No one likes going through long fine-prints. This is especially true for invoice terms and conditions. However, terms and conditions are necessary when managing a broad spectrum of business interactions. Whenever a buyer is served with an invoice from a seller, for instance, the last thing a client would wish to have is a document with glaring errors or inconsistencies.

What Are Invoice Terms and Conditions?

Invoice terms and conditions are a set of contractually agreed-upon terms between a seller and a buyer. Typical invoice terms include when payments are due, the nature of goods delivered, and when they were delivered.

Invoice Payment Terms and Conditions Explained

The terms and conditions included in an invoice are often overlooked, especially by buyers. However, these terms are the bedrock of any transaction. Invoice terms and conditions usually accompany invoice payments.

Manage Invoices & Ensure Legal Compliance with Ease. Try Our GST-Ready Software Free!

1. Payment Terms and Conditions

Ideally, payment terms are legally binding agreements that outline seller-buyer obligations on order. These include when the customer is expected to meet their end of the bargain and the consequences of late payments. In most cases, invoice payment terms for Indian businesses usually include the following:

- Invoice date

- Timeframes that your client is expected to meet

- Transaction amounts

- Billing method & address

Invoice terms and conditions are not usually attached to the invoice documents. Instead, most Indian businesses resort to using some payment terms, which are often used to communicate the due date. While it is common practice to have the due date written on the invoice, here is a list of invoice payment terms usually employed in Indian markets:

- 15 MFI: “15th of the Month Following the Invoice.” This abbreviation means that payments for goods or services delivered should be made by the 15th day of the month following the invoice issue

- 30 MFI: 30th of the month following the invoice date. The customer is expected to pay before the 30th day of the month following the invoice date.

- EOM: Abbreviation for “End of the Month.” This abbreviation communicates to the customers that payments ought to be made on, or before the end of the month you receive an invoice.

- Net 7: This invoice term gives the customer a maximum of 7 days from the invoice dates to make payment arrangements

- Net 30: The customer must pay 30 days after the invoice date.

- Net 90: The customer has 90 days from the invoice date to make payments

- Cash Account: No Credit: All payments are to be made in cash (No Credit is allowed)

- Cash Account: Letter of Credit: Payments should be made in cash, but credit is allowed upon confirmation from the customer’s bank

- Upon Receipt: The client is expected to pay immediately after receiving the invoice

- 50% Upfront: The customer must meet 50% of the price beforehand. This is usually applicable to long-term projects

- CIA: “Cash in Advance” the customer is expected to pay before the delivery of goods or the rendering of a service

- CWO: “Cash with Order” The customer must make payments when submitting their order.

- CBS: “Cash before Shipment.” The customer is expected to pay before a dispatch is made

- COD: “Cash on Delivery.” The customer only pays upon delivery.

- RD: “Rolling Deposit” is usually applied when the seller is willing to extend credit to the customer. Customers can work with limited credit while making payment arrangements, like with prepaid secure cards.

- Discounts: Some businesses extend discounts to encourage their customers to pay faster. While a small discount might dig into the enterprise’s profits, it will save you some grey hairs.

While this list of payment terms is not entirely exhaustive, sellers and clients should be clear with the invoice terms used. Clarity is vital in ensuring that clients honor their payments on time.

Also, invoice terms and conditions are not always cast in stone. As such, some terms might favor some clients and not others. Some clients might pay in cash, while others might require time to mobilize funds. Thus, it’s all about striking a balance to meet the business’s financial obligations.

2. Warranty Terms and Conditions

For businesses selling products or offering services that carry a warranty, it is always a good practice to be clear on all terms and conditions accrued to the warranty. Any warranty documents should address the following points:

- Warranty period or duration

- The person offering the warranty

- Contact details of the warranty issuer

- Nature of the warranty

3. Refund/Returns Terms

There are cases where a return or a refund is owed. In such cases, it is always important to be clear about scenarios where refunds or returns are acceptable. For example, most retailers require that the goods be in the same condition as during packaging. Refund and return policies come in different names, including:

- Returns and exchange policy

- Shipping and return policy

- Store return policy

A well-drafted return policy is critical in attracting and retaining customers. Also, a clear refund policy saves the business from potential losses from unnecessary returns or refunds. As such, the invoice terms and conditions for Indian business should include the following points:

- Duration within which a replacement or a refund can be issued

- Charges applied on refunds and replacements

- Actions taken if goods are damaged

- Qualification for a replacement or a refund. For instance, “items must be returned in saleable and unaltered conditions to qualify for a warranty.”

4. Late Payment Penalties

It is imperative to educate the client on the consequences of late payments. As such, it is always advisable to include them in your agreement for the following reasons:

- They act as a reminder to the client to observe set timelines.

- They improve payment times and reduce delays.

- They also compensate business owners for costs accrued due to payment delays.

5. Currencies and Payment Forms

While most businesses in India do not have to deal with different currencies, those that work with an international clientele have to deal with foreign currencies. As such, you should start by listing acceptable currencies. Similarly, it is in your best interests to specify the forms of payment (cash, cheque, card, or wire transfer) you accept.

6. Jurisdiction Terms

While legal battles are highly discouraged, they are always bound to happen in business. As such, the business should always come clear of its legal jurisdiction. This is particularly important for small businesses, which can only afford to handle disputes in their local courts. This explains why many invoices have a jurisdictional cause, such as – “subject to Delhi Jurisdiction Only.”

Manage Invoices & Ensure Legal Compliance with Ease. Try Our GST-Ready Software Free!

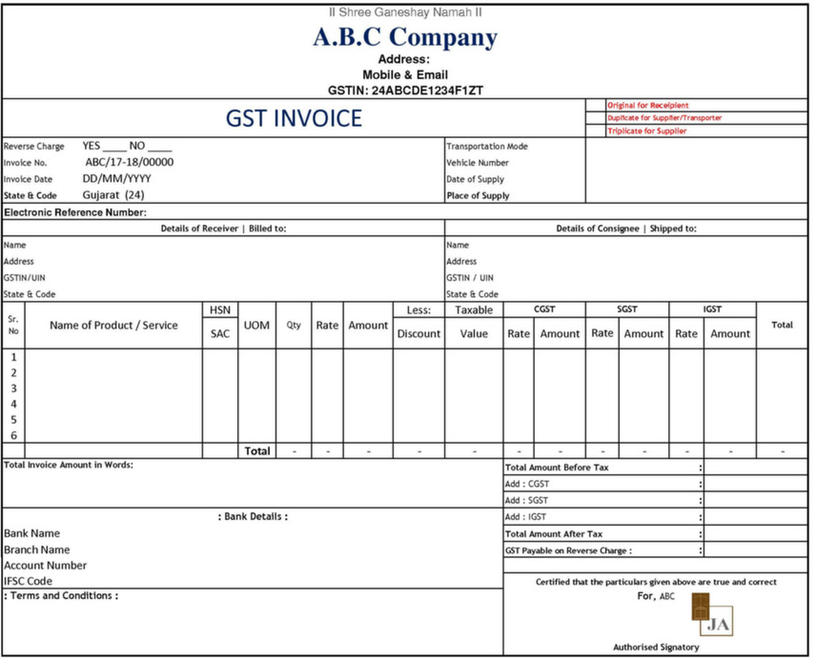

7. Good Services Tax (GST) Invoice Requirements

As per Indian laws, a bill of sales for goods or services should always accompany any transaction. As such, when merchants deem it fit to include such goods and services, a GST invoice should be sent to the buyer in compliance with GST laws enacted on 1st July 2017. This requirement is vital in fostering tax compliance. The image below shows a an ABC Company GST invoice:

8. E & O.E.

An abbreviation for “Errors and Omissions Expected,” E & O.E is a common phrase in invoice terms. In essence, the inclusion of the terms seeks to mitigate legal liability and potential losses for incorrect or incomplete information supplied in an invoice. In essence, E & O.E. takes care of invoice errors, which can be amended when they arise.

Also Read: Mandatory Information To Include In A Tax Invoice For Goods

Importance of Invoice Payment Terms

Most small businesses in India struggle to get paid on time. This practice is often blamed on ineffective invoicing systems. The sole purpose of invoice payment terms is to ensure a clear understanding between the seller and the buyer on when the payment is expected. Clear communication of these expectations goes a long way in helping the business manage its cash flow needs while mitigating financial risks.

Moreover, clear invoice terms and conditions (T&Cs) for businesses in India act as a safeguard for both companies and clients. When expectations for both parties are clear, delays and cash flow inconsistencies are significantly reduced. Also, clients benefit from clarity in understanding payment timelines, thus mitigating misunderstandings and fostering trust and loyalty.

Also Read: The Importance Of Including All Required Elements On A Tax Invoice

Best Practices for Invoice Payment Terms

It is a known fact that there is no one-size-fits-all approach when drafting invoice payment terms for Indian businesses. However, the following tips go a long way in helping companies to get the “invoicing job” done more effectively.

1. Define Terms in a Contract

In most cases, it is paramount to negotiate your payment terms with a potential customer before getting to work. These arrangements come in handy in ensuring that both parties to the contract get the best fit.

Once there is a consensus, ensure that every detail agreed upon is captured in the contract. Ideally, documenting the agreement gives the seller a legal standing in case the customer defaults. This contract is usually essential because an invoice might not always be considered legal.

2. Prompt Invoicing

Any seller should try to send the invoice once the order is marked complete. Delays in invoice issuance often attract late payments, which hurt business operations.

Businesses employ diverse strategies to ensure they send prompt invoices. Irrespective of the nature of the business, automated invoice generation systems prove invaluable in this regard.

3. Secure Invoicing

With the evolution of the invoicing method, Indian business owners should try to secure their invoice payments. Investing in digital security protocols is crucial in avoiding financial losses for businesses and clients.

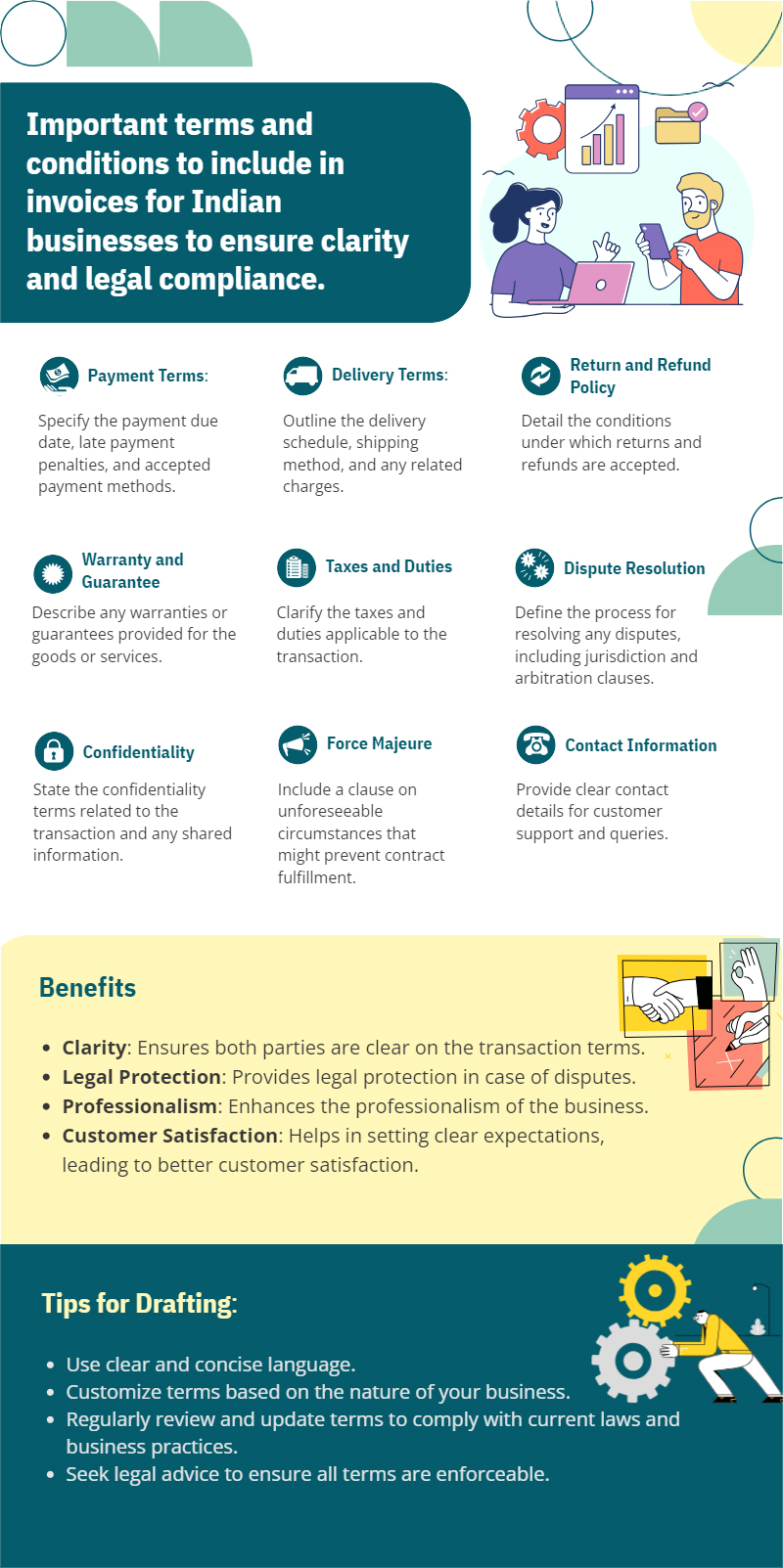

Why Indian Businesses Need Invoice Terms and Conditions?

From the onset, drafting invoice T&Cs should be a very deliberate process. With clear terms, business owners are at an advantage when controlling how clients remit their payments. Clear terms and conditions are fundamental in the following ways:

- Helps customers understand invoice terms: When terms and conditions are clear, the service provider can keep payment terms clear. For instance, when you should make payment and penalties for any delays.

- Helps businesses meet legal requirements: Under GST laws, all businesses are required to prepare invoices. This requirement is not just for tax remittance purposes; it can also be used when clients fail to honor their part of the bargain.

- Helps align business operations: When payment terms and timelines are well-defined, incidences of non-compliance are significantly reduced. This, in turn, allows the business owner to execute his business dealings optimally.

The Fundamentals of Drafting Invoice Terms and Conditions for Indian Businesses

Besides the “major” requirements, several small yet critical aspects should be included in invoice T&Cs. A good document should tick the following boxes:

- It should be written in simple language

- It should capture all essential details of the transacting parties

- It should have an invoice or reference number

- It should suggest the preferred payment mode

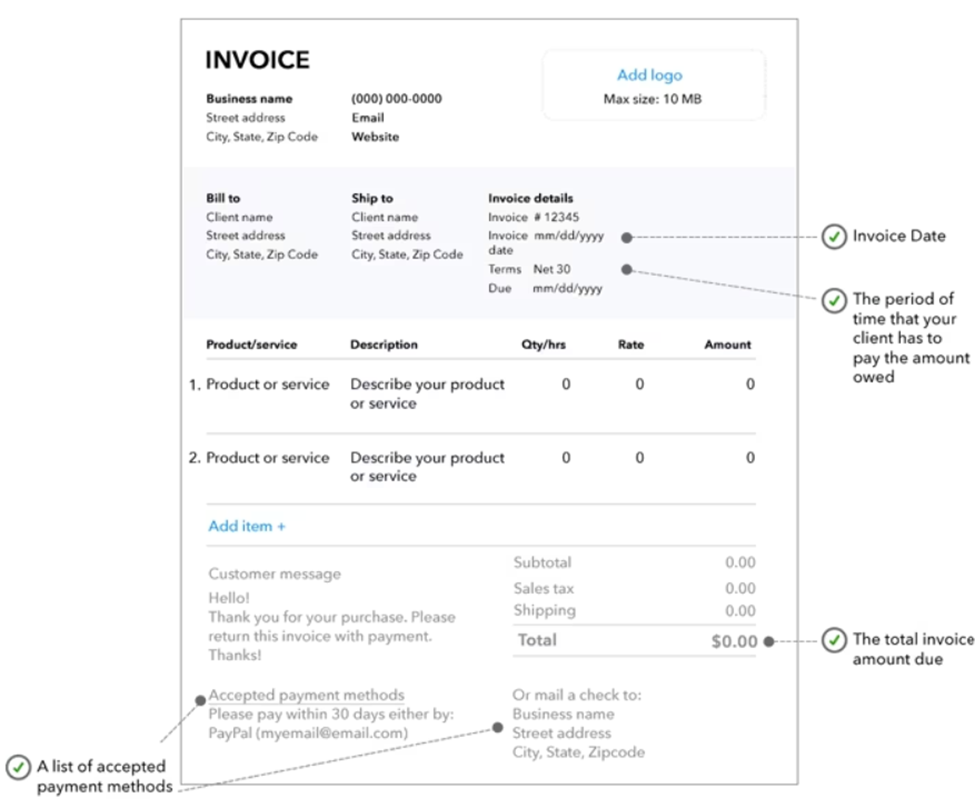

The image below from intuit quickbooks shows a typical invoice with its unique features:

Final Thoughts

The difference between successful businesses and those that aren’t very successful lies in how they conduct their operations. This also holds when invoicing. Invoicing procedures are an integral part of business accounting. As such, clear and elaborate payment terms communicate expectations to clients, translating to better business and fewer misunderstandings. Invoice terms and conditions act as a safety net in case of fraud.

Also Read: Tax Invoice For Goods: Key Components And Legal Requirements

Listen Navigating the Seas of Small Business Finance

FAQs About Invoice Terms and Conditions for Indian Businesses

1. What Should be Included in Invoice Terms and Conditions?

Terms and conditions are meant to communicate or outline customer expectations and obligations. Among the details to include on invoice payment terms are delivery, refund, or cancellation properties, despite resolution and anything affecting business transactions.

2. What happens when a client violates invoice terms and conditions?

The remedy for non-adherence to invoice terms and conditions, for instance, a non-payment, can be addressed by imposing penalties or legal actions as stipulated by the T&Cs.

3. Is it mandatory to include GST in invoices?

Yes. Indian laws have made it mandatory for business owners to include GST data and other tax information in invoices.

4. Are invoice terms applicable to both goods and services?

Yes, invoice terms apply to both goods and services. The only disparity should be that terms and conditions should be tailored to address the specifics of the transaction.

5. Are invoice T&Cs legally binding in India?

Yes, provided both parties have agreed upon them and are consistent with Indian contract laws.