Introduction to GST and Consultancy Charges

The Goods and Services Tax significantly changes a taxation system by establishing a comprehensive indirect tax framework. Among the various transactions that fall within the authority of Goods and Services Tax (GST), consulting services represent a vital and frequently complex domain. Enterprises that offer or receive consulting services must manage all aspects of Goods and Services Tax obligations. Businesses and consultants need to understand the GST rates for consulting Services.

In this article, we explore the complexities related to the applicability of GST on consulting services. The discussion aims to explain the variables influencing tax implications on consultancy charges, including the definition of the term and the relevant GST laws. Stay tuned to explore the complications surrounding consultancy fees and GST.

Understanding GST and Its Application

The Goods and Services Tax, or GST, was implemented in 2017 to simplify India’s intricate tax system. Multiple taxes were eliminated by this unified tax structure, bringing the era of “one country, one tax.” The fundamental idea involves taxing consumable products and services, which are divided into several tax slabs.

Manage GST on Consultancy Services & Your Invoices with Ease. Try Our Software Free!

Classification of GST

GST is classified as follows:

1. CGST (Central Goods and Services Tax):

- Replaces taxes such as central excise duty, service tax, and customs charges.

- Applies to intrastate movements, and split revenue between the state and federal governments.

2. SGST (State Goods and Services Tax):

- Revenue sharing between the federal and state governments applies to transactions within the same state.

- Does not include Puducherry and Delhi, which have their own legislative council and assembly.

3. IGST (Integrated Goods and Services Tax):

- It applies to interstate transactions and concerns supplies, imports, and exports between two states.

- The consumer state and the federal government split the revenue.

Applicability of GST:

Businesses that generate more than Rs 40 lakhs in revenue (Rs 10 lakhs in the Northeast and hilly areas) are subject to the GST. Tax collection techniques have been simplified by the quarterly online submission of GST. GST has made tax procedures simpler. It is advantageous to consumers as well as enterprises.

Determining the Applicability of GST on Consultancy Charges

- Consultancy services are businesses that offer professional advice and direction. It seeks to accomplish its objectives, enhance operations, and resolve challenging business issues. These services include financial, IT, legal, management, and other consulting services.

- Consulting services need to be aware of the GST and tax effects on consulting fees in addition to consulting costs. Consulting services must be aware of consultancy fees and GST and tax implications on consultancy charges.

- The applicability of GST on consulting Services depends on several factors. The rate of Reverse Charge Mechanism (RCM) for consultant charges in India is 18% under the Goods and Services Tax (GST) system.

- Under the RCM system, the recipient of the goods or services pays the taxes to the government instead of the supplier. A registered individual must pay the GST under RCM if they are using an unregistered individual’s services.

- RCM transfers the supplier’s tax responsibility to the service recipient. The applicable rate of GST for RCM is equivalent to the rate for the corresponding products or services. GST rates for consulting services are usually 18%.

- The elements that determine the application of RCM include requirements related to the kind of products or services, the nature of the transaction, and the supplier’s status. Consult a tax professional or go through the provisions of the GST Act if you’re not sure how RCM applies to a certain item or service.

Check if you are you looking for Free GST Consultation

GST Registration for Consultancy Services

Manage GST on Consultancy Services & Your Invoices with Ease. Try Our Software Free!

Businesses operating in India must finish the registration procedure for the Goods and Services Tax (GST). The following is a step-by-step methodology for a consulting services provider registering for GST:

- Determine Eligibility:

- Verify whether your company satisfies the requirements for GST registration, which include turnover limits and particular business activities.

- Online Portal Access:

- Go to the official GST portal to begin the registration procedure.

- Start the Registration Process:

- To start the registration procedure, navigate to the “Services” page on the site and click “New Registration.”

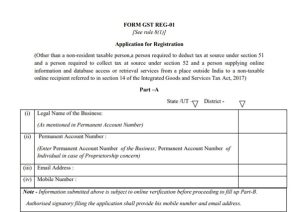

New Registration GST Form

- Part A – Fill Form GST REG-01:

- Give basic information like the company’s PAN, email address, and mobile number.

- Get a one-time password (OTP) on the registered phone number for security.

Form GST REG-01

- Part B – Fill Form GST REG-02:

- Following a successful verification process, fill out the registration form with your business’s information. It includes the nature of consultancy services offered, additional places of business, and any relevant business activities.

- Upload Required Documents:

- Submit the necessary documentation in the formats specified, including your bank statements, Aadhar card, PAN card, and proof of business registration.

- Business Verification:

- The GST officer examines the application and supporting documentation.

- The applicant might receive a notification if more information is required.

- Clarifications and Responses:

- Answer any questions the GST officer raises during the verification procedure as soon as possible.

- Issuance of GST Certificate:

- The GST officer will digitally issue the GST registration certificate once the verification process is successful.

- Display GSTIN:

- Showcase the assigned Goods and Services Tax Identification Number (GSTIN) visibly at the business location.

Although time may vary based on the validity of the information filed and the tax authorities’ workload, the entire process often takes 7–10 working days. Adhere to current GST laws, which include timely updates of any changes in business facts and the submission of regular returns.

Impact of GST on Consultancy Charges

The Goods and Services Tax (GST) has a considerable effect on consulting fees that affect many different facets of the ecosystem that supports consulting services. Important things to think about when assessing how GST may affect consulting fees are as follows:

- Impact on Service Recipients: Businesses that use consulting services must budget for consulting fees and include the appropriate GST. It becomes a crucial component of managing expenses and financial planning.

- Impact on Cost Structure: The total cost structure for service providers and recipients may change if GST applies to consulting fees. It is imperative to have open and honest communication with clients regarding the tax implications.

- Ease of Doing Business: The Goods and Services Tax (GST) aims to simplify the tax system. This facilitates commercial dealings for providers of consulting services.

- Nationwide Impact: Since GST is a federal tax, it guarantees that consulting services are treated uniformly in each state when it comes to taxes, which fosters a smooth business atmosphere.

- Tax Planning Opportunities: Gaining an understanding of the GST structure can help consulting firms plan their taxes, maximize the system’s advantages, and maintain effective financial management.

Exemptions and Special Cases

Certain consulting services may qualify for lower rates or exclusions from GST. To ensure accurate tax compliance, tax professionals must be aware of certain exemptions.

The following are some basic aspects and things to consider when it comes to GST exemptions and special cases for consulting services:

- Export of Services: Consultancy services provided to clients outside of India can be exempted from taxation under the category of service export. Specific requirements and record-keeping needs are important.

- Services Provided by Government: Business entities are frequently excluded from GST when they receive services from the government or local authorities. However, this exemption’s terms and conditions could change.

- Education and training services: Under certain circumstances, certain consulting services related to training and education may be excluded. This can include services provided by reputable organizations or educational institutions.

- Healthcare and Medical services: There may be special GST exclusions available for consulting services involving medical and healthcare services. A specific categorization often applies to health-related services.

- Non-profit organizations: Under GST, services supplied for charity purposes by non-profit organizations may qualify for exemptions or special consideration. NGOs may offer specific consulting services in this way.

- Legal consultancy services: Depending on the circumstances and nature of the work, legal consulting services may be exempt from some laws or regulations. Reviewing the GST laws related to legal services is crucial.

- Small service providers: Small service providers may be exempt from GST registration or eligible for the composition scheme if their annual revenue falls below the specified threshold. Their consulting services may be subject to different taxes as a result.

Some types of consultant services may be exempt from taxes or subject to special rates announced by the government. It’s essential to often review GST notifications to keep updated.

GST Rates and Slabs Relevant to Consultancy Services

GST on consultancy services is charged at five fixed rates, which is just under 18 percent. Other GST rates applicable to advisory services include 0%, 5%, 12%, 18%, and 28%.

Advisory Services Code SAC India has utilized the Service Accounting Code (SAC) listed below for a range of advertising services:

- Technical, Commercial Services, and other professional services fall under SAC Code 9983.

- Knowledge and technology services including management consulting and management services fall under SAC Code 99831.

- PR and business consulting services fall under SAC Code: 998312.

Compliance and Record-Keeping for GST on Consultancy Charges

Compliance and record-keeping are crucial to ensuring that consulting services adhere to Goods and Services Tax (GST) regulations. It ensures smooth operations and lowers the risk of audits or fines related to GST.

Here is an overview that covers the essential elements of keeping records and complying with GST on consultancy charges:

- GST Registration: If the whole turnover exceeds the allowable threshold, be careful to timely and accurately register for GST. Display the Goods and Services Tax Identification Number (GSTIN) on all necessary documentation.

- Proper Invoicing: Create invoices that comply with GST regulations for consulting services. These invoices should contain necessary information like the GSTINs of both the service provider and recipient, a description of the services, applicable GST rates, and the total billed amount.

- Determine Correct GST Rate: Determine the relevant GST rate by classifying the consulting services. Recognize the distinct characteristics of the services offered and apply the appropriate rate according to the GST slabs.

- GST Returns: Regularly, submit your GST returns before the deadline. Make sure that the GST return forms accurately report turnover, input tax credits, and other necessary details.

- Documentation: Maintain thorough records of every transaction relevant to consulting services. Keep records for a minimum amount of time as necessary by GST legislation, including agreements, invoices, payment receipts, and other necessary paperwork.

- File Annual Return: File the annual GST return (GSTR-9) at the end of the financial year. Also, submit the consolidated summary of all of your GST transactions.

- Requirements for Audits: Get ready For the GST audits. Maintain all relevant documentation, including accounting records and reconciliations. It helps to prove the accuracy of your GST returns.

- Client Communications: Provide clients with a brief overview of the impact of GST on consulting rates. Ensure that your clients are aware of how the GST component impacts the total amount owed on the bills.

Conclusion

In summary, the application of GST on consultancy charges is a complex topic. It requires a thorough knowledge of the GST system. GST can affect several aspects of consultancy services. It is critical to use input tax credits, assure compliance, and choose the appropriate tax rates. GST creates a single tax system, improves transparency, and streamlines taxes. Both consultancy providers and clients need to grasp GST complexities for maximum benefits. Staying updated on GST changes and seeking professional advice is essential for accurate compliance and a seamless business environment under the GST system.

Listen: Why GST Billing is so important for MSME’s ?|

FAQs

Q1: Does GST apply to consulting fees?

Yes, consulting fees are subject to the Goods and Services Tax (GST).

Q2: What is the consulting services GST rate?

Although the GST rate for consulting services is subject to change, it is normally 18%.

Q3: Are there any exemptions for GST on consultancy charges?

Some consultancy services may be exempted from GST based on certain criteria. It is advisable to check the specific GST regulations for details.

Q4: Do independent consultants have to file a GST registration?

Individual consultants must register for GST if their consulting services exceed the specified turnover level, which is normally INR 20 lakhs (subject to change).

Q5: Is GST applicable to international consultancy services?

Yes, GST applies to international consultancy services if the place of supply is in India.

Q6: How is the consulting fee GST calculated?

GST is calculated as a proportion of the total consulting fees. For instance, the GST payment is equal to 18% of the consulting costs if the GST rate is 18%.

Q7: Can a consultancy company claim an input tax credit for GST paid on expenditures?

If a consulting firm complies with GST requirements, they are eligible to receive an input tax credit on GST paid for business-related costs.

Q8: Are there any particular documentation requirements for consulting fees subject to GST?

Both individuals and consulting businesses must keep accurate records of their services, including invoices to comply with GST regulations.

Q9: How does GST’s reverse charge mechanism for consulting services work?

When the service recipient is required to pay GST rather than the service provider, the reverse charge strategy can be applicable. Comprehending and adhering to reverse charge regulations is crucial.

Q10: Do freelancers who offer consulting services have to pay GST?

Yes, just like any other service provider, independent contractors offering consulting services must abide by GST laws if their revenue exceeds the established amount.

Not sure if GST applies to consultancy charges? Get clarity with a FREE 1:1 CA consultation from a CaptainBiz expert. Book Now!