Input tax credit is an essential component of GST, which eliminates the cascading effect of taxes and brings transparency and efficiency to the indirect tax system in the country. It ensured that businesses could claim credit at every stage of the supply chain. In this process, the tax paid by the supplier on the purchase of goods and services for manufacture is used by the taxpayer to offset the tax liability on his outward supplies. The tax authorities observed that the input tax credit was wrongly claimed. In such cases, the ITC claim is required to be reversed in the subsequent months. Here we discuss ITC reversal as per Rules 42 and 43 of the CGST Act.

Read More: GST Composite Taxpayer Benefits for Small Businesses and Startups

ITC Reversal under GST

Though the basic conditions for claiming are fulfilled, ITC is required to be reversed in cases where the goods and services are used for non-business purposes, blocked ITC, and so on. In such situations, the ITC utilized earlier must be added to the output tax liability to nullify the wrongly claimed credit. Total ITC can be divided into:

Struggling with Input Tax Credit reversals? Automate compliance with smart GST billing software!

- Specific Credit: Specific credit refers to the credit that can be directly linked to either a taxable or non-taxable supply or to supplies used for personal purposes.

- Common Credit: ITC that cannot be attributed to a specific supply but is used partly for manufacturing and partly for personal consumption is termed common credit.

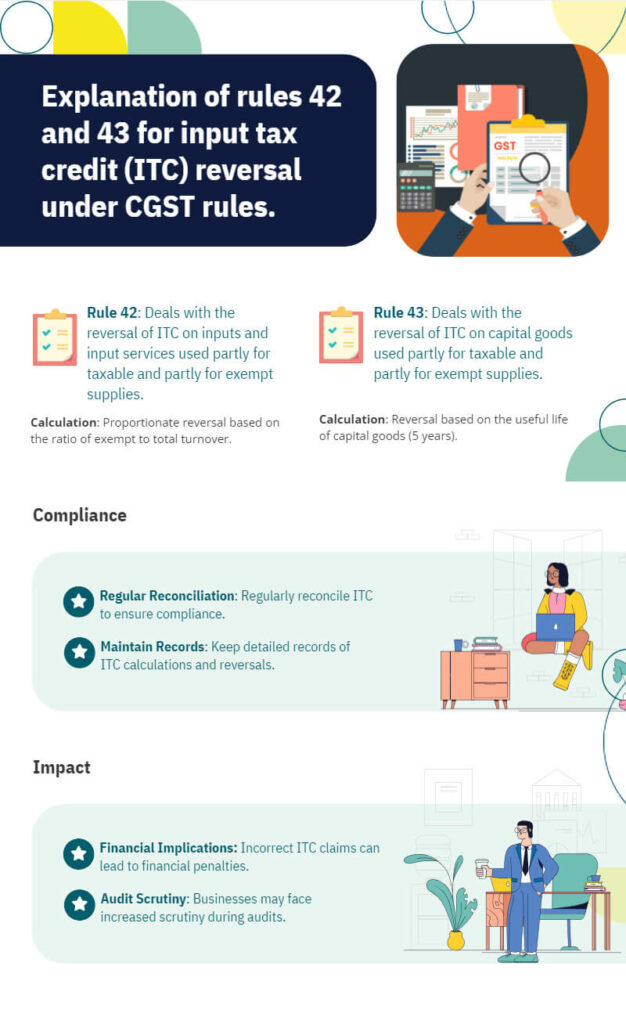

Rule 42 states the method of determining the reversal ITC for goods and services, and Rule 43 offers the method for determining the ITC input tax credit reversal amount on capital goods.

Read More: Input Tax Credit (ITC) Provisions in GSTR-5

Rules 42 and 43 of the CGST

Rules 42 and 43 apply for the input tax credit claimed when the supply is used partly for business and partly for personal purposes. The input tax claimed is required to be reversed and nullified. The rules provide the method for determining the ITC that is to be reversed, which is used partly for business and partly for non-business or personal purposes.

Rule 42-ITC Reversal on Inputs and Input Services

The ITC reversal of inputs and input services is done in the following steps:

Step 1: Businesses must first separate the specific credits that are ineligible to be claimed from the total ITC in the following manner:

The following variables and formulas are used in the calculation:

- T denotes the total input tax credit on inputs and input services in a tax period.

- Specific credits, out of T, attributed to inputs or input services intended to be used exclusively for non-business or personal uses are T1.

- T denotes the total input tax credit on inputs and input services in a tax period.

- The amount of tax, out of T, deemed as ‘blocked credits’ under Section 17(5) is T3.

Step 2: The joint credit is obtained by reducing T!, T2, and T3 from the total ITCs as follows:

- C1=T (ITC credited to the electronic credit ledger) + (T1 + T2 + T3)

- T4 represents the credits for inputs and input services used solely for making taxable supplies, which include zero-rated supplies such as exports and supplies to Special Economic Zones (SEZ).

- T1, T2, T3, and T4 will be determined and declared at the invoice level by the taxpayer in Form GSTR-2.

- C2 =C1-T4 is the ITC on the inputs that have been used partly for making taxable supplies and partly for exempt supplies or for non-business purposes.

Struggling with Input Tax Credit reversals? Automate compliance with smart GST billing software!

Step 3: Calculate the amount of ITC to be reversed from the common credit as follows:

The input tax credit attributable to exempt supplies is denoted by D1 and is calculated as follows:

- D1 = (E/F) x C2.

- Where E is the aggregate value of supplies during the tax period and F is the total turnover in the state of the registered person during the tax period,

- When the taxpayer does not have any turnover during the tax period or the aforesaid information is not available, the value of E/F is to be calculated by taking the values of E and F of the previous tax period in which the details are available.

- D2 is deemed to be the ITC attributable for non-business purposes where common inputs and input services are used partly for business and partly for non-business purposes and is equal to 5% of C2.

- C3 represents the remaining eligible input tax credit used for business purposes, including supplies other than exempted ones, such as zero-rated supplies.

- C3 = C2-(D1+D2)

- The taxpayer has to compute C3 separately for input tax credits from the central tax, state tax, union territory tax, and integrated tax.

Example:

- Supplies by company XYZ in the month of September 2022 in Karnataka

- Total ITC available (T)15 – Rs. 180000/-

- ITC on inputs and supplies used by the business owner for personal use (T1) =Rs. 10000/-

- ITC on exempted inputs and supplies (T2) = Rs. 15000/-

- Blocked Credits (T3) = Rs. 5000

- Input tax credit for taxable supplies (T4) = Rs. 110000/-

- Total value of exempted supplies made in September (E) = Rs.250000/-

- Total Turnover (F) = Rs. 4000000/-; therefore, we can compute

- C1=T-(T1+T2+T3)

- C1=Rs.180000-(10000+15000+5000) = Rs.150000/-

- The common credit C2=C1-T4

- C2=Rs.150000-110000=Rs.40000/-

- D1 = (E/F) x C2

- D1 = (250000/4000000) x 40000 = Rs. 2500/-

- D2 = 5% of C2

- D2 = 5% of 40000 =Rs. 2000/-

- C3 = C2 – (D1 + D2).

- C3 = Rs. 40000 – (2500 + 2000) = Rs. 35500/-

- Therefore, out of the original ITC of Rs. 180000/-, only C3 (Rs. 35500) and T4 (Rs. 110000/-) are credited eventually to the electronic credit ledger. D1 (Rs. 2500) and D2 (Rs. 2000) were required to be reversed.

Rule 43 – ITC Reversal on Capital Goods

The first step is to determine whether the ITC meets either of the following criteria:

- ITC is applicable to capital goods utilized only for exempt or non-business purposes.

- ITC is available for capital goods that are solely used to produce non-exempt supplies, including zero-rated goods such as exports and supplies to special economic zones (SEZ).

If the ITC falls under category (a) above, credit is not allowed for the same. If the ITC falls under category (b) above, credit is allowed and recorded in the electronic credit ledger. Five years from the date of the invoice is considered the useful life of the capital goods.

Therefore, if the capital goods were covered under categories ‘a’ or ‘b’ previously and are no longer covered under either, the ITC is referred to as Tc or ‘common credit’ and 5% needs to be deducted from the common credit for every quarter or part-quarter for the time it was covered in the category ‘a’ or ‘b’.

Though the capital goods are considered to have a useful life of five years, as our reporting period is based on supplies received or made in a certain month, we calculate the ITC for the month by dividing the credit by 60.

To calculate the ITC reversal on capital goods, the following variables and formula are used:

- Tm = Tc/60 Amount of ITC attributable to a tax period (a month) on common capital goods during their useful life

- Tr = the aggregate Tm of all the capital goods with useful life remaining at the commencement of the tax period.

- Te = Common credit for exempted supply, which is calculated as E/F where

- E = the total amount of exempted goods or supplies made during the tax period.

- F = total turnover of the taxpayer during the tax period

Te along with applicable interest, will be added to the output tax liability of each tax period during the useful life of the capital goods involved. The above calculations would differ slightly if the supply is of the type covered by paragraph 5(b), Schedule II, of the CGST Act.

Example

A company XYZ, having business in Karnataka, had availed of the following ITC on various capital goods purchased in the month of August 2022:

- ITC on Machine A used solely in the supply of exempt goods = Rs. 120000

- ITC on Machine B used solely in the supply of taxable goods is Rs. 700,000.

- ITC on Machine C used solely for non-business purposes = Rs. 20,000

- ITC on Machine D is used partially in the supply of taxable goods and partially in the supply of exempted goods = a total of Rs. 600,000.

- The company had made output supplies in Karnataka in August as follows:

- Turnover related to exempt supplies = Rs. 2000000/-

- Turnover related to taxable supplies = Rs. 5000000/-

Therefore, we can compute the ITC reversal as follows:

- ITC on Machines A and C will not be credited to the electronic ledger (Rs. 120000 + 20000 = 140000).

- ITC on Machines B will be credited to the electronic credit ledger at Rs. 700,000.

- ITC on Machines D will also be credited to the electronic credit ledger.

- Tc= Rs.600000/-

- Tm = Tc/60 = Rs.10000/-, which is also Tr in this case.

- The amount of ITC that will be reversed for the month of August 2022 will be (E/F) x Tr = (Rs. 20,00,000, 50,00,000) 10000 = Rs. 4000/-.

- Thus, the total ITC reversed for the company XYZ on capital goods for August 2020 is Rs. 4000/-.

Conclusion

ITC reversal under GST is the reversal of the wrongly claimed ITC, the formulae and process for which have been clearly mentioned in Rules 42 and 43 of the CGST Act. It is important for taxpayers to understand the rules and process of ITC reversal on inputs and input services, as well as on capital goods, to avoid interest, penalties, and other consequences. In case of any doubts, it is better for taxpayers to seek the help of GST specialists like Captainbiz, who provide easy-to-use solutions for GST and non-GST companies.