts in consulting, law, and accounting now operate within a more straightforward tax framework.

The implementation of Goods and Services Tax (GST) replaces other indirect taxes and simplifies the computation and submission of professional fee taxes. Although it guarantees more uniformity and transparency, professionals must be careful to comprehend the implications for their clients, the applicable GST rates, and the requirements for invoicing.

Professionals can claim credits for taxes paid on inputs using the Input Tax Credit mechanism, which helps to make the tax system more effective. In general, the effect of GST on professional fees shows a shift in the direction of a more structured and transparent tax system.

Also Read: How Does GST Impact The Service Sector?

Challenges and Considerations

Professionals must address the following challenges and considerations to adequately understand the GST field. It helps to guarantee seamless operations in the provision of their services.

- Diverse Nature of Services: Professionals provide a wide range of services so there is a diversity of professional fees. It makes it difficult to appropriately classify them under GST.

- Place of Supply Rules: Professionals are often working across state boundaries, therefore it’s important to comprehend the complex Place of Supply regulations under GST for correct taxation.

- Threshold Limits and Registration: Professionals must keep an eye on their turnover to see if they exceed the threshold for GST registration. It’s important to follow the registration requirements.

- Client Education: Professionals frequently have to inform their clients about the consequences of GST on professional fees to prevent misconceptions and guarantee clear transactions.

- Shifting from Older Tax Systems: It may be difficult to comprehend and adjust to the new taxing dynamics while moving from the older tax system to the new GST framework.

- Effect on Cost Structure: GST may have an impact on a professional’s total revenue. So, it is crucial that professionals carefully consider how GST can impact their pricing strategies and cost structures.

Compliance and Legal Aspects

GST regulations for service providers are necessary to comply with the law and avoid penalties. Here are some important details regarding professional services GST compliance:

- GST Registration: Professionals must register for GST if their total revenue exceeds the set amount.

- Invoicing Compliance: One crucial element is to create invoices that comply with GST. Invoices must contain the following: the professional’s GSTIN, customer details, a service description, the relevant GST rates, and the total amount due.

- GST Returns Filing: It is necessary to submit timely and accurate GST returns. Professionals must become proficient in every aspect of filing a GST return to adhere to the regulations.

- Input Tax Credit Documentation: It becomes crucial to keep accurate records for input tax credits. Effective ITC claims need professionals to keep track of and record their expenses.

- Exemptions and Concessions: Recognize any GST regulations that may apply exclusions or concessions to particular professional services.

- Reverse Charge Mechanism: Recognize the terms of the reverse charge mechanism, which imposes GST liability on the service recipient.

- Record-Keeping: As necessary for GST legislation, keep thorough records for the relevant period, including invoices, agreements, and financial papers.

- Continual Regulatory Changes: The most recent updates on GST notifications and changes that may impact the tax implications for professionals. So, professionals must stay up to date on GST regulations for service providers to guarantee continuous compliance.

Recent Updates and Amendments

The Central Goods and Services Tax Act (CGST Act) underwent many amendments before coming into effect on October 1, 2023. The modifications provide recipients with a 180-day grace period if they do not pay invoices in full and specify when suppliers must be paid. If this happens, recipients must pay an amount equal to the claimed input tax credit (ITC).

Furthermore, the amendment to Section 139 designates the provision of products that are warehoused to individuals as an exempt supply to reverse the Input Tax Credit (ITC). ITC eligibility for products or services utilized in Corporate Social Responsibility (CSR) initiatives is restricted by Section 17(5)(fa).

A three-year statute of limitations applies to delayed returns (Form GSTR-1, GSTR-3B, GSTR-8, GSTR-9, and GSTR-9C) filed after the due date under GST Sections 142-145.

Section 146 has been amended to standardize the treatment of ITC and to provide temporary refund procedures. Notably, Section 158 permits the sharing of data with taxpayer approval.

The government has the power to establish guidelines and restrictions for interest payment on refunds that are delayed by more than 60 days under Section 147 of the FA, 2023 – Section 56 of the CGST Act.

The deadline for filing Form GSTR 3B or Form GSTR 10 in Best Judgment Assessment instances is extended under GST Section 148 from 30 to 60 days, and it may be extended to 120 days with the payment of an additional late fee.

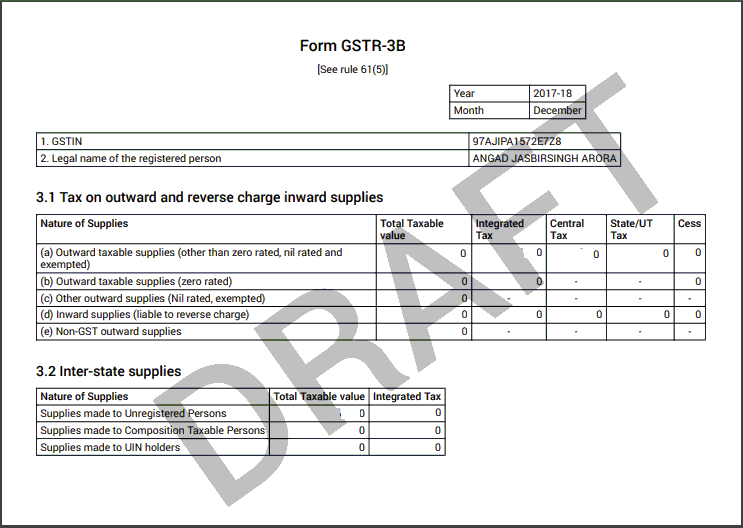

Sample format of FORM GSTR-3B

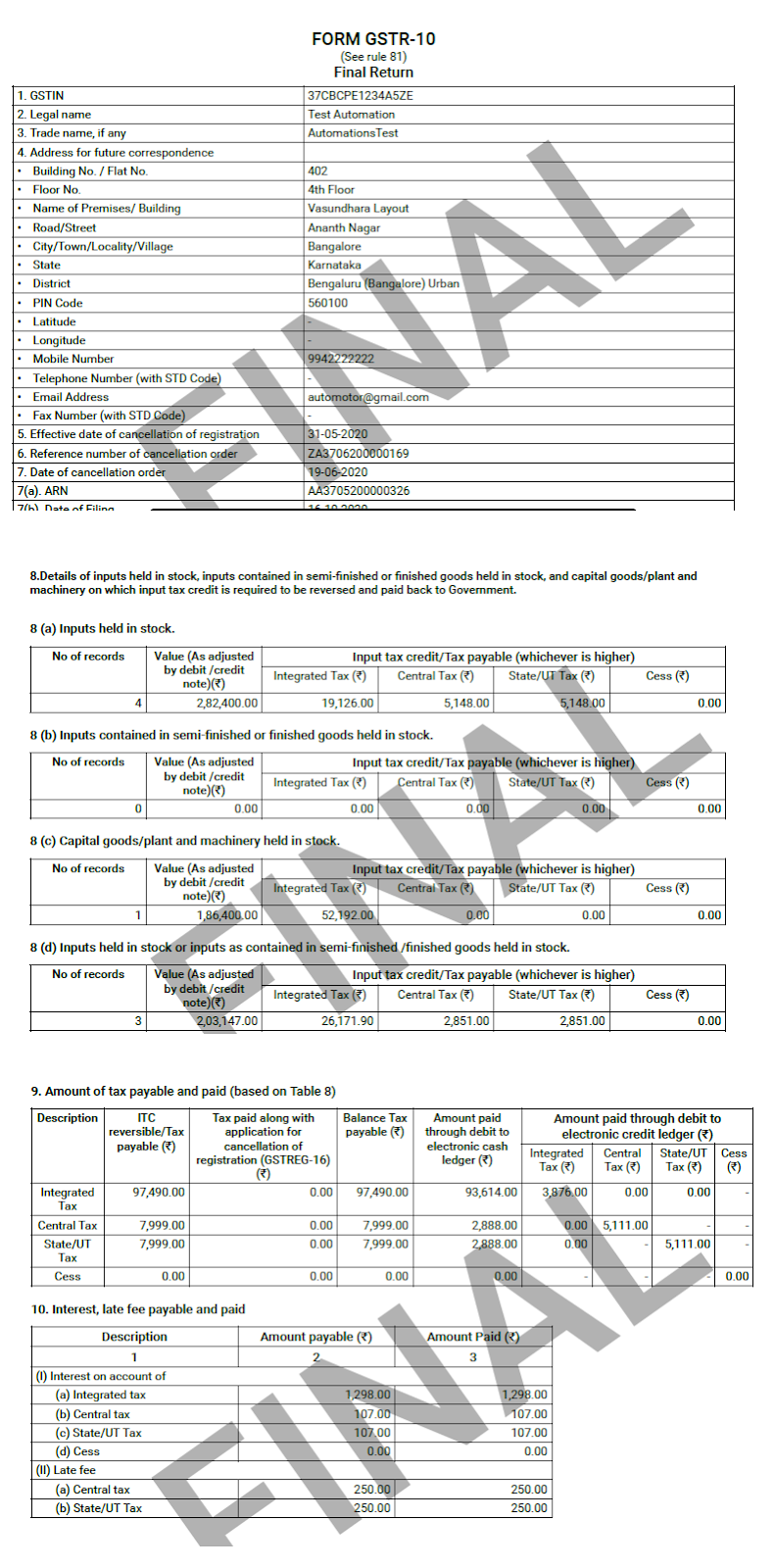

Sample PDF format of FORM GSTR-10

Except for fraudulent invoices, GST Section 156 decriminalizes several tax offenses and raises the prosecution threshold from INR 1 crore to INR 2 crore for the majority of offenses. The prior threshold of Rs. 1 crore continues to be the trigger for prosecution for fake invoicing.

The updated version and modifications are a result of continuous efforts to improve and simplify the GST framework’s functionality.

Also Read: GST Rate Updates 2024 – Goods And Service Tax Rates

Conclusion

In summary, both service providers and recipients must take into account the application of the Goods and Services Tax (GST) on professional fees. Professional fees are subject to complex GST requirements that affect the procedures of calculation, invoicing, and compliance.

It is crucial to comprehend the particular regulations, rates, and eligibility for Input Tax Credits for precise and transparent transactions. The professional services sector may achieve compliance with the unified tax system by GST management.

Also Listen: Is GST Applicable to Legal Consultancy Fees in India?

FAQs

-

Are professional fees subject to GST?

Yes, Professional fees are subject to GST.

-

Who needs to pay GST on professional fees?

Businesses and individuals offering taxable professional services are required to pay GST.

-

What is the professional fees GST rate?

The GST rate on professional fees is 18%. It varies based on the kind of services which range from 5% to 18%.

-

Does GST registration become mandatory for small enterprises offering professional services?

Yes, GST registration becomes mandatory if their total turnover exceeds the established criteria.

-

Can freelancers and consultants claim ITC for GST paid on professional services?

Yes, if they have registered for GST, they are eligible to claim ITC.

-

Are there any GST exclusions available for certain professional services?

Small-scale professionals are excluded from GST compliance if their gross receipts do not exceed twenty lakhs.

-

How often should GST on professional fees be filed?

GST returns for professional fees need to be filed as per the prescribed schedule, usually monthly or quarterly.

-

Can professionals charge GST separately on invoices?

Yes, professionals can separately charge GST on their invoices.

-

What occurs if a professional neglects the GST rules?

Legal consequences and fines might result from noncompliance.

-

Is GST applicable to international professional services?

Yes, GST applies to cross-border professional services, subject to specific rules and regulations.