Introduction

The new GST Act provides tax relief for Indian taxpayers. Businesses that suffered from cascading indirect taxes benefited from the unified GST tax. The government tax authorities could also check tax evasion and fraud using the new GST tax regime. The ‘One Nation One Tax’ concept has increased the number of taxpayers in the country. The GST tax collections increased by 12%, reaching 172 lakh crore in October 2023.

As the Indian startup sector is booming, entrepreneurs are now keen on starting their businesses. The reduced tax burden and streamlined tax payment through the GST network have contributed significantly to SME growth in India.

This blog will dive into the top benefits of GST for small businesses in India.

How Does the GST Act Work?

Until the introduction of GST, the taxation system in India was confusing. Businesses must deal with different types of state tax, central tax, customs duty, excise duty, VAT, etc. when they supply goods or services. The services sector suffered from compounded taxes due to the illogical flow of tax in the supply chain. Business owners often had to pay tax on tax due to taxation on multiple points in the supply chain.

Now, GST is levied only where goods or services are consumed. The destination-based tax is included in the purchasing price of the product. Each participant in the supply chain must pay their share of taxes so that the manufacturer doesn’t have to pay multiple taxes. At every step in the supply chain, the participant adds value to the product and thus increases the taxation value. The tax burden on any single entity in the supply chain is reduced with GST.

The GST tax invoice includes the total cost of the product, including the GST. This GST is a combination of CGST and IGST. In each case, equal amounts of CGST and SGST will contribute to the total GST tax rate. For example, if the GST on a product is 18%, then SGST and CGST will be 9% each. The supplier only has to pay one tax. Also, when a business places a purchase order and pays the GST tax, it can claim the input tax credit. This ITC will enable them to offset their GST liabilities. So, the refund and return system is more streamlined as businesses can reduce their tax burden with ITC.

The following are the main types of GST taxes in India:

- IGST – Integrated Goods and Services Tax is levied on the supply of goods and services between two different states. It is also applicable to import and export transactions. Taxpayers must pay this part to the central government.

- SGST – The state levies State Goods and Services Tax for the supply of taxable goods or services within the same state.

- CGST – The central government levies Central Goods and Services Tax on intrastate trades.

- UTGST – Union Territory Goods and Services Tax applies in place of SGST when the transaction involves union territories. This applies to all union territories of India, such as Andaman and Nicobar Islands, Chandigarh, Dadra and Nagar Haveli, Lakshadweep, and Daman Diu.

Also Read: Tax Implications For Small Businesses In Specific Industries

8 Reasons Why GST for Small Business is Crucial

As businesses adopt digital technology, they need a unified and streamlined system for taxation. Foreign investments were feasible only with a simplified taxation system. More investments will flow in when investors can understand the simple taxation policies and expedite the process using online channels. It will also encourage small businesses in remote cities to thrive amidst the competition. Let’s dig deeper into the benefits of GST for small companies and startups in India.

#1 GST Composition Scheme

To encourage small-sized businesses to capture new markets, the Indian government has introduced the GST Composition Scheme. Small businesses with an annual turnover of less than Rs. 1 crore can join this Composition Scheme and pay a lower tax. As the small businesses are in the early stages, their tax burden will be reduced with a lower tax rate.

With the previous taxation policy, the service tax alone could come up to Rs. 10 lakh for such businesses. Based on the state, VAT will add Rs. 5 lakh to Rs. 10 lakh. Companies registering under the Composition Scheme must only pay 1% of their business turnover. This will divide as 0.5% for SGST and 0.5% for CGST.

Small businesses registering under the Composition Scheme can get away with paying much less tax. They can use the capital flow for business operations and expand their reach.

#2 Improved Transparency

The integration of the GST network throughout the country for the purpose of taxation has streamlined tax-related transactions in India. Digital operations ensure that there is minimal chance of tax evasion or fraud. All businesses can benefit from online tax payment and GST return submission. The GST network streamlines and simplifies the complicated tax system.

Businesses can use GST billing software to generate GST-compliant invoices, upload them directly to the GST portal, generate GST return forms, and file returns using the online portal. With a few clicks, they can use the e-invoicing portal to generate e-invoices for all business transactions. The billing software equipped with bank reconciliation completes the account process within a few hours.

#3 Efficient Logistics

Transport between states had to go through Octroi with the CST tax structure previously. With the introduction of GST, there is no need for Octroi. This has reduced taxation for all the parties in the supply chain. As a result, the logistics costs have gone down. Now, companies can ship between states without additional tax burden. The system transfers cost savings to the customer with added product value.

#4 Reduced Compliance Costs

A unified tax system has reduced compliance costs and compliance burdens for all entrepreneurs in India. They need to approach multiple tax agencies for submitting tax returns. There is no need to spend for auditors during tax season. Companies must submit monthly, quarterly, and annual tax returns with GST. You can also complete this process online.

A tech-savvy business owner can do it all by themselves and easily submit tax returns.

#5 Facilitate Startups

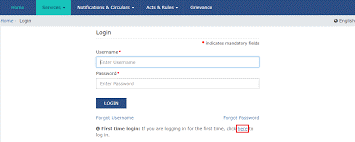

Businesses that reach the threshold limit for GST tax must begin by registering for GST. They will get a GSTIN and login credentials to connect to the GST portal. If businesses need to expand to multiple states, they simply need to register in those states and conduct business without any worries. There is no fee involved in registering for GST as a taxpayer. Also, there is no confusion about paying different taxes in each state.

#6 Better Business Scaling and Expansion

Businesses often limit their expansion to other states because of the tax cost and compliance requirements. With the introduction of GST, companies can quickly provide seamless pan-India operations. They can reach out to a wide range of customers and establish branch offices in multiple states. Also, businesses can expand their business verticals and only need to register for GST to start a new operation. The registration is also processed online, and companies can get their registration certificate within 5 working days of application.

#7 Business-friendly Tax Policy

GST Council continuously makes amendments and updates to the GST tax policy to accommodate new changes. For example, ecommerce operators must register for GST irrespective of their turnover. This facilitates the tax authorities to monitor all online transactions closely. Similarly, policies are updated to facilitate casinos, horse racing, and online gaming transactions. GST policies for the fintech sector are also updated to meet the new demands and requirements. The ultimate goal is to create tax policies that free entrepreneurs from tax burden and facilitate inter-business operations.

#8 Input Tax Credit

Before GST, the services sector suffered more due to the taxation system. They paid a service tax but couldn’t use the VAT on purchases. So, the service tax bill remained high. With GST, there is a distinction between the types of taxes. Any business can get an input tax credit for the GST they paid during purchase orders. Simply, they can deduct the taxes they paid on purchases from the taxes they must pay for sales. As a result, their tax liabilities are reduced, and they can claim input tax credits while filing GST returns.

Also Read: GST: Everything You Need To Know For Small Business

Conclusion

GST has brought about a complete transformation in India’s tax system. However, this system is not perfect. It allows businesses to reduce compliance complexities with a unified tax. At the same time, the tax authorities have imposed stringent requirements to file tax returns monthly. Companies must generate and issue invoices within the period to avoid penalties and fines. In the upcoming years, the GST Council will continue to change the GST regulations, enabling businesses to perform better.

CaptainBiz is India’s leading GST automated billing software that helps small businesses to maintain accurate transaction records and ensure GST compliance. To get all the benefits of the GST system, visit CaptainBiz.

Also Listen: CaptainBiz | Why Core GST Fields Matter for Businesses

FAQs

1. Is GST important for small businesses in India?

Yes, small businesses looking to expand operations must understand GST regulations and requirements. Once your annual turnover exceeds a specific limit, you must pay GST tax as required. Failure to comply with GST requirements can result in penalties, fines, and losses for the business.

2. Is GST better than multiple taxes that existed previously?

From a generic point of view, the concept of an 18% GST tax (for example) could seem like a significant percentage. However, with the previous system, the compounding of taxes resulted in manufacturers paying different types of taxes. These taxes had different compliance requirements, and they must be filed separately. A unified GST tax streamlines operations and eliminates tax cascading. So, GST is better than multiple taxes.

3. Does it cost more for GST registration?

No, businesses that reach the GST threshold limit can register for free to get their GSTIN. You can use the online GST portal to register your business as a taxpayer. Once registered, you must pay the GST tax according to the taxation requirements.

4. Do export businesses register for GST?

Yes, export businesses must also register for GST. They may have to pay IGST tax apart from the CGST and SGST tax. However, it is also included in the GST. So, all businesses in India, whether they supply within India or outside India, must pay only one GST.

5. How does GST affect the supply chain and logistics?

GST is charged at the place where the goods are consumed. Manufacturers must pay GST only at the time of supply. Every participant in the supply chain needs to pay only destination-based taxes. So, the supply chain becomes more efficient, with no tax burden on any single player.

6. Can any business claim ITC under GST?

Businesses registering for GST as taxpayers can claim ITC on their purchase orders. They can use their tax credit to offset their GST liabilities. So, with ITC, the total tax the business has to pay is reduced. However, companies registered under the Composition Scheme cannot claim ITC. Also, buyers must furnish accurate invoice details to claim ITC.

7. What will happen if I upload incorrect invoices?

Before filing GST returns, you can make corrections in the invoices on the GST portal. However, after filing returns, you can issue credit or debit notes to correct the tax liabilities if the invoices are inaccurate. Businesses that are found to falsify invoices will be penalised and fined.

8. How does GST level the field for small businesses?

Regardless of the size of the establishment, all businesses eligible to pay GST must pay the standardised tax amount. No corruption is involved, and no authority can increase or decrease the GST on any product. Only the GST Council can determine changes in the GST rates, which remain the same for all businesses. This improves competitiveness and transparency for small businesses.

9. How can small businesses ensure GST compliance?

The critical compliance requirement for GST is maintaining accurate records of invoices and business transactions. This is possible with the use of GST billing software. Generating invoices within the time limit and submitting GST forms on time are crucial for GST compliance.

10. How does GST impact cash flow for businesses?

With standardised GST, suppliers will know the exact amount of tax they need to pay for each supply transaction. Also, they will know the exact ITC they can get from their purchase orders. The automated GST billing tool will offset ITC against GST tax liabilities and calculate accurate GST tax to be paid. This will enable businesses to understand their finances better to improve cash flow.