Think about the last time you checked a business invoice and noticed an extra charge for VAT or GST. These aren’t just small add-ons; they’re indirect taxes and they play a big role in how businesses plan their finances. In this blog, we’ll discover how these taxes affect businesses and how efficient tax planning can help organizations lead the way forward.

Managing indirect taxes like GST or VAT is important for any business. Get it right, and you can save money, plan better, and even find new ways to grow. We’ll cover everything from basic understanding to smart strategies for indirect tax planning.

Whether you’re a small business owner or part of a larger corporation, this blog is designed to help you understand how Indirect taxes work. We’re focusing squarely on indirect taxes like GST and VAT, and how they impact your business’s financial health. We’ll go beyond just explaining these taxes; we’ll show you how to effectively manage them, potentially turning a regulatory requirement into a financial opportunity for your business.

Introduction to Indirect Taxes

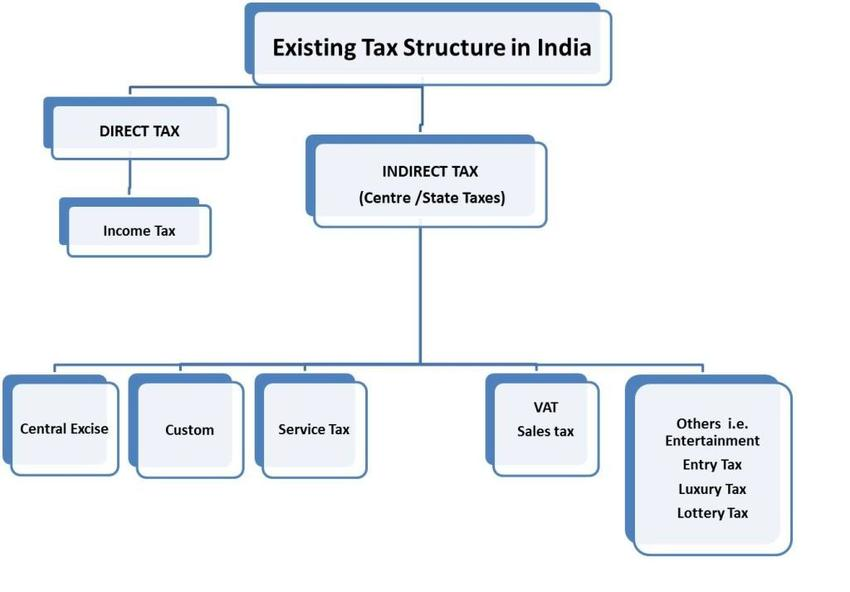

Indirect taxes are taxes levied on goods and services rather than on income or profits. The most common examples include Value Added Tax (VAT), Goods and Services Tax (GST), and sales tax. These taxes are typically included in the price of products or services and are paid by consumers, making them a key revenue source for governments. Unlike direct taxes, which are based on personal income or corporate profits, indirect taxes apply to transactions and consumption. Their impact is widespread, affecting pricing strategies, consumer spending, and overall business economics.

Types of Indirect Taxes

Indirect taxes are essential components of a country’s fiscal policy and play a significant role in shaping the economic framework. The major types of indirect taxes include:

- Value Added Tax (VAT): VAT is a tax on the value added to goods and services at each step of production or distribution. It’s commonly applied in many countries. For example, when a manufacturer produces a product and sells it to a retailer, VAT is charged on the sale. Then, when the retailer sells to the consumer, VAT is applied again, but the retailer can reclaim the VAT paid at the purchase. This cycle ensures tax is paid on the added value at each stage.

- Goods and Services Tax (GST): Similar to VAT, GST is a broad-based tax applied to most goods and services. The key difference is that GST is often used in a federal system, where it integrates state and central taxes. For instance, in India, GST replaced various taxes like service tax, VAT, and excise duty to unify the tax system, making it easier for businesses to comply and for the government to administer.

Also Read: GST: The Complete Guide

- Sales Tax: In India, Sales Tax was a state-level tax that was charged on the sale of goods. It varied from state to state and was levied at the point of sale or during the transfer of goods. However, with the introduction of the Goods and Services Tax (GST) in July 2017, Sales Tax, along with many other indirect taxes, was subsumed under GST. This was done to unify the diverse tax structure and create a single, streamlined system. For example, prior to GST, if a business in Mumbai sold goods to a customer in Pune, it had to deal with different Sales Tax rates and rules for Maharashtra. Post-GST, the taxation process has been replaced by a unified GST structure across the country.

- Excise Duties: These are taxes on specific goods, particularly those considered harmful or luxurious. Common examples include alcohol and tobacco. The aim is often to discourage consumption while generating revenue. For example, high excise duties on cigarettes aim to reduce smoking rates while providing governments with funds that can be used for public health.

- Custom Duties: Applied to goods imported or exported, custom duties regulate international trade, protect domestic industries, and generate revenue. An example is tariffs imposed by a country on imported goods to protect its own domestic industries from foreign competition or to retaliate against unfair trade practices.

Understanding these different forms of indirect taxation is essential for businesses to ensure compliance and optimize tax planning.

Strategies for Mitigating Indirect Tax Burden

Effective management of indirect taxes not only ensures compliance with tax regulations but can also turn tax obligations into opportunities for financial optimization and strategic business growth. The key is in understanding and applying the principles of indirect taxation in a way that aligns with the business’s overall goals. To optimize tax payments and enhance profitability, businesses need to adopt effective strategies. These include:

- Indirect Tax Planning: This strategy involves structuring business transactions and operations in a way that legally minimizes tax liabilities. It includes choosing the right business model, product classification, and understanding tax implications of different business decisions. Effective indirect tax planning helps businesses reduce costs and avoid legal pitfalls related to tax compliance. By staying ahead of tax obligations and updates, companies can maintain profitability and avoid penalties. For example, a company might choose to establish its manufacturing unit in a region with lower tax rates or claim exemptions on certain categories of products that qualify for tax relief.

- VAT Optimization Strategies: This involves scrutinizing the VAT paid on business inputs and ensuring maximum recovery of VAT where applicable. VAT optimization strategies include accurate VAT accounting, timely filing of returns, and understanding cross-border VAT rules. This is required for enhancing the cash flow and ensuring that a business is not paying more VAT than necessary. It helps in improving the cash flow and reduces overall business costs. For example, a business may analyze its supply chain to identify stages where VAT can be reclaimed, ensuring that it only bears the net tax cost.

- Supply Chain Tax Efficiency: Companies restructure their supply chains to align with jurisdictions that have favorable tax regimes. This might involve shifting manufacturing bases, warehousing, or even the structure of sales and distribution networks to leverage lower tax rates. Consider a multinational corporation that chooses to set up its distribution hub in a country with lower indirect tax rates; this strategic move can reduce the overall tax burden substantially.

- Leveraging Tax Credits and Rebates: Businesses claim tax credits for the taxes paid on inputs or rebates available under various tax laws. This includes keeping track of all eligible credits and understanding how they can be applied. Keeping track of eligible credits and understanding their application can lead to substantial savings. A common example is a manufacturer claiming input tax credits for GST paid on raw materials, which in turn reduces the GST liability on their final products.

Indirect Taxes in a Global Context

When it comes to running a business that spans across different countries, handling indirect taxes like GST can be quite a task. Different countries have their own tax rules, and a multinational company needs to keep up with all these changes. It’s not just about following the rules; it’s also about figuring out how to manage taxes in a smart way that’s good for business. For example, how GST affects a business in India might be different from how it works in Australia.

For companies that work in many countries, it’s also important to look at how they can make the most of VAT. This might mean changing how they move goods around to places where the VAT is lower, saving money in the process. Think of it like finding the best route on a road trip to save on fuel. This is a big part of what makes good global indirect tax management.

In short, for businesses that go beyond borders, it’s all about staying up-to-date and being smart with indirect tax planning. This way, they can save money and keep things running smoothly.

Also Read: GST And The Global Tax Landscape

Indirect Taxes and Business Growth

Business growth is significantly impacted by the handling of indirect taxes like GST and VAT. It’s akin to finding a more efficient route in a complex network – it quickens the journey towards achieving business objectives. Proper management of these taxes ensures that businesses don’t spend more on tax liabilities than necessary, thereby optimizing cash flow. Additionally, it empowers companies to strategically price their products or services, maintaining market competitiveness while preserving profit margins.

Also Read: GST And The Ease Of Doing Business

In Conclusion

Dealing with indirect taxes like GST and VAT is of utmost importance for any business. It’s not just about adhering to the compliance requirements, but more about finding smart ways to use these taxes to their advantage. By managing these taxes, businesses can improve their cash flow cycles, thus having more money to work with, setting better prices, and running more smoothly. Plus, by leveraging technology, businesses can make handling taxes a lot easier, especially if the business is spread out multinationally.

Frequently Asked Questions (FAQs)

-

What is indirect tax planning and why is it important?

Indirect tax planning aims to legally minimize tax liabilities within a company’s operations. By strategically planning transactions and supply chain processes, businesses can reduce costs, ensuring compliance with tax regulations, and ultimately improving profitability.

-

How can VAT optimization strategies benefit a business?

VAT optimization strategies involve identifying opportunities to reclaim VAT, thereby improving a business’s cash flow. By carefully analyzing transactions and VAT obligations, businesses can reduce the overall tax burden, leading to significant cost savings and financial efficiency.

-

What challenges do global indirect tax management present?

Global indirect tax management requires businesses to comply with different tax laws and rates in various countries. This complex task involves ensuring compliance, understanding international tax implications, and optimizing tax strategies to maintain profitability across borders.

-

What is the impact of GST on businesses?

The introduction of GST impacts businesses by simplifying the tax structure, merging multiple indirect taxes into one. The GST impact on businesses led to easier compliance, potentially lower tax burdens, and streamlined financial operations, significantly affecting a business’s financial planning.

-

How does supply chain tax efficiency contribute to business success?

Supply chain tax efficiency is important for minimizing tax costs associated with the movement of goods. By optimizing the supply chain structure, businesses can take advantage of favorable tax regimes, leading to cost savings and enhanced competitiveness in the market.

-

How does effective indirect tax planning benefit a company?

Effective indirect tax planning ensures a business remains compliant while minimizing its tax liabilities. Through strategic planning and understanding of tax regulations, businesses can maintain financial stability and avoid unnecessary tax expenses.

-

Can VAT optimization strategies vary for different businesses?

Yes, VAT optimization strategies vary depending on business type, size, and the nature of transactions, requiring a tailored approach for maximum benefit.

-

How does global indirect tax management affect multinational companies?

For multinational corporations, global indirect tax management is vital for following diverse tax regulations in different countries. Effective management ensures legal compliance, optimizes tax liabilities, and maintains consistency in global financial strategies.

-

What role does GST play in a business’s financial strategy?

GST plays a significant role in a business’s financial strategy by affecting tax liabilities, compliance requirements, and operational costs. Understanding and adapting to GST regulations is essential for efficient financial planning and maintaining market competitiveness.

-

How can supply chain tax efficiency improve a business’s bottom line?

Supply chain tax efficiency can improve a business’s bottom line by reducing tax-related liabilities. Strategically restructuring the supply chain to leverage favorable tax regimes can lead to significant savings, contributing to overall business profitability.